Cancer biomarkers for neuroendocrine tumour Market Size (2024 – 2030)

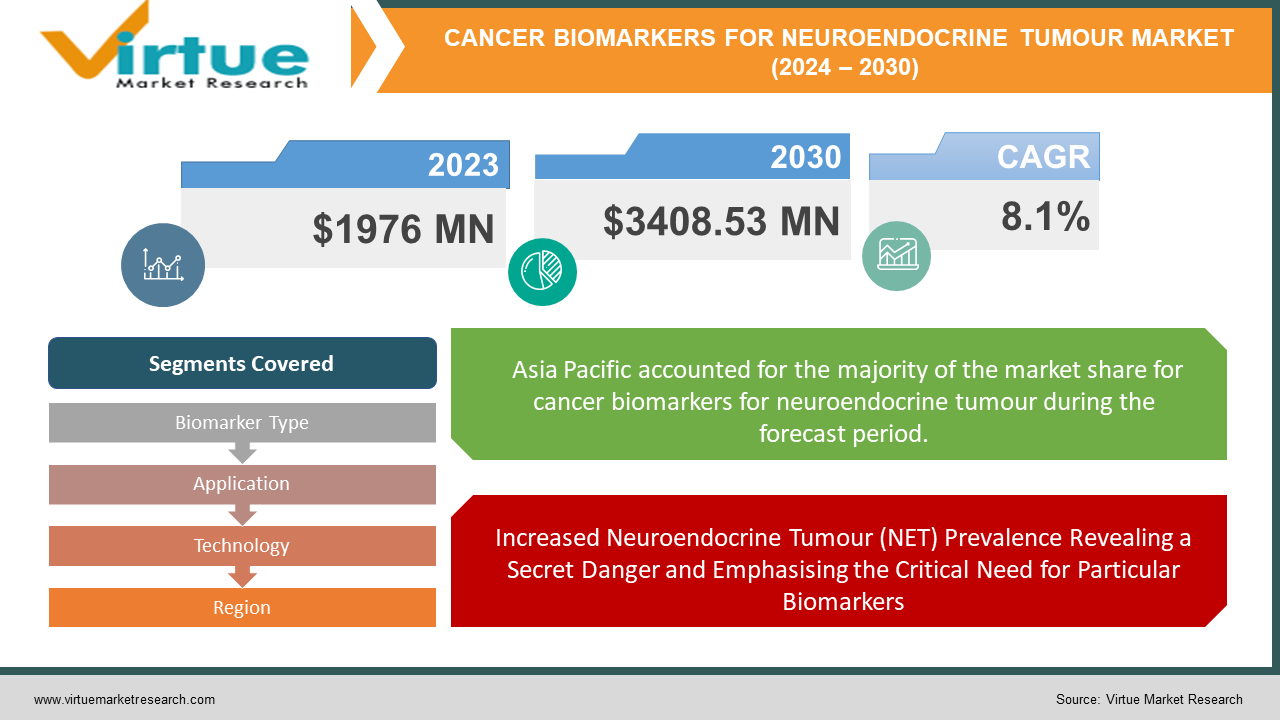

The Global Cancer biomarkers for neuroendocrine tumour Market was valued at $1976 million in 2023 and is projected to reach a market size of $3408.53 million by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 8.1%.

The most widely used biomarker for neuroendocrine tumours (NETs) is chromogranin A (CgA), which may be detected in the blood or urine. Various biomarkers may be diagnostic of various disorders including neuron-specific enolase (NSE) and 5-hydroxyindoleacetic acid (5-HIAA). While no one biomarker is ideal for diagnosis, a combination of tests that include these indicators aids physicians in the diagnosis, monitoring, and evaluation of NET treatments. There are even more specific markers for certain NET subtypes.

Key Market Insights:

A significant trend in the Cancer biomarkers for neuroendocrine tumour market is the development of new drugs and therapies. Companies are receiving FDA fast-track designations for innovative treatments.

Government funding for research and development is crucial for Cancer biomarkers for the neuroendocrine tumour market. The National Cancer Institute in the U.S. received an increased budget of $7.3 billion in 2023.

The increasing prevalence of NETs, along with advancements in precision medicine and immunotherapy, presents market opportunities.

Cancer biomarkers for the neuroendocrine tumour market’s future growth is expected to be driven by the integration of nanotechnology in drug delivery and the development of novel radiopharmaceuticals.

By 2024, the artificial intelligence (AI) industry is expected to grow to a value of $57.6 billion. This quick expansion shows how AI is being used in Cancer biomarkers for the neuroendocrine tumour sector to automate processes, boost productivity, and customise consumer experiences.

Global Cancer biomarkers for neuroendocrine tumour Market Drivers:

Increased Neuroendocrine Tumour (NET) Prevalence Revealing a Secret Danger and Emphasising the Critical Need for Particular Biomarkers

The market for cancer biomarkers faces a double-edged sword as neuroendocrine tumours (NETs) increase. Advancements in diagnostic methods like as endoscopies and scans are revealing more NETs than ever before. In terms of early detection and treatment, this is a good development, but it also results in a greater patient population and an increasing demand for precise diagnosis. The problem is that while the number of NETs is increasing, some of the diagnostic techniques now in use aren't particularly precise. This may result in an incorrect diagnosis and needless treatments. This is when NET cancer biomarkers come into play. Biomarkers provide a more accurate means of identifying and describing these tumours, which can aid medical professionals in verifying diagnoses, distinguishing NETs from other illnesses, and eventually enhancing patient outcomes. Better diagnoses are leading to a higher incidence of NETs, which is driving up demand for the discovery and application of accurate and targeted biomarkers in this expanding industry.

Growing Costs of Healthcare a Two-Pronged Sword Boosting Accessibility and Investment in the NETs Biomarker Market

The market for cancer biomarkers for neuroendocrine tumours has two opportunities due to the increase in healthcare spending globally. Budgets for healthcare may be allocated more for cancer diagnosis and treatment because of rising costs. This means that more money will be available for the study and creation of cutting-edge diagnostic instruments, such as biomarkers created especially for NETs. More funding may facilitate the identification and validation of novel biomarkers, resulting in a greater range of more precise and effective testing. Additionally, hospitals and other healthcare facilities could be more likely to use these new biomarker tests if they had a higher budget for cancer treatment, which would make them more accessible to patients. In summary, the market for NET biomarkers may be buoyed by growing healthcare costs, which will spur research and enhance the field's capacity for diagnosis.

Global Cancer biomarkers for neuroendocrine tumour Market Restraints and Challenges:

There are a few challenges facing the global market for cancer biomarkers for neuroendocrine tumours: first, current biomarkers aren't ideal for early detection, which is crucial for better patient outcomes; second, diagnostic tests, especially imaging techniques, can be expensive, restricting access to diagnosis; and third, complex reimbursement policies can discourage the adoption of new biomarker tests.

Global Cancer biomarkers for neuroendocrine tumour Market Opportunities:

There are encouraging prospects in the worldwide market for cancer biomarkers for neuroendocrine tumours. First off, more precise diagnosis may result from the creation of highly specific biomarkers that combine genetic or protein signals. Second, a less intrusive and possibly less expensive diagnostic approach is offered by the growing popularity of liquid biopsies, which examine biomarkers in blood. Thirdly, certain biomarkers can direct precision medicine strategies, customising care for each patient. Finally, the need for biomarker testing in this developing market may be fueled by rising awareness of NETs and the need for early identification as well as technological developments.

CANCER BIOMARKERS FOR NEUROENDOCRINE TUMOUR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.1% |

|

Segments Covered |

By Biomarker Type, Application, Technology, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Abbott Laboratories, bioMérieux, Eli Lilly and Company, Merck & Co., Novartis, Pfizer, Roche Diagnostics, Siemens Healthineers |

Global Cancer biomarkers for neuroendocrine tumour Market Segmentation: By Biomarker Type

-

Chromogranin A (CgA) and Neuron-specific Enolase (NSE)

-

Other Established Biomarkers

-

Emerging Biomarkers

Because blood-based biomarkers are simple to employ and less intrusive, they dominate the NETs biomarker industry. With liquid biopsies leading the way, this market is predicted to continue dominating and developing at the quickest rate. Although they are still useful, tissue-based biomarkers could increase more slowly because of their intrusive methods. Imaging biomarkers are useful for diagnosis, but their development may be constrained by expense and possible safety issues

Global Cancer biomarkers for neuroendocrine tumour Market Segmentation: By Application

-

Diagnosis

-

Prognosis and Treatment Selection

-

Treatment Monitoring

The types of biomarkers in the NETs biomarker market are changing. Due to their well-established applications, neuron-specific enolase (NSE) and chromogranin A (CgA) now dominate the market, but their lack of specificity is driving demand for more accurate solutions. Emerging biomarkers, the fastest-growing market, hold the key to the future. The development of these innovative, highly specific diagnostics might lead to earlier and more precise neuroendocrine tumour diagnosis.

Global Cancer biomarkers for neuroendocrine tumour Market Segmentation: By Technology

-

Blood-Based Biomarkers

-

Tissue-Based Biomarkers

-

Imaging Biomarkers

Because blood-based biomarkers are simple to employ and less intrusive, they dominate the NETs biomarker industry. With liquid biopsies leading the way, this market is predicted to continue dominating and developing at the quickest rate. Although they are still useful, tissue-based biomarkers could increase more slowly because of their intrusive methods. Imaging biomarkers are useful for diagnosis, but their development may be constrained by expense and possible safety issues.

Global Cancer biomarkers for neuroendocrine tumour Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The geography of the worldwide market for NET biomarkers varies. Because of its vast patient population and robust healthcare infrastructure, North America presently holds the top spot, but Asia-Pacific is quickly becoming the rising star in the field. This area is poised for rapid market expansion in the upcoming years due to rising disposable income, expanding awareness of NETs, and government spending on healthcare innovations. While South America the Middle East and Africa are developing, they face obstacles including inadequate infrastructure and reduced investment that might impede their early growth. In contrast, Europe is a mature market with a strong base.

COVID-19 Impact Analysis on the Global Cancer biomarkers for neuroendocrine tumour Market:

The COVID-19 pandemic has had a mixed effect on the market for NET biomarkers. Short-term shifts in priorities away from clinical trials and elective operations probably contributed to delays in biomarker testing and NET diagnosis. Furthermore, the funding of COVID-19 research may have impeded the creation of novel biomarkers. Pandemics, however, may also have long-term advantages. demand on healthcare systems may draw attention to the need for early cancer identification, raising awareness of NETs, and the critical role biomarkers play in early diagnosis. Additionally, the growth of telemedicine during COVID-19 may make it easier to conduct remote consultations on biomarker data and NETs. Lastly, placing a strong emphasis on reducing contact may hasten the creation of more trustworthy in-vitro diagnostic tools for NET biomarkers by utilising liquid biopsies' least invasive technique.

Recent Trends and Developments in the Global Cancer biomarkers for neuroendocrine tumour Market:

There is a notable surge in the worldwide market for cancer biomarkers that are unique to neuroendocrine tumours (NETs). The increasing emphasis on early detection, which calls for more accurate and sensitive biomarkers, is a major motivator. Liquid biopsies are becoming more and more popular as a less intrusive substitute for tissue biopsies in the analysis of blood biomarkers. Furthermore, the creation of biomarkers is being sped up by developments in proteomics, genomics, and artificial intelligence. This is in perfect harmony with the emergence of precision medicine, in which targeted treatment regimens may be guided by certain biomarkers to improve patient outcomes. The market for NET biomarkers seems promising, with growing investment spurred by the condition's increasing prevalence and the potential for major advancements in the diagnosis, treatment, and management of NETs.

Key Players:

-

Abbott Laboratories

-

bioMérieux

-

Eli Lilly and Company

-

Merck & Co.

-

Novartis

-

Pfizer

-

Roche Diagnostics

-

Siemens Healthineers

Chapter 1. Cancer biomarkers for neuroendocrine tumour Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cancer biomarkers for neuroendocrine tumour Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cancer biomarkers for neuroendocrine tumour Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cancer biomarkers for neuroendocrine tumour Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cancer biomarkers for neuroendocrine tumour Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cancer biomarkers for neuroendocrine tumour Market – By Biomarker Type

6.1 Introduction/Key Findings

6.2 Chromogranin A (CgA) and Neuron-specific Enolase (NSE)

6.3 Other Established Biomarkers

6.4 Emerging Biomarkers

6.5 Y-O-Y Growth trend Analysis By Biomarker Type

6.6 Absolute $ Opportunity Analysis By Biomarker Type, 2024-2030

Chapter 7. Cancer biomarkers for neuroendocrine tumour Market – By Application

7.1 Introduction/Key Findings

7.2 Diagnosis

7.3 Prognosis and Treatment Selection

7.4 Treatment Monitoring

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Cancer biomarkers for neuroendocrine tumour Market – By Technology

8.1 Introduction/Key Findings

8.2 Blood-Based Biomarkers

8.3 Tissue-Based Biomarkers

8.4 Imaging Biomarkers

8.5 Y-O-Y Growth trend Analysis By Technology

8.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 9. Cancer biomarkers for neuroendocrine tumour Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Biomarker Type

9.1.3 By Application

9.1.4 By By Technology

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Biomarker Type

9.2.3 By Application

9.2.4 By Technology

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Biomarker Type

9.3.3 By Application

9.3.4 By Technology

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Biomarker Type

9.4.3 By Application

9.4.4 By Technology

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Biomarker Type

9.5.3 By Application

9.5.4 By Technology

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Cancer biomarkers for neuroendocrine tumour Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Abbott Laboratories

10.2 bioMérieux

10.3 Eli Lilly and Company

10.4 Merck & Co.

10.5 Novartis

10.6 Pfizer

10.7 Roche Diagnostics

10.8 Siemens Healthineers

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Cancer biomarkers for neuroendocrine tumour Market size is valued at USD 1976 million in 2023.

The worldwide Global Cancer biomarkers for neuroendocrine tumour Market growth is estimated to be 8.1% from 2024 to 2030.

The Global Cancer biomarkers for the neuroendocrine tumour Market are segmented By Biomarker Type (Chromogranin A (CgA) and Neuron-specific Enolase (NSE), Other Established Biomarkers, Emerging Biomarkers); By Application (Diagnosis, Prognosis and Treatment Selection, Treatment Monitoring); By Technology (Blood-Based Biomarkers, Tissue-Based Biomarkers, Imaging Biomarkers) and by region.

It is anticipated that the development of highly specific and least invasive biomarkers, coupled with the rising acceptance of liquid biopsies and an increased emphasis on early diagnosis, will propel the worldwide market for cancer biomarkers for neuroendocrine tumours in the future.

Because the COVID-19 pandemic disrupted clinical trials and ordinary healthcare services, it may have had a short-term detrimental effect on the global market for cancer biomarkers for neuroendocrine tumours. Emphasising the need for early cancer diagnosis and expediting the development of new diagnostic techniques, may potentially have good long-term effects.