Camelina Sativa Market Size (2024-2030)

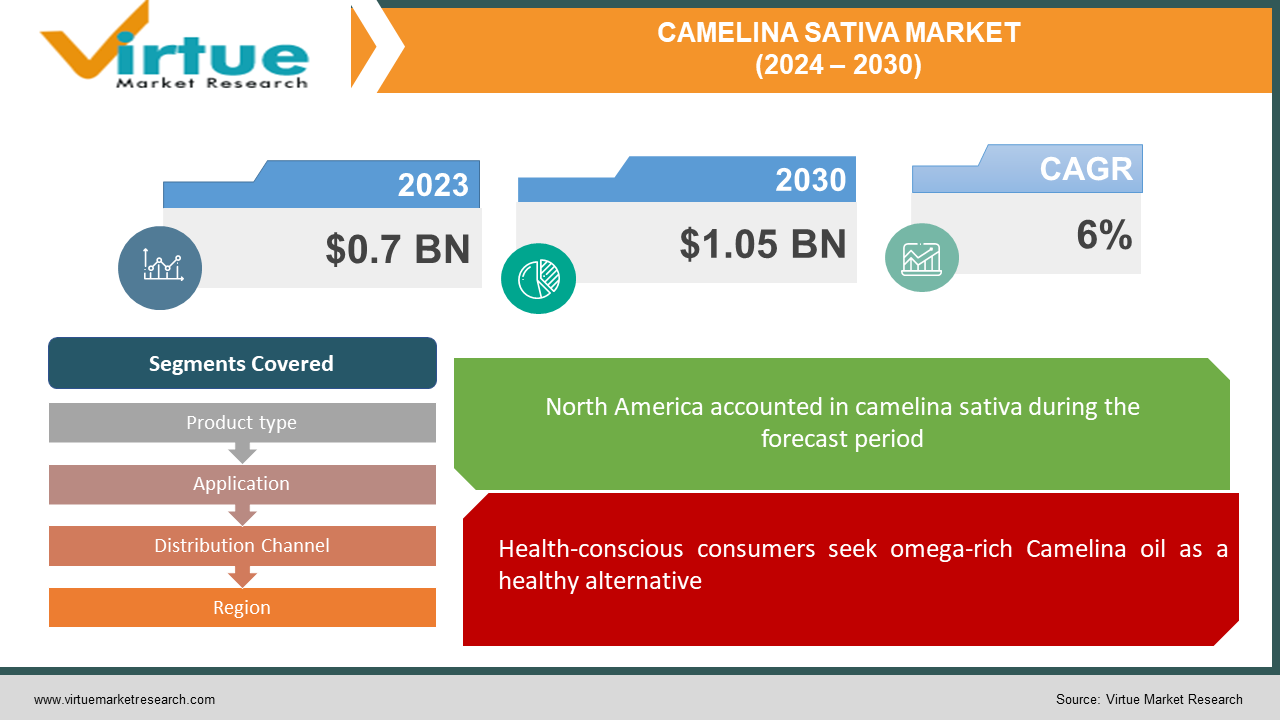

The Camelina Sativa Market was valued at USD 0.7 billion in 2023 and is projected to reach a market size of USD 1.05 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6%.

The Camelina sativa market is on the rise, driven by the increasing demand for its versatile crop. Camelina sativa, a flowering plant cultivated for its oilseeds, is gaining recognition for its sustainability. The plant thrives in a variety of climates with low water requirements and boasts a short growing season. The hero of this crop is Camelina oil, praised for its nutritional profile and finding uses in everything from salad dressings to biofuels. Even leftover plant parts are put to good use in animal feed and industrial products. While production isn't as widespread as other oilseeds and the market can experience price fluctuations, Camelina saliva’s potential for growth and diverse applications make it an exciting prospect in the agricultural and industrial worlds.

Key Market Insights:

The Camelina sativa market is flourishing, driven by its potential as a healthy and sustainable crop. Camelina oil, derived from the plant's seeds, is rich in omega-3 and omega-6 fatty acids, making it a compelling alternative for health-conscious consumers. This demand is particularly strong in the food and nutraceutical sectors. Beyond its nutritional benefits, Camelina sativa boasts impressive sustainability credentials.

Furthermore, Camelina sativa offers exceptional versatility. While Camelina oil is the hero, other parts of the plant find valuable uses as well. Leftover plant material is used in animal feed (reducing reliance on other grains) and even industrial products, minimizing waste, and maximizing the plant's economic potential.

The Camelina Sativa Market Drivers:

Health-conscious consumers seek omega-rich Camelina oil as a healthy alternative.

One of the primary drivers is the growing demand for healthy oils. Camelina oil stands out with its impressive content of omega-3 and omega-6 fatty acids, both essential for human health. This healthy profile positions it as a compelling alternative to traditional oils for health-conscious consumers. This trend is particularly strong within the food industry, where Camelina oil is finding its way into salad dressings and cooking oils, and in the nutraceutical sector, where it's used as an ingredient in dietary supplements.

Camelina sativa's low water requirements make it a sustainable champion.

Camelina sativa shines as a champion of sustainability. Unlike some water-intensive crops, Camelina sativa thrives with minimal water requirements. This characteristic makes it a highly attractive option in regions facing water scarcity. Furthermore, its short growing season allows for multiple harvests within a year. This rapid growth cycle translates to efficient land use and potentially higher yields compared to other oilseed crops.

Versatility extends Camelina Sativa's value beyond oil with uses in animal feed and potentially more.

The value proposition of Camelina sativa extends far beyond its oil. While Camelina oil is undoubtedly the star player, other parts of the plant find valuable uses as well. Leftover plant material after oil extraction doesn't go to waste. Instead, it's utilized in animal feed, providing a valuable protein source, and potentially reducing reliance on other grains for livestock nutrition. Additionally, research is ongoing to explore the use of these non-oil portions of the plant in industrial products and lubricants, further maximizing the economic potential of Camelina sativa.

The emerging Camelina sativa market shows promise but experiences price fluctuations due to limited production.

The Camelina sativa market is projected for steady growth, with estimates suggesting a Compound Annual Growth Rate (CAGR) of around 5.5% to 6%. This indicates a promising future for the crop. However, it's important to note that production is not yet as widespread as other established oil seeds. This limited production can lead to some price fluctuations as supply and demand for Camelina sativa products reach equilibrium.

The Camelina Sativa Market Restraints and Challenges:

While the Camelina sativa market offers exciting possibilities, there are hurdles to overcome before it reaches its full potential. One major challenge is limited market awareness. Compared to established oilseed crops, consumers are generally less familiar with Camelina sativa and its benefits. This lack of awareness can translate to lower demand for Camelina oil, and other products derived from the plant.

Another hurdle is the issue of high production costs. Cultivating, harvesting, and processing Camelina sativa can be more labor-intensive compared to some other crops. These higher production costs can ultimately affect the final price point for consumers, potentially hindering its affordability and widespread adoption.

Strict regulations also pose a challenge. As a relatively new crop for industrial applications, Camelina sativa may face more stringent regulations compared to established options. Obtaining the necessary approvals for its use in various applications, such as biofuels or food additives, can be a time-consuming and challenging process, delaying market entry for Camelina sativa products.

Finally, limited genetic diversity presents a challenge. Years of being a neglected crop have resulted in a lack of genetic variety within Camelina sativa. This limited diversity can restrict improvements in areas like crop yield, oil content, and resistance to pests and diseases. Further research and development efforts focused on improving the genetic diversity of Camelina sativa could be crucial for overcoming this limitation.

The Camelina Sativa Market Opportunities:

The Camelina sativa market, while facing challenges, presents a multitude of exciting opportunities. The growing focus on health and wellness creates a prime opportunity for Camelina oil. Its balanced omega-3 and omega-6 content positions it perfectly as a star ingredient in health-conscious food products and dietary supplements. Furthermore, Camelina oil's potential as a sustainable biofuel feedstock is another major opportunity. As environmental concerns rise and the demand for renewable energy sources increases, Camelina sativa offers a viable alternative to traditional biofuels, with its low water requirements and short growing season adding to its eco-friendly appeal. Beyond its oil, the non-oil portions of the plant hold untapped potential in industrial applications. Research is ongoing to explore possibilities like using leftover plant material for lubricants, bioplastics, or even construction materials. Unlocking these possibilities can significantly enhance the economic viability of Camelina sativa cultivation. Finally, collaboration between researchers, farmers, and industry players is crucial to unlocking the full potential of this crop. Developing new cultivars with higher yields, improved oil content, and better disease resistance can significantly improve the crop's economic viability. Additionally, research into streamlining processing methods and reducing production costs can make Camelina sativa products more competitive in the market. With continued exploration and investment, the Camelina sativa market has the potential to become a major player, offering a healthy, sustainable, and versatile solution across various sectors.

CAMELINA SATIVA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Product type, Application, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

BASF, Bayer, BioPlanète, Cargill, DuPont Pionee, Khosla Group, Linnea Corporation, Nuseed, Yield10 Bioscience |

Camelina Sativa Market Segmentation: By Product Type

-

Food Grade Oil

-

Industrial Grade Oil

By product type, the dominant segment in the Camelina sativa market is likely industrial-grade oil. This is due to the established applications in biofuels and lubricants, which currently have a larger market volume compared to food-grade oil consumption. However, the fastest-growing segment is expected to be food-grade oil. Rising health consciousness and demand for omega-3/omega-6-rich oils could drive significant growth in the food sector.

Camelina Sativa Market Segmentation: By Application

-

Food Industry

-

Nutraceutical Industry

-

Biofuel Industry

-

Animal Feed Industry

-

Industrial Products

By application, the food industry is likely the most dominant segment for Camelina sativa due to its established use in cooking oils and salad dressings. However, the non-food applications segment is expected to be the fastest-growing area, driven by the increasing demand for sustainable biofuels and nutraceuticals. Research into industrial applications like lubricants and bioplastics has the potential to further propel this segment's growth.

Camelina Sativa Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distribution Through Wholesalers and Retailers

-

Online Marketplaces

In the Camelina Sativa Market by Distribution Channel segmentation, the most dominant segment is likely 'Distribution Through Wholesalers and Retailers' catering to smaller-scale buyers. However, 'Online Marketplaces' are expected to be the fastest-growing segment due to the increasing popularity of e-commerce platforms for consumer purchases.

Camelina Sativa Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America is witnessing a surge in Camelina sativa production, fueled by government incentives and a growing focus on environmental sustainability. The market here is likely driven by applications in biofuels and the food industry, with the potential for Camelina oil used in cooking oils, salad dressings, or even as an ingredient in health-conscious food products.

Europe boasts well-established production facilities and a strong commitment to research and development. With a focus on sustainable agricultural practices, Europe is expected to witness continued growth in this sector. This established infrastructure and emphasis on sustainability position Europe as a key player in the global Camelina sativa market.

Asia-Pacific presents immense potential for future growth due to its large and rapidly growing population. The increasing demand for sustainable resources, coupled with government initiatives promoting biofuels, creates a favorable environment for Camelina sativa. The Asia-Pacific market is expected to be a significant driver of future growth in the Camelina sativa market, with potential applications across various sectors.

While still in its early stages, the Camelina sativa market in South America is starting to take root. Government support for sustainable farming practices and the growing interest in renewable energy sources like biofuels could fuel significant market expansion in this region. Further development of infrastructure and supportive government policies will play a crucial role in unlocking the potential of Camelina sativa in South America.

COVID-19 Impact Analysis on the Camelina Sativa Market:

The COVID-19 pandemic has left its mark on the Camelina sativa market, presenting both challenges and opportunities. On the negative side, global lockdowns disrupted supply chains for Camelina sativa seeds and products, leading to temporary shortages and price fluctuations in some regions. Additionally, a decline in demand from the food service industry, which might have used Camelina oil for cooking, could have dampened the market. Furthermore, government focus shifted towards managing the pandemic, potentially leading to delays or a slowdown in funding for research and development related to Camelina sativa.

However, there are also positive sides to the story. The pandemic heightened consumer awareness of health and immunity, potentially boosting the demand for Camelina oil. Its omega-3 and omega-6 content could position it favorably in dietary supplements and health-conscious food products. The pandemic has also spurred a renewed interest in sustainable practices and local food production. Camelina Sativa's low water requirements and potential as a sustainable crop could position it well in this evolving landscape. Finally, fluctuations in oil prices during the pandemic could lead to a renewed focus on alternative biofuels, potentially benefiting Camelina Sativa's promise as a sustainable biofuel feedstock.

Overall, the COVID-19 pandemic's long-term impact on the Camelina sativa market is still being felt. While initial disruptions were observed, the market's potential for growth in health, sustainability, and biofuels remains promising. The coming years will reveal how effectively the Camelina sativa market can adapt to the new landscape emerging after the pandemic.

Latest Trends/ Developments:

The Camelina sativa market is buzzing with exciting developments. Research is delving into new applications beyond oil, exploring the potential of leftover plant material for bioplastics, construction materials, and even lubricants. This diversification could significantly boost the economic viability of cultivating Camelina sativa. Sustainability remains a major focus as environmental concerns rise. Camelina Sativa's low water needs and short growing season make it an attractive option, and research is underway to develop even more eco-friendly cultivars. Breeding innovation is another key area, with efforts dedicated to creating Camelina sativa varieties with higher yields, improved oil content, and better disease resistance. These advancements can significantly improve the crop's economic viability and market competitiveness. Collaboration is on the rise, with researchers, farmers, and industry players working together. This collaborative approach can accelerate advancements in breeding, processing methods, and product development, ultimately benefiting the entire Camelina sativa market. The Camelina sativa market is a dynamic space with a promising future as a sustainable and versatile crop with applications across various sectors.

Key Players:

-

BASF

-

Bayer

-

BioPlanète

-

Cargill

-

DuPont Pioneer

-

Khosla Group

-

Linnea Corporation

-

Nuseed

-

Yield10 Bioscience

Chapter 1. Camelina Sativa Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Camelina Sativa Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Camelina Sativa Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Camelina Sativa Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Camelina Sativa Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Camelina Sativa Market – By Product Type

6.1 Introduction/Key Findings

6.2 Food Grade Oil

6.3 Industrial Grade Oil

6.4 Y-O-Y Growth trend Analysis By Product Type

6.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Camelina Sativa Market – By Application

7.1 Introduction/Key Findings

7.2 Food Industry

7.3 Nutraceutical Industry

7.4 Biofuel Industry

7.5 Animal Feed Industry

7.6 Industrial Products

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Camelina Sativa Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Direct Sales

8.3 Distribution Through Wholesalers and Retailers

8.4 Online Marketplaces

8.5 Y-O-Y Growth trend Analysis By Distribution Channel

8.6 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Camelina Sativa Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Application

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Application

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Application

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Application

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Application

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Camelina Sativa Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 BASF

10.2 Bayer

10.3 BioPlanète

10.4 Cargill

10.5 DuPont Pioneer

10.6 Khosla Group

10.7 Linnea Corporation

10.8 Nuseed

10.9 Yield10 Bioscience

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Camelina Sativa Market was valued at USD 0.7 billion in 2023 and is projected to reach a market size of USD 1.05 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 6%.

Health-Conscious Consumers and Omega-Rich Oil, Sustainability Credentials, Versatility across Applications, Emerging Market with Fluctuating Prices.

Food Industry, Nutraceutical Industry, Biofuel Industry, Animal Feed Industry, Industrial Products.

Europe is the most dominant region for the Camelina Sativa Market due to established production facilities, research efforts, and a focus on sustainable agriculture.

BASF, Bayer, BioPlanète, Cargill, DuPont Pioneer, Khosla Group, Linnea Corporation, Nuseed, Yield10 Bioscience.