Camel Milk Market Size (2024 – 2030)

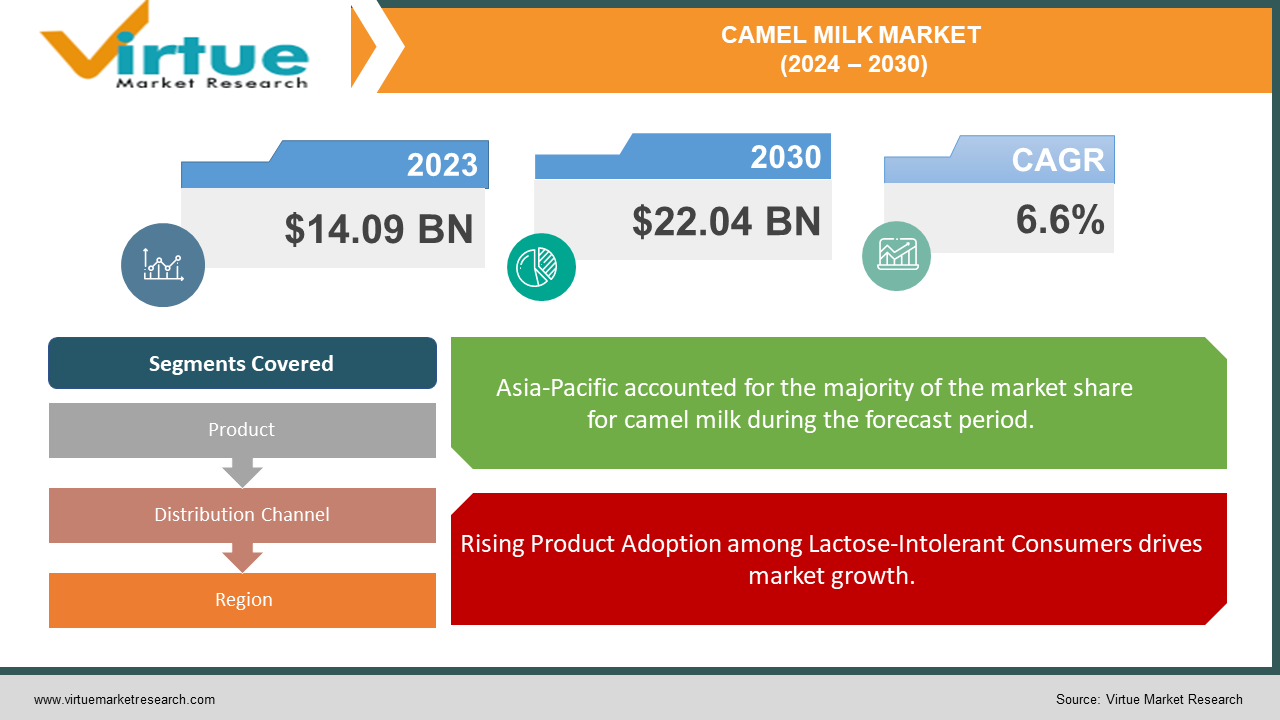

The Camel Milk Market was valued at USD 14.09 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 22.04 billion by 2030, growing at a CAGR of 6.6%.Camel milk and related dairy commodities are experiencing significant acclaim due to their diverse health advantages. These products are notably beneficial for enhancing lipid profiles and mitigating insulin resistance within individuals. Camel milk, in particular, boasts a substantial concentration of vitamin C and iron in contrast to conventional dairy options, while also exhibiting lower levels of cholesterol and fat.

In recent times, camel milk has garnered considerable attention as a sought-after delicacy worldwide. It boasts lower saturated fat levels and approximately ten times the amount of vitamin C, calcium, iron, and potassium found in cow's milk. These exceptional nutritional attributes, along with its low lactose content, drive consumer demand for camel milk. Renowned for its rich nutrient profile, camel milk stands out as one of the most wholesome dairy beverages, naturally enriched with probiotics. Moreover, camel milk contributes to bolstering systemic immunity and promoting gastrointestinal health. With a lipid content ranging between 2% and 3% less than that of cow's milk, it appeals particularly to health-conscious individuals mindful of their calorie intake. Notably, camel milk serves as the nearest alternative to breast milk for both infants and newborns.

Key Market Insights:

According to the U.S. Food and Drug Administration's report, camel milk typically contains about 3 percent fat. Nonetheless, it's noted that the fat content proportion varies across different regions. Furthermore, medical research suggests that camel milk has demonstrated favorable effects on improving the quality of life for autistic children. Additionally, manufacturers of camel dairy products are expanding their offerings by introducing a variety of flavors and expanding their product range throughout the forecast period.

Camel Milk Market Drivers:

Rising Product Adoption among Lactose-Intolerant Consumers drives market growth.

In recent years, there has been a growing consumer interest worldwide in camel milk and its derivatives, driven by the nutritional benefits associated with camel milk. A significant feature of camel milk is its absence of β-lactoglobulin, an allergenic component present in all forms of dairy milk. This characteristic renders camel milk an ideal choice for individuals with lactose intolerance seeking an animal-based milk alternative over plant-based or vegan options.

Increasing Product Demand in the Pharmaceutical Industry drives market growth.

In recent years, camel milk has experienced a surge in popularity worldwide due to its remarkable therapeutic attributes. Enzymes present in camel milk exhibit antibacterial and antiviral properties, contributing to disease resistance, while an insulin-like substance aids in reducing blood sugar levels among diabetic patients. Consequently, camel milk has found widespread acceptance in the global pharmaceutical sector.

Renowned for its therapeutic potential, camel milk is extensively utilized in formulating supplements within the pharmaceutical industry. Furthermore, its lack of β-lactoglobulin renders it an excellent component for developing antidiabetic, antihypertensive, and antimicrobial supplements. Notably, camel milk has demonstrated notable efficacy in enhancing long-term glycemic control in diabetic patients.

Numerous studies have highlighted camel milk's efficacy in treating conditions such as cancer, autism, and hepatitis. Additionally, it serves as an optimal alternative to cow milk, particularly for children with bovine milk allergies, ensuring safety and nutritional adequacy. These exceptional therapeutic properties inherent in camel milk and its derivatives continue to drive its application within the pharmaceutical industry.

Camel Milk Market Restraints and Challenges:

Expensive and Intensive Production hinders market growth.

The production process of camel milk is notably time-consuming and labor-intensive, contributing to a significant demand-supply gap and subsequently elevated product prices. Rigorous medical screenings are conducted on each camel to ensure the absence of infectious diseases, followed by training sessions in milking parlors. Maintaining a tranquil and relaxed environment for camels during milking is crucial for optimal milk production. However, these intricate procedures significantly escalate production costs, posing a substantial challenge for the camel milk market.

Moreover, camels exhibit a considerably lower milking capacity compared to cows, with an average daily yield of up to 7 liters per camel as opposed to cows, which can produce up to 50 liters daily. Unlike the conventional dairy industry practice of disposing of male calves, maintaining young camels alongside lactating ones is imperative for sustaining milk production. Consequently, the necessity of supporting both young and lactating camels incurs higher feeding expenses, further compounded by the modest milk output. These factors collectively impede the growth of the camel milk market.

Camel Milk Market Opportunities:

Leading companies in the dairy industry are making substantial investments in ventures centered around camel milk products, spurred by a notable uptick in demand both domestically and internationally. The participation of established companies in this sector serves to heighten consumer consciousness regarding camel milk products, consequently driving up demand for such commodities. With limited competition in the domestic market and only a handful of players operating globally, such as "Camelicious," the market for camel milk products presents promising growth prospects.

CAMEL MILK MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.6% |

|

Segments Covered |

By Product, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Camelicious, Aadvik Foods and Products Pvt. Ltd., Al Ain Dairy, Vital Camel Milk, Desert Farms, Lokhit Pashu Palak Sansthan (LPPS), Tiviski Dairy, Camilk Dairy, The Good Earth Dairy, Camel Dairy Farm Smits |

Camel Milk Market Segmentation: By Product

-

Plain Camel Milk

-

Flavored Camel Milk

-

Pasteurized Camel Milk

The plain milk segment holds a dominant position in the global market in 2023 and is projected to demonstrate a Compound Annual Growth Rate (CAGR) of 6.1% throughout the forecast period. A key driver of this growth is the escalating prevalence of lactose intolerance and milk allergies associated with alternative types of milk, propelling the demand for camel milk. Renowned for its rich nutritional profile comprising essential vitamins such as C and B, along with minerals like potassium, calcium, and iron, camel milk entices health-conscious consumers to transition towards this alternative. Furthermore, the widespread availability of plain camel milk, compared to other camel milk derivatives such as cheese, yogurt, and butter, is anticipated to further stimulate its demand.

Numerous studies have underscored camel milk as a viable option for individuals allergic to cow's milk due to its lack of beta-lactoglobulin, a primary trigger of milk allergies. Additionally, camel milk is recognized for its potential health benefits, including blood sugar reduction and enhanced insulin sensitivity, further bolstering its appeal among consumers seeking functional food options.

Camel Milk Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online Stores

-

Others

The offline segment commands the largest market share and is forecasted to grow at a CAGR of 6.5% throughout the projected period. This distribution channel encompasses hypermarkets/supermarkets, convenience stores, and other local retailers. Among these, supermarkets/hypermarkets account for the majority share within the offline channel, attributed to the availability of diverse products coupled with attractive discounts. The convenience and cost-effectiveness offered by supermarkets/hypermarkets incentivize consumers to prefer purchasing through offline channels. Collaborative efforts between brands and hypermarkets to optimize product display further enhance customer engagement and sales.

Cafes also play a significant role in offline distribution, particularly in Middle Eastern countries, where camel milk products enjoy popularity. These establishments serve as key touchpoints for consumers seeking camel milk products, contributing to the offline segment's robust market presence and growth.

Camel Milk Market Segmentation: By Packaging Type

-

Cartons

-

Bottles

-

Cans

-

Jars

-

Others

Bottles have emerged as the primary packaging solution dominating the market, serving as the preferred choice for packaging both camel milk and flavored camel milk beverages. Offering secure and tamper-evident packaging, bottles guarantee product integrity throughout storage and distribution. Typically crafted from food-grade materials such as plastic or glass, bottles are available in diverse sizes to accommodate varying consumer preferences and requirements.

Meanwhile, cartons are widely utilized for packaging camel milk and other dairy products, providing a lightweight, eco-friendly, and convenient storage and transportation option. Featuring resealable designs, cartons facilitate product freshness preservation and enable multiple uses, enhancing consumer convenience and product usability.

Camel Milk Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The Asia-Pacific region stands as the foremost global market shareholder in camel milk products and is projected to maintain a Compound Annual Growth Rate (CAGR) of 7.1% throughout the forecast period. Camel milk and its derivatives hold a traditional consumption legacy in numerous countries within the region, including India, China, and Australia. These nations boast expansive desert regions where herders and tribal communities have long incorporated camel milk into their diets. Recognizing its exceptional nutritional attributes and potential therapeutic benefits, prominent dairy entities in these countries actively promote camel milk products.

Meanwhile, North America is poised to experience robust growth with an estimated CAGR of 7.8% during the forecast period. Camel milk emerges as a burgeoning nutritional trend across the region, with consumers increasingly adopting camel milk and its derivatives. This surge in popularity is attributed to the remarkable nutritional profile of camel milk, which boasts qualities such as tenfold higher vitamin C and iron content compared to bovine milk, along with the absence of β-lactoglobulin.

COVID-19 Pandemic: Impact Analysis

The enduring consumer preference for products crafted from natural ingredients, particularly accentuated by the challenges posed by the COVID-19 pandemic, has ignited a notable surge in the global market. This upswing presents significant growth opportunities for the camel milk segment, particularly within the realm of functional foods and beverages. However, the industry's reliance on seasonal labor, a considerable portion of which consists of migrant workers, underscores a critical vulnerability. The onset of the COVID-19 pandemic has profoundly impacted these workers, potentially exposing them to heightened health risks. Challenges such as inadequate temporary housing arrangements and difficulties in adhering to social distancing guidelines may exacerbate health concerns within this workforce, necessitating proactive measures to safeguard their well-being.

Latest Trends/ Developments:

-

In March 2023, Camel Milk Co Australia introduced a novel product to the market: camel milk freeze-dried powder, packaged in a resealable stand-up pouch. This powder, crafted entirely from 100% camel milk, undergoes a unique freeze-drying process distinct from conventional hot spray drying methods. During this process, small quantities of pasteurized camel milk are frozen on trays and subjected to vacuum conditions. Under vacuum, the ice sublimates directly into vapor without transitioning back into liquid form, thereby preserving the taste, texture, and nutrients of the milk to a significant extent. Additionally, the powdered form offers the added advantage of an extended shelf life compared to fresh milk.

-

In December 2022, Amul expanded its camel dairy product portfolio by introducing camel milk ice cream and camel milk powder. Amul emphasizes that camel milk serves as the sole ingredient in its latest camel milk ice cream variant. This ice cream boasts a distinct camel milk flavor and is free from any artificial flavorings or colorings, aligning with Amul's commitment to offering wholesome and natural dairy products to consumers.

Key Players:

These are the top 10 players in the Camel Milk Market: -

-

Camelicious

-

Aadvik Foods and Products Pvt. Ltd.

-

Al Ain Dairy

-

Vital Camel Milk

-

Desert Farms

-

Lokhit Pashu Palak Sansthan (LPPS)

-

Tiviski Dairy

-

Camilk Dairy

-

The Good Earth Dairy

-

Camel Dairy Farm Smits

Chapter 1. Camel Milk Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Camel Milk Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Camel Milk Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Camel Milk Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Camel Milk Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Camel Milk Market – By Product

6.1 Introduction/Key Findings

6.2 Plain Camel Milk

6.3 Flavored Camel Milk

6.4 Pasteurized Camel Milk

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Camel Milk Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3 Convenience Stores

7.4 Specialty Stores

7.5 Online Stores

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Camel Milk Market – By Packaging Type

8.1 Introduction/Key Findings

8.2 Cartons

8.3 Bottles

8.4 Cans

8.5 Jars

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Packaging Type

8.8 Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 9. Camel Milk Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Distribution Channel

9.1.4 By Packaging Type

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Distribution Channel

9.2.4 By Packaging Type

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Distribution Channel

9.3.4 By Packaging Type

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Distribution Channel

9.4.4 By Packaging Type

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Distribution Channel

9.5.4 By Packaging Type

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Camel Milk Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Camelicious

10.2 Aadvik Foods and Products Pvt. Ltd.

10.3 Al Ain Dairy

10.4 Vital Camel Milk

10.5 Desert Farms

10.6 Lokhit Pashu Palak Sansthan (LPPS)

10.7 Tiviski Dairy

10.8 Camilk Dairy

10.9 The Good Earth Dairy

10.10 Camel Dairy Farm Smits

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In recent years, there has been a growing consumer interest worldwide in camel milk and its derivatives, driven by the nutritional benefits associated with camel milk.

The top players operating in the Camel Milk Market are - Camelicious, Aadvik Foods and Products Pvt. Ltd., Al Ain Dairy, Vital Camel Milk, Desert Farms, Lokhit Pashu Palak Sansthan (LPPS), Tiviski Dairy, Camilk Dairy, The Good Earth Dairy, Camel Dairy Farm Smits.

The enduring consumer preference for products crafted from natural ingredients, particularly accentuated by the challenges posed by the COVID-19 pandemic, has ignited a notable surge in the global market.

The participation of established companies in this sector serves to heighten consumer consciousness regarding camel milk products, consequently driving up demand for such commodities.

North America is poised to experience robust growth with an estimated CAGR of 7.8% during the forecast period.