Cannabis Testing Market Size (2023 - 2030)

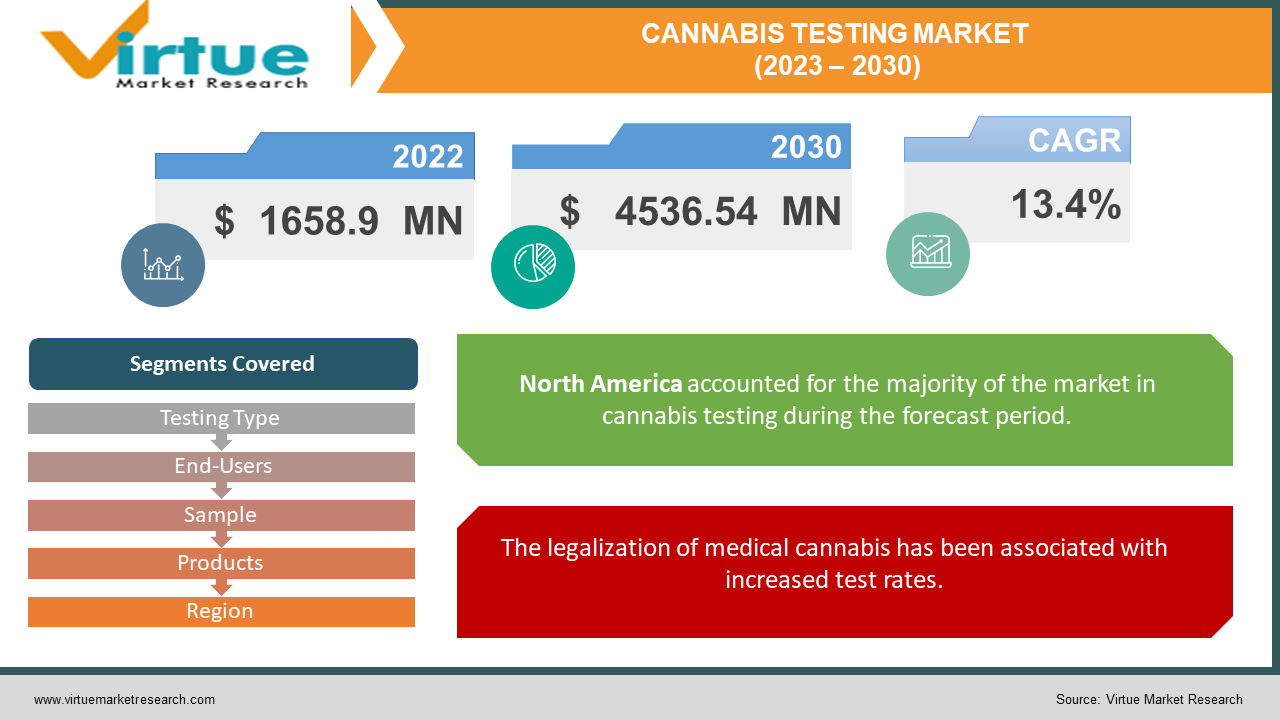

Global Cannabis Testing Market is estimated to be worth USD 1658.9 Million in 2022 and is projected to reach a value of USD 4536.54 Million by 2030, growing at a CAGR of 13.4% during the forecast period 2023-2030.

With many countries like Canada, Mexico, South Africa, the District of Columbia, Thailand, etc, legalizing Cannabis the demand has subsequently increased thereby facilitating more testing. Approximately 540 chemical compounds are found in the cannabis plant. The compound of Cannabis is known as Cannabinoids. The two most well-known and investigated cannabinoids are cannabidiol (CBD) and tetrahydrocannabinol (THC). According to a 2022 review of clinical research in Inflammopharmacology, medications that combine THC and CBD can be effective treatments for chronic pain, particularly neuropathic pain (pain caused by nerve damage), nociceptive pain (pain caused by ongoing inflammation and related damage), and nociplastic pain (pain arising from the altered function of pain-related sensory pathways). CBD was demonstrated to reduce blood pressure in human volunteers in 2017 research done by JCI Insight. It lowered their resting blood pressure and blood pressure following stress tests such as mental arithmetic, isometric exercise, and the cold pressor test. Apart from this, it also helps in reducing inflammation, preventing relapse in drug and alcohol addiction, treating anxiety disorders, etc.

Cannabis testing is vital for a variety of reasons, including establishing confidence with consumers and healthcare practitioners, mitigating risks in a fast-increasing sector, emphasis on quality products, etc. Tests are performed to determine the potency, pesticide, microbes, and heavy metals. As regulations change, more testing data is collected, and testing programs are evaluated, the industry must look to other established and regulated industries (pharmaceutical, food, and environmental) and adopt a collective approach to cannabis testing to ensure the industry's continued growth, credibility, and acceptance.

Global Cannabis Testing Market Drivers:

The legalization of medical cannabis has been associated with increased test rates.

Medical marijuana’s active compounds are comparable to chemicals produced by the body that are involved in hunger, memory, mobility, and pain. Additionally, they help in relieving migraine, nausea, and vomiting. Owing to medical uses, countries like Canada, Georgia, Malta, Mexico, South Africa, Thailand, and Uruguay, plus 23 states, 3 territories, and the District of Columbia in the United States and the Australian Capital Territory in Australia have legalized the consumption. This has boosted the demand for various analytical testing methods. According to scientific experts, the industry is projected to grow due to more legalization, adapting mindset in a certain percent of the population, and increased adoption of cannabis testing techniques.

Initiatives taken for improvement in the R&D sector have attracted the scientific community augmenting the cannabis testing market.

DCC is looking for research proposals that would help the public understand cannabis and the impacts of legalization. Through this initiative, DCC seeks to increase intellectual understanding about cannabis, discover how government policy decisions affect individuals, communities, and equity, and assist government authorities in making fact-based policy decisions. The Department hopes that the study funded by these funds will expand the corpus of scientific knowledge regarding cannabis and benefit policymakers not only in California but also across the country and the world. The study would prioritize topics like the cannabis industry's health, cannabinoids, and their effectiveness, monopolies and unjustified competition, and cannabis as a medicine. This will create employment opportunities and pique the interest of scientists as well as researchers thereby helping in understanding more about the sector.

Increased Adoption of Laboratory Information Management Systems (LIMS) in the Cannabis Testing Industry is boosting market growth.

LIMS is a software-based system with capabilities that enable the operations of a contemporary laboratory. Workflow and data tracking support, flexible design, and data interchange interfaces are key elements that fully support its use in regulated environments. A LIMS has grown from simple sample monitoring to an enterprise resource planning solution that controls numerous areas of laboratory informatics throughout the years. It can help in assessing chemicals, microbes, pesticides, metals, etc. which can be present in the compound. This helps in driving the Cannabis Testing Market forward by providing efficiency and maintaining more accurate results.

Global Cannabis Testing Market Challenges:

High start-up costs can hinder the revenue of the global cannabis testing market. The equipment requires constant upgradation, cleaning, maintenance, software, accreditation, and certificates. Techniques like chromatography and spectroscopy have advanced features and functionalities. Therefore, a lot of amount needs to be invested constantly to ensure accurate results. This can be a major setback for startups in the initial years. Secondly, skilled professionals having proper theoretical and practical knowledge for handling and testing are required. Thus, these are some of the factors that can drain the global cannabis testing market.

Global Cannabis Testing Market Opportunities:

The cannabis testing market is projected to see exponential growth in developing countries. Asia Pacific regions are encouraging more life science research programs and investing in the same. A lot of investors and prominent companies are attracted to various schemes as well as developments in the R&D sector. This has caused an improvement in the operations and advancements of the technologies used for cannabis testing. Furthermore, legalization in many countries has caused a positive inclement towards further exploring the medical aspects and benefits on the human body.

COVID-19 Impact on the Global Cannabis Testing Market:

Covid-19 has affected the cannabis testing market economy. Firstly, due to movement restrictions, lockdown, and social distancing the production of drugs reduced significantly thus decreasing the demand. This caused a restrain on transportation affecting the supply chain. Secondly, a lot of financial losses were reported by companies regarding cannabis testing due to the closure of academic and research institutions. Furthermore, a lot of companies recorded low sales of cannabis because of the chaos and people realizing the adversity it can otherwise cause to human health.

Global Cannabis Testing Market Recent Developments:

RS Group Lifestar in May 2022 launched a dietary supplement called Krill Oil Plus CBD supplement after undergoing evaluation from the FDA.

CANNABIS TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

13.4% |

|

Segments Covered |

By Testing Type, End-Users, Sample, Products, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Agilent Technologies, Inc., Shimadzu Corporation, MERCK KGAA, Thermo Fisher Scientific, DigiPath, Inc., Steep Hill Inc., SC Laboratories, Inc., PharmLabs LLC, Waters Corporation, PerkinElmer Inc. |

Global Cannabis Testing Market Segmentation: By Testing Type

-

Heavy Metal Testing

-

Microbial Analysis

-

Potency Testing

-

Residual Screening

-

Mycotoxin testing

-

Terpene Profiling

-

Others

Based on segmentation by type of testing, potency testing holds the highest share in the global cannabis testing market. There has been more awareness in consumption of CBD for medical uses which happens to be the major market driver for potency testing. Potency testing helps scientists in determining the effects a particular dosage of the drug will have on the biological system. The fastest-growing segment happens to be terpene profiling. Terpene profiling is critical for determining the identification and medicinal effectiveness of cannabis cultivars or strains.

Global Cannabis Testing Market Segmentation: By End-Users

-

Laboratories

-

Research Institutes

-

Cultivators

-

Others

Based on segmentation by end-users, cultivators hold the highest share in the global cannabis testing market. Testing becomes crucial owing to consumer safety, guidelines, regulations export rules, etc. Laboratories are projected to be the fastest segment. This is mainly because of extensive research activities conducted regarding human consumption, medical properties, and overall benefit.

Global Cannabis Testing Market Segmentation: By Sample

-

Flowers

-

Extracts

-

Edibles

-

Others

Cannabis flowers hold the highest market share in the global cannabis market. The flowers are processed and meant to reduce anxiety, and inflammation, and relieve pain. However, care has to be taken regarding their consumption as overuse can create a lot of serious impacts. The edibles are the fastest growing segment in the cannabis testing market owing to their uses like helping in recovering lost appetite, pain, and weight loss caused due to cancer.

Global Cannabis Testing Market Segmentation: By Products

-

Instruments

-

Chromatography

-

Liquid Chromatography

-

Gas Chromatography

-

Others

-

-

Spectroscopy

-

Mass Spectrometry

-

Atomic Spectroscopy

-

Others

-

-

-

Consumables

-

Software

Based on segmentation by products, instruments hold the highest share in the global cannabis testing market. This high growth is attributed to the legalization taking into account the medical benefits it offers. Additionally, funding programs for laboratory settings also play a pivotal role. The market of consumables happens to be the fastest growing due to an increase in usage.

Global Cannabis Testing Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

Based on region, North America dominates the global cannabis testing market. This is due to technological advancements, software availability, legalization in many countries, and services. Additionally, North America has witnessed an increase in the number of chronological disorders, epilepsy cases, and anxiety. This has led to more consumption of CBD because of its medical properties. The United States and Canada are the fastest-growing regions in North America. Asia Pacific happens to be the fastest growing in the global cannabis testing market. More funds are being invested in biopharmaceutical companies, research programs, and testing centers. Additionally, new technological advancements are boosting growth. China happens to be a major producer of hemp which has a considerably low percentage of THC. Therefore, testing becomes crucial.

Global Cannabis Testing Market Key Players:

-

Agilent Technologies, Inc.

-

Shimadzu Corporation

-

MERCK KGAA

-

Thermo Fisher Scientific

-

DigiPath, Inc.

-

Steep Hill Inc.

-

SC Laboratories, Inc.

-

PharmLabs LLC

-

Waters Corporation

-

PerkinElmer Inc.

Chapter 1. Cannabis Testing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Assumptions

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cannabis Testing Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.3 COVID-19 Impact Analysis

2.3.1 Impact during 2023 – 2030

2.3.2 Impact on Supply – Demand

Chapter 3. Cannabis Testing Market – Competition Scenario

3.1 Market Share Analysis

3.2 Product Benchmarking

3.3 Competitive Strategy & Development Scenario

3.4 Competitive Pricing Analysis

3.5 Supplier - Distributor Analysis

Chapter 4. Cannabis Testing Market - Entry Scenario

4.1 Case Studies – Start-up/Thriving Companies

4.2 Regulatory Scenario - By Region

4.3 Customer Analysis

4.4 Porter's Five Force Model

4.4.1 Bargaining Power of Suppliers

4.4.2 Bargaining Powers of Customers

4.4.3 Threat of New Entrants

4.4.4 .Rivalry among Existing Players

4.4.5 Threat of Substitutes

Chapter 5. Cannabis Testing Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cannabis Testing Market - By Testing Type

6.1 Heavy Metal Testing

6.2 Microbial Analysis

6.3 Potency Testing

6.4 Residual Screening

6.5 Mycotoxin testing

6.6 Terpene Profiling

6.7 Others

Chapter 7. Cannabis Testing Market - By End-Users

7.1 Laboratories

7.2 Research Institutes

7.3 Cultivators

7.4 Others

Chapter 8. Cannabis Testing Market - By Sample

8.1 Flowers

8.2 Extracts

8.3 Edibles

8.4 Others

Chapter 9. Cannabis Testing Market - By Products

9.1 Instruments

9.2 Chromatography

9.3 Liquid Chromatography

9.4 Gas Chromatography

9.5 Others

9.6 Spectroscopy

9.7 Mass Spectrometry

9.8 Atomic Spectroscopy

9.9 Others

9.10 Consumables

9.11 Software

Chapter 10. Cannabis Testing Market – By Region

10.1 North America

10.2 Europe

10.3 Asia-Pacific

10.4 Latin America

10.5 The Middle East

10.6 Africa

Chapter 11. Cannabis Testing Market – Key Players

11.1 Agilent Technologies, Inc.

11.2 Shimadzu Corporation

11.3 MERCK KGAA

11.4 Thermo Fisher Scientific

11.5 DigiPath, Inc.

11.6 Steep Hill Inc.

11.7 SC Laboratories, Inc.

11.8 PharmLabs LLC

11.9 Waters Corporation

11.10 PerkinElmer Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Global Cannabis Testing Market is estimated to be worth USD 1658.9 Million in 2022 and is projected to reach a value of USD 4536.54 Million by 2030, growing at a CAGR of 13.4% during the forecast period 2023-2030.

The Global Cannabis Testing Market Drivers are the legalization of medical cannabis, initiatives taken to improve the R&D sector, and increasing adoption of Learning Information Management System software for testing.

Based on the End-Users, the Global Cannabis Testing Market is segmented into Laboratories, Research Institutes, Cultivators, and Others.

The United States is the most dominating country in the region of North America for the Global Cannabis Testing Market.

Agilent Technologies, Inc., Shimadzu Corporation, and MERCK KGAA are the leading players in the Global Cannabis Testing Market.