Caps and Closures Market Size (2024 – 2030)

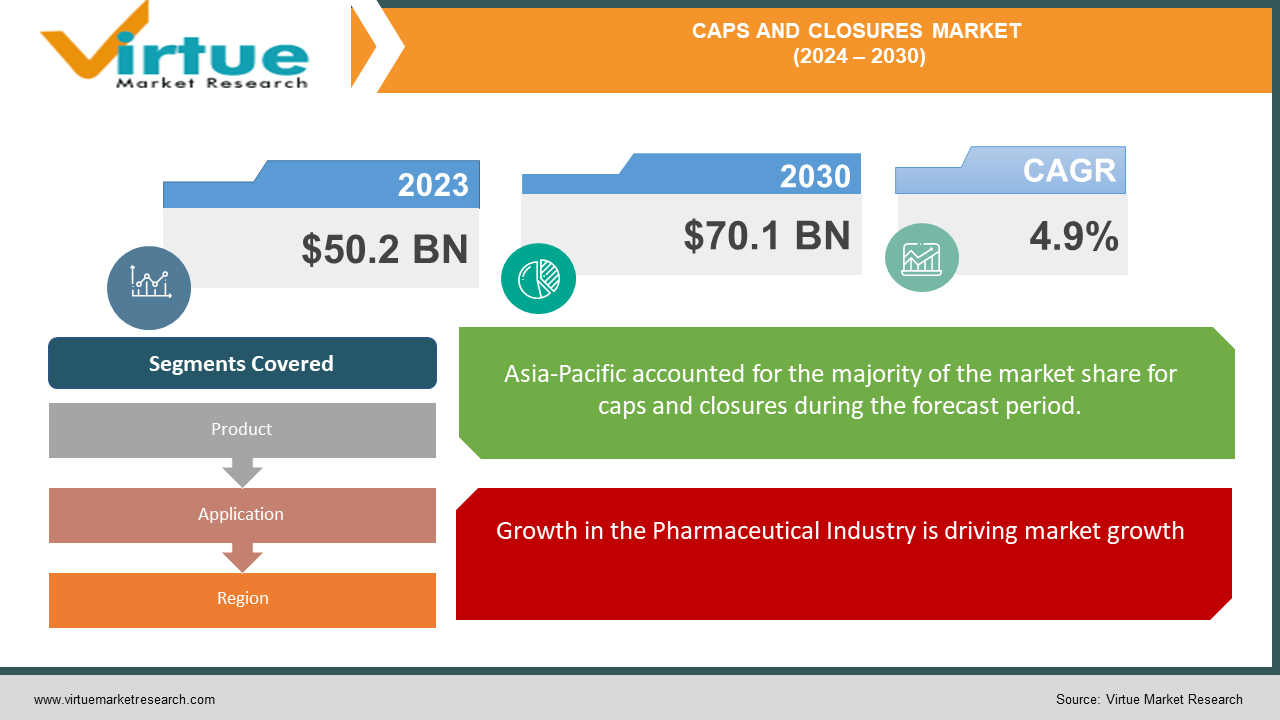

The Global Caps and Closures Market was valued at USD 50.2 billion in 2023 and is projected to reach USD 70.1 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030.

Caps and closures are critical components in the packaging industry, serving the essential function of preserving the product, extending shelf life, and ensuring safety. These products are used across various industries, including food and beverages, pharmaceuticals, cosmetics, and household products. The market's growth is driven by the increasing demand for convenient packaging solutions, innovations in packaging materials, and the rising consumption of packaged goods.

Key Market Insights

The increasing consumption of packaged food and beverages is a significant driver, with the food and beverage segment holding the largest market share in 2023, contributing over 45% to the overall revenue.

Technological advancements and innovations in packaging materials, such as biodegradable and sustainable options, are propelling the market forward, with eco-friendly materials expected to grow at a CAGR of 6.1% during the forecast period.

The pharmaceutical industry's expansion, driven by the increasing prevalence of chronic diseases and the aging population, is boosting the demand for caps and closures. This segment is expected to grow at a CAGR of 5.2% from 2024 to 2030.

There is a growing preference for lightweight and durable materials, such as plastic and aluminum, in caps and closures. Plastic caps and closures accounted for 55% of the market share in 2023.

Emerging economies in Asia-Pacific and Latin America are witnessing rapid urbanization and rising disposable incomes, contributing significantly to market growth. Asia-Pacific is projected to exhibit the highest CAGR of 5.5% during the forecast period.

The expansion of e-commerce and online retail channels is driving the demand for secure and tamper-proof packaging solutions, leading to an increased adoption of advanced caps and closures.

Manufacturers are increasingly focusing on branding and aesthetics to attract consumers. Customization and innovative designs in caps and closures are becoming a key trend, with the cosmetics and personal care segment showing significant growth.

Global Caps and Closures Market Drivers

Increasing Demand for Packaged Food and Beverages is driving market growth:

The growing global population and changing consumer lifestyles have significantly increased the demand for packaged food and beverages. Convenience, safety, and extended shelf life are critical factors driving consumers toward packaged goods. Caps and closures play a vital role in maintaining the integrity and freshness of these products. The food and beverage industry, being the largest end-user of caps and closures, is expected to witness sustained growth. Additionally, the rising trend of on-the-go consumption and the demand for smaller, single-serve packaging formats further fuel the market. Innovations in packaging technology, such as resealable and tamper-evident closures, enhance consumer convenience and trust, contributing to market growth.

Growth in the Pharmaceutical Industry is driving market growth:

The pharmaceutical industry is experiencing robust growth due to the increasing prevalence of chronic diseases, aging populations, and advancements in healthcare infrastructure. Caps and closures are crucial in the pharmaceutical sector for ensuring the safety, efficacy, and integrity of medications. With the rising demand for prescription and over-the-counter drugs, the need for secure, child-resistant, and tamper-evident packaging solutions is paramount. Regulatory requirements for pharmaceutical packaging are stringent, driving manufacturers to innovate and improve their products continuously. The pharmaceutical segment is projected to grow significantly, contributing to the overall expansion of the caps and closures market.

Technological Advancements and Sustainable Packaging Solutions are driving market growth:

Technological advancements in materials and manufacturing processes are driving innovation in the caps and closures market. The development of sustainable and eco-friendly packaging solutions is a key trend, as consumers and regulatory bodies increasingly prioritize environmental concerns. Biodegradable and recyclable materials are gaining traction, with companies investing in research and development to meet sustainability goals. Additionally, advancements in smart packaging technologies, such as NFC-enabled closures and QR codes, enhance product security and consumer engagement. These innovations not only meet regulatory requirements but also cater to the growing demand for environmentally responsible packaging, driving market growth.

Global Caps and Closures Market Challenges and Restraints

Environmental Concerns and Regulatory Compliance is restricting market growth:

The caps and closures market faces significant challenges related to environmental concerns and regulatory compliance. Plastic waste and its impact on the environment have led to increased scrutiny and regulations aimed at reducing plastic usage and promoting sustainable practices. Manufacturers are under pressure to develop eco-friendly alternatives and invest in recycling and waste management solutions. Compliance with varying regional regulations on packaging materials, safety standards, and labeling requirements adds complexity and costs for market players. Navigating these challenges requires continuous innovation and investment, posing a restraint on market growth.

High Competition and Fluctuating Raw Material Prices are restricting market growth:

The caps and closures market is highly competitive, with numerous players vying for market share. Intense competition leads to price pressures and challenges in maintaining profit margins. Additionally, the market is susceptible to fluctuations in raw material prices, particularly plastic resins and metals. Volatility in raw material costs can impact production expenses and overall profitability. Manufacturers need to adopt effective cost-management strategies and explore alternative materials to mitigate these challenges. Strategic partnerships, mergers, and acquisitions are common strategies to enhance market position and competitiveness in this dynamic landscape.

Market Opportunities

The growing consumer preference for sustainable and eco-friendly packaging solutions presents significant opportunities in the caps and closures market. As environmental awareness increases, demand for biodegradable and recyclable materials is rising. Manufacturers can capitalize on this trend by developing innovative, sustainable products that meet regulatory requirements and consumer expectations. Additionally, the expansion of e-commerce and online retail channels offers opportunities for tamper-evident and secure packaging solutions. The integration of smart packaging technologies, such as QR codes and NFC-enabled closures, can enhance product traceability and consumer engagement. Emerging markets in Asia-Pacific and Latin America, with rising disposable incomes and urbanization, offer untapped potential for market growth. Collaborations and partnerships with local players can facilitate market entry and expansion, driving revenue growth in these regions.

CAPS AND CLOSURES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amcor plc, Berry Global, Inc., Crown Holdings, Inc., AptarGroup, Inc., Silgan Holdings Inc., Gerresheimer AG, Guala Closures Group, RPC Group PLC, Reynolds Group Holdings Limited, Berlin Packaging |

Caps and Closures Market Segmentation - By Product

-

Plastic Caps and Closures

-

Metal Caps and Closures

-

Others (Glass, Rubber, etc.)

Plastic caps and closures are the dominant segment in the market. Their widespread use across various industries, such as food and beverages, pharmaceuticals, and personal care, is attributed to their lightweight, cost-effective, and versatile properties. Plastic closures accounted for approximately 55% of the market share in 2023, driven by the demand for convenience and innovative designs.

Caps and Closures Market Segmentation - By Application

-

Food and Beverages

-

Pharmaceuticals

-

Cosmetics and Personal Care

-

Household Goods

-

Others (Chemicals, Automotive, etc.)

The food and beverages segment is the most dominant application segment in the caps and closures market. This dominance is due to the high demand for packaged food and beverages, which require secure and convenient packaging solutions. In 2023, the food and beverages segment contributed over 45% to the overall market revenue, driven by the increasing consumption of ready-to-eat and on-the-go food products.

Caps and Closures Market Segmentation - By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region in the global caps and closures market. The region's rapid urbanization, rising disposable incomes, and growing consumer demand for packaged goods are key factors driving market growth. Countries such as China and India are significant contributors, with the region projected to exhibit the highest CAGR of 5.5% during the forecast period. The increasing adoption of sustainable packaging solutions and the expansion of the food and beverage industry further bolster the market in this region.

COVID-19 Impact Analysis on the Caps and Closures Market

The COVID-19 pandemic had a mixed impact on the caps and closures market. Initially, the outbreak and lockdowns disrupted supply chains and production activities, creating short-term challenges for market players. However, the pandemic also accelerated certain trends that positively influenced the market. Heightened awareness of hygiene and safety significantly drove demand for packaged food and beverages, pharmaceuticals, and personal care products. This surge in demand for essential goods increased the need for secure and tamper-evident packaging solutions, benefiting the caps and closures market. Additionally, the rise of e-commerce and online retail channels during the pandemic further boosted the demand for protective packaging. As consumers turned to online shopping, the need for reliable and safe packaging became paramount. Overall, while the market faced initial disruptions, the long-term impact of COVID-19 has been positive, with increased emphasis on packaging safety and hygiene. The pandemic underscored the importance of secure packaging in maintaining product integrity and consumer trust, reinforcing the value of caps and closures in various industries.

Latest Trends/Developments

The caps and closures market is witnessing several notable trends and developments. One of the key trends is the growing focus on sustainability and eco-friendly packaging solutions. Manufacturers are increasingly investing in biodegradable and recyclable materials to meet environmental regulations and consumer demand for sustainable products. Another trend is the integration of smart packaging technologies, such as QR codes and NFC-enabled closures, which enhance product traceability, security, and consumer engagement. Innovations in design and functionality, including tamper-evident and child-resistant closures, are also gaining traction. Additionally, the expansion of e-commerce and online retail channels is driving the demand for secure and convenient packaging solutions. The rising consumer preference for customized and aesthetically appealing packaging is further influencing market dynamics, with companies focusing on branding.

Key Players

-

Amcor plc

-

Berry Global, Inc.

-

Crown Holdings, Inc.

-

AptarGroup, Inc.

-

Silgan Holdings Inc.

-

Gerresheimer AG

-

Guala Closures Group

-

RPC Group PLC

-

Reynolds Group Holdings Limited

-

Berlin Packaging

Chapter 1. Caps and Closures Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Caps and Closures Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Caps and Closures Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Caps and Closures Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Caps and Closures Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Caps and Closures Market – By Product

6.1 Introduction/Key Findings

6.2 Plastic Caps and Closures

6.3 Metal Caps and Closures

6.4 Others (Glass, Rubber, etc.)

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Caps and Closures Market – By Application

7.1 Introduction/Key Findings

7.2 Food and Beverages

7.3 Pharmaceuticals

7.4 Cosmetics and Personal Care

7.5 Household Goods

7.6 Others (Chemicals, Automotive, etc.)

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Caps and Closures Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Caps and Closures Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Amcor plc

9.2 Berry Global, Inc.

9.3 Crown Holdings, Inc.

9.4 AptarGroup, Inc.

9.5 Silgan Holdings Inc.

9.6 Gerresheimer AG

9.7 Guala Closures Group

9.8 RPC Group PLC

9.9 Reynolds Group Holdings Limited

9.10 Berlin Packaging

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Caps and Closures Market was valued at USD 50.2 billion in 2023 and is projected to reach USD 70.1 billion by 2030, growing at a CAGR of 4.9% from 2024 to 2030.

The primary drivers include the increasing demand for packaged food and beverages, the growth of the pharmaceutical industry, and technological advancements in sustainable and eco-friendly packaging solutions.

The market is segmented by product type (plastic caps and closures, metal caps and closures, and others) and by application (food and beverages, pharmaceuticals, cosmetics and personal care, household goods, and others).

Asia-Pacific is the dominant region in the global caps and closures market, driven by rapid urbanization, rising disposable incomes, and growing consumer demand for packaged goods.

Leading players include Amcor plc, Berry Global, Inc., Crown Holdings, Inc., AptarGroup, Inc., Silgan Holdings Inc., and Gerresheimer AG, among others.