Carbon Fiber FRP Pipe Market Size (2024 – 2030)

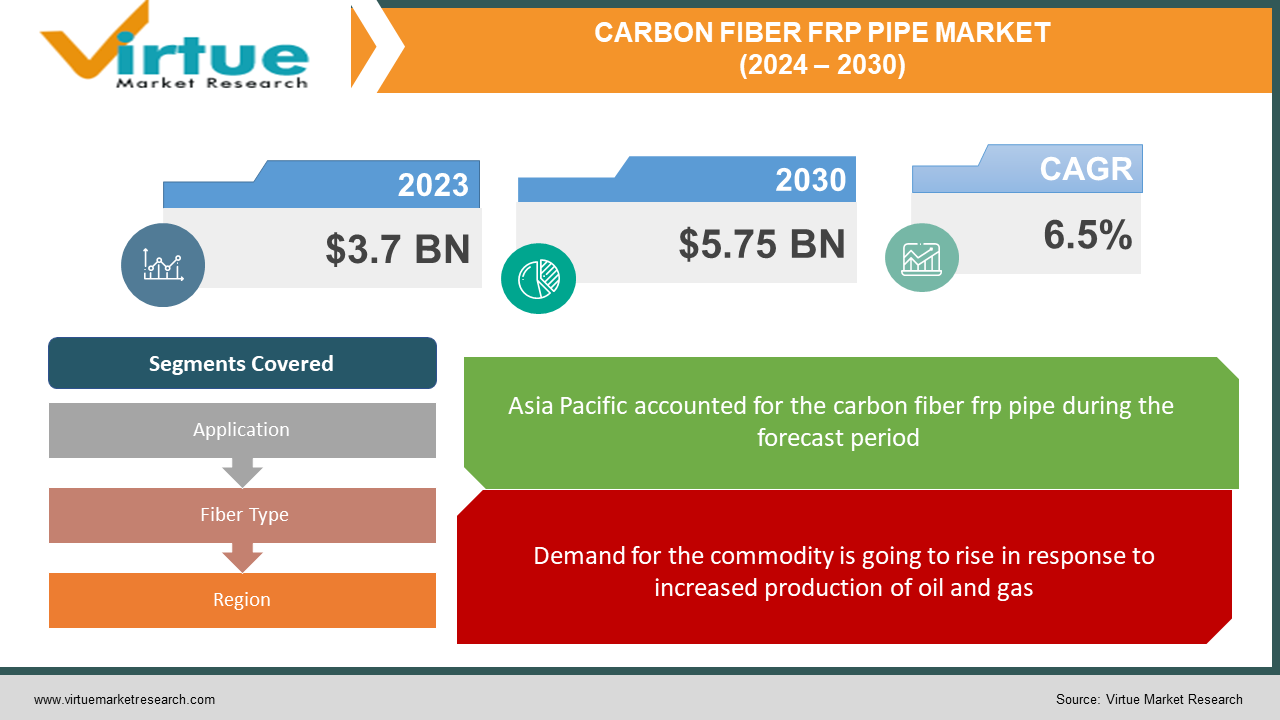

The global Carbon Fiber FRP Pipe Market size was exhibited at USD 3.7 billion in 2023 and is projected to hit around USD 5.75 billion by 2030, growing at a CAGR of 6.5% during the forecast period from 2024 to 2030.

Pipes composed of plastic resin reinforced with fibres are generally referred to as fiber-reinforced plastic pipes. The most popular kind of FRP pipe is reinforced with fibreglass and strikes a nice mix of strength and cost. Nevertheless, carbon fibre is also used in some FRP pipes. Though less popular than fibreglass FRP pipes, carbon fibre FRP pipes have a few important benefits. Since carbon fibre is stiffer and stronger than fibreglass, carbon fibre FRP pipes can withstand the same pressure while weighing less. Additionally, they have outstanding corrosion resistance. Due to its higher cost compared to fibreglass, carbon fibre FRP pipes are usually limited to usage in applications where weight reduction or increased strength are essential.

Key Market Insights:

Many types of resins, such as vinyl ester, epoxy, polyurethane, phenolic, and thermosetting polyester resin, can be used to create FRP pipes. Oil and gas, chemical and petrochemical, industrial water, and wastewater, ducting and vent piping, slurry piping, power plants, and other applications are just a few of the many uses for FRP pipes. The US government declared that the Alaska LNG Liquefaction Plant project will continue to operate. The 800-mile pipeline, gas treatment plant, and three-train liquefaction plant comprise the Alaska LNG. Starting operations in 2025, the facility is expected to export around 3.5 billion cubic feet of gas per day from Alaska's North Slope gas reserves.

Global Carbon Fiber FRP Pipe Market Drivers:

Demand for the commodity is going to rise in response to increased production of oil and gas.

One of the main factors driving the market's expansion is the always-rising demand for oil and gas supplies from the commercial, residential, and industrial sectors. For example, Nigeria declared the commencement of the Dangote Refinery and Polypropylene Plant project, which is anticipated to start up. The plant is anticipated to process various crude grades, including shale oil, and can produce fuel oil. The Nord Stream route's gas capacity has increased thanks to the pipeline. As a result, the need for FRP pipe systems to be employed in these production sites would rise along with the need for oil and gas production operations in various nations throughout the world.

Demand for the product is most likely to rise in response to an increase in demand from the electricity sector.

In the power sector, FRP pipes and equipment are frequently utilised for a variety of purposes, including process vessels, storage tanks, slurry piping, cooling tower pipes, circulating water systems, stacks, and chimney liners. To fulfil the future power demand of cooperative electric consumers, for example, the Florida Public Service Commission approved the start of a combined project for the creation of two new gas-fired power plants. In Putnam County, a new plant is being built by Seminole Electric Cooperative.

Global Carbon Fiber FRP Pipe Market Restraints and Challenges:

Even with its potential, the global market for FRP pipes made of carbon fiber has several obstacles. One major barrier still exists because carbon fiber is more expensive than fiberglass. This prevents it from being widely used and limits its employment to situations where the extra cost is justified by weight savings or extraordinary strength. Furthermore, production costs may rise due to the very intricate manufacturing process in comparison to conventional solutions. Furthermore, market expansion may be hampered in some areas by a lack of knowledge about the advantages of carbon fiber FRP pipes. Ultimately, the implementation of sustainable and cost-effective recycling processes can mitigate the issues posed by increasing environmental rules governing the disposal of these composites.

Global Carbon Fiber FRP Pipe Market Opportunities:

The market for carbon fibre FRP pipes worldwide offers promising prospects for expansion in several industries. The growing need for high-performance, lightweight materials in sectors like transportation and construction is a major driving force. Here, the strength-to-weight advantage of carbon fibre FRP pipes can be fully utilised, possibly resulting in lighter and more fuel-efficient constructions or automobiles. Additionally, because carbon fibre FRP pipes are suitable for wind turbine components, the increased focus on renewable energy, especially wind power, opens openings for them. These pipes have the potential to replace conventional choices due to tougher environmental rules requiring corrosion-resistant materials in oil and gas and chemical processing industries. Global investments in infrastructure modernization might also support market expansion.

CARBON FIBER FRP PIPE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Application, Fiber Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amiantit Company, Chemical Process Piping Pvt Ltd., China National Building Material Company Limited, Ershing Inc., Future Pipe Industries, HengRun Group Co. Ltd., Hobas, National Oilwell Varco, Sarplast SA., Sekisui Chemicals |

Global Carbon Fiber FRP Pipe Market Segmentation: By Application

-

Oil & Gas

-

Chemical & Industrial

-

Water & Wastewater Treatment

-

Construction

-

Other Applications

Due to the growing need for FRP pipes for pipeline systems in the sector, the oil and gas application held the highest share of the FRP pipe market in 2023 and is predicted to increase. For instance, the Rovuma LNG project, which is Africa's largest privately funded project. An estimated ton of LNG is produced annually at the Rovuma facility. Because of their superior non-corrosive qualities, abrasion resistance, and low maintenance costs, FRP pipes which are made of thermosetting polyester resin, epoxy resin, vinyl ester resin, polyurethane resin, phenolic resin, and more are being utilized as piping systems in the oil and gas industry more and more. Therefore, throughout the forecast period, an increase in upcoming oil and gas projects is anticipated to propel market expansion.

Global Carbon Fiber FRP Pipe Market Segmentation: By Fiber Type

-

Carbon Fiber FRP Pipes

-

Glass Fiber FRP Pipes

Though presently Carbon FRP pipes have a smaller market share than glass fibre choices, carbon fibre FRP pipes are the category that is anticipated to grow at the fastest rate during the forecast period, 2024-2030. Multiple elements are driving this quick expansion. These pipes are perfect for purposes where weight reduction is crucial, like some aeronautical or marine applications, because carbon fibre has an unrivaled strength-to-weight ratio. They are an invaluable resource in hostile settings like chemical processing facilities because of their exceptional corrosion resistance. Although the increased price is a deterrent, in some specific applications the exceptional qualities of carbon fibre make the investment worthwhile. The market for FRP pipes is seeing a faster increase in the carbon fibre category due to this targeted demand and growing knowledge of its benefits.

Global Carbon Fiber FRP Pipe Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

In the FRP Pipe Market, Asia Pacific accounted for the highest proportion in 2023. Because of the growing demand for FRP pipes from the local oil and gas industries, the consumption of these pipes is particularly high in this region. The Ministry of Petroleum and Natural Gas (MoPNG), for example, declared that work on oil and gas projects has restarted in India. Recent information indicates that oil and gas projects are expected to begin production. The Yantai Expansion terminal is one of the biggest projects. It is anticipated that operations will start in 2025. The rising demand for FRP piping systems to be employed in prospective oil and gas projects can be attributed to its superior non-corrosive qualities, resilience to abrasion, and low maintenance costs.

COVID-19 Impact Analysis on the Global Carbon Fiber FRP Pipe Market:

The worldwide market for FRP pipes made of carbon fiber suffered a temporary setback because of the COVID-19 pandemic. Supply chains were interrupted by lockdowns and project delays, which also resulted in a drop in demand in important user industries including oil and gas and construction. As a result, the market's growth trajectory experienced a brief pause. Long-term prospects, however, appear promising. Infrastructure spending and an increased emphasis on renewable energy sources might be major tailwinds as economies recover. Carbon fiber FRP pipes are strong and long-lasting, which makes them ideal for these industries and may boost further market growth.

Recent Trends and Developments in the Global Carbon Fiber FRP Pipe Market:

Sarplast designs specialized FRP pipe solutions for difficult industrial projects in the Middle East in partnership with a top engineering firm. To meet the rising demand in the region, Lianyungang Zhongfu Lianzhong Composites Group Co. Ltd. establishes a distribution network in South America as part of its global expansion strategy. A large-scale pipeline installation in a European nation is successfully finished by HOBAS, demonstrating the dependability and effectiveness of its FRP pipe systems. In a rapidly developing Asian nation, Hanwei Energy Services Corp. wins a sizable contract to supply FRP pipes for a substantial water transmission project.

Key Players:

-

Amiantit Company

-

Chemical Process Piping Pvt Ltd.

-

China National Building Material Company Limited

-

Ershing Inc.

-

Future Pipe Industries

-

HengRun Group Co. Ltd.

-

Hobas

-

National Oilwell Varco

-

Sarplast SA.

-

Sekisui Chemicals

Chapter 1. Carbon Fiber FRP Pipe Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Carbon Fiber FRP Pipe Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Carbon Fiber FRP Pipe Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Carbon Fiber FRP Pipe Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Carbon Fiber FRP Pipe Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Carbon Fiber FRP Pipe Market – By Fiber Type

6.1 Introduction/Key Findings

6.2 Carbon Fiber FRP Pipes

6.3 Glass Fiber FRP Pipes

6.4 Y-O-Y Growth trend Analysis By Fiber Type

6.5 Absolute $ Opportunity Analysis By Fiber Type, 2024-2030

Chapter 7. Carbon Fiber FRP Pipe Market – By Application

7.1 Introduction/Key Findings

7.2 Oil & Gas

7.3 Chemical & Industrial

7.4 Water & Wastewater Treatment

7.5 Construction

7.6 Other Applications

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Carbon Fiber FRP Pipe Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Fiber Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Fiber Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Fiber Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Fiber Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Fiber Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Carbon Fiber FRP Pipe Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

9.1 Amiantit Company

9.2 Chemical Process Piping Pvt Ltd.

9.3 China National Building Material Company Limited

9.4 Ershing Inc.

9.5 Future Pipe Industries

9.6 HengRun Group Co. Ltd.

9.7 Hobas

9.8 National Oilwell Varco

9.9 Sarplast SA.

9.10 Sekisui Chemicals

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Carbon Fiber FRP Pipe Market size is valued at USD 3.7 billion in 2023.

The worldwide Global Carbon Fiber FRP Pipe Market growth is estimated to be 6.5% from 2024 to 2030.

The Global Carbon Fiber FRP Pipe Market is segmented By Application (Oil & Gas, Chemical & Industrial, Water & Wastewater Treatment, Construction, Other Applications); By Fiber Type (Carbon Fiber FRP Pipes, Glass Fiber FRP Pipes), and By Region.

The market for carbon fiber FRP pipes is anticipated to increase in the future due to the growing need across a range of sectors for high-performance, lightweight materials. Potential markets for growth include expanding infrastructure projects, the oil and gas industry's increasing use of corrosion resistance, and the emphasis on renewable energy sources like wind power.

In the near run, the market for carbon fiber FRP pipes was adversely affected by the COVID-19 pandemic. Construction and oil and gas are two industries that use these pipes; supply chains were disrupted, and demand fell because of lockdowns and project delays. The long-term picture, though, might be favorable. Because of their strength and longevity, these pipes may become more in demand as infrastructure investment and the recovery shifts to renewable energy sources.