Cards and Payments Market Size (2024 – 2030)

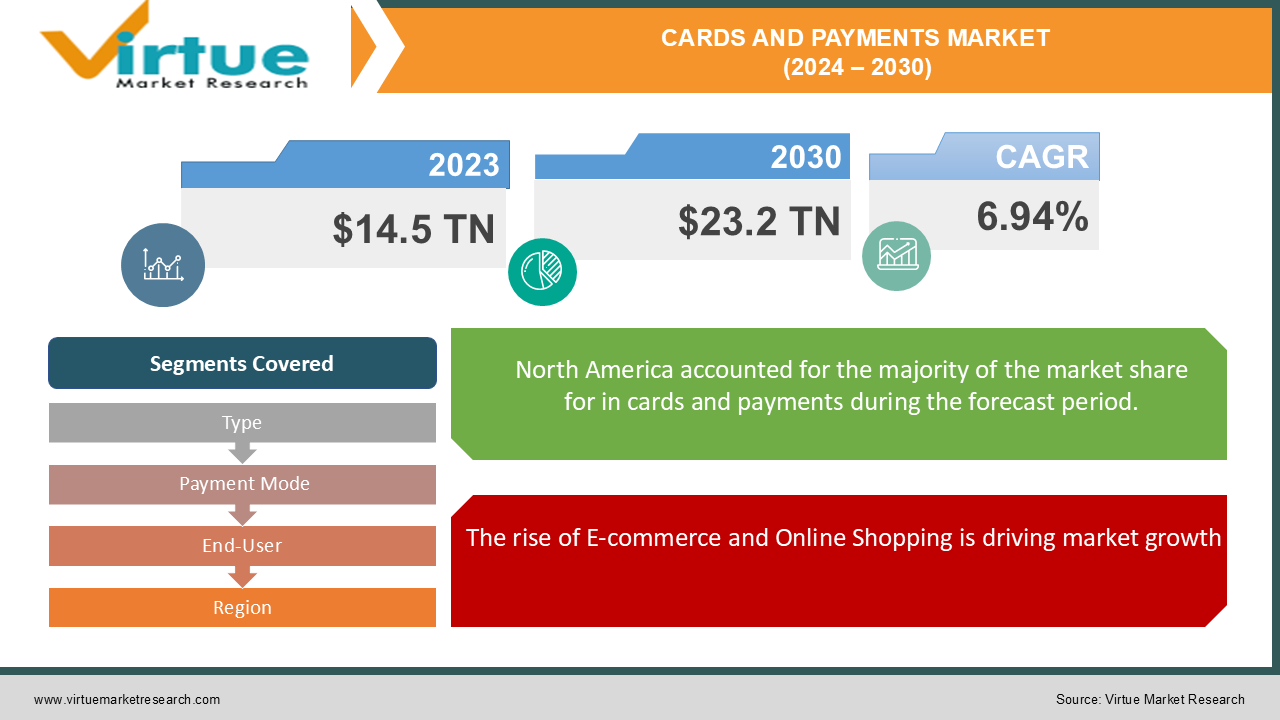

In 2023, the global cards and payments market was valued at USD 14.5 trillion and is expected to reach USD 23.2 trillion by 2030, growing at a CAGR of 6.94% over the forecast period.

The surge in online shopping, coupled with the rising consumer preference for convenient and secure payment methods, is accelerating the adoption of cards and digital payment solutions. In developed economies, the shift towards a cashless society is nearly complete, while in emerging markets, the adoption of mobile and card payments is rapidly increasing due to financial inclusion initiatives and the expansion of digital infrastructure. The shift towards digital payments has been further propelled by advancements in financial technology (FinTech), enabling secure, fast, and seamless transactions across various sectors such as retail, hospitality, transportation, and government services. This transformation is fostering the growth of the cards and payments market globally.

Key Market Insights:

Debit cards are the most widely used payment method, particularly in regions like Asia-Pacific and Europe, where banking penetration is high.

The online payment segment is seeing rapid growth due to the surge in e-commerce activities, digital services, and the proliferation of online retail platforms.

Mobile payments, including digital wallets, are becoming a dominant force in both developed and emerging economies, thanks to increasing smartphone penetration and rising consumer demand for frictionless payment experiences.

The corporate segment is expected to witness substantial growth due to the rising adoption of business cards and digital payment solutions for expense management, procurement, and business-to-business (B2B) payments.

North America holds the largest share of the market, driven by the widespread adoption of credit cards and digital payments, as well as the dominance of tech companies such as Apple, Google, and PayPal in the mobile payments space.

Global Cards and Payments Market Drivers:

The rise of E-commerce and Online Shopping is driving market growth The rapid growth of e-commerce platforms globally has significantly boosted the demand for secure, fast, and efficient digital payment solutions. Consumers are increasingly using credit, debit, and prepaid cards, as well as digital wallets, to make purchases online. The COVID-19 pandemic accelerated this trend as people turned to online shopping for essentials, entertainment, and other services, further driving demand for online payment solutions.

Increasing Adoption of Mobile Payments is driving the market growth Mobile payment solutions such as Apple Pay, Google Pay, and Samsung Pay, and regional platforms like Alipay and WeChat Pay are witnessing widespread adoption, particularly among tech-savvy consumers and younger generations. These platforms provide a convenient, secure, and contactless way to make payments, both online and in-store. The growing preference for contactless transactions, fueled by the need for hygienic solutions during the pandemic, has further accelerated the adoption of mobile payments worldwide.

Expansion of Financial Inclusion and Digital Banking is driving the market growth In emerging markets, governments and financial institutions are making concerted efforts to increase financial inclusion by promoting digital banking and payment solutions. Programs aimed at providing bank accounts, debit cards, and mobile wallets to underserved populations are helping bridge the gap between the unbanked and formal financial services. In regions like Africa, Southeast Asia, and Latin America, mobile payments are increasingly being adopted as the primary method of transacting due to their ease of use and accessibility.

Global Cards and Payments Market Challenges and Restraints:

Data Security and Fraud Concerns is restricting the market growth While digital payment systems provide convenience, they also present significant security challenges. The increasing use of online payments, mobile banking apps, and card transactions has led to a rise in cyberattacks, fraud, and data breaches. Ensuring robust cybersecurity measures, protecting sensitive customer information, and preventing payment fraud remain key challenges for players in the cards and payments market. The cost of addressing security breaches and maintaining customer trust is substantial for both financial institutions and merchants.

Regulatory and Compliance Hurdles is restricting the market growth The global cards and payments market is subject to a complex regulatory environment that varies from country to country. In addition to complying with financial regulations, payment service providers must also adhere to data protection laws, such as the General Data Protection Regulation (GDPR) in Europe and various national data privacy laws. Changes in regulatory policies, such as caps on interchange fees and evolving anti-money laundering (AML) requirements, can impact the profitability and operations of payment service providers.

Infrastructure Gaps in Emerging Markets is restricting the market growth Despite the growing adoption of digital payments in developing countries, there are still significant infrastructure challenges that hinder widespread adoption. Many rural and remote areas lack the necessary internet connectivity, mobile coverage, or banking infrastructure to support digital payments. Furthermore, financial literacy remains low in certain regions, limiting the adoption of cards and mobile payment solutions. Addressing these infrastructure and knowledge gaps is critical to expanding the global cards and payments market.

Market Opportunities:

The global cards and payments market is ripe with opportunities, especially in the fields of contactless payments, open banking, and cross-border payment solutions. As consumers become increasingly accustomed to contactless transactions due to convenience and hygiene concerns, there is a significant opportunity for companies to innovate in the contactless payments space. The adoption of Near Field Communication (NFC) technology in credit and debit cards, as well as mobile wallets, is set to increase as more retailers and service providers integrate contactless payment solutions into their systems. The rise of open banking, where banks share customer data (with their consent) with third-party providers via Application Programming Interfaces (APIs), is transforming the payments landscape. Open banking allows consumers to use a single platform to manage multiple bank accounts, track spending, and make payments, creating new opportunities for FinTech companies to offer innovative financial services. This movement is expected to disrupt the traditional banking and payments ecosystem, offering consumers more control and flexibility. With globalization and the growth of international trade and travel, there is an increasing need for efficient cross-border payment solutions. Traditional methods of transferring funds internationally, such as wire transfers, can be slow and expensive. There is a growing demand for digital cross-border payment services that are faster, more affordable, and accessible. FinTech companies offering real-time international payment solutions are well-positioned to capitalize on this growing opportunity.

CARDS AND PAYMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.94% |

|

Segments Covered |

By Type, Payment Mode, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Visa Inc., Mastercard Inc., PayPal Holdings, Inc.,American Express Company, Square, Inc., Ant Group Co., Ltd. (Alipay), Tencent Holdings Ltd. (WeChat Pay), Samsung Electronics Co., Ltd. (Samsung Pay), Google LLC (Google Pay), Apple Inc. (Apple Pay) |

Cards and Payments Market Segmentation: By Type

-

Credit Cards

-

Debit Cards

-

Prepaid Cards

-

Mobile Payments

Mobile payments have emerged as the dominant method of transaction among credit, debit, and prepaid cards. With the ubiquity of smartphones and the integration of advanced payment technologies, mobile wallets have become indispensable for consumers. These digital wallets allow users to store their payment information, including credit, debit, and prepaid card details, making it incredibly convenient to make purchases with a simple tap or swipe.

Cards and Payments Market Segmentation: By Payment Mode

-

POS (Point of Sale)

-

Online Payments

Online payments have rapidly become the preferred method of transaction for countless individuals and businesses worldwide. With the advent of advanced technology and the widespread adoption of smartphones and computers, consumers can now effortlessly make payments from the comfort of their homes or offices. This shift towards digital payments has revolutionized the way we conduct financial transactions, offering convenience, speed, and security that traditional methods simply cannot match.

Cards and Payments Market Segmentation: By End-User

-

Retail

-

Corporate

The debit cards segment dominates the market in terms of transaction volume, particularly in regions like Europe and Asia-Pacific, where they are widely used for everyday purchases. Mobile payments are the fastest-growing segment, driven by the increasing use of digital wallets and mobile banking apps. POS payments are prevalent for in-store transactions, while online payments are seeing rapid growth due to the rise of e-commerce.

Cards and Payments Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America holds the largest share of the global cards and payments market, driven by the widespread use of credit cards, contactless payments, and mobile wallets. : Europe is a mature market with high debit card penetration and a well-established digital payment infrastructure. Asia-Pacific is the fastest-growing region in the cards and payments market, fueled by the rising adoption of mobile payments, particularly in China and India. Latin America is experiencing steady growth in the cards and payments market, driven by the increasing use of prepaid and debit cards, as well as the rise of mobile payments

COVID-19 Impact Analysis on the Global Cards and Payments Market:

The COVID-19 pandemic had a profound impact on the global cards and payments market, accelerating the shift towards digital payments as consumers and businesses moved away from cash-based transactions. The rise of e-commerce and contactless payments became particularly prominent during the pandemic, as people sought safer, more convenient ways to pay for goods and services. Mobile payments and online shopping surged during lockdowns, boosting the adoption of digital wallets, contactless cards, and other electronic payment methods. As the world recovers from the pandemic, many of the changes in consumer behavior, such as the increased use of digital payments and a decline in cash usage, are expected to persist, further driving the growth of the cards and payments market.

Latest Trends/Developments:

Cryptocurrencies are gaining traction as a potential alternative payment method, with several major companies exploring ways to accept Bitcoin, Ethereum, and other digital currencies for goods and services. Some payment platforms are also integrating crypto wallets for seamless transactions. Artificial Intelligence (AI) is being integrated into payment systems for enhanced fraud detection, personalized offers, and customer service automation. Additionally, blockchain technology is being explored for secure, transparent, and efficient cross-border payments. Biometric authentication, including fingerprint and facial recognition, is gaining popularity as a secure, convenient method for authorizing payments. Many financial institutions and tech companies are introducing biometric payment solutions to enhance security and user experience.

Key Players:

-

Visa Inc.

-

Mastercard Inc.

-

PayPal Holdings, Inc.

-

American Express Company

-

Square, Inc.

-

Ant Group Co., Ltd. (Alipay)

-

Tencent Holdings Ltd. (WeChat Pay)

-

Samsung Electronics Co., Ltd. (Samsung Pay)

-

Google LLC (Google Pay)

-

Apple Inc. (Apple Pay)

Chapter 1. Cards and Payments Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cards and Payments Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cards and Payments Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cards and Payments Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cards and Payments Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cards and Payments Market – By Type

6.1 Introduction/Key Findings

6.2 Credit Cards

6.3 Debit Cards

6.4 Prepaid Cards

6.5 Mobile Payments

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Cards and Payments Market – By Payment Mode

7.1 Introduction/Key Findings

7.2 POS (Point of Sale)

7.3 Online Payments

7.4 Y-O-Y Growth trend Analysis By Payment Mode

7.5 Absolute $ Opportunity Analysis By Payment Mode, 2024-2030

Chapter 8. Cards and Payments Market – By End-User

8.1 Introduction/Key Findings

8.2 Retail

8.3 Corporate

8.4 Y-O-Y Growth trend Analysis By End-User

8.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Cards and Payments Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Payment Mode

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Payment Mode

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Payment Mode

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Payment Mode

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Payment Mode

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Cards and Payments Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Visa Inc.

10.2 Mastercard Inc.

10.3 PayPal Holdings, Inc.

10.4 American Express Company

10.5 Square, Inc.

10.6 Ant Group Co., Ltd. (Alipay)

10.7 Tencent Holdings Ltd. (WeChat Pay)

10.8 Samsung Electronics Co., Ltd. (Samsung Pay)

10.9 Google LLC (Google Pay)

10.10 Apple Inc. (Apple Pay)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 14.5 trillion in 2023 and is expected to reach USD 23.2 trillion by 2030, growing at a CAGR of 6.94%.

Key drivers include the rise of e-commerce, the increasing adoption of mobile payments, and financial inclusion efforts in emerging markets.

North America holds the largest share, with high credit card penetration and the dominance of mobile payment solutions.

Challenges include data security and fraud risks, regulatory hurdles, and infrastructure gaps in emerging markets.

Key players include Visa Inc., Mastercard Inc., PayPal Holdings, Inc., American Express Company, and Square, Inc.