Carbon Fiber-Based Solar Panels Market Size (2024–2030)

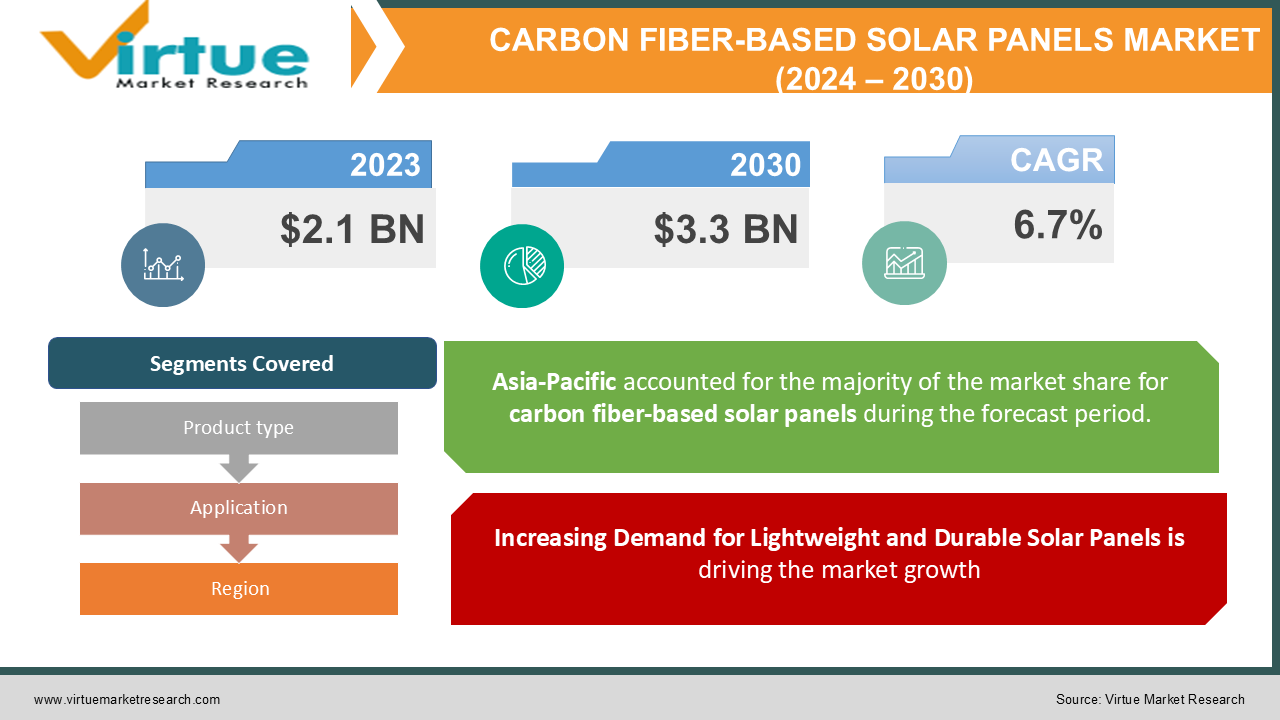

The Global Carbon Fiber-Based Solar Panels Market was valued at USD 2.1 billion in 2023 and is expected to grow at a CAGR of 6.7% from 2024 to 2030, reaching USD 3.3 billion by 2030.

Carbon fiber-based solar panels are gaining traction due to their lightweight properties, high strength, and durability compared to traditional solar panels. These panels incorporate carbon fiber composites, making them lighter yet stronger, and providing better performance, particularly in applications where weight is a crucial factor.

The increasing demand for renewable energy sources and the growing global push toward carbon neutrality have contributed to the market's expansion. The shift toward more efficient and durable solar panels, especially in industries such as aerospace, automotive, and military, is driving the growth of carbon fiber-based solar panels. Furthermore, these panels are increasingly being adopted in residential and commercial installations, where the lightweight nature helps in easier installation and handling.

Key Market Insights:

-

Monocrystalline carbon fiber solar panels dominate the market with a share of 55%, largely due to their superior efficiency and energy conversion rate compared to polycrystalline panels.

-

The commercial sector is the largest application segment, accounting for 45% of the total market revenue in 2023, driven by increased demand for solar power installations in corporate buildings, malls, and retail centers.

-

Asia-Pacific leads the global carbon fiber-based solar panels market, representing over 40% of the market share, supported by rising investments in solar energy infrastructure in countries such as China, India, and Japan.

-

The industrial application segment is expected to grow at the fastest rate, with a CAGR of 7.2% from 2024 to 2030, as industries look to reduce energy costs and improve sustainability by switching to solar energy.

-

Carbon fiber-based solar panels offer improved resistance to environmental degradation and wear, increasing their lifespan by 20-30% compared to traditional silicon-based panels.

Global Carbon Fiber-Based Solar Panels Market Drivers:

Increasing Demand for Lightweight and Durable Solar Panels is driving the market growth:

The growing need for lightweight, durable, and highly efficient solar panels has been a significant driver of the carbon fiber-based solar panels market. Traditional solar panels, typically made of glass and silicon, tend to be heavy and prone to damage over time due to environmental factors such as extreme weather, dust, and corrosion. Carbon fiber composites, on the other hand, offer several advantages over these materials, including higher strength-to-weight ratios, greater resistance to environmental wear, and improved durability. The lightweight nature of carbon fiber-based solar panels makes them particularly attractive for applications where weight is a critical factor, such as in aerospace, automotive, and military sectors. In aerospace, for instance, solar panels with carbon fiber are increasingly being used in the construction of solar-powered drones, satellites, and space stations, where reducing weight is crucial for enhancing fuel efficiency and payload capacity. Furthermore, the improved durability of carbon fiber-based panels extends their lifespan, reducing maintenance costs and making them a more cost-effective option in the long term. These panels are also more resistant to bending and cracking, ensuring better performance in harsh environments. As a result, the demand for carbon fiber-based solar panels is expected to continue rising across a wide range of industries, including transportation, telecommunications, and utility-scale solar power plants.

Rising Adoption of Renewable Energy Sources and Carbon Neutrality Goals is driving the market growth:

The global push toward renewable energy adoption and carbon neutrality has played a significant role in driving the growth of the carbon fiber-based solar panels market. Governments and organizations worldwide are increasingly focusing on reducing greenhouse gas emissions and transitioning to cleaner energy sources as part of their efforts to combat climate change. Solar energy is one of the most promising renewable energy sources, and carbon fiber-based solar panels offer a viable solution for meeting the growing demand for clean energy. Countries such as the United States, China, and those in the European Union have set ambitious targets for increasing the share of renewable energy in their energy mix. For instance, the European Union aims to achieve at least 32% of its energy from renewable sources by 2030, while China is targeting carbon neutrality by 2060. These goals are driving investments in solar power infrastructure, creating a favorable environment for the growth of the carbon fiber-based solar panels market. Moreover, as companies and industries face increasing pressure to reduce their carbon footprints, many are turning to solar energy as a cost-effective and sustainable solution. In particular, carbon fiber-based solar panels are gaining traction in industries where high energy consumption and emissions are a concern, such as manufacturing, mining, and data centers. The growing adoption of renewable energy in these sectors is expected to fuel the demand for carbon fiber-based solar panels over the forecast period.

Technological Advancements in Carbon Fiber Composites and Solar Panel Efficiency is driving the market growth:

Technological innovations in both carbon fiber composites and solar panel efficiency have been key drivers of the carbon fiber-based solar panels market. Over the past few years, significant advancements have been made in the development of high-performance carbon fiber materials that are not only lighter and stronger but also more cost-effective to produce. These materials have paved the way for the widespread adoption of carbon fiber in solar panel manufacturing, particularly in sectors where traditional materials fall short in terms of performance and durability. Additionally, continuous improvements in photovoltaic (PV) technology have led to higher energy conversion efficiencies in solar panels, making them more attractive to consumers and businesses alike. Monocrystalline carbon fiber solar panels, for example, offer higher efficiency rates than polycrystalline panels, making them ideal for applications where space is limited but energy demand is high. This efficiency, combined with the durability and strength of carbon fiber, makes these panels a superior alternative to traditional solar panels. Furthermore, research and development efforts are focused on enhancing the flexibility and adaptability of carbon fiber-based solar panels. Flexible solar panels, which can be easily installed on curved surfaces such as rooftops, vehicles, and portable devices, are becoming increasingly popular. The integration of advanced materials like carbon fiber in these flexible panels further improves their durability and performance, opening up new opportunities for solar energy deployment in a variety of applications.

Global Carbon Fiber-Based Solar Panels Market Challenges and Restraints:

High Initial Costs and Manufacturing Complexities is restricting the market growth:

One of the primary challenges facing the carbon fiber-based solar panels market is the high initial cost of production and installation. Carbon fiber is a premium material known for its strength and lightweight properties, but it is also expensive to manufacture compared to traditional materials used in solar panels, such as glass and silicon. The production of carbon fiber involves energy-intensive processes and requires specialized equipment, which drives up the overall cost of carbon fiber-based solar panels. Additionally, the manufacturing process for carbon fiber composites is complex and time-consuming. Producing carbon fiber-based solar panels requires precise control over the layering and bonding of materials, as well as rigorous quality checks to ensure optimal performance. These factors contribute to higher production costs and longer lead times, making carbon fiber-based panels less affordable for certain markets, particularly in developing regions where cost is a significant barrier to adoption. While technological advancements are helping to reduce production costs over time, the high upfront investment required for carbon fiber-based solar panels remains a challenge for widespread adoption. To address this issue, manufacturers are exploring ways to streamline production processes, improve material efficiency, and develop cost-effective alternatives to traditional carbon fiber composites.

Competition from Traditional Solar Panels and Alternative Materials is restricting the market growth:

Another key restraint for the carbon fiber-based solar panels market is the intense competition from traditional solar panels made from glass, silicon, and other conventional materials. While carbon fiber-based panels offer superior strength, durability, and efficiency, traditional solar panels remain the dominant choice in the market due to their lower cost and widespread availability. Silicon-based solar panels, in particular, have benefited from decades of research and development, resulting in a mature and cost-effective manufacturing process. Furthermore, emerging alternative materials, such as perovskite solar cells, are gaining attention as potential competitors to both traditional and carbon fiber-based solar panels. Perovskite solar cells offer the potential for higher efficiency and lower production costs compared to silicon-based panels, and they are currently being developed for large-scale commercial applications. The rapid advancements in alternative solar technologies could pose a threat to the growth of the carbon fiber-based solar panels market if they prove to be more cost-effective and efficient. To remain competitive, manufacturers of carbon fiber-based solar panels must continue to innovate and differentiate their products by focusing on niche applications where the unique properties of carbon fiber, such as lightweight and durability, offer a clear advantage. Additionally, partnerships with governments and industries that prioritize sustainability and high-performance solar solutions can help drive demand for carbon fiber-based panels.

Market Opportunities:

The global carbon fiber-based solar panels market presents numerous growth opportunities, particularly in the areas of transportation, aerospace, and portable energy solutions. As industries such as automotive and aerospace increasingly prioritize weight reduction and energy efficiency, carbon fiber-based solar panels are emerging as a key solution to meet these demands. In the automotive industry, carbon fiber-based solar panels can be integrated into electric vehicles (EVs) and hybrid vehicles to improve energy efficiency and reduce reliance on traditional energy sources. By utilizing lightweight solar panels on the vehicle's surface, manufacturers can enhance the vehicle's energy capture while minimizing the impact on its weight and performance. This not only improves fuel efficiency but also supports the growing demand for sustainable and environmentally friendly transportation solutions. In the aerospace sector, the lightweight and durable properties of carbon fiber-based solar panels make them ideal for use in drones, satellites, and other space technologies. Solar-powered drones, for example, can remain airborne for extended periods of time, providing valuable applications in surveillance, environmental monitoring, and communication. The ability to harness solar energy through carbon fiber panels allows these technologies to operate more efficiently and with reduced reliance on traditional power sources. Additionally, portable solar energy solutions present a significant market opportunity. The growing demand for portable energy devices, such as solar-powered chargers, backpacks, and camping gear, is driving the need for lightweight and efficient solar panels that can be easily integrated into these products. Carbon fiber-based solar panels are uniquely suited for these applications due to their strength, flexibility, and ability to withstand rugged conditions. This opens up new possibilities for the use of solar energy in off-grid and remote environments, where access to traditional power sources is limited.

CARBON FIBER-BASED SOLAR PANELS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.7% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Trina Solar Limited, SunPower Corporation, First Solar, Inc., Jinko Solar Holding Co., Ltd., Canadian Solar Inc., Hanwha Q Cells Co., Ltd., LONGi Green Energy Technology Co., Ltd., LG Electronics Inc., Risen Energy Co., Ltd., JA Solar Technology Co., Ltd. |

Carbon Fiber-Based Solar Panels Market Segmentation: By Product Type

-

Monocrystalline Carbon Fiber Solar Panels

-

Polycrystalline Carbon Fiber Solar Panels

The monocrystalline carbon fiber solar panels segment is the dominant product type, accounting for over 55% of the market share in 2023. Monocrystalline panels are known for their high efficiency and superior energy conversion rates, making them the preferred choice for applications where space is limited but energy demands are high. These panels are widely used in residential and commercial installations due to their higher performance, even in low-light conditions.

Carbon Fiber-Based Solar Panels Market Segmentation: By Application

-

Residential

-

Commercial

-

Industrial

-

Utility

The commercial segment leads the market, contributing 45% of the total market revenue in 2023. Commercial buildings, shopping centers, and corporate facilities are increasingly adopting solar energy solutions to reduce operational costs and improve sustainability. The use of carbon fiber-based solar panels in these installations provides enhanced durability and efficiency, making them an attractive option for businesses looking to invest in long-term energy solutions.

Carbon Fiber-Based Solar Panels Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

Asia-Pacific dominates the global carbon fiber-based solar panels market, with over 40% of the market share in 2023. The region's dominance is driven by the growing investments in renewable energy infrastructure in countries such as China, India, and Japan. China, in particular, is a major producer and consumer of solar panels, and the country’s increasing focus on advanced solar technologies, including carbon fiber-based panels, is contributing to the market’s growth. Additionally, government incentives and favorable policies for solar energy adoption in Asia-Pacific further support the market’s expansion.

COVID-19 Impact Analysis:

The COVID-19 pandemic had a mixed impact on the global carbon fiber-based solar panels market. In the initial stages of the pandemic, disruptions in supply chains, manufacturing delays, and reduced consumer demand led to a temporary slowdown in the market. Many solar panel manufacturers faced challenges in sourcing raw materials, particularly carbon fiber composites, due to restrictions on transportation and production. However, as the pandemic progressed, the market began to recover, driven by the increased focus on sustainability and renewable energy solutions. The shift toward remote work and the growing reliance on digital infrastructure highlighted the need for reliable and sustainable energy sources. As a result, investments in solar energy, including carbon fiber-based solar panels, gained momentum in the post-pandemic era. Moreover, the pandemic underscored the importance of resilient and decentralized energy systems. Many businesses and homeowners sought to reduce their reliance on traditional energy grids by investing in solar panels, leading to increased demand for innovative and durable solutions like carbon fiber-based panels. This trend is expected to continue in the coming years, as governments and industries prioritize renewable energy as part of their economic recovery strategies.

Latest Trends/Developments:

Several key trends are shaping the global carbon fiber-based solar panels market, including the increasing focus on sustainable energy solutions and the integration of solar panels into electric vehicles (EVs). As consumers and industries continue to prioritize sustainability, there is growing interest in solar technologies that offer enhanced efficiency and durability. In particular, the development of solar-powered EVs is gaining traction as automakers seek to reduce the carbon footprint of their vehicles. By incorporating carbon fiber-based solar panels into the design of EVs, manufacturers can extend the vehicle's driving range and reduce its dependence on traditional charging infrastructure. This trend aligns with the broader shift toward electrification and renewable energy in the transportation sector. Additionally, advancements in flexible and portable solar panels are opening up new opportunities for the use of carbon fiber-based solar panels in off-grid and remote applications. These panels can be integrated into portable devices, outdoor equipment, and emergency power supplies, providing reliable energy in areas with limited access to traditional power sources.

Key Players:

-

Trina Solar Limited

-

SunPower Corporation

-

First Solar, Inc.

-

Jinko Solar Holding Co., Ltd.

-

Canadian Solar Inc.

-

Hanwha Q Cells Co., Ltd.

-

LONGi Green Energy Technology Co., Ltd.

-

LG Electronics Inc.

-

Risen Energy Co., Ltd.

-

JA Solar Technology Co., Ltd.

Chapter 1. Carbon Fiber-Based Solar Panels Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Carbon Fiber-Based Solar Panels Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Carbon Fiber-Based Solar Panels Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Carbon Fiber-Based Solar Panels Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Carbon Fiber-Based Solar Panels Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Carbon Fiber-Based Solar Panels Market – By Product

6.1 Introduction/Key Findings

6.2 Monocrystalline Carbon Fiber Solar Panels

6.3 Polycrystalline Carbon Fiber Solar Panels

6.4 Y-O-Y Growth trend Analysis By Product

6.5 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Carbon Fiber-Based Solar Panels Market – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Industrial

7.5 Utility

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Carbon Fiber-Based Solar Panels Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Carbon Fiber-Based Solar Panels Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Trina Solar Limited

9.2 SunPower Corporation

9.3 First Solar, Inc.

9.4 Jinko Solar Holding Co., Ltd.

9.5 Canadian Solar Inc.

9.6 Hanwha Q Cells Co., Ltd.

9.7 LONGi Green Energy Technology Co., Ltd.

9.8 LG Electronics Inc.

9.9 Risen Energy Co., Ltd.

9.10 JA Solar Technology Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global carbon fiber-based solar panels market was valued at USD 2.1 billion in 2023 and is expected to reach USD 3.3 billion by 2030, growing at a CAGR of 6.7%.

The key drivers include increasing demand for lightweight and durable solar panels, rising adoption of renewable energy sources, and technological advancements in carbon fiber composites and solar panel efficiency.

The market is segmented by product type (monocrystalline carbon fiber solar panels, polycrystalline carbon fiber solar panels) and application (residential, commercial, industrial, utility).

Asia-Pacific is the dominant region, accounting for over 40% of the market share in 2023, driven by strong investments in renewable energy infrastructure in countries such as China, India, and Japan.

Leading players include Trina Solar Limited, SunPower Corporation, First Solar, Inc., Jinko Solar Holding Co., Ltd., and Canadian Solar Inc..