GLOBAL CARAMEL INGREDIENTS MARKET (2023 - 2030)

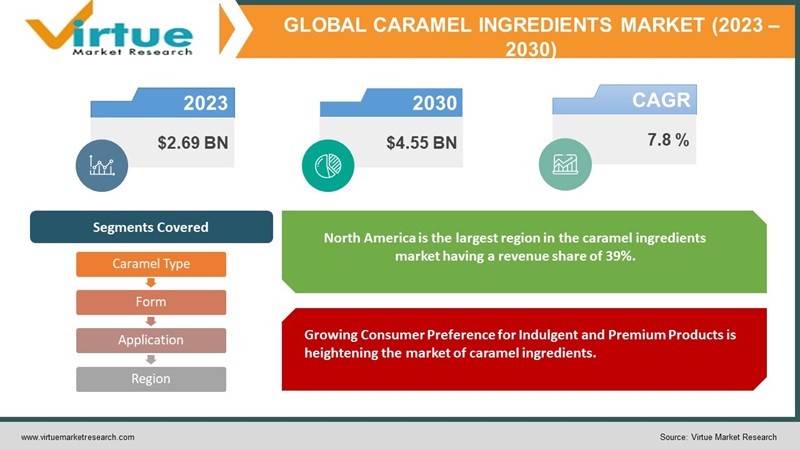

The Global Caramel Ingredients Market was valued at USD 2.69 Billion in 2023 and is projected to reach a market size of USD 4.55 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.8%.

The caramel ingredients market is a dynamic sector within the food industry, driven by the growing demand for caramel flavor and color across various applications. Key ingredients in the caramel market include sugar, glucose syrup, butter, cream, and salt, with variations such as caramel color and flavoring agents. The market is influenced by factors like consumer preference for indulgent and sweet products, the expansion of the confectionery and bakery industries, and the adoption of caramel in beverages and dairy products. The market is affected by the availability of raw materials, production processes, and regulations related to caramel color additives. As consumers continue to seek diverse and innovative flavor profiles, the caramel ingredients market is expected to experience steady growth, with manufacturers focusing on product innovation, clean-label solutions, and sustainable sourcing to meet evolving consumer preferences.

Key Market Insights:

Many alcoholic drinks like beer, whiskey, scotch, and dark rum use caramel ingredients. In the fall, a beer called salted caramel porter is quite popular. Every year, companies come up with new and exciting versions of this beer to offer something different to consumers. For example, in December 2018, Arcadia Brewing Company partnered with Biggby Coffee to launch a limited edition beer called Salted Caramel Coffee Porter, which was sold in selected stores in the United States.

The frozen bakery products market is on the rise because people with busier lives and higher incomes are looking for convenient options. Another trend in food is that consumers are getting more into decorating their dishes. These factors are impacting the market for caramel ingredients. As more people are eating out, food manufacturers are using caramel ingredients to make their products more appealing to consumers in everyday life. This has led to the development of various applications, such as enhancing the look of desserts, cakes, and ice cream, and blending traditional foods with caramel ingredients, creating an evolving concept around these ingredients.

Caramel Ingredients Market Drivers:

Growing Consumer Preference for Indulgent and Premium Products is heightening the market of caramel ingredients.

Consumers' evolving tastes and preferences for indulgent and premium food products have contributed significantly to the growth of the caramel ingredients market. Caramel is associated with rich, sweet, and complex flavor profiles, making it a popular choice for enhancing the taste of various products such as chocolates, ice creams, desserts, and beverages. As consumers seek more indulgent and flavorful options, food manufacturers are incorporating caramel ingredients to meet these demands. This trend is driving the demand for caramel ingredients across the food and beverage industry.

As Confectionery and Bakery Industries are expanding, the demand for caramel ingredients is also increasing.

The confectionery and bakery sectors are major consumers of caramel ingredients. The growth of these industries, driven by changing consumer preferences and the global popularity of sweets and baked goods, has led to increased usage of caramel ingredients. Caramel can be used in a wide range of confectionery and bakery products, including caramel-filled chocolates, toffees, caramels, cakes, cookies, and pastries. As these industries expand and diversify their product offerings, the demand for caramel ingredients continues to rise, providing a significant driver for the market's growth.

Caramel Ingredients Market Restraints and Challenges:

Regulatory Compliance and Labeling Requirements are essential in the caramel ingredients market, failure could hinder market growth.

One significant challenge in the caramel ingredients market is navigating the complex regulatory landscape, especially when it comes to caramel color additives. Different countries and regions may have varying regulations and standards regarding the use of caramel colors in food and beverages. Manufacturers must ensure compliance with these regulations, which often involve meticulous testing, documentation, and adherence to specified limits for potentially harmful substances such as 4-methylimidazole (4-MEI). Meeting these requirements can be time-consuming and costly, and non-compliance can result in product recalls and damage to brand reputation.

Fluctuating Raw Material Prices in the caramel ingredients market might become challenging for businesses.

The caramel ingredients market heavily relies on key raw materials like sugar, glucose syrup, and dairy products, which are subject to price fluctuations influenced by factors such as weather conditions, crop yields, and global commodity markets. These price variations can affect the production costs for caramel ingredients, making it challenging for manufacturers to maintain consistent pricing for their products. Fluctuating raw material costs can also impact profit margins and the overall competitiveness of companies within the market, necessitating effective supply chain management and strategies to mitigate the impact of price volatility.

Caramel Ingredients Market Opportunities:

The caramel ingredients market presents several promising opportunities, including the rising trend of clean-label and natural ingredients, which allows manufacturers to develop caramel products with minimal additives and preservatives, catering to health-conscious consumers. Furthermore, the expansion of the food and beverage industry, particularly in emerging markets, provides avenues for increased caramel ingredient adoption in a wide range of applications, from confectionery and bakery to dairy and beverages. The growing popularity of caramel-flavored and salted caramel products offers room for innovation, enabling companies to diversify their product portfolios and capture new consumer segments, ultimately driving market growth.

CARAMEL INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

7.8 % |

|

Segments Covered |

By Caramel Type, Form, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Incorporated, Kerry Group, Sensient Technologies Corporation, Sethness Caramel Color, Puratos Group, Nigay SAS Martin Braun Backmittel und Essenzen KG Bakels Group, The Hershey Company |

Caramel Ingredients Market Segmentation:

Caramel Ingredients Market Segmentation: By Caramel Type:

-

Liquid Caramel

-

Solid Caramel

-

Powdered Caramel

The largest segment by caramel type in the caramel ingredients market is typically Liquid Caramel holding a market share of 68.9%. This is because liquid caramel is highly versatile and widely used in a variety of applications, including confectionery, bakery products, dairy, beverages, and sauces. Its liquid form makes it easy to incorporate into various recipes, providing a consistent flavor and color. Liquid caramel is also favored by manufacturers for its suitability in large-scale food production, making it the dominant choice in the market due to its extensive applications and convenience for food and beverage manufacturers. The liquid caramel segment is also the fastest-growing segment in the caramel ingredients market. This growth is primarily attributed to its versatility and wide range of applications in the food and beverage industry, including confectionery, bakery, dairy products, and beverages. Liquid caramel is preferred for its ease of use in manufacturing processes, providing consistent flavor, color, and texture to various products. The rising demand for clean-label and natural ingredients has driven the growth of liquid caramel, as it can be produced with fewer additives and preservatives, aligning with consumer preferences for more natural and transparent food options.

Caramel Ingredients Market Segmentation: By Form:

-

Caramel Syrup

-

Caramel Chunks

-

Caramel Powder

-

Caramel Flakes

The largest segment by form in the caramel ingredients market is Caramel Syrup having a huge market share of 79%. Caramel syrup is a versatile and widely used form of caramel in various applications, such as confectionery, bakery, dairy products, and beverages. Its liquid consistency allows for easy incorporation into recipes, providing the desired caramel flavor and color. Additionally, caramel syrup is a popular choice for flavoring and sweetening coffee, desserts, and various food products, making it a preferred form for both industrial food production and home cooking. The fastest-growing segment by form in the caramel ingredients market is Caramel Syrup growing at a rate of 20.1%. This growth can be attributed to its versatility and widespread use in various applications. Caramel syrup is commonly used in beverages, including coffee and flavored milk, as well as in the confectionery and bakery sectors. The increasing popularity of specialty coffee drinks and flavored beverages, coupled with the demand for sweet and indulgent treats, has driven the growth of caramel syrup as it can be easily integrated into a wide range of products, making it a preferred choice among manufacturers and consumers alike.

Caramel Ingredients Market Segmentation: By Application:

-

Confectionery

-

Bakery Products

-

Dairy Products

-

Beverages

-

Snacks

-

Sauces and Spreads

-

Others

The largest segment by application in the caramel ingredients market is the confectionery sector which has a prominent share of 61%. This dominance can be attributed to the enduring popularity of caramel in a wide variety of confectionery products, including candies, chocolates, toffees, and caramel-filled confections. The delightful combination of sweetness, chewiness, and rich flavor that caramel brings to these treats has enduring consumer appeal. The confectionery industry has a strong tradition of innovation, creating new caramel-infused products and variations, which further drives the demand for caramel ingredients in this segment. The fastest-growing segment by application in the caramel ingredients market is the Beverages category expected to grow with a CAGR of 19.8%, due to the increasing popularity of flavored coffee, specialty teas, and various alcoholic drinks with caramel additives. The demand for caramel-flavored beverages has been on the rise due to changing consumer preferences and the quest for unique and indulgent flavor experiences in the beverage industry. The expansion of the coffeehouse culture and the launch of innovative caramel-flavored beverages by leading coffee chains contributed to this segment's rapid growth.

Caramel Ingredients Market Segmentation: Regional Analysis:

North America

Asia- Pacific

Europe

South America

Middle East and Africa

North America is the largest region in the caramel ingredients market having a revenue share of 39%. This is primarily due to the mature and well-established food and beverage industry in the region, along with a significant consumer preference for caramel-flavored products in a wide range of applications, including confectionery, bakery, and dairy. The region's emphasis on innovation and clean-label products contributed to the growth of the caramel ingredients market. Asia-Pacific region is experiencing the fastest growth in the caramel ingredients market growing at a CAGR of 23.4%. This growth can be attributed to factors such as increasing disposable income, urbanization, and changing consumer preferences in this region. As consumers in Asia-Pacific seek a wider range of confectionery, bakery, and dairy products, there is a rising demand for caramel ingredients. The region's thriving food and beverage industry, along with a growing middle-class population, has provided opportunities for both domestic and international caramel ingredient manufacturers to expand their presence, leading to rapid market growth.

COVID-19 Impact Analysis on the Global Caramel Ingredients Market:

The global caramel ingredients market experienced both challenges and opportunities in the wake of the COVID-19 pandemic. While the initial disruptions in supply chains, labor shortages, and decreased consumer spending affected the market, the resilience of the food industry, coupled with the growing demand for comfort foods and indulgent treats during lockdowns, led to sustained demand for caramel ingredients. Manufacturers pivoted towards e-commerce and online sales channels to cater to changing consumer preferences and safety concerns. The pandemic emphasized the importance of clean-label and natural ingredients, driving innovation in this direction. In the post-pandemic landscape, the caramel ingredients market is expected to rebound, with a heightened focus on product quality, safety, and diversified applications to meet evolving consumer needs.

Latest Trends/ Developments:

A notable trend in the caramel ingredients market is the increasing consumer demand for clean-label and natural products. Many consumers are seeking caramel ingredients that are free from artificial additives, preservatives, and synthetic flavors. This trend has prompted manufacturers to develop caramel ingredients using simpler, more transparent ingredient lists, including organic and non-GMO options. Clean-label caramel ingredients appeal to health-conscious consumers looking for products with minimal processing and a focus on natural flavor and color.

A significant development in the caramel ingredients market is the growing emphasis on sustainability and ethical sourcing practices. As consumers become more environmentally and socially conscious, there is a shift toward sourcing raw materials like sugar, dairy, and cocoa used in caramel ingredients from suppliers with sustainable and ethical practices. This includes considerations for fair trade, responsible farming, and reducing the environmental impact of production. Manufacturers are increasingly adopting sustainable sourcing initiatives to align with consumer values and reduce their carbon footprint, which also helps improve their brand image and market competitiveness.

Key Players:

-

Cargill, Incorporated

-

Kerry Group

-

Sensient Technologies Corporation

-

Sethness Caramel Color

-

Puratos Group

-

Nigay SAS

-

Martin Braun Backmittel und Essenzen KG

-

Bakels Group

-

The Hershey Company

In July 2021, Big Train, which is under the Kerry Group umbrella, introduced a range of dairy-free caramel latte flavors within its Big Train beverage mixup, designed for both hot and cold drinks and featuring the beneficial GanedenBC30 probiotic. This product expansion was driven by the goal of catering to the growing consumer interest in health-conscious offerings, especially among food service providers.

Chapter 1. Global Caramel Ingredients Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Caramel Ingredients Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Global Caramel Ingredients Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Caramel Ingredients Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Caramel Ingredients Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Caramel Ingredients Market – By Caramel Type

6.1. Liquid Caramel

6.2. Solid Caramel

6.3. Powdered Caramel

Chapter 7. Global Caramel Ingredients Market – By Form

7.1. Caramel Syrup

7.2. Caramel Chunks

7.3. Caramel Powder

7.4. Caramel Flakes

Chapter 8. Global Caramel Ingredients Market – By Application

8.1. Confectionery

8.2. Bakery Products

8.3. Dairy Products

8.4. Beverages

8.5. Snacks

8.6. Sauces and Spreads

8.7. Others

Chapter 9. Global Caramel Ingredients Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Caramel Type

9.1.3. By Form

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Caramel Type

9.2.3. By Form

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Caramel Type

9.3.3. By Form

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By Caramel Type

9.4.3. By Form

9.4.4. By Application Channel

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Type

9.5.3. By End User

9.5.4. By Distribution Channel

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Caramel Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Cargill, Incorporated

10.2. Kerry Group

10.3. Sensient Technologies Corporation

10.4. Sethness Caramel Color

10.5. Puratos Group

10.6. Nigay SAS

10.7. Martin Braun Backmittel und Essenzen KG

10.8. Bakels Group

10.9. The Hershey Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Caramel Ingredients Market was valued at USD 2.69 Billion in 2023 and is projected to reach a market size of USD 4.55 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.8%.

Growing Consumer Preference for Indulgent and Premium Products and expansion of the Confectionery and Bakery Industries are drivers of the Caramel Ingredients market

Based on caramel type, the Global Caramel Ingredients Market is segmented into Liquid Caramel, Solid Caramel, and Powdered Caramel

North America is the most dominant region for the Global Caramel Ingredients Market.

Cargill, Incorporated, Kerry Group, Sensient Technologies Corporation, and Sethness Caramel Color are a few of the key players operating in the Global Caramel Ingredients Market.