Cancer Supportive Care Products Market Size (2024–2030)

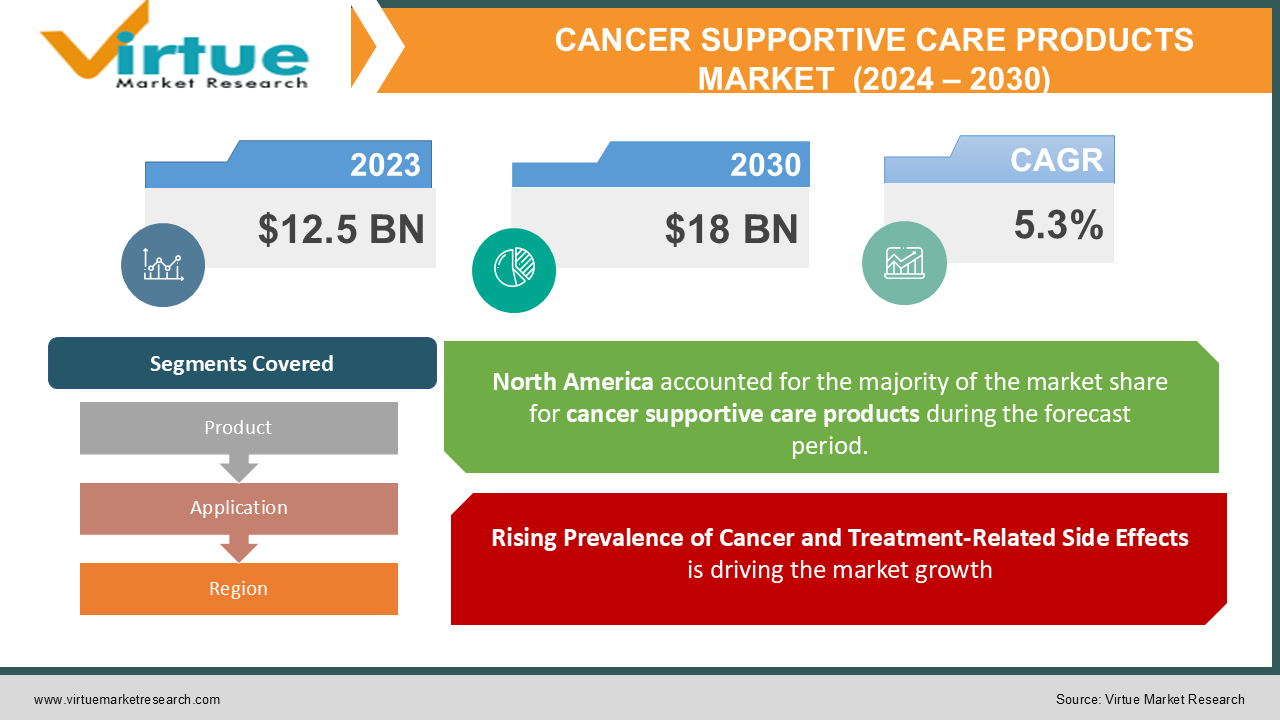

The Global Cancer Supportive Care Products Market was valued at USD 12.5 billion in 2023 and is expected to grow at a CAGR of 5.3% from 2024 to 2030, reaching USD 18 billion by 2030.

Cancer supportive care products are critical in managing side effects and enhancing the quality of life for patients undergoing cancer treatment. These products encompass a wide range of therapies including erythropoietin-stimulating agents (ESAs), pain management drugs, antiemetics, granulocyte colony-stimulating factors (G-CSFs), and others.

The demand for supportive care products is largely driven by the rising incidence of cancer, which necessitates comprehensive treatment and symptom management. With advancements in cancer therapies, such as immunotherapies and precision medicine, there is a growing emphasis on managing associated side effects like fatigue, nausea, and infections. Additionally, the aging population and the increasing adoption of chemotherapy and radiotherapy are boosting the market for supportive care products.

Key Market Insights:

-

Erythropoietin-stimulating agents (ESAs) held a substantial market share in 2023, accounting for 25% of the total market revenue, due to their efficacy in treating anemia associated with cancer treatments.

-

The anti-emetics segment is anticipated to grow at a CAGR of 5.3% from 2024 to 2030, driven by increasing demand for nausea and vomiting management among chemotherapy patients.

-

The pain management segment witnessed significant growth in recent years, accounting for 20% of the market share in 2023, with opioids and other analgesics commonly prescribed to alleviate cancer-related pain.

-

North America holds the largest regional share, contributing 40% of the global market revenue in 2023, supported by advanced healthcare infrastructure and a high prevalence of cancer cases.

Global Cancer Supportive Care Products Market Drivers:

Rising Prevalence of Cancer and Treatment-Related Side Effects is driving the market growth:

The increasing incidence of cancer worldwide is a primary driver of the demand for supportive care products. As of recent data, there are approximately 19.3 million new cancer cases and 10 million cancer-related deaths globally each year. These statistics underscore the need for effective treatment options that manage not only the primary disease but also the often severe side effects of therapies such as chemotherapy and radiation. Cancer treatments are known for causing significant adverse effects, including anemia, fatigue, pain, nausea, and immunosuppression, which can drastically reduce the quality of life for patients. Erythropoietin-stimulating agents (ESAs), for example, are widely prescribed to treat anemia caused by chemotherapy. In addition, granulocyte colony-stimulating factors (G-CSFs) are commonly used to boost white blood cell counts, reducing the risk of infections in patients with weakened immune systems. The high prevalence of cancer and the need for symptomatic relief have spurred demand for a broad array of supportive care products. As the healthcare sector increasingly recognizes the importance of holistic cancer care, the market for supportive products is expected to see sustained growth.

Increased Adoption of Chemotherapy and Radiotherapy is driving the market growth:

Chemotherapy and radiotherapy are among the most common treatments for cancer, and they frequently necessitate supportive care to manage adverse effects. Chemotherapy drugs, while effective in targeting cancer cells, can also harm healthy cells, leading to side effects such as nausea, vomiting, and immune system suppression. Radiotherapy, which uses high-energy radiation to destroy cancer cells, can also result in side effects, including fatigue, skin irritation, and gastrointestinal symptoms. As cancer treatment protocols continue to rely heavily on chemotherapy and radiotherapy, there is an ongoing need for supportive care products to manage associated symptoms. For example, anti-emetics are widely used to control nausea and vomiting in patients undergoing chemotherapy, while pain management drugs help alleviate pain associated with cancer treatments. In recent years, targeted therapies and immunotherapies have also emerged as treatment options, but they too often require supportive care for side effect management. With the increasing adoption of cancer treatments worldwide, the demand for supportive care products is expected to rise, contributing to the growth of the global cancer supportive care products market.

Growing Awareness of Quality of Life and Palliative Care in Cancer Treatment is driving the market growth:

There is a growing emphasis on quality of life and palliative care for cancer patients, particularly in the context of long-term survivorship. As cancer survival rates improve due to advances in diagnosis and treatment, supportive care has become an essential component of comprehensive cancer care. Supportive care products are critical for improving patient well-being, minimizing suffering, and helping patients cope with the physical and emotional challenges of cancer treatment. The increasing focus on quality of life is evident in the expanding role of palliative care in healthcare systems worldwide. Palliative care teams often recommend supportive care products to alleviate symptoms and improve patient comfort, which has led to increased demand for products such as pain management drugs, anti-emetics, and G-CSFs. Moreover, supportive care is not only about symptom management but also includes psychological and emotional support, which is recognized as crucial for patient recovery and quality of life.

Global Cancer Supportive Care Products Market Challenges and Restraints:

High Costs of Cancer Supportive Care Products is restricting the market growth:

The high costs associated with cancer supportive care products present a significant challenge to market growth. Many of these products, such as erythropoietin-stimulating agents (ESAs) and granulocyte colony-stimulating factors (G-CSFs), are costly, and their expenses can add up, especially for patients undergoing long-term treatment. The costs of pain management drugs, anti-emetics, and other supportive care medications can also be a burden on patients and healthcare systems. While insurance coverage may alleviate some of these costs, the high price of cancer supportive care remains a barrier for many patients, particularly in developing regions where healthcare funding may be limited. Additionally, certain supportive care products, such as biologics, are subject to strict regulatory requirements, which can increase production costs and limit affordability. Efforts to introduce more affordable options, such as biosimilars, have helped alleviate some of these financial barriers. However, the high costs associated with supportive care products remain a significant challenge that may limit market expansion, especially in regions with limited healthcare resources.

Limited Access to Cancer Supportive Care in Low-Income Regions is restricting the market growth:

Access to cancer supportive care is limited in many low-income and developing regions, where healthcare infrastructure is underdeveloped, and resources are scarce. In these areas, cancer patients may lack access to essential supportive care products, and healthcare providers may have limited knowledge or training in cancer supportive care. This disparity in access to supportive care products is a major challenge for the global cancer supportive care products market. Additionally, logistical challenges, such as the lack of specialized facilities and trained personnel, further hinder access to cancer supportive care in these regions. Governments and international organizations are working to address these issues through programs aimed at improving cancer care infrastructure and increasing access to supportive care. However, achieving equitable access to cancer supportive care remains a challenge that may hinder market growth in certain regions.

Market Opportunities:

The cancer supportive care products market offers significant growth opportunities, particularly in the areas of biosimilars, telemedicine, and personalized care solutions. The rise of biosimilars presents an opportunity to provide more affordable supportive care options. For instance, biosimilars of erythropoietin and granulocyte colony-stimulating factors (G-CSFs) offer cost-effective alternatives to their reference products, making supportive care more accessible to a broader patient population. As regulatory bodies continue to approve biosimilars for supportive care, this segment is expected to see robust growth. The integration of telemedicine and digital health technologies in supportive care is another promising opportunity. Telemedicine enables patients to access supportive care resources remotely, ensuring they receive consistent care even if they are unable to visit healthcare facilities. Digital platforms can help monitor symptoms, manage medication adherence, and provide educational resources, enhancing patient compliance and improving overall outcomes. With the increasing adoption of digital health, supportive care products can be effectively integrated into patients’ everyday lives, offering convenience and ensuring continuity of care. Another area for growth is the development of personalized supportive care solutions. Advances in genomics and biomarker research are making it possible to tailor supportive care to individual patient profiles, enhancing efficacy and reducing side effects. Personalized supportive care products are expected to improve patient quality of life, making them an attractive option for healthcare providers and patients alike.

CANCER SUPPORTIVE CARE PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.3% |

|

Segments Covered |

By Product, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Amgen Inc., Hoffmann-La Roche Ltd., Pfizer Inc., Teva Pharmaceutical Industries Ltd., Merck & Co., Inc., Johnson & Johnson Services, Inc., Helsinn Healthcare SA, Kyowa Kirin Co., Ltd., Sanofi S.A., Novartis AG |

Cancer Supportive Care Products Market Segmentation: By Product

-

Erythropoietin Stimulating Agents (ESAs)

-

Pain Management Drugs

-

Anti-Emetics

-

Granulocyte Colony-Stimulating Factors (G-CSFs)

-

Others

The erythropoietin-stimulating agents (ESAs) segment is the dominant segment, accounting for 25% of the market in 2023. ESAs are widely used to treat anemia associated with chemotherapy, enhancing patient well-being by reducing fatigue and improving energy levels.

Cancer Supportive Care Products Market Segmentation: By Application

-

Chemotherapy

-

Radiation Therapy

-

Surgery

-

Others

The chemotherapy segment leads the market in terms of demand, with chemotherapy-associated side effects driving significant demand for supportive care products. Chemotherapy patients frequently require anti-emetics, pain management drugs, and ESAs to manage symptoms and maintain quality of life during treatment.

Cancer Supportive Care Products Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America is the dominant region in the cancer supportive care products market, with a 40% market share in 2023. The region’s leadership is supported by high cancer prevalence rates, advanced healthcare infrastructure, and a well-established market for supportive care products.

COVID-19 Impact Analysis:

The COVID-19 pandemic initially disrupted the global cancer supportive care products market, with healthcare resources redirected to address the pandemic and cancer care services delayed or postponed. This shift impacted patient access to supportive care products, with some treatments put on hold or deprioritized. However, as healthcare systems adapted to the new normal, cancer care resumed, and demand for supportive care products recovered. The pandemic also accelerated the adoption of telemedicine, which played a crucial role in providing remote access to supportive care for cancer patients.

Latest Trends/Developments:

The market is witnessing the rise of biosimilar supportive care products, advancements in digital health platforms, and the growing emphasis on personalized supportive care solutions. These trends are enhancing patient access, improving the affordability of supportive care, and enabling customized treatments tailored to individual needs. The cancer supportive care products market is witnessing significant growth and development, driven by the increasing prevalence of cancer and the growing emphasis on improving patient quality of life during and after cancer treatment. Key trends and developments include the emergence of innovative therapies like targeted and personalized medicine, advancements in drug delivery systems, and a focus on combination therapies to address multiple symptoms simultaneously. Additionally, there's a growing emphasis on preventive measures and early detection to reduce the burden of cancer. The market is also witnessing a surge in the development of new drugs and therapies, particularly in areas like pain management, nausea and vomiting control, and fatigue management. Furthermore, the increasing availability of affordable and accessible cancer supportive care products is driving market growth, especially in emerging markets.

Key Players:

-

Amgen Inc.

-

Hoffmann-La Roche Ltd.

-

Pfizer Inc.

-

Teva Pharmaceutical Industries Ltd.

-

Merck & Co., Inc.

-

Johnson & Johnson Services, Inc.

-

Helsinn Healthcare SA

-

Kyowa Kirin Co., Ltd.

-

Sanofi S.A.

-

Novartis AG

Chapter 1. Cancer Supportive Care Products Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cancer Supportive Care Products Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cancer Supportive Care Products Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cancer Supportive Care Products Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cancer Supportive Care Products Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cancer Supportive Care Products Market – By Product

6.1 Introduction/Key Findings

6.2 Erythropoietin Stimulating Agents (ESAs)

6.3 Pain Management Drugs

6.4 Anti-Emetics

6.5 Granulocyte Colony-Stimulating Factors (G-CSFs)

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Cancer Supportive Care Products Market – By Application

7.1 Introduction/Key Findings

7.2 Chemotherapy

7.3 Radiation Therapy

7.4 Surgery

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Cancer Supportive Care Products Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cancer Supportive Care Products Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Amgen Inc.

9.2 Hoffmann-La Roche Ltd.

9.3 Pfizer Inc.

9.4 Teva Pharmaceutical Industries Ltd.

9.5 Merck & Co., Inc.

9.6 Johnson & Johnson Services, Inc.

9.7 Helsinn Healthcare SA

9.8 Kyowa Kirin Co., Ltd.

9.9 Sanofi S.A.

9.10 Novartis AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 12.5 billion in 2023 and is projected to reach USD 18 billion by 2030, growing at a CAGR of 5.3%.

Key drivers include the rising prevalence of cancer, increased adoption of chemotherapy, and a growing focus on quality of life and palliative care in cancer treatment.

The market is segmented by product (ESAs, pain management drugs, anti-emetics, G-CSFs) and by application (chemotherapy, radiation therapy, surgery, and others).

North America dominates, with a 40% share of the global market in 2023.

Leading players include Amgen Inc., Hoffmann-La Roche Ltd., Pfizer Inc., Teva Pharmaceutical Industries Ltd., and Merck & Co., Inc., among others.