Candy Corn Market Size (2023 – 2030)

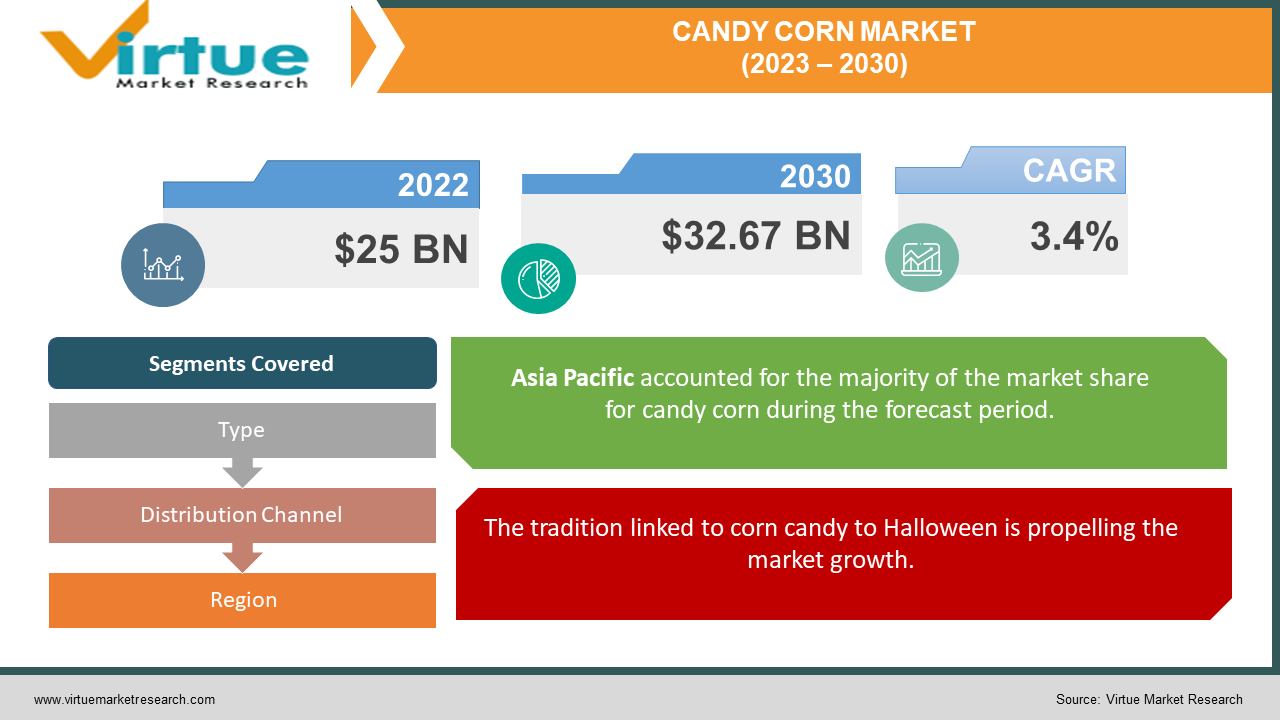

In 2022, the Global Candy Corn Market was valued at USD 25 billion and is projected to reach a market size of USD 32.67 billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 3.4%.

INDUSTRY OVERVIEW

Candy is a type of confection, and sugar is its main component. While children and young people are the primary target market for candy. People of various ages across the world take pleasure in it. Modernization, westernization, and rising consumer disposable income are the key drivers of the candy market's expansion. Other indirect drivers for the expansion of the confectionery sector include the ever-increasing young population and the increased demand for dark chocolate. The term "candy" also refers to a sweet culinary product. Sugar is the primary component of the confectionery e. Candies come in the form of tiny bits, drops, and bars and are manufactured from a mixture of chocolate, milk, nuts, fruits, and artificial sweeteners. Certain sweets that include vitamins and minerals and give protein value can aid in bodybuilding. Candy is a popular mini snack choice for those with busy schedules since it can be consumed quickly and is enjoyable during breaks.

Candy corn is a compact, pyramid-shaped confection with a waxy texture and a flavor based on honey, sugar, butter, and vanilla. It is often separated into three portions of various colors. It is a traditional treat during Halloween in North America and the fall season.

The tri-color pattern of candy corn, which originally originated in an agrarian civilization like that of the United States, was regarded as revolutionary. Candy corn was only produced seasonally due to the lack of mechanized technology, with production likely beginning in late August and lasting through the fall. It hasn't altered in more than a century and is a Halloween staple. Yellow, orange, and white, the classic colors of candy corn, are symbolic of the harvest in the fall or of corn on the cob, with the broad yellow end resembling a corn kernel. As "Halloween's most disputed sweet" that people "love" or "detest," candy corn has a reputation for evoking strong feelings in individuals. The candies were once produced by hand. Producers first made a slurry by cooking a mixture of sugar, maize syrup, water, and carnauba wax. Marshmallows and fondant were added to give the dish a soft bite and texture. The finished mixture was then heated and poured into the desired shapes. For the pouring procedure, there were three passes necessary—one for each colored part. [Required Citation

Almost little has changed with the recipe since then. The production process, known as "corn starch modelling," has remained constant even if operations that were first carried out by hand were quickly replaced by specially designed machines.

COVD-19 IMPACT ON THE CANDY CORN MARKET

The production of food & beverages has been significantly impacted by the COVID-19 epidemic. The socioeconomic condition has a detrimental impact on specific product consumption trends. As the output of cocoa in tiny but important cocoa-producing nations exceeded the demand in the early months of the pandemic, the limits imposed as a result of COVID-19 resulted in losses for farmers cultivating cocoa. Due to this, cocoa prices (in USD/ton) significantly decreased. The average price of the nearest cocoa contract in January 2021 was USD 2,528 per ton, according to the International Cocoa Organization (ICCO) in New York, a 6 % decline from the average price of USD 2,675 per ton for the previous crop year. The world's largest producer of luxury chocolate and cocoa products, The Barry Callebaut Group, reported a slowdown in the first half of the year as a result of the coronavirus pandemic, with volumes falling by 14.3% in the third quarter (ended 31 May 2020). The COVID-19-related curfews effectively shut down several crucial distribution hubs for the cocoa and chocolate-producing enterprises, including eateries, lodging facilities, and other food service establishments, which lowered chocolate sales throughout all application sectors. Governments implemented stringent lockdowns and limited public movement as a result of the global COVID-19 epidemic, which had a devastating effect on the economy and food business.

MARKET DRIVERS:

The tradition linked to corn candy to Halloween is propelling the market growth:

The custom of eating corn candy on Halloween is one of the primary drivers of industry expansion. The tastiest crop of the season is candy corn, and most people in North America look forward to this annual custom around Halloween. Millions of people in the US prefer it because they adore its sweet, mellow flavor.

Candy Corn has a longer shelf life:

Corn candy has a longer shelf life which is a major factor influencing the market growth. Candy corn has an established shelf life of three to six months once it has been opened, according to Whiteside of the National Confectioners Association. A new, unopened product has a nine-month shelf life.

MARKET RESTRAINTS:

The rise in the availability of alternative products is a prime reason restraining the market development

Alternative items, such as chocolates and biscuits, are widely available in the market. The market for candy corn will be impacted due to the presence of various new alternatives in the market. People are now preferring chocolate, cookies, biscuits, cakes and other confectionery options which has resulted in negatively impacting the market growth.

Industry Performance May Be Affected by Variations in Raw Material Prices

Among the crucial raw ingredients that are mostly used to make candy corn are cocoa and sugar. Due to rapid changes in supply and demand on the international market, the price of sugar and cocoa has fluctuated during the past few years. Due to poor weather, crop diseases, labor shortages, stock ratios, and other economic issues that impede the smooth exchange of their supply and demand in the market, cocoa and sugar yields suffer. Because of this, the average yearly price of raw materials ranges from low to high, causing an excess or understock of the raw materials needed to make sugar and chocolate goods for the market. As a result, in the next years, fluctuating raw material prices are anticipated to reduce total demand.

CANDY CORN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

3.4% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Sugarfina, Ferrara Candy, Brach, Others |

CANDY CORN MARKET – BY TYPE

-

Harvest Corn

-

Blackberry Cobbler

-

Bunny Corn

-

Others

Based on type, a few types of candy corn available in the market include Harvest Corn, Blackberry Cobbler, Bunny Corn and Others. Among these, the harvested corn is the most popular one. A well-liked variant known as "harvest corn" that includes cocoa powder and has a chocolate brown broad end, an orange center, and a pointed white tip is frequently offered around Thanksgiving. In Eastern Canada, candy corn in the shape of pumpkins and blackberry cobbler may be available around Halloween. Additional color options for various festivals have been added by confectioners.

The Valentine's Day variation also known as "cupid corn” often has a red end and a pink center, while the Christmas variety is also known as "reindeer corn" typically has a red end and a green core. The Easter version sometimes called bunny corn, is usually only a two-color candy and comes with a variety of pastel bases pink, green, yellow, and purple with white tips all in one package. Candy Corn is also known as freedom corn and can be found at celebratory cookouts and patriotic celebrations in the United States during Independence Day celebrations. Additionally, there have been candy corn flavors with flavors like birthday cake and green and orange carrot corn, caramel apple and green apple, s'mores, and pumpkin spice.

CANDY CORN MARKET - BY DISTRIBUTION CHANNEL

-

Online

-

Offline

Based on distribution channels, the cookies market is segmented into Online Mode and Offline Mode. Among these, the offline segment dominated the market in 2021. The market dominance can be attributed to the increased exposure of supermarkets and convenience shops as significant selling channels in developing economies such as China and India. Furthermore, the convenient accessibility of a range of flavor options in supermarkets is propelling the Candy Corn Market forward. However, due to the increasing popularity of e-commerce sites, the online channels category is predicted to develop at the quickest rate during the projection years. This trend may be attributed to reasons such as increased awareness of the cost-effectiveness and accessibility of purchasing various cookies over digital portals, as well as a trend in the young generation toward a sedentary lifestyle.

CANDY CORN MARKET - BY REGION

-

North America

-

Europe

-

The Asia Pacific

-

Latin America

-

The Middle East

-

Africa

By region, the Candy Corn market is grouped into North America, Europe, Asia Pacific, Latin America, The Middle East and Africa. The market for corn candies is presently dominated by North America and will remain so during the anticipated time frame, with the United States and Canada emerging as the major contributors. This is because Candy Corn consumption and giving as gifts around Halloween is a tradition, moreover prevalence of major players in the market and the introduction of new flavors is a major reason attributed to this dominance.

CANDY CORN MARKET - BY COMPANIES

Some of the major players operating in the Candy Corn market include:

-

Cargill

-

Sugarfina

-

Ferrara Candy

-

Brach

-

Others

NOTABLE HAPPENING IN THE CANDY CORN MARKET

PRODUCT LAUNCH- Brach launched a new turkey dinner flavored variant of their iconic candy corn in October 2021, which received over 6 billion web impressions.

Chapter 1. Candy Corn Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Candy Corn Market – Executive Summary

2.1 Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Candy Corn Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Candy Corn Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Candy Corn Market - Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Candy Corn Market - BY TYPE

6.1 Introduction/Key Findings

6.2 Harvest Corn

6.3 Blackberry Cobbler

6.4 Bunny Corn

6.5 Others

6.6 Y-O-Y Growth trend Analysis BY TYPE

6.7 Absolute $ Opportunity Analysis BY TYPE, 2023-2030

Chapter 7. Candy Corn Market- BY DISTRIBUTION CHANNEL

7.1 Introduction/Key Findings

7.2 Online

7.3 Offline

7.4 Y-O-Y Growth trend Analysis BY TYPE

7.5 Absolute $ Opportunity Analysis BY TYPE, 2023-2030

Chapter 8. Candy Corn Market, By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.2 BY TYPE

8.3 BY DISTRIBUTION CHANNEL

8.4 BY TYPE

8.5 Countries & Segments - Market Attractiveness Analysis

8.6 Europe

8.6.1 By Country

8.6.1.1 U.K.

8.6.1.2 Germany

8.6.1.3 France

8.6.1.4 Italy

8.6.1.5 Spain

8.6.1.6 Rest of Europe

8.7 BY TYPE

8.8 BY DISTRIBUTION CHANNEL

8.9 Countries & Segments - Market Attractiveness Analysis

8.10 Asia Pacific

8.10.1 By Country

8.10.1.1 China

8.10.1.2 Japan

8.10.1.3 South Korea

8.10.1.4 India

8.10.1.5 Australia & New Zealand

8.10.1.6 Rest of Asia-Pacific

8.11 BY TYPE

8.12 BY DISTRIBUTION CHANNEL

8.13 Countries & Segments - Market Attractiveness Analysis

8.14 South America

8.14.1 By Country

8.14.1.1 Brazil

8.14.1.2 Argentina

8.14.1.3 Colombia

8.14.1.4 Chile

8.14.1.5 Rest of South America

8.15 BY TYPE

8.16 BY DISTRIBUTION CHANNEL

8.17 Countries & Segments - Market Attractiveness Analysis

8.18 Middle East & Africa

8.18.1 By Country

8.18.1.1 United Arab Emirates

8.18.1.2 Saudi Arabia

8.18.1.3 Qatar

8.18.1.4 Israel

8.18.1.5 South Africa

8.18.1.6 Nigeria

8.18.1.7 Kenya

8.18.1.8 Egypt

8.18.1.9 Rest of MEA

8.19 BY TYPE

8.20 BY DISTRIBUTION CHANNEL

8.21 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Candy Corn Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Cargill

9.2 Sugarfina

9.3 Ferrara Candy

9.4 Brach

9.5 Others

Download Sample

Choose License Type

2500

4250

5250

6900