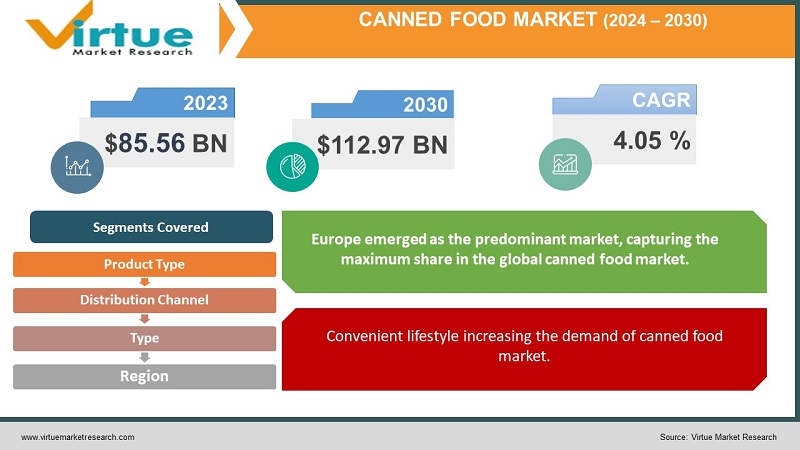

Canned Food Market Size (2024-2030)

The Canned Food Market was valued at USD 85.56 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 112.97 billion by 2030, growing at a CAGR of 4.05%.

Download Free Sample Report Now

Canning involves the preservation of food items to prolong their shelf life. The utilization of canned products is widespread in numerous countries due to the advantages they offer. The spoilage of food is mitigated by canned items, safeguarding against external factors such as sunlight, air, or insects. The process of canning maintains the nutritional integrity of the food. Numerous fast-food establishments and restaurants opt for canned foods, such as corn and tomato purees, due to their convenience and extended shelf life.

Key Market Insights:

The preservation of food items through canning involves the sealing and sterilization of the products within airtight containers. Diverse offerings in the canned food market encompass seafood, meat, fruits, vegetables, meals, sweets and desserts, soups and sauces, as well as beans, lentils, and pastas. The canning process effectively preserves numerous essential nutrients, establishing canned food products as a favored option among preserved food choices in the market.

Unlock Market Insights: Get Your FREE Sample Report Today!

Canned Food Market Drivers:

Convenient lifestyle increasing the demand of canned food market.

The surge in the demand for convenience food is primarily propelled by the key factor of convenience, underpinned by the global increase in disposable income and the growing population of working women. The preference for convenience food products among consumers has experienced a notable upswing due to their hectic lifestyles. Canned foods, recognized for their ability to retain high levels of nutrients, color, and flavor, have emerged as one of the most favored options in the preserved foods category.

Changes in consumer lifestyles, combined with heightened spending on food and beverages, contribute to a substantial dietary shift characterized by an augmented demand for animal-sourced food, fats and oils, refined grains, as well as fruits and vegetables. Individuals with busy schedules, particularly those lacking culinary expertise, find respite from the demands of a fast-paced lifestyle through the convenience offered by canned foods.

Demographic shifts in consumer profiles play a pivotal role in steering the convenience foods market, with the prevailing sentiment indicating a strong correlation between food sales and the level of convenience they provide. Notably, convenience stands out as a significant value addition across all categories of canned foods.

Health concern is driving the global canned food market.

The health concern factor is an additional driver in the market, with an increasing awareness of the drawbacks associated with plastic packaging. The demand for sustainable solutions, along with a global uptick in recycling rates, further contributes to the momentum in the market.

Canned Food Market Restraints and Challenges:

Environment concern hamper the growth of the market.

Environmental concerns are acting as a constraint on the growth of the canned food market. The preservation of canned food products in non-biodegradable tin and aluminum cans raises environmental issues as these materials persist in the biosphere for extended periods after disposal. The discarded cans, when exposed to abiotic or biotic factors, emit harmful gasses and toxic substances, contributing to environmental hazards. Several governments have advised against the use of tin and aluminum cans, further adversely affecting the market.

Increase in the demand for organic food restrain the market growth.

The growing desire among consumers for fresh foods poses a significant impediment to the growth of the canned food market. The shift in consumer preferences towards healthier eating habits has resulted in the perception that fresh foods offer greater nutrition compared to canned alternatives, which are often perceived to contain higher levels of sodium and fewer nutrients. This change in consumer behavior is influencing the demand for canned foods, with an increasing number of shoppers opting for fresh produce, particularly in light of the expanding organic and local food movements. Consequently, the canned food market encounters challenges in both retaining and expanding its customer base.

Canned Food Market Opportunities:

Demand for ready to cook meat is generating opportunities in the market.

The primary impetus behind the market's growth stems from the increasing urban population's inclination toward convenient and easily accessible food, coupled with a robust demand for health-conscious products rich in protein, functional fibers, vitamins, and omega-3 fatty acids. Consumers demonstrating a willingness to invest slightly more in products that offer such nutritional attributes contribute significantly to market sales. The surge in demand for compact, convenient, ready-to-cook meat and seafood, as well as organic canned fruits and vegetables, further propels market growth.

The proliferation of food retail outlets, concurrent with escalating urbanization, research and development investments, and strategic marketing approaches adopted by industry players in the canned food market, is anticipated to exert a positive influence on the overall revenue of the global canned food market.

GLOBAL CANNED FOOD MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.05% |

|

Segments Covered |

By Product Type, Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Kraft Heinz Company, Del Monte Foods Inc., Nestlé S.A , Conagra Brands Inc., Bolton Group, AYAM , Campbell Soup Company, Shanghai Maling, CHB Group, Danish Crown |

Canned Food Market Segmentation:

Canned Food Market Segmentation By Product Type:

- Canned Meat Products

- Canned Fish/Seafood

- Canned Vegetables

- Canned Fruits

- Others

In terms of product type, the canned meat and seafood segment holds the largest share and asserts dominance in the global market. Among consumers, canned meat and seafood have emerged as the preferred choice within the canned food category, driven by the increasing global demand for meat and seafood products and the rising popularity of high-protein foods. The heightened demand for convenient food products is expected to propel the ready meals market to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period for the canned food market.

Canned Food Market Segmentation By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Retail Stores

- Other Distribution Channels

In terms of distribution channels, the supermarket/hypermarket segment maintained its dominance, capturing approximately half of the market share in the canned food segment and is anticipated to sustain this leadership throughout the forecast period. Supermarkets and hypermarkets are the preferred outlets for bulk purchases of canned foods, with a substantial presence of chained and independent establishments in developed countries and an increasing penetration in developing nations contributing to their significant share in the canned food market.

The e-commerce segment is poised for the highest growth rate during the forecast period, attributed to the busy lifestyles of consumers and their growing inclination towards convenience. Actively participating in online channels for the purchase of canned food products is becoming a common trend, further driving the growth of the e-commerce segment in the canned food market.

Canned Food Market Segmentation By Type:

- Organic

- Conventional

In terms of type, the conventional segment secured a substantial share in the global market. Nevertheless, the organic segment is poised to achieve a considerable growth rate, driven by the escalating consumer preference for organic food products. Heightened awareness about the adverse effects of synthetic chemicals on health has prompted consumers to become more discerning about the food products they choose, contributing to the notable growth of organic variants within the canned food market. The organic category holds significant growth potential, reflecting a broader consumer trend emphasizing health and sustainability.

Canned Food Market Segmentation:

Canned Food Market Segmentation By Region:

- North America

- Europe

- South America

- Asia Pacific

- Middle East & Africa

Europe emerged as the predominant market, capturing the maximum share in the global canned food market. This dominance is primarily attributed to the substantial consumption of canned food products across various European countries, including Germany, France, Italy, and the UK. The appeal of canned food products with novel flavors, diverse textures, and enhanced nutritional value resonates with consumers in this region, contributing significantly to the growth of the canned food market.

The Asia-Pacific region is anticipated to be the fastest growing region with the highest Compound Annual Growth Rate (CAGR). This growth trajectory is driven by the increasing disposable income and busy lifestyles of consumers, resulting from higher employment rates and a rising population of working women in the region. These factors collectively contribute to the expanding market for canned food products in the Asia-Pacific region.

COVID-19 Pandemic: Impact Analysis

COVID-19 has a positive impact on the market. Due to the various restrictions imposed by the government people were not able to get fresh food. Canned food demand increased as it has a long shelf-life people could store in their house. But due to a halt in the manufacture and supply chain there were delays in the production and also an increase in the price of the food.

Latest Trends/ Developments:

- In 2023, the Thai Union Group initiated an Innovation Challenge with the aim of collaborating with startups focused on developing ocean-derived ingredients and applications.

- Also in 2023, Dole Packaged Foods unveiled several innovative products at the Natural Products Expo West in Anaheim, California. These new offerings were prominently featured in the frozen food and snack sections of supermarkets.

- In October 2022, Campbell Soup Company's Chunky Soup introduced four new flavors, namely Spicy Chicken Noodle, Spicy Steak n' Potato, Spicy Sirloin Burger, and Spicy Chicken and Sausage Gumbo.

- In September 2022, Campbell's Pacific Foods launched a range of new organic ready-to-serve soups and plant-based chilis, featuring a total of 14 new flavors.

Key Players:

These are top 10 players in the Canned Food Market: -

- Kraft Heinz Company

- Del Monte Foods Inc.

- Nestlé S.A

- Conagra Brands Inc.

- Bolton Group

- AYAM

- Campbell Soup Company

- Shanghai Maling

- CHB Group

- Danish Crown

Chapter 1. GLOBAL CANNED FOOD MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL CANNED FOOD MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL CANNED FOOD MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL CANNED FOOD MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL CANNED FOOD MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL CANNED FOOD MARKET– BY PRODUCT TYPE

6.1. Introduction/Key Findings

6.2. Canned Meat Products

6.3. Canned Fish/Seafood

6.4. Canned Vegetables

6.5. Canned Fruits

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Product Type

6.8. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. GLOBAL CANNED FOOD MARKET– BY DISTRIBUTION CHANNEL

7.1. Introduction/Key Findings

7.2. Supermarkets/Hypermarkets

7.3. Convenience/Grocery Stores

7.4. Online Retail Stores

7.5. Other Distribution Channels

7.6. Y-O-Y Growth trend Analysis By DISTRIBUTION CHANNEL

7.7. Absolute $ Opportunity Analysis By DISTRIBUTION CHANNEL , 2024-2030

Chapter 8. GLOBAL CANNED FOOD MARKET– BY TYPE

8.1. Introduction/Key Findings

8.2 Organic

8.3. Conventional

8.4. Y-O-Y Growth trend Analysis Type

8.5. Absolute $ Opportunity Analysis Type , 2024-2030

Chapter 9. GLOBAL CANNED FOOD MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By DISTRIBUTION CHANNEL

9.1.3. By Product Type

9.1.4. By Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By DISTRIBUTION CHANNEL

9.2.3. By Product Type

9.2.4. By Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By DISTRIBUTION CHANNEL

9.3.3. By Product Type

9.3.4. By Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By DISTRIBUTION CHANNEL

9.4.3. By Product Type

9.4.4. By Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By DISTRIBUTION CHANNEL

9.5.3. By Product Type

9.5.4. By Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL CANNED FOOD MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Kraft Heinz Company

10.2. Del Monte Foods Inc.

10.3. Nestlé S.A

10.4. Conagra Brands Inc.

10.5. Bolton Group

10.6. AYAM

10.7. Campbell Soup Company

10.8. Shanghai Maling

10.9. CHB Group

10.10. Danish Crown

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The surge in the demand for convenience food is primarily propelled by the key factor of convenience, underpinned by the global increase in disposable income and the growing population of working women.

The top players operating in the Canned Food Market are - Kraft Heinz Company, Del Monte Foods Inc., Nestlé S.A, Conagra Brands Inc, Bolton Group, AYAM Campbell Soup Company, Shanghai Maling, CHB Group, Danish Crown.

Covid-19 has a positive impact on the market. Due to the various restrictions imposed by the government people were not able to get fresh food.

There are various trends and opportunities for the canned food market that will increase the demand in the forecasted year.

The Asia-Pacific region is anticipated to be the fastest growing region with the highest Compound Annual Growth Rate (CAGR).