Care Coordination And Collaboration Market Size (2024 – 2030)

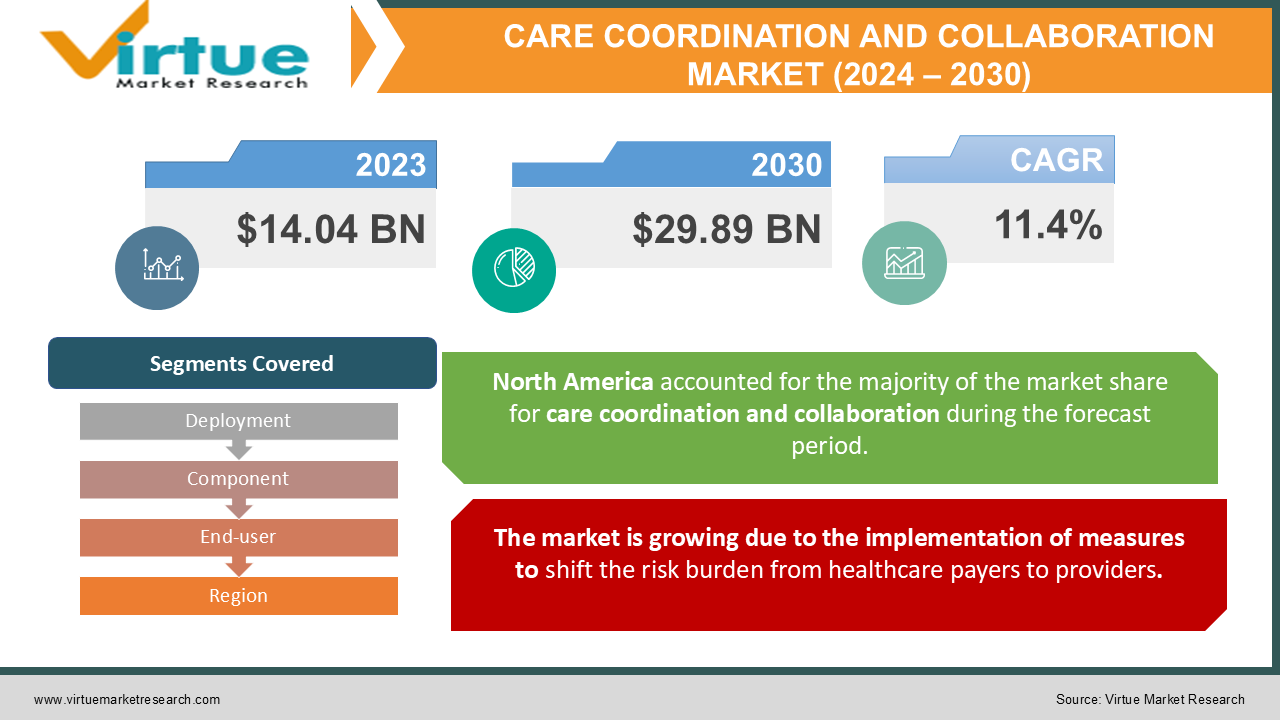

In 2023, the Care Coordination and Collaboration Market was valued at $14.04 Billion, and is projected to reach a market size of $29.89 Billion by 2030. Over the forecast period of 2024-2030, market is projected to grow at a CAGR of 11.4%.

Market Overview

Care coordination and collaboration refers to a set of activities aimed at improving patient care and lowering medical costs by assisting patients and caregivers in better managing their health problems. Many healthcare organizations are just beginning to join risk-based contracts, in which they will be held liable for providing treatment to specified patient populations while adhering to best practices in care management. Other businesses have a lot of expertise in care management, but they rely on homegrown or commercial systems that aren't scalable. Others, operating in a fee-for-service (FFS) setting, are just breaking even with their current care management initiatives and desire improved results. . An analytics-driven care management system is required to address these issues by streamlining workflows, prioritizing daily tasks for care team members in a predictive manner, and directing activity to the areas that will have the greatest positive impact on the lives of the most patients in the most efficient manner.

Technological advancements have made it easier for healthcare personnel to communicate and coordinate efficiently in recent years. Clinical mobility has helped relieve pressure on the healthcare system by streamlining workflows, increasing patient care, and allowing for more efficient use of scarce resources. Clinical mobility has allowed for the replacement of manual and error-prone procedures with digital solutions that have expedited operations, enhanced patient identification accuracy, and improved patient care quality. By decreasing and eliminating errors, collaboration technologies have aided in digitally capturing information and distributing it in real-time to healthcare professionals.

Due to the rising use of smart devices in hospitals, clinical communication and collaboration (CC&C) solutions have gained popularity. Patients benefit from these devices in a variety of ways, including improved communication with care teams, easier access to medical records, and the ability to complete administrative activities on time. Handheld gadgets and cell phones specifically built for the healthcare ecosystem are used by healthcare workers. These devices prevent device fragmentation, which was a problem in the past when many clinicians used various devices for communication and collaboration, such as pagers and cell phones.

Covid Impact on Care coordination and collaboration market

Medical practices of all sizes are under tremendous strain as a result of the COVID-19 epidemic, and healthcare facilities around the world have been overwhelmed by the massive number of patients who see them regularly. In various countries, the increased prevalence of COVID-19 has fuelled the need for reliable diagnosis and treatment technologies. Care management solutions have proven to be quite useful in this area, as they allow healthcare providers to seamlessly combine solutions like EHR with healthcare payer solutions like claims management and payment management. In the early months of the pandemic, demand for electronic data transfer and claims handling surged considerably in various nations due to lockdowns and travel restrictions.

MARKET DRIVERS

The market is growing due to the implementation of measures to shift the risk burden from healthcare payers to providers.

Various initiatives are being conducted around the world to shift the risk burden from payers to providers. This movement encourages the use of healthcare information technology (HCIT) solutions (such as care management solutions) to improve healthcare delivery efficiency and cut costs. Alternative payment methods, like bundled payments, physician incentives, and customer incentives, are all used to encourage value-based treatment. These payment schemes are intended to encourage healthcare professionals to embrace responsibility for the treatment they give, thereby shifting risk from payers to providers.

Emerging markets have a strong growth potential, which is propelling market expansion.

The expansion of this market in Asia is being driven by a variety of reasons, including the implementation of government policies boosting the adoption of HCIT solutions and increased government healthcare expenditure. Authorities in China are concentrating on modernizing the country's healthcare management sector, which is now confronting issues such as underfunded rural health facilities, overburdened metropolis hospitals, and a statewide scarcity of doctors. Technological improvements are playing a crucial role. The Indian government launched the Digital India campaign to ensure that residents may access government services electronically by strengthening the country's IT infrastructure and internet connectivity. The existence of trained IT experts, government initiatives for the deployment of HCIT solutions, and an increase in government spending on healthcare systems are all factors promoting the growth of the care coordination and collaboration market in the Asia Pacific region.

MARKET RESTRAINTS

The market's expansion is being stifled by a scarcity of skilled workers.

A strong IT infrastructure and IT support within the company, as well as at the solution provider's end, are required for effective care coordination and collaboration. In a healthcare business, technical assistance is always needed to keep the server and network running well so that clinical operations may run smoothly and care management solutions can interface quickly. If the server or network is not properly maintained, it will generate screen loads, which will slow down the clinical process.

Market expansion is being hampered by data breaches and loss of confidentiality.

The digitalization of medical and patient data has increased data risks and liabilities, as well as the likelihood of data breaches. This could be due to a lack of internal control over patient data, adherence to outmoded policies and procedures/non-adherence to existing policies and procedures, and insufficient personnel training. In the short term, the risk of data security and confidentiality breaches connected with digitalization may deter the adoption of HCIT solutions until present vulnerabilities are addressed. As a result, the market's growth may suffer.

CARE COORDINATION AND COLLABORATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.4% |

|

Segments Covered |

By Deployment, Component, End-user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Spok Inc., Cerner Corporation, Hill Room Services, Inc., Vocera Communications, and Cisco Systems Inc. |

Care coordination and collaboration market - by Deployment

-

Hosted

-

On-premise

To accommodate the increased need for data, healthcare institutions have upgraded their IT infrastructure. These firms have traditionally been hesitant to adopt cloud-based deployment, preferring on-premise since IT administrators have more control over the physical data centers. However, due to the high maintenance costs associated with on-premise deployments, demand for on-premise solutions is likely to diminish over the projection period.

Cloud-based storage options appeal to covered entities because they provide a scalable and flexible environment at a lower cost than on-premise deployments. Over the next few years, the segment's expansion will be fuelled by the increasing number of remotely distributed teams that demand a cloud-based platform to share, collaborate, and interact with all locations in real-time. The ability for healthcare employees to access collaborative tools via their smartphone, as well as the freedom to use the platform remotely, has contributed to a rise in cloud-based software adoption. The use of cloud-based software has also improved a function that records incidents and allows others to review them afterward.

Care coordination and collaboration market - by Component

-

Solution

-

Services

In 2021, the solution category accounted for more than 60% of sales. The CC&C solutions make it easier to share data in real-time, capture alarms and notifications, and improve care transitions, all of which help to improve patient safety and satisfaction. To give immediate reactions during crisis management, the clinical communication and collaboration systems use patient data, bed management systems, and telemetry provided by the location. Furthermore, in the COVID-19 situation, companies like Cerner Corporation are developing solutions to assist healthcare institutions in successfully monitoring and screening patient populations for probable virus cases. Furthermore, the company has built COVID-19-specific updates for customers that notify doctors when a patient is in danger so that clinicians can take proper isolation measures.

In addition, to increase operational efficiency and patient care, solution providers are merging IoT with collaboration solutions. Wellness applications, wearables, beacons, smart devices, and other connected devices are configured in the healthcare IoT environment to help patients adhere to their care regimens and facilitate analytics. Hospitals utilize mobile phones and Bluetooth beacons to assist patients and visitors in navigating huge campuses. For example, Boston Children's Hospital's Wayfinding app provides turn-by-turn directions for its 12-building healthcare campus.

Care coordination and collaboration market - by End-user

-

Hospitals

-

Small Hospitals

-

Medium Hospitals

-

Large Hospitals

-

-

Clinical Labs

-

Physicians

-

Others

In 2020, hospitals accounted for more than half of the revenue in the care coordination and collaboration industry. Because of the rise in COVID-19 instances, hospitals have realized the value of contactless communication and collaboration. Companies have also begun to offer low-cost or no-cost collaboration solutions to enterprises battling the coronavirus pandemic. Microsoft, for example, has given NHS staff in the United Kingdom the option of using Microsoft Teams to connect with their co. workers swiftly and efficiently.

Furthermore, according to the Joint Commission, 70 percent of medical errors are caused by a breakdown in communication. The intricate architectural structure of hospitals necessitates effective communication and collaboration. Clinical mobility has developed as an extra benefit to operational efficiency in the hospital ecosystem. Furthermore, it has been found that tech-savvy patients find comfort in technology and bring their data with them, as well as their willingness to exchange electronic health measurements with healthcare practitioners.

Care coordination and collaboration market - by region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

The Middle East and Africa

In 2021, North America had the greatest market share of almost 31%. The regional market is predicted to develop due to rising healthcare spending in the United States followed by Europe. To reach their digital healthcare aim, the majority of hospitals in the United States have installed clinical communication and collaboration technologies. Columbia County Health Systems, for example, has introduced collaboration systems that allow for real-time communication across geographically distributed care teams.

Over the forecast period, Asia Pacific is expected to increase at the fastest rate. The COVID-19 outbreak in the Asia Pacific has resulted in a boom in the use of telemedicine platforms and applications. As a result of the COVID epidemic, digital health platforms in Indonesia, Australia, and Singapore have seen a boom in uptake. Furthermore, the

Care coordination and collaboration market by Company

-

Spok Inc.,

-

Cerner Corporation,

-

Hill Room Services, Inc.,

-

Vocera Communications, and

-

Cisco Systems Inc.

Cloud-based collaboration tools are being offered by vendors to improve patient confidentiality and privacy. St. Luke's University Health Network, for example, has implemented a cloud-based clinical cooperation strategy. To accelerate speed and agility in clinical, administrative, and back-end contexts, the business uses a cloud-based collaboration platform.

As vendors in the market try to separate themselves from their rivals through collaborations and innovations, interest in CC&C solutions will continue to grow. Mergers, acquisitions, and strategic alliances are common in the business; for example, Vocera Communications Inc. recently bought Extension Healthcare, a clinical and workflow collaboration software supplier, to expand its care coordination and collaboration portfolio.

NOTABLE HAPPENINGS IN THE CARE COORDINATION AND COLLABORATION MARKET IN THE RECENT PAST.

-

Product Launches and Product Expansions: In March 2021, Health Catalyst introduced a new Healthcare AI to bring augmented intelligence to the healthcare business at scale.

-

Mergers and Acquisitions: In March 2021, Kantar Health's extensive life sciences experience is joined with Cerner's extensive collection of real-world data (RWD) and technology to accelerate life sciences research innovation and improve patient outcomes around the world.

-

Partnerships, Collaborations, and Agreement: In February 2021, Health Catalyst Inc., a leading provider of data and analytics technology and services to healthcare organizations, announced a strategic partnership with Smarter Health, a Singapore-based healthcare technology company that operates a platform to provide seamless data integration between payers and providers in the Southeast Asia region.

Chapter 1.Care coordination and collaboration market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Care coordination and collaboration market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3.Care coordination and collaboration market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Care coordination and collaboration market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Care coordination and collaboration market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Care coordination and collaboration market – By Deployment

6.1. Hosted

6.2. On-premise

Chapter 7.Care coordination and collaboration market – By Component

7.1. Solution

7.2. Services

Chapter 8.Care coordination and collaboration market – By End-User

8.1. Hospitals

8.1.1.Small Hospitals

8.1.2.Medium Hospitals

8.1.3.Large Hospitals

8.2.Clinical Labs

8.3.Physicians

8.4.Others

Chapter 9.Care coordination and collaboration market – By Region

9.1. North America

9.2. Europe

9.3. The Asia Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10.Care coordination and collaboration market – Company Profiles – (Overview, Product Portfolio, Financials, Developments)

10. 1. Spok Inc.

10.2. Cerner Corporation

10.3. Hill Room Services

10.4. Inc.

10.5. Vocera Communications

10.6. Cisco Systems Inc

Download Sample

Choose License Type

2500

4250

5250

6900