Carbonized Gas Market Size (2024-2030)

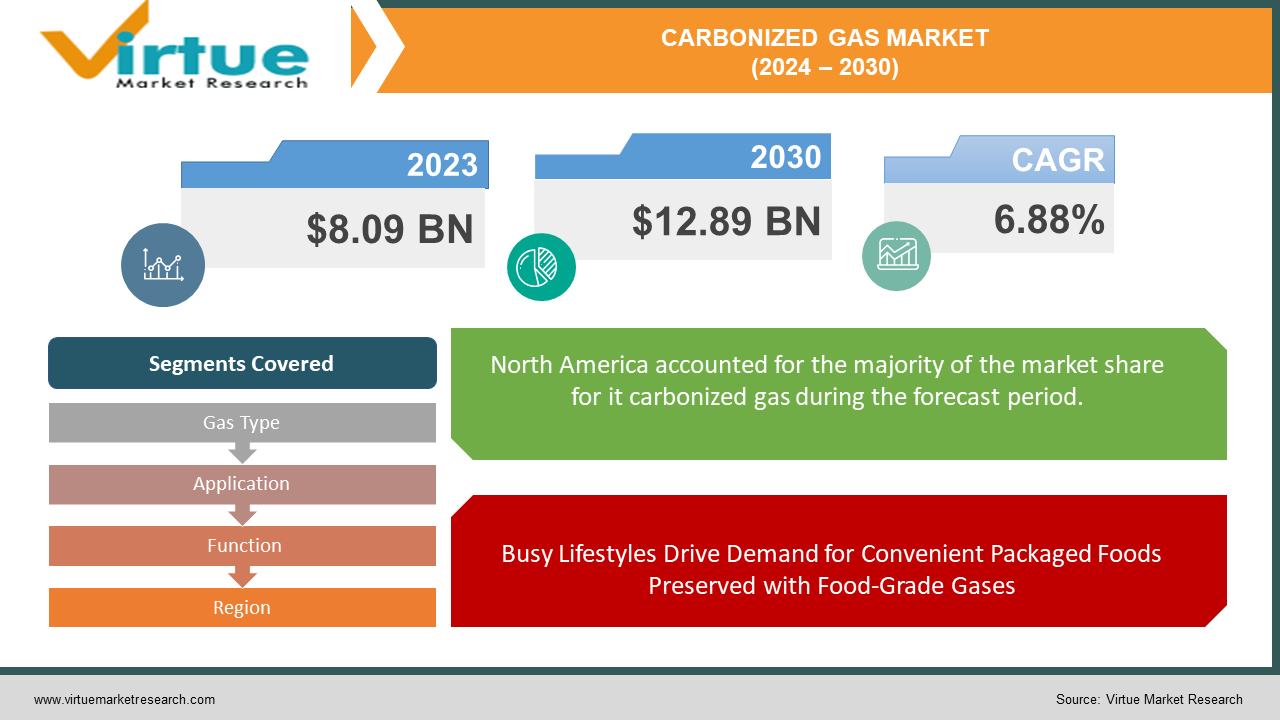

The Carbonized Gas Market was valued at USD 8.09 billion in 2023 and is projected to reach a market size of USD 12.89 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.88%.

The food-grade gas market thrives alongside our evolving food preferences. Consumers are increasingly drawn to convenient, packaged, and processed foods. This trend, coupled with the growing popularity of ready-to-eat meals, fuels the demand for food-grade gases. These gases play a crucial role in food safety and preservation. From carbonation in beverages to modified atmosphere packaging for meats and vegetables, food-grade gases extend shelf life and maintain food quality.

Key Market Insights:

The food-grade gas market growth is further bolstered by a growing focus on food safety. Consumers are more aware of potential foodborne illnesses, and manufacturers are responding by adopting techniques that utilize food-grade gases. One such technique is oxygen scavenging, which uses these gases to create an environment that inhibits bacterial growth and extends shelf life.

Looking ahead, the market for food-grade gases is expected to see continued growth, particularly in developing economies. As disposable incomes rise in these regions, so does the consumption of packaged foods. This creates a new and expanding market for food-grade gases, with applications in everything from carbonation to modified atmosphere packaging.

The Carbonized Gas Market Drivers:

Busy Lifestyles Drive Demand for Convenient Packaged Foods Preserved with Food-Grade Gases

Our fast-paced lives are leading to a significant rise in the demand for convenient food options. Consumers are increasingly drawn to packaged and processed foods that offer extended shelf life and require minimal preparation. This trend directly translates to a growing market for food-grade gases, which play a vital role in preserving the freshness and quality of these products during storage and transportation.

Heightened Food Safety Concerns Prompt Manufacturers to Utilize Food-Grade Gases for Extended Shelf Life

Public awareness about foodborne illnesses is at an all-time high. In response, manufacturers are actively adopting techniques that utilize food-grade gases to enhance food safety. One such technique is oxygen scavenging, which involves introducing gases that create an environment within the packaging that inhibits the growth of bacteria and other microorganisms. This not only improves food safety but also extends shelf life, reducing spoilage and waste.

Food Processing and Packaging Innovations Leverage Food-Grade Gases for Enhanced Freshness

The food industry is constantly innovating, and food-grade gases are at the forefront of these advancements. Techniques, like Modified Atmosphere Packaging (MAP), involve flushing food packages with specific combinations of gases like nitrogen and carbon dioxide. This controlled environment slows down the natural spoilage process, allowing food products to stay fresh for longer periods. Additionally, active packaging technologies are emerging, which utilize food-grade gases to actively interact with the food itself, further enhancing its quality and shelf life.

Rising Disposable Incomes in Developing Economies Fuel Consumption of Packaged Foods Reliant on Food-Grade Gases

As disposable incomes rise in developing countries, consumer spending on packaged foods is witnessing a significant increase. This burgeoning market for packaged food creates a new and expanding demand for food-grade gases. These gases have diverse applications across the food industry in developing economies, from carbonation in beverages to modified atmosphere packaging for meat, poultry, and vegetables. This trend is expected to continue as these economies grow and consumer preferences evolve.

The Carbonized Gas Market Restraints and Challenges:

The food-grade gas market, while experiencing growth, faces some hurdles. Environmental concerns are a key challenge. Production and use of some gases, like carbon dioxide, contribute to greenhouse gas emissions. This raises questions about the industry's sustainability. Strict regulations around safety and production standards are another hurdle. Ensuring food safety throughout the supply chain requires constant monitoring and adherence to complex regulations, adding cost and complexity to the market.

Emerging technologies present another challenge. New preservation techniques like high-pressure processing and pulsed electric fields may replace food-grade gases in some applications. Finally, the market faces uncertainty due to fluctuating raw material prices. Food-grade gas production relies on materials like natural gas, and price volatility in these resources can create challenges for manufacturers who depend on a steady supply. Despite these restraints, the market for food-grade gases is expected to grow due to the factors mentioned previously. Innovation in the industry may lead to the development of more environmentally friendly options and more efficient production processes.

The Carbonized Gas Market Opportunities:

The food-grade gases market, while primarily focused on food preservation, offers a treasure trove of exciting opportunities that extend far beyond its current applications. As environmental concerns take center stage, the industry can play a pivotal role in developing sustainable packaging solutions. Imagine a future where captured carbon dioxide, a major greenhouse gas is given a second life by being reused in food packaging, significantly reducing reliance on virgin materials and creating a more circular economy.

Furthermore, advancements in gas blending technology are poised to revolutionize the way food-grade gases are utilized. These new technologies allow for the creation of precise gas mixtures customized for specific applications. This newfound level of control can lead to a significant reduction in gas waste, minimizing environmental impact and production costs while simultaneously ensuring optimal effectiveness in preserving food quality.

CARBONIZED GAS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.88% |

|

Segments Covered |

By Gas Type, Application, Function, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Linde, Air Products & Chemicals, Air Liquide, The Messer Group, Taiyo Nippon Sanso, Wesfarmers, Massy Group, Sol SpA, Matheson Tri-Gas, Gulf Cryo |

Carbonized Gas Market Segmentation: By Gas Type

-

Carbon Dioxide (CO2)

-

Nitrogen (N2)

-

Oxygen (O2)

-

Other Gases

The food-grade gases market is segmented by gas type, with carbon dioxide (CO2) being the dominant player. Its applications in carbonation, modified atmosphere packaging, and freezing are widespread. While data on the fastest-growing segment is inconclusive, the rising demand for packaged and processed foods suggests nitrogen (N2) used for purging oxygen and preventing spoilage could be a strong contender.

Carbonized Gas Market Segmentation: By Application

-

Beverages

-

Food Packaging

-

Food Processing

The dominant segment in the food-grade gases market by application is Food Packaging, particularly Modified Atmosphere Packaging (MAP). This technique utilizes precise gas mixtures to extend shelf life and maintain the freshness of various food products. The fastest-growing segment is expected to be Food Processing. This segment is experiencing growth due to the increasing adoption of techniques like oxygen scavenging for fresh meat and controlled atmosphere storage for fruits and vegetables, all of which rely on food-grade gases.

Carbonized Gas Market Segmentation: By Function

-

Preservation

-

Carbonation

-

Packaging

-

Other Functions

Within the function segment of the food-grade gases market, preservation reigns supreme. Carbon dioxide and nitrogen play a vital role in inhibiting bacterial growth and extending shelf life, making it the dominant function. However, the fastest-growing segment is likely packaging. Advancements in modified atmosphere packaging (MAP) and the rise of smart packaging technologies that utilize food-grade gases for real-time monitoring are driving significant growth in this area.

Carbonized Gas Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America has traditionally been a dominant player in the food-grade gases market, due to a well-established food processing industry and a high demand for convenient packaged foods. The presence of major industrial gas companies like Air Liquide and Linde further strengthens North America's position. However, market growth is expected to mature in this region compared to developing economies.

Asia-Pacific is expected to witness the fastest growth in the food-grade gases market. The burgeoning middle class and rising disposable incomes are leading to a surge in the consumption of packaged and processed foods. Additionally, growing awareness of food safety and a developing food processing industry are creating significant opportunities for the market. China and India are expected to be the key growth drivers in this region.

COVID-19 Impact Analysis on the Carbonized Gas Market:

The COVID-19 pandemic caused a temporary upheaval in the food-grade gases market, which includes carbon dioxide. Initial lockdowns and disruptions to the food service industry led to a drop in demand for these gases typically used in restaurants and hospitality settings. However, this decline was offset by a surge in demand for packaged and shelf-stable foods as consumers stockpiled groceries. This required increased use of food-grade gases for preserving these products.

Looking beyond the initial disruption, the pandemic has had some lasting effects on the market. The rise of e-commerce for food delivery has created a need for packaging that maintains freshness during transport. This has led to a continued demand for food-grade gases used in modified atmosphere packaging (MAP) for various food items. Additionally, heightened hygiene concerns have placed a greater emphasis on food safety. Techniques like oxygen scavenging, which rely on food-grade gases, have become even more important in this context.

Latest Trends/ Developments:

The food-grade gas market is bubbling with innovation, constantly seeking solutions to satisfy evolving consumer demands and growing environmental concerns. Sustainability is a major focus area, with research and development actively exploring bio-based food-grade gases derived from renewable sources like biomass. This holds immense promise for significantly reducing the industry's environmental footprint. On the efficiency front, advancements in gas blending technology are revolutionizing the way food-grade gases are utilized. Imagine creating highly customized gas mixtures tailored to specific applications. This newfound level of precision can minimize gas waste by ensuring you only use what's necessary, ultimately lowering production costs. The future might even involve a fascinating convergence between food-grade gases and smart packaging technologies. Imagine intelligent packaging equipped with sensors that can monitor gas levels and food freshness in real time. This real-time data could be used to optimize storage conditions and prevent food spoilage throughout the supply chain, significantly reducing waste. Consumer preferences for clean-label ingredients are also driving innovation. The exploration of natural antimicrobials derived from plants or essential oils is gaining traction. These natural alternatives could potentially be combined with food-grade gases for even more effective preservation without relying on artificial additives. And who knows, the future might even involve 3D-printed food packaging that utilizes food-grade gases for optimal preservation! These exciting advancements have the potential to revolutionize the food-grade gas market, ensuring a more sustainable, efficient, and consumer-centric future for the food industry.

Key Players:

-

Linde

-

Air Products & Chemicals

-

Air Liquide

-

The Messer Group

-

Taiyo Nippon Sanso

-

Wesfarmers

-

Massy Group

-

Sol SpA

-

Matheson Tri-Gas

-

Gulf Cryo

Chapter 1. Carbonized Gas Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Carbonized Gas Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Carbonized Gas Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Carbonized Gas Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Carbonized Gas Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Carbonized Gas Market – By Gas Type

6.1 Introduction/Key Findings

6.2 Carbon Dioxide (CO2)

6.3 Nitrogen (N2)

6.4 Oxygen (O2)

6.5 Other Gases

6.6 Y-O-Y Growth trend Analysis By Gas Type

6.7 Absolute $ Opportunity Analysis By Gas Type, 2024-2030

Chapter 7. Carbonized Gas Market – By Application

7.1 Introduction/Key Findings

7.2 Beverages

7.3 Food Packaging

7.4 Food Processing

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Carbonized Gas Market – By Function

8.1 Introduction/Key Findings

8.2 Preservation

8.3 Carbonation

8.4 Packaging

8.5 Other Functions

8.6 Y-O-Y Growth trend Analysis By Function

8.7 Absolute $ Opportunity Analysis By Function, 2024-2030

Chapter 9. Carbonized Gas Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Gas Type

9.1.3 By Application

9.1.4 By By Function

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Gas Type

9.2.3 By Application

9.2.4 By Function

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Gas Type

9.3.3 By Application

9.3.4 By Function

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Gas Type

9.4.3 By Application

9.4.4 By Function

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Gas Type

9.5.3 By Application

9.5.4 By Function

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Carbonized Gas Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Linde

10.2 Air Products & Chemicals

10.3 Air Liquide

10.4 The Messer Group

10.5 Taiyo Nippon Sanso

10.6 Wesfarmers

10.7 Massy Group

10.8 Sol SpA

10.9 Matheson Tri-Gas

10.10 Gulf Cryo

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Carbonized Gas Market was valued at USD 8.09 billion in 2023 and is projected to reach a market size of USD 12.89 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6.88%.

Shifting Consumer Preferences Towards Convenience, Heightened Focus on Food Safety and Extended Shelf Life, Advancements in Food Processing and Packaging Technologies, Expansion of the Packaged Food Market in Developing Economies.

Beverages, Food Packaging, Food Processing.

North America leads the food-grade gas market due to a strong food processing industry and high demand for packaged foods.

Linde, Air Products & Chemicals, Air Liquide, The Messer Group, Taiyo Nippon Sanso, Wesfarmers, Massy Group, Sol SpA, Matheson Tri-Gas, Gulf Cryo.