Carbon Fiber Axle Market Size (2024 –2030)

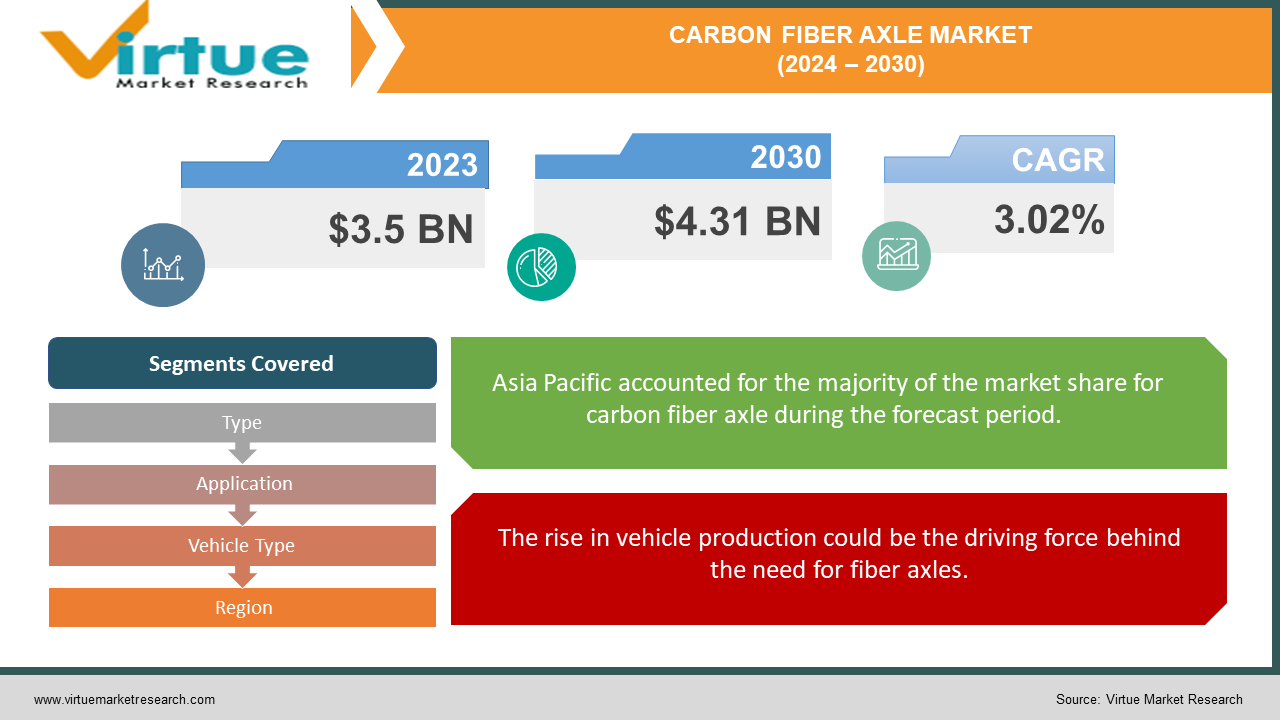

The Global Carbon Fiber Axle Market was estimated to be worth USD 3.5 billion in 2023 and is projected to reach a value of USD 4.31 billion by 2030, growing at a CAGR of 3.02% during the forecast period 2024-2030.

Axles made of carbon fiber resemble superpowered versions of ordinary axles. They can withstand challenging conditions like extreme heat or chemicals and are incredibly light and strong. They are performance enhancers found in off-road vehicles, motorcycles, and racing karts. Vehicles can move more smoothly and effectively thanks to carbon fiber axles, which are light in comparison to steel or aluminum axles. They are constructed by joining metal components for the wheel attachments with carbon fiber tubes or rods. Occasionally, additional reinforcement in the form of aluminum is added to them to increase their strength. Because they are expensive and require special manufacturing techniques, they are not very common, but they are growing in popularity among consumers who demand excellent performance. Because they are robust and light, which is essential for safe flying, scientists are also considering using them in aircraft.

Key Market Insights:

The global carbon fiber axle market is estimated to reach around $7 billion in value in the next 7 years, driven by the increasing demand from the automotive and aerospace industries for lightweight and high-strength components.The automotive segment accounts for nearly 65% of the global carbon fiber axle market share, attributed to the growing focus on vehicle weight reduction to improve fuel efficiency and reduce emissions.The aerospace and defense segment holds a market share of over 25% in the carbon fiber axle market, owing to the superior strength-to-weight ratio and corrosion resistance offered by carbon fiber axles.Europe is expected to grow at a rate of around 7% annually in the carbon fiber axle market, driven by the presence of major automotive manufacturers and their efforts to develop lightweight vehicles.The sport and racing segment contributes to around 10% of the overall carbon fiber axle market, with the demand for high-performance and lightweight components in racing applications.

Global Carbon Fiber Axle Market Drivers:

The rise in vehicle production could be the driving force behind the need for fiber axles.

More people have more money to spend now, in both wealthy and developing nations. As a result, they are purchasing better goods, such as cars. As a result, more cars—including high-end ones—are produced. Additionally, as the number of cars increases, so does the demand for auto parts like axles. As a result, auto manufacturers are producing more axles since more cars are being produced.

Technology advancement could help the fiber axle market grow.

Cars are now more sophisticated thanks to new fancy car technologies. Additionally, as cars get more sophisticated, so do the components they require, such as axles. The growing popularity of electric and hybrid vehicles has increased demand for axles for these vehicles. Better axles are now being installed in even large trucks to support their weight and motion. As a result, manufacturers are producing more axles because they are required for all these various vehicle types.

Carbon Fiber Axle Market Challenges and Restraints:

The cost of the raw materials used to make automotive axles fluctuates greatly. It becomes more difficult for businesses to produce enough axles to meet demand when prices rise. As a result, they produce fewer axles and raise the price even further. This indicates that because axles are too costly, fewer people purchase them. Additionally, because of their high cost, industries that utilize these axles may purchase fewer of them. Therefore, the primary issue facing the automotive axle market is the constantly fluctuating cost of raw materials.

Carbon Fiber Axle Market Opportunities:

The carbon fiber axle market is full of opportunities, particularly given how rapidly the global automotive industry is expanding. Automobiles that are more environmentally conscious and fuel-efficient are requiring lighter solutions, such as carbon fiber axles. However, these robust yet lightweight axles are not just useful for automobiles; the aerospace, defense, and sports equipment industries also find use for them. Technology breakthroughs have improved manufacturing techniques, increasing the effectiveness and affordability of carbon fiber axles. Additionally, there is a trend toward customization, whereby businesses can modify axles to meet the requirements of various vehicles. A major focus is sustainability, and carbon fiber axles are thought to be a more environmentally friendly option than metal ones. Thus, in this growing market, businesses that can innovate, provide customized solutions, and emphasize sustainability are likely to succeed.

CARBON FIBER AXLE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.02% |

|

Segments Covered |

By Type, Application, Vehicle Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

American Axle & Manufacturing, Inc., Dana Incorporated, Daimler AG, GNA Group, Meritor Inc., ZF Friedrichshafen AG, Melrose Industries PLC, Talbros Engineering Limited, HYUNDAI WIA, CARDONE Industries |

Global Carbon Fiber Axle Market Segmentation: By Type

-

Drive

-

Dead

-

Lift

Drive axles account for about 65% of the market. Because they can grip surfaces better, especially in front-wheel drive and all-wheel drive cars, these axles are popular. There is a growing need for various drive axle types in North America, Europe, and Asia Pacific regions as more people purchase automobiles. Lift axles are predicted to grow at the fastest rate, 1.8%, over the projected period. Large trucks that transport heavy loads over long distances are ideal for these axles. They contribute to equal weight distribution, less brake wear, and fuel economy. Heavy-duty trucks with lift axles are becoming more and more popular as a result of these advantages. By the regulations of the European Economic Community, these axles are made to automatically lower or raise to properly balance the weight.

Global Carbon Fiber Axle Market Segmentation: By Application

-

Front

-

Rear

Front axles account for more than half of the market, primarily due to their widespread use in every day, less expensive cars. The market for front axles is anticipated to expand further as vehicles with multiple wheels and all-wheel drive become more common. The category for rear axles is expanding at a rate of approximately 2.0% as well. This is a result of increased production of large trucks and passenger cars in Europe and Asia Pacific. The goal of manufacturers is to make rear axles more affordable, secure, and cozy. Additionally, there is a greater need for rear axles as international trade increases.

Global Carbon Fiber Axle Market Segmentation: By Vehicle Type

-

Passenger Cars

-

Light Commercial Vehicle (LCV)

-

Heavy Commercial Vehicle (HCV)

With passenger cars accounting for over half of all sales, they are the main segment of the market. Due to the growth of cities, population, and disposable income, more people are purchasing passenger cars. The production of automobiles in nations like South Africa, China, India, and Indonesia is also contributing to the market's expansion. Due to the increased use of luxury and hybrid vehicles with fancy features like front-wheel, rear-wheel, and all-wheel drive, the market is predicted to expand even further. It is anticipated that the market for large trucks and other heavy commercial vehicles will expand at a pace of roughly 2.0%. The logistics industry is expanding, particularly in North America and Europe, which is the reason for this growth. Large trucks frequently employ unique axles known as lift axles, which contributes to the market expansion. Numerous large trucks have six, eight, or even more wheels, which opens up additional market space.

Global Carbon Fiber Axle Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

More than half of all fiber axle sales take place in Asia Pacific, which comprises nations like China, India, and Japan. People are purchasing more cars overall and commercial cars in particular because major auto markets like China and India are nearby. As a result, the market for automotive axles grows. Cars with new axles that have advanced technology installed are more efficient. Made of materials like carbon fiber, these axles are lightweight, provide improved grip, and consume less fuel. The axle market is anticipated to expand at the fastest rate, roughly 1.9%, in North America. This is because the demand for axles in this area is increasing as more people in North America purchase luxury and commercial vehicles.

COVID-19 Impact on the Global Carbon Fiber Axle Market:

Numerous businesses worldwide suffered as a result of the tight lockdown regulations implemented to contain the virus, particularly those in the hotel, aviation, and auto industries. Since no one could travel, fewer cars were required. As a result, fewer auto parts were produced and used, such as axles. In 2021, when lockdowns became less severe, automobile sales resumed. However, there remained issues obtaining sufficient materials to manufacture every component, including axles. Demand for axles increased as the automobile industry began to improve and more axles were required for the engines of the cars.

Latest Trend/Development:

Carbon fiber axles have gained popularity recently across several industries, primarily the automotive one. These axles provide advantages like increased vehicle performance and fuel efficiency because they are lightweight and incredibly strong. Originally common in luxury automobiles, their application is currently growing to include sports equipment, aerospace, and defense. Better carbon fiber axles are being developed as a result of technological breakthroughs, with an emphasis on customization to match the needs of particular vehicles. Notwithstanding their benefits, there are still drawbacks, such as expensive production costs and intricate manufacturing procedures. To overcome these obstacles and increase the affordability and accessibility of carbon fiber axles, initiatives are in motion. Furthermore, sustainability is becoming more and more important, and carbon fiber axles are thought to be a more environmentally friendly option than conventional metal axles. Understanding the future of the carbon fiber axle market will require keeping an eye on the most recent trends and developments as the industry continues to change.

Key Players:

-

American Axle & Manufacturing, Inc.

-

Dana Incorporated

-

Daimler AG

-

GNA Group

-

Meritor Inc.

-

ZF Friedrichshafen AG

-

Melrose Industries PLC

-

Talbros Engineering Limited

-

HYUNDAI WIA

-

CARDONE Industries

Chapter 1. Carbon Fiber Axle Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Carbon Fiber Axle Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Carbon Fiber Axle Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Carbon Fiber Axle Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Carbon Fiber Axle Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Carbon Fiber Axle Market – By Type

6.1 Introduction/Key Findings

6.2 Drive

6.3 Dead

6.4 Lift

6.5 Y-O-Y Growth trend Analysis By Type

6.6 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Carbon Fiber Axle Market – By Application

7.1 Introduction/Key Findings

7.2 Front

7.3 Rear

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Carbon Fiber Axle Market – By Vehicle Type

8.1 Introduction/Key Findings

8.2 Passenger Cars

8.3 Light Commercial Vehicle (LCV)

8.4 Heavy Commercial Vehicle (HCV)

8.5 Y-O-Y Growth trend Analysis By Vehicle Type

8.6 Absolute $ Opportunity Analysis By Vehicle Type, 2024-2030

Chapter 9. Carbon Fiber Axle Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By Vehicle Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By Vehicle Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By Vehicle Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By Vehicle Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By Vehicle Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Carbon Fiber Axle Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 American Axle & Manufacturing, Inc.

10.2 Dana Incorporated

10.3 Daimler AG

10.4 GNA Group

10.5 Meritor Inc.

10.6 ZF Friedrichshafen AG

10.7 Melrose Industries PLC

10.8 Talbros Engineering Limited

10.9 HYUNDAI WIA

10.10 CARDONE Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Carbon Fiber Axle Market was estimated to be worth USD 3.5 billion in 2023 and is projected to reach a value of USD 4.31 billion by 2030, growing at a CAGR of 3.02% during the forecast period 2024-2030.

The demand for fiber axles may be fueled by the increase in vehicle production and the market growth for fiber axles may be boosted by technological progress are the factors driving the Global Carbon Fiber Axle Market.

The market expansion for fiber axles may be hampered by fluctuating raw material prices.

Lift axle type is the fastest growing in the Global Carbon Fiber Axle Market.

North America region is the fastest growing in the Global Carbon Fiber Axle Market.