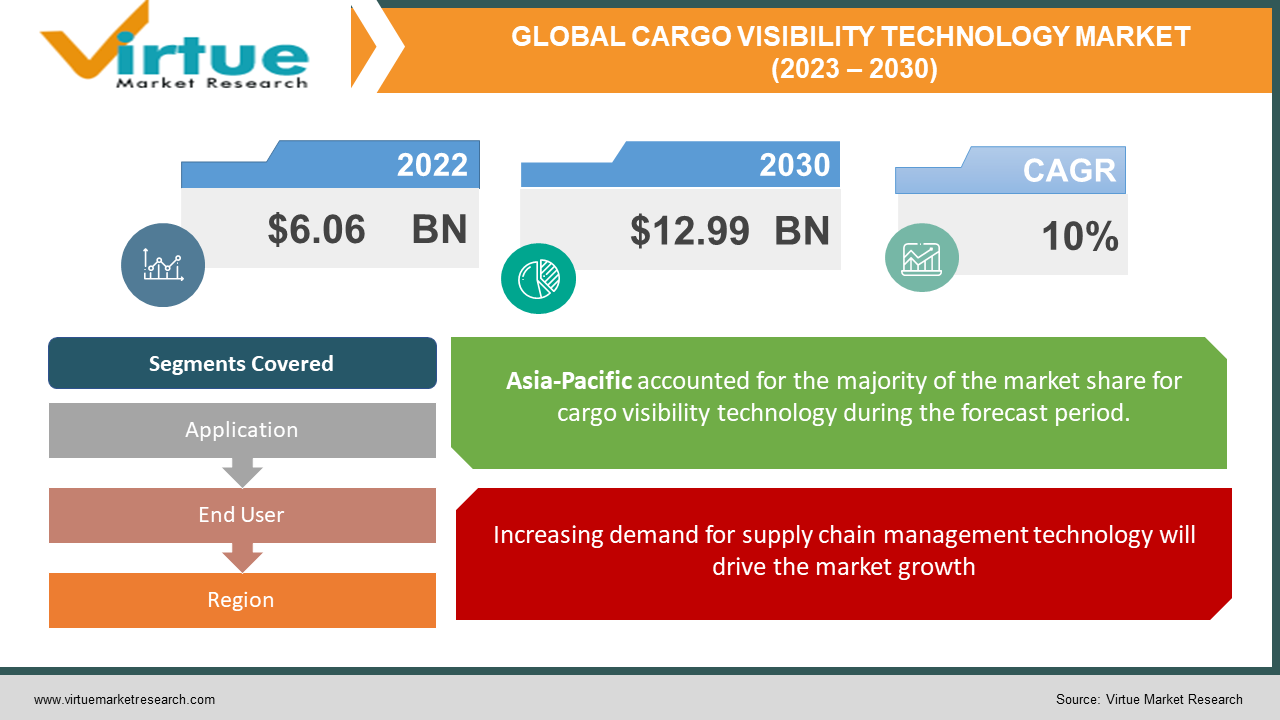

Global Cargo Visibility Technology Market Size (2023 – 2030)

According to our research report, the global cargo visibility technology market was valued at $6.06 Billion in 2022, and is projected to reach a market size of $12.99 Billion by 2030. The market is projected to grow with a CAGR of 10% per annum during the period of analysis (2023 - 2030).

Industry Overview

Cargo is transported over large distances. Unfortunately, there is a rise in theft, tax evasion, and clearance delays, all of which result in higher costs. Electronic cargo tracking has benefitted carriers in poor nations by increasing efficiency and production, which has resulted in cost savings. Finally, the system improves shipment and container veracity, which is built around a core of security issues. These are usually thought of as tools to keep good customers and increase market share and revenue.

In 2019, there were 7.5 million active tracking devices deployed for cargo loading units such as trailers, intermodal containers, rail freight wagons, air cargo containers, cargo boxes, and pallets across the world. This number is predicted to reach 23.2 million by 2024, with a compound annual growth rate (CAGR) of 25.4 percent. Trailer telematics is the most developed market in terms of installed units, followed by tracking devices for general cargo applications and intermodal containers. The markets for rail freight wagons and air cargo container tracking technologies are much smaller, but they are expected to increase significantly over the next five years. In 2019, the overall market value for trailer and cargo container tracking solutions was predicted to be about $1.1 billion.

Asset tracking for trailers and cargo containers is a subset of asset tracking that attempts to improve operational efficiency and security in logistics networks. A real-time tracking solution, according to Berg Insight, is a system that includes data logging, satellite location, and data transmission to a back-office application. Both vehicles and trailers may be tracked using trailer tracking as part of fleet management solutions. Fleet management solutions have a long history, but tracking and monitoring of shipping containers became more prominent after 9/11. Mobile and satellite networks can now provide ubiquitous internet connectivity at a low cost, while mobile computer and sensor technologies can give great performance and usability. All of these components work together to create supply chain, security, and operations management solutions that connect trailers, containers, cargo, and businesses.

Impact of Covid-19 on the Industry

Going forward, the worldwide COVID-19 pandemic is expected to raise the focus on supply chain visibility and security. Recent occurrences have demonstrated the need for real-time data on the location and condition of cargo in transit for an effective and trustworthy supply chain. Low-power wide-area (LPWA) networks, including Sigfox, CAT-M1, NB-IoT, and LoRaWAN, created expressly for IoT applications, are becoming more widely available throughout the world, lowering the hurdles to tracking solution adoption. There will be a boom in demand for cargo tracking systems following COVID-19, and numerous communications technology alternatives will be available to accommodate varied client demands.

Market Drivers

Increasing demand for supply chain management technology will drive the market growth

In today's economy, increasing supply chain efficiency is becoming increasingly vital. Delays in business procedures have a significant impact on your firm's operations and contribute to lower customer satisfaction. In today's economy, increasing supply chain efficiency is becoming increasingly vital. Delays in business procedures have a significant impact on your firm's operations and contribute to lower customer satisfaction. Cargo tracking allows for easy process monitoring, particularly in terms of transportation status, by combining all relevant information on a plan/actual basis. This allows you to notice any delays and enhance supply chain processes by removing bottlenecks.

Cargo tracking increases operational efficiency and is highly cost-effective

Real-time cargo tracking helps the companies to improve their time efficiency by planning all the cargo routes ahead of time and making a spontaneous decision if there is any obstacle or hurdle in the route of the transportation of cargo. Cargo monitoring displays the status of all parties involved in your supply chain, including customers, partners, vendors, distributors, and dealers. By integrating shipment and schedule information into a cargo monitoring system, you can easily communicate, regulate, and follow the progress of all connected parties.

Market Restraints

The high initial investment in hardware and software

Cargo visibility technology requires the installation of expensive hardware and software. Installation of such technology requires a high initial investment which makes it difficult for small businesses to adopt such technologies to track their cargo.

GLOBAL CARGO VISIBILITY TECHNOLOGY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Application, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ORBCOMM, SkyBitz, 7PSolutions, ,Agheera, Amsted Rail, Arkivav, Arviem, AT&T , Axscend (SAF-Holland), Ayantra, BlackBerry |

This research report on the global cargo visibility technology market has been segmented and sub-segmented based on Applications, and End-User in the region.

Global Cargo Visibility Technology Market- By Application

- Trailers

- Intermodal containers

- rail freight wagons

- cargo boxes

- pallet

In 2020, there were 9.3 million active tracking devices installed for cargo loading units such as trailers, intermodal containers, rail freight wagons, air cargo containers, cargo boxes, and pallets across the world. This number is predicted to reach 28.9 million by 2025, with a compound annual growth rate (CAGR) of 25.3 percent. Trailer telematics is the most developed market in terms of installed units, followed by tracking devices for general cargo applications and intermodal containers. The markets for rail freight wagons and air cargo container tracking technologies are much smaller, but they are expected to increase significantly over the next five years.

Global Cargo Visibility Technology Market- By End User

- Transportation & Logistics

- Warehouse Management

- Others

The logistics company operation relies heavily on the transportation management system. The main factors for logistics providers to succeed in today's tough business market are loading efficiency, effective route planning, delivery delay reduction, cost-cutting with high service quality, and cost-cutting with high service quality. As a result, logistic providers are continuously looking for the best strategy to maximize their resources while also coordinating with their subcontractors. To maximize their services to clients while maintaining efficiency and profitability, transportation and logistics companies require market-leading strategies and solutions. Globalization, regulatory changes, and competitive barriers are all continual challenges for these businesses. Market demands are always changing, and fast technological advancements and global supply chain practices have generated several chances for businesses to modify and improve their offerings.

Global Cargo Visibility Technology Market- By Geography & Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

In terms of active units, ORBCOMM, SkyBitz, Spireon, CalAmp, PowerFleet, and Samsara are the major participants in the North American trailer telematics market. ORBCOMM, Idem Telematics, Schmitz Cargobull, Transics/WABCO, and Novacom Europe lead the European trailer telematics industry, which is significantly smaller than the North American sector. Maersk Line is the world's largest intermodal container shipping company. Envirotech, ORBCOMM, TRAXENS, ZillionSource, and Globe Tracker are some of the other market leaders. In the neighboring swap body category, Mecomo and Agheera, both headquartered in Europe, are prominent providers.

Global Cargo Visibility Technology Market- By Companies

- ORBCOMM

- SkyBitz

- 7PSolutions

- Agheera

- Amsted Rail

- Arkivav

- Arviem

- AT&T

- Axscend (SAF-Holland)

- Ayantra

- BlackBerry

NOTABLE HAPPENINGS IN THE GLOBAL CARGO VISIBILITY TECHNOLOGY MARKET IN THE RECENT PAST:

- Merger & Acquisition: - In September 2021, ORBCOMM agreed to be acquired by GI partners which were approved by the shareholders

- Business Partnership: - In June 2021, 7P Solution and Cloudleaf have formed a commercial collaboration to enable companies to make intelligent real-time choices based on actual occurrences as raw materials, components, and completed goods flow through their complicated global supply chains.

Chapter 1. Global Cargo Visibility Technology Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Cargo Visibility Technology Market – Executive Summary

2.1. Market Size & Forecast – (2022 – 2027) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2022 - 2027

2.3.2. Impact on Supply – Demand

Chapter 3. Global Cargo Visibility Technology Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Global Cargo Visibility Technology Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Cargo Visibility Technology Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Cargo Visibility Technology Market – By End User

6.1. Transportation & Logistics

6.2. Warehouse Management

6.3. Others

Chapter 7. Global Cargo Visibility Technology Market – By Application

7.1. Trailers

7.2. Intermodal containers

7.3. rail freight wagons

7.4. cargo boxes

7.5. pallet

Chapter 8. Global Cargo Visibility Technology Market- By Region

8.1. North America

8.2. Europe

8.3. Asia-Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Chapter 9. Global Cargo Visibility Technology Market – Key Companies

9.1 ORBCOMM

9.2 SkyBitz

9.3 7PSolutions

9.4 Agheera

9.5 Amsted Rail

9.6 Arkivav

9.7 Arviem

9.8 AT&T

9.9 Axscend (SAF-Holland)

9.10 Ayantra

9.11 BlackBerry

Download Sample

Choose License Type

2500

4250

5250

6900