Carbon Fiber Material for Construction Market Size (2024 – 2030)

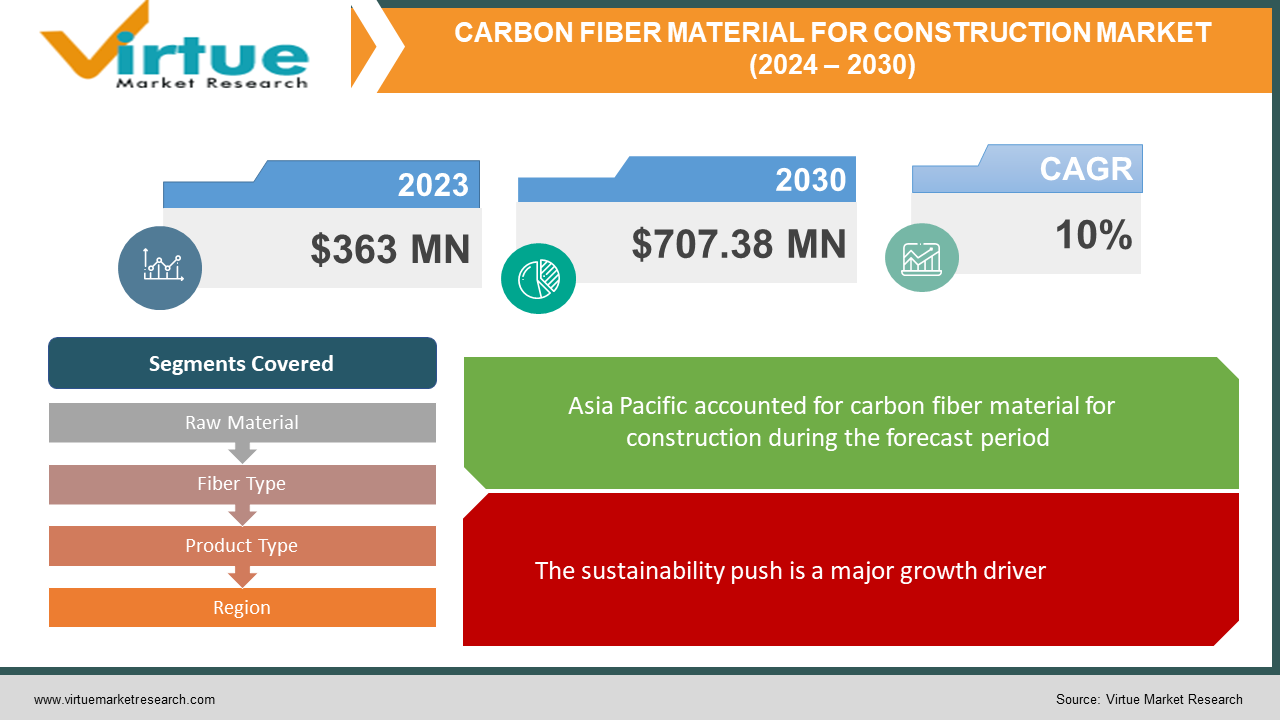

The global carbon fiber material for construction market was valued at USD 363 million in 2023 and is projected to reach a market size of USD 707.38 million by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 10%.

A variety of sophisticated composite materials made from carbon fibres, which are incredibly strong, light, and long-lasting, are referred to as carbon fibre materials for building. To increase sustainability, decrease weight, and improve structural performance, these materials are being utilised more and more in a variety of building applications.

Key Market Insights:

The global carbon fiber market for construction is expected to be driven by increasing infrastructure development in developing economies, particularly in Asia and the Pacific. This growth is attributed to factors like urbanization, government investments in infrastructure projects, and growing awareness of the benefits of carbon fiber in construction, such as its high strength-to-weight ratio and seismic resistance. There's a growing focus on sustainable construction practices globally. Carbon fiber offers a lightweight alternative to traditional materials like steel, which can lead to reduced building weight and consequently lower CO2 emissions during construction and throughout the building's lifecycle. Advancements in carbon fiber production technologies are expected to bring down the cost of the material, making it more accessible for construction applications. Researchers are developing new techniques like dry-filament winding and automated fiber placement, which can improve production efficiency and reduce costs.

Carbon Fiber Material for Construction Market Drivers:

The sustainability push is a major growth driver.

The construction industry is increasingly focusing on eco-friendly practices. Carbon fiber offers a compelling solution. Being lightweight, it reduces building weight, leading to lower CO2 emissions during construction and throughout the building's lifespan. Additionally, its durability extends building lifespans, minimizing the need for replacements and demolitions that create further environmental impact. A study by the Carbon Leadership Project revealed that buildings and construction are responsible for nearly 40% of global CO2 emissions. So, a shift towards carbon fiber in construction can significantly contribute to achieving sustainability goals in the building sector.

Advancements in carbon fiber technology are boosting the growth in the market.

Research and development in carbon fiber production technologies are making the material more affordable for construction applications. New techniques like dry-filament winding and automated fiber placement are being developed to improve production efficiency and bring down costs. Furthermore, research on bio-based resins for carbon fiber composites is underway, offering a more sustainable alternative to traditional petroleum-based resins. These advancements can significantly drive the adoption of carbon fiber in the construction industry.

Market Restraints and Challenges:

The high cost of carbon fiber is restraining market growth.

A major hurdle for wider adoption in construction is the high cost of carbon fiber compared to traditional building materials like steel or concrete. The complex manufacturing process and reliance on precursor materials like polyacrylonitrile (PAN) contribute to this high price point. This price factor can be particularly impactful in developing economies, where budget constraints are often a significant consideration.

The limited availability of skilled labor is a major challenge for the industry.

Working with carbon fiber in construction requires specialized knowledge and skills. Currently, there's a limited pool of workers trained in handling and applying carbon fiber composites effectively. This lack of skilled labor can hinder the widespread adoption of carbon fiber in construction projects, particularly for large-scale applications. Addressing this challenge will require increased training programs and educational initiatives to develop a skilled workforce for the future of carbon fiber construction.

End-of-life management is restricting market growth.

The relatively new application of carbon fiber in construction raises questions about its end-of-life management. Unlike traditional materials, established recycling processes for carbon fiber composites in construction are not yet widely available. Developing efficient and cost-effective recycling methods for carbon fiber composites is crucial to ensuring the long-term sustainability of this material in the construction sector. Research into new recycling technologies and the creation of a robust recycling infrastructure are critical steps to address this challenge.

Market Opportunities:

Seismic retrofitting and renovation are opening new growth opportunities for the market.

The growing need for earthquake-resistant buildings presents a significant opportunity for carbon fiber in construction. Due to its high strength-to-weight ratio and excellent seismic performance, carbon fiber composites can be used to strengthen existing structures and improve their resilience to earthquakes. Additionally, carbon fiber's lightweight properties can minimize the additional load on a structure during retrofitting. The carbon fiber construction repair market, which includes seismic retrofitting applications, is expected to reach a value of USD 2.2 billion by 2027. This highlights the potential for growth in this specific segment of the carbon fiber construction market.

Prefabricated carbon fiber construction is a new opportunity for the market.

Prefabricated construction using carbon fiber composites offers a promising opportunity for faster, more efficient, and sustainable building methods. Prefabricated carbon fiber components can be manufactured off-site under controlled conditions, ensuring high quality and consistency. This approach can significantly reduce construction time and minimize on-site waste. Additionally, the lightweight nature of carbon fiber can simplify transportation and assembly processes. With advancements in prefabrication technology and design optimization, carbon fiber construction has the potential to revolutionize the construction industry, particularly for high-performance buildings and temporary structures.

CARBON FIBER MATERIAL FOR CONSTRUCTION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10% |

|

Segments Covered |

By Raw Material, Fiber Type, Product Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sika AG, Mapei SaA, Fosroc, Master Builders Solutions, Fyfe, DowAksa, Dextra Group, Rhino Carbon Fiber Reinforcement Products, Chomarat Group |

Carbon Fiber Material for Construction Market Segmentation: By Raw Material

-

Pan-based Carbon Fiber

-

Pitch-based Carbon Fiber

While both PAN-based and pitch-based carbon fibers are used in construction, PAN-based fibers currently dominate the market due to their superior mechanical properties, such as higher tensile strength and modulus. Pan-based carbon fiber is widely used in many different industries, including aerospace, automotive, and sports goods. Its exceptional strength-to-weight ratios allow for the construction of strong, lightweight structures. However, pitch-based fibers are the fastest-growing category. Pitch-based carbon fiber has its roots in specialized industries like aerospace and defense and is highly resistant to heat and chemicals, making it ideal for harsh environments and high-stress applications. They offer a potential cost advantage due to the lower cost of the precursor pitch. As research and development efforts continue, improvements in the performance of pitch-based fibers could make them a more viable option for specific construction applications where cost is a primary concern. The ongoing development of bio-based precursor materials for both PAN and pitch-based fibers presents a promising future direction for a more sustainable carbon fiber construction industry.

Carbon Fiber Material for Construction Market Segmentation: By Fiber Type

-

Virgin Carbon Fiber

-

Recycled Carbon Fiber

Virgin carbon fiber currently dominates the market due to its superior performance characteristics. Virgin carbon fiber has an unmatched strength-to-weight ratio, corrosion resistance, and durability, making it widely used in demanding applications where strength, stiffness, and performance are crucial. However, recycled carbon fiber is the fastest-growing segment. They offer a more sustainable and potentially cost-effective option. Recycled carbon fiber is used in the construction industry to produce lightweight components, reinforce concrete buildings, and meet environmental goals without sacrificing functionality. As research and development efforts progress, the performance of recycled carbon fiber is expected to improve, making it a more viable choice for a wider range of construction applications.

Carbon Fiber Material for Construction Market Segmentation: By Product Type

-

Continuous Carbon Fiber

-

Long-carbon fiber

-

Short Carbon Fiber

The selection of carbon fiber type for a construction project depends on the specific application and desired properties. Continuous carbon fiber is the largest and fastest-growing type. They offer the highest strength and stiffness, making them ideal for high-performance applications like seismic retrofitting. Long carbon fiber provides a good balance between strength and ease of use, while short carbon fiber is often used in applications requiring formability or where fiber length is not critical. As research and development efforts continue, improvements in the production and performance of all three carbon fiber types can be expected, leading to a wider range of options for construction projects with varying requirements.

Carbon Fiber Material for Construction Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

The Asia Pacific region is the largest and fastest-growing market in the carbon fiber construction market, driven by factors like rapid urbanization, government investments in infrastructure projects, and a growing awareness of the benefits of carbon fiber in construction. North America and Europe are also expected to witness significant growth due to a focus on sustainable construction practices and advancements in carbon fiber technology. South America the Middle East and Africa may see slower adoption rates due to budgetary constraints and a lack of established infrastructure for carbon fiber construction. However, with increasing awareness and potential cost reductions in the future, these regions hold promise for future growth.

COVID-19 Impact Analysis on the Global Carbon Fiber Material for Construction Market:

The global COVID-19 pandemic did disrupt the burgeoning carbon fiber construction market. Lockdowns and restrictions on movement hampered construction activity worldwide, leading to a temporary decline in demand for carbon fiber for construction applications. This resulted in a slowdown in market growth compared to pre-pandemic projections. For instance, research suggests that demand for carbon fiber from the construction sector only grew by 1% during the first half of the pandemic. However, the impact appears to be short-lived. The construction industry has exhibited a strong rebound since the initial shock of the pandemic. Furthermore, the focus on infrastructure development and sustainable building practices remains a priority in many regions. This, coupled with advancements in carbon fiber technology and potential cost reductions, suggests that the long-term growth trajectory of the carbon fiber construction market remains positive. The COVID-19 pandemic may have caused a temporary setback, but the underlying drivers for carbon fiber in construction are still very much in play.

Latest Trends/Developments:

Prefabricated carbon fiber construction is beneficial.

This trend focuses on constructing buildings using prefabricated carbon fiber components manufactured off-site under controlled conditions. These components offer advantages like high quality, consistency, faster construction times, reduced on-site waste, and lighter weight for easier transportation and assembly. Advancements in prefabrication technology and design optimization hold promise for revolutionizing construction, particularly for high-performance buildings and temporary structures.

Bio-based resins for carbon fiber composites are being emphasized.

Traditionally, carbon fiber composites rely on petroleum-based resins. However, a growing trend is the development and adoption of bio-based resins derived from renewable resources like plant oils. This shift aligns with the focus on sustainability in the construction industry and can significantly reduce the environmental impact of carbon fiber composites throughout their lifecycle. Research efforts in this area are ongoing, to create high-performance bio-based resins that can match or even exceed the properties of traditional petroleum-based options.

3D Printing with carbon fiber composites is another major trend.

This emerging trend involves utilizing 3D printing technology to create complex and customized building components using carbon fiber composites. This offers exciting possibilities for innovative and lightweight building designs with enhanced structural properties. While this application is still in its early stages, advancements in 3D printing technology and carbon fiber composites have the potential to disrupt traditional construction methods in the future.

Key Players:

-

Sika AG

-

Mapei SaA

-

Fosroc

-

Master Builders Solutions

-

Fyfe

-

DowAksa

-

Dextra Group

-

Rhino Carbon Fiber Reinforcement Products

-

Chomarat Group

In February 2024, Japanese telecommunications giant KDDI and materials manufacturer Toray announced a collaboration to develop robots for automated layup of carbon fiber composites on construction sites. This technology has the potential to streamline construction processes, reduce reliance on manual labor, and improve safety in carbon fiber construction projects.

Chapter 1. Carbon Fiber Material for Construction Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Carbon Fiber Material for Construction Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Carbon Fiber Material for Construction Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Carbon Fiber Material for Construction Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Carbon Fiber Material for Construction Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Carbon Fiber Material for Construction Market – By Raw Material

6.1 Introduction/Key Findings

6.2 Pan-based Carbon Fiber

6.3 Pitch-based Carbon Fiber

6.4 Y-O-Y Growth trend Analysis By Raw Material

6.5 Absolute $ Opportunity Analysis By Raw Material, 2024-2030

Chapter 7. Carbon Fiber Material for Construction Market – By Fiber Type

7.1 Introduction/Key Findings

7.2 Virgin Carbon Fiber

7.3 Recycled Carbon Fiber

7.4 Y-O-Y Growth trend Analysis By Fiber Type

7.5 Absolute $ Opportunity Analysis By Fiber Type, 2024-2030

Chapter 8. Carbon Fiber Material for Construction Market – By Product Type

8.1 Introduction/Key Findings

8.2 Continuous Carbon Fiber

8.3 Long-carbon fiber

8.4 Short Carbon Fiber

8.5 Y-O-Y Growth trend Analysis By Product Type

8.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 9. Carbon Fiber Material for Construction Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Raw Material

9.1.3 By Fiber Type

9.1.4 By Product Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Raw Material

9.2.3 By Fiber Type

9.2.4 By Product Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Raw Material

9.3.3 By Fiber Type

9.3.4 By Product Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Raw Material

9.4.3 By Fiber Type

9.4.4 By Product Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Raw Material

9.5.3 By Fiber Type

9.5.4 By Product Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Carbon Fiber Material for Construction Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Sika AG

10.2 Mapei SaA

10.3 Fosroc

10.4 Master Builders Solutions

10.5 Fyfe

10.6 DowAksa

10.7 Dextra Group

10.8 Rhino Carbon Fiber Reinforcement Products

10.9 Chomarat Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global carbon fiber material for construction market was valued at USD 363 million in 2023 and is projected to reach a market size of USD 707.38 million by the end of 2030. Over the forecast period of 2024–2030, the market is expected to grow at a CAGR of 10.0%.

Key drivers include growth in developing economies, a sustainability push, and advancements in carbon fiber technology.

Residential, Commercial, Bridge, Water Structure, Oil & Natural Gas Pipeline, Industrial Structure, and Others are verticals of the Global Carbon Fiber Material for Construction Market.

Asia-Pacific dominates the market with a significant share of over 35%.

Sika AG, Mapei SaA, Fosroc, Master Builders Solutions, Fyfe, DowAksa, Dextra Group, Rhino Carbon Fiber Reinforcement Products, and Chomarat Group are some of the leading players in the global carbon fiber material for the construction market.