Capacitance Liquid Level Sensor Market Size (2024 – 2030)

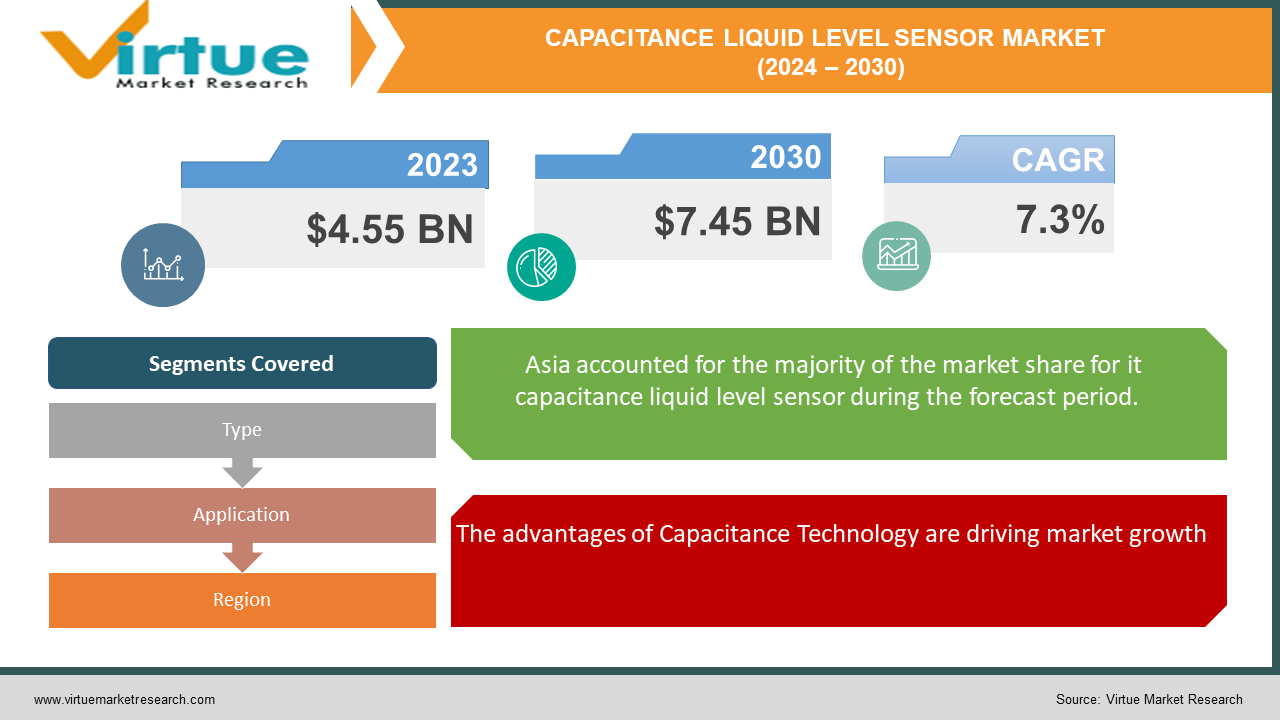

The Global Capacitance Liquid Level Sensor Market was valued at USD 4.55 billion in 2023 and will grow at a CAGR of 7.3% from 2024 to 2030. The market is expected to reach USD 7.45 billion by 2030.

The capacitance liquid level sensor market deals with sensors that use changes in electrical capacitance to detect liquid levels in tanks and vessels. These sensors offer advantages like working with conductive and non-conductive liquids, being resistant to corrosion, and having no moving parts. The market is expected to grow due to its role in process efficiency, safety, and automation across various industries like oil & gas, food & beverage, and chemicals.

Key Market Insights:

Capacitance sensors are a sub-segment within the level sensor market and are expected to benefit from the overall growth due to their advantages. For monitoring storage tanks and ensuring safe and efficient operations. Maintaining hygiene standards and optimizing production processes.

The integration of capacitance sensors with the Industrial Internet of Things (IIoT) allows for remote monitoring and data analysis, further driving market growth.

The overall level sensor market's growth and the unique advantages of capacitance technology suggest a promising future for this segment.

Global Capacitance Liquid Level Sensor Market Drivers:

Growing Demand for Process Efficiency and Automation are driving market growth:

The industrial landscape is undergoing a transformation driven by automation. This push to automate processes is fueled by a three-pronged attack: boosting efficiency, minimizing costs, and reducing human error. Capacitance liquid level sensors are emerging as champions in this automated revolution. Their ability to deliver accurate and dependable liquid level data makes them a perfect fit for these intelligent systems. Furthermore, the rise of Industry 4.0, which emphasizes smart manufacturing and data-driven decision-making, throws gasoline on the fire for advanced-level sensors like capacitance-based ones. These sensors seamlessly integrate with Industrial Internet of Things (IIoT) platforms, allowing for remote monitoring and real-time data analysis. This empowers industries to optimize processes, predict maintenance needs, and make data-driven decisions that elevate their entire operation. In essence, capacitance liquid level sensors are not just measuring liquids; they're measuring the future of industrial automation and intelligent manufacturing.

The advantages of Capacitance Technology are driving market growth:

Capacitance liquid level sensors stand out from the crowd due to their versatility, durability, and accuracy. Unlike some sensors limited to conductive liquids, capacitance technology shines in its ability to measure both conductive and non-conductive liquids. This broadens their application palette significantly, making them suitable for everything from monitoring oil tanks to tracking water levels. Their secret weapon lies in their non-intrusive design. By not coming into direct contact with the liquid, they avoid corrosion and wear, leading to a longer lifespan and lower maintenance costs. This is particularly beneficial in harsh environments where traditional sensors might struggle. But their greatest strength lies in their precision. Capacitance sensors deliver highly accurate liquid level measurements, which is paramount for maintaining process control and ensuring product quality. In industries with strict regulations or where product consistency is critical, this accuracy becomes a game-changer. With these combined advantages, capacitance sensors are not just measuring liquids; they ensure smooth operations, reduced costs, and consistent quality across a vast array of applications.

Stringent Regulations and Safety Concerns are driving market growth:

Capacitance liquid level sensors stand out from the crowd due to their versatility, durability, and accuracy. Unlike some sensors limited to conductive liquids, capacitance technology shines in its ability to measure both conductive and non-conductive liquids. This broadens their application palette significantly, making them suitable for everything from monitoring oil tanks to tracking water levels. Their secret weapon lies in their non-intrusive design. By not coming into direct contact with the liquid, they avoid corrosion and wear, leading to a longer lifespan and lower maintenance costs. This is particularly beneficial in harsh environments where traditional sensors might struggle. But their greatest strength lies in their precision. Capacitance sensors deliver highly accurate liquid level measurements, which is paramount for maintaining process control and ensuring product quality. In industries with strict regulations or where product consistency is critical, this accuracy becomes a game-changer. With these combined advantages, capacitance sensors are not just measuring liquids; they ensure smooth operations, reduced costs, and consistent quality across a vast array of applications.

Global Capacitance Liquid Level Sensor Market challenges and restraints:

Competition is a significant hurdle for Capacitance Liquid Level Sensors:

The capacitance liquid level sensor market navigates a competitive landscape dominated by established players offering a plethora of technologies like ultrasonic, radar, and float sensors. While capacitance sensors boast clear advantages, attracting new users and encouraging a switch from existing solutions necessitates a well-defined unique value proposition. This proposition should effectively communicate how capacitance sensors address specific pain points that competing technologies might not. For instance, emphasizing their ability to handle both conductive and non-conductive liquids can be a major selling point for industries that deal with a wide variety of fluids. Additionally, highlighting their durability and low maintenance requirements, due to the absence of moving parts, can be attractive to users looking for long-term cost-effectiveness. By clearly articulating these unique strengths and how they translate into benefits like improved process efficiency and reduced downtime, capacitance sensor manufacturers can carve out a niche within the competitive level sensor market.

Cost Considerations are throwing a curveball at the Capacitance Liquid Level Sensor market:

A potential hurdle for capacitance liquid level sensors is their initial cost compared to simpler sensor technologies. This can be a significant obstacle for budget-conscious industries or applications. While the upfront investment might be higher, it's crucial to consider the long-term value proposition. Capacitance sensors offer several advantages that can translate into cost savings over time. Their non-intrusive design and lack of moving parts minimize maintenance needs and the risk of breakdowns, reducing overall operational expenses. Additionally, their durability ensures a longer lifespan compared to simpler sensors that might require frequent replacements. Furthermore, the high accuracy of capacitance sensors can lead to improved process control and reduced product waste. For instance, in the food & beverage industry, precise level monitoring prevents overflows and ensures optimal ingredient ratios, minimizing product loss. By effectively communicating these long-term cost benefits and highlighting the potential return on investment, capacitance sensor manufacturers can bridge the initial cost gap and convince budget-conscious users of the technology's true value.

Calibration Needs are a growing nightmare for Capacitance Liquid Level Sensors:

Despite their reliability, capacitance liquid level sensors aren't without their maintenance considerations. These sensors can be susceptible to factors like foam buildup on the surface of the liquid or changes in the electrical properties (dielectric constant) of the liquid itself. This sensitivity can necessitate regular calibration to guarantee accurate measurements. While this calibration process isn't inherently complex, it adds another step to the maintenance routine compared to simpler sensor technologies. The frequency of calibration will depend on the specific application and the factors mentioned above. Industries with processes involving foaming liquids or those using liquids with varying compositions might require more frequent calibrations. However, manufacturers are constantly innovating to develop self-calibration features or algorithms that can compensate for minor changes in the dielectric properties, reducing the need for manual intervention. Additionally, the long lifespans and overall reliability of capacitance sensors can offset the calibration requirement, making them a compelling choice in the long run.

Market Opportunities:

The capacitance liquid level sensor market presents a brimming landscape of opportunities fueled by automation, Industry 4.0, and growing demand across various industries. The increasing focus on process efficiency and automation creates a fertile ground for capacitance sensors, as their ability to deliver accurate and reliable data on conductive and non-conductive liquids makes them ideal for integrated control systems. Furthermore, the rise of Industry 4.0, emphasizing smart manufacturing and data-driven decision-making, further amplifies the need for these advanced sensors. Their seamless integration with IIoT platforms allows for remote monitoring, real-time analysis, and predictive maintenance, empowering industries to optimize processes and make data-driven choices. Stringent regulations in industries like food & beverage and chemical processing present another lucrative opportunity. Here, capacitance sensors play a critical role in ensuring accurate level readings, preventing overflows, spills, and contamination, thus adhering to safety and environmental protection standards. This translates to maintaining hygiene in food production, preventing product waste, and ensuring accurate mixing ratios in chemical processing. The growing demand for these sensors extends beyond these sectors. The oil & gas industry requires them for safe and efficient storage and transportation of products. Water & wastewater treatment facilities benefit from their ability to optimize water management and prevent leaks. These diverse applications, coupled with the ongoing advancements in sensor technology to improve accuracy, communication capabilities, and cost-effectiveness, paint a bright future for the capacitance liquid level sensor market. As industries strive for increased automation, efficiency, and regulatory compliance, capacitance sensors are poised to become an indispensable tool, shaping the future of intelligent manufacturing and precise liquid level monitoring across various sectors.

CAPACITANCE LIQUID LEVEL SENSOR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.3% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ABB (Switzerland), Emerson Electric Company (United States), Endress+Hauser Group Services AG (Switzerland), Siemens AG (Germany), Honeywell International Inc. (United States), TE Connectivity Ltd (Switzerland), Pepperl+Fuchs GmbH (Germany), Gems Sensors Inc. (United States), VEGA Grieshaber KG (Germany), Yokogawa Electric Corporation (Japan) |

Capacitance Liquid Level Sensor Market segmentation - By Type

-

Switch-Type Sensors

-

Continuous-Type Sensors

Continuous-type capacitance liquid level sensors are expected to be the more prominent sector within the market. While switch-type sensors offer a basic on/off function and are cost-effective, they lack the detailed data collection capabilities crucial for modern industrial needs. Continuous-type sensors, on the other hand, provide real-time, precise monitoring of liquid levels. This continuous data allows for better process control, optimization, and integration with Industry 4.0 practices, making them a more valuable tool for industries focused on automation, efficiency, and data-driven decision-making.

Capacitance Liquid Level Sensor Market segmentation - By Application

-

Oil & Gas Industry

-

Food & Beverage Industry

Determining the most prominent sector between Oil & Gas and Food & Beverage for capacitance liquid level sensors is challenging as reliable data is limited. Both Oil & Gas and Food & Beverage present significant opportunities for capacitance liquid level sensors. While Oil & Gas might have a larger market size, the specific sensor type preference and potential for wider adoption of continuous-type sensors in Food & Beverage make it a strong competitor. Further research into market reports or industry publications focusing on capacitance sensor applications in each sector might provide more definitive insights.

Capacitance Liquid Level Sensor Market segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

While definitive data is limited, Asia is projected to be the dominant region in the capacitance liquid level sensor market. This combination of factors positions Asia as the most promising region for the capacitance liquid level sensor market, although North America and Europe are expected to remain significant players due to established industrial bases and focus on technological advancements.

COVID-19 Impact Analysis on the Global Capacitance Liquid Level Sensor Market

The COVID-19 pandemic caused a ripple effect on the global capacitance liquid level sensor market, presenting both challenges and opportunities. Initial lockdowns and disruptions in global supply chains hampered the production and distribution of these sensors. Additionally, project delays across various industries, particularly oil & gas and automotive, due to reduced demand, led to a temporary decline in market growth. However, the pandemic also accelerated automation trends as companies sought to minimize human contact and improve operational efficiency. This shift in focus has spurred renewed interest in capacitance liquid level sensors, particularly the continuous-type, as they play a vital role in automated processes and remote monitoring. Additionally, the growing emphasis on hygiene and sanitation in food & beverage production due to COVID-19 concerns creates a positive outlook for these sensors in this sector. Overall, the COVID-19 impact is expected to be short-term. While the initial shockwaves caused a temporary setback, the long-term trends of automation, Industry 4.0 adoption, and stricter regulations in various industries are likely to propel the global capacitance liquid level sensor market forward in the coming years.

Latest trends/Developments

The capacitance liquid level sensor market is brimming with exciting advancements. Miniaturization efforts are leading to compact sensor designs, ideal for space-constrained applications. Material innovation focuses on specialized coatings and composites to enhance sensor sensitivity, durability, and suitability for harsh environments. A key trend is the integration with Industrial Internet of Things (IIoT) platforms. This allows for seamless data collection, real-time monitoring of liquid levels from remote locations, and integration with advanced analytics for process optimization and predictive maintenance. Furthermore, manufacturers are exploring self-calibration features and algorithms to address potential calibration needs due to factors like foam buildup, reducing maintenance requirements. The market is also witnessing a growing focus on wireless capacitance level sensors. This eliminates the need for complex wiring and simplifies installation, particularly for monitoring tanks in remote or hard-to-reach locations. Overall, these trends highlight a focus on enhanced sensor performance, improved data management capabilities, and simplified user experience, paving the way for wider adoption of capacitance liquid level sensors across various industries.

Key Players:

-

ABB (Switzerland)

-

Emerson Electric Company (United States)

-

Endress+Hauser Group Services AG (Switzerland)

-

Siemens AG (Germany)

-

Honeywell International Inc. (United States)

-

TE Connectivity Ltd (Switzerland)

-

Pepperl+Fuchs GmbH (Germany)

-

Gems Sensors Inc. (United States)

-

VEGA Grieshaber KG (Germany)

-

Yokogawa Electric Corporation (Japan)

Chapter 1. Capacitance Liquid Level Sensor Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Capacitance Liquid Level Sensor Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Capacitance Liquid Level Sensor Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Capacitance Liquid Level Sensor Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Capacitance Liquid Level Sensor Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Capacitance Liquid Level Sensor Market – By Type

6.1 Introduction/Key Findings

6.2 Switch-Type Sensors

6.3 Continuous-Type Sensors

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Capacitance Liquid Level Sensor Market – By Application

7.1 Introduction/Key Findings

7.2 Oil & Gas Industry

7.3 Food & Beverage Industry

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Capacitance Liquid Level Sensor Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Capacitance Liquid Level Sensor Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ABB (Switzerland)

9.2 Emerson Electric Company (United States)

9.3 Endress+Hauser Group Services AG (Switzerland)

9.4 Siemens AG (Germany)

9.5 Honeywell International Inc. (United States)

9.6 TE Connectivity Ltd (Switzerland)

9.7 Pepperl+Fuchs GmbH (Germany)

9.8 Gems Sensors Inc. (United States)

9.9 VEGA Grieshaber KG (Germany)

9.10 Yokogawa Electric Corporation (Japan)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Capacitance Liquid Level Sensor Market was valued at USD 4.55 billion in 2023 and will grow at a CAGR of 7.3% from 2024 to 2030. The market is expected to reach USD 7.45 billion by 2030.

Growing Demand for Process Efficiency and Automation, Advantages of Capacitance Technology, Stringent Regulations, and Safety Concerns are the reasons that are driving the market.

Based on Application it is divided into two segments – Oil & Gas Industry, Food & Beverage Industry.

Asia Pacific is the most dominant region for the Market.

ABB (Switzerland), Emerson Electric Company (United States), Endress+Hauser Group Services AG (Switzerland), Siemens AG (Germany), Honeywell International Inc. (United States).