Calcined Alumina Oxide Materials Market Size (2024 – 2030)

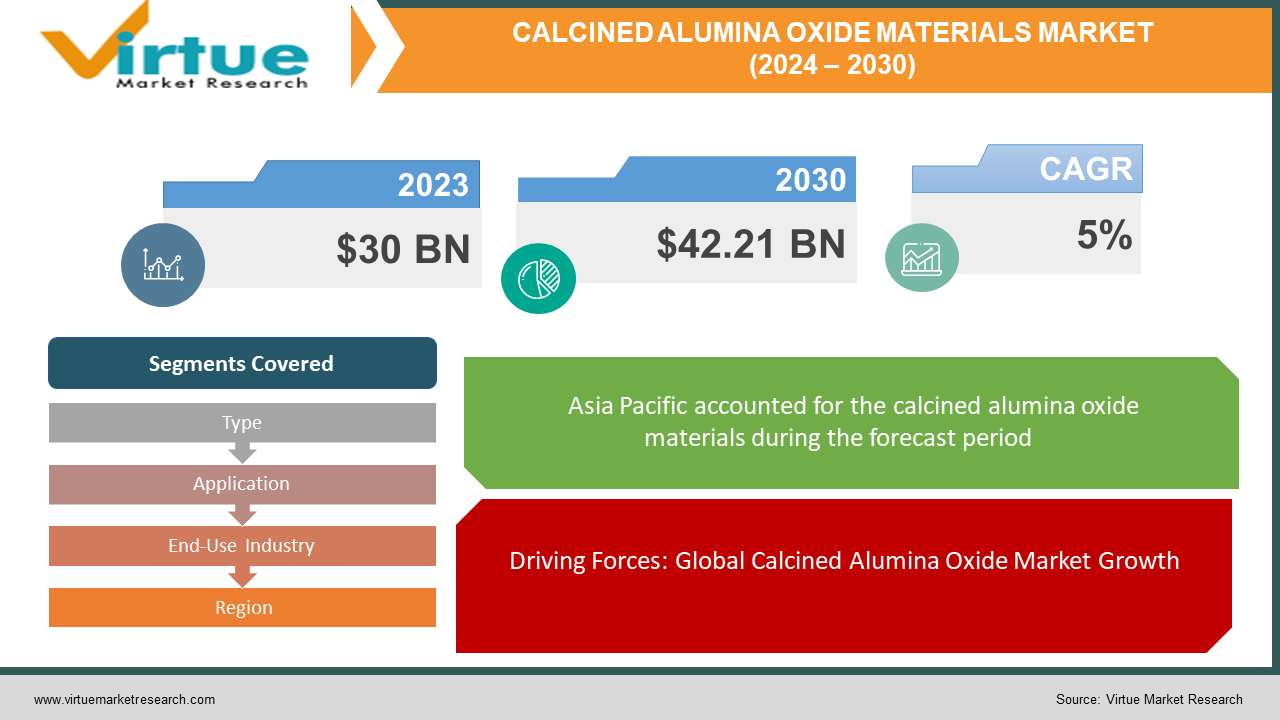

The global calcined alumina oxide materials market was valued at USD 30 billion in 2023 and is projected to reach a market size of USD 42.21 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 5%.

The global calcined alumina oxide materials market is measured by fixed progress driven by cumulative demand from numerous industries such as ceramics, electronics, and automotive. Calcined alumina oxide, recognized for its high transparency and thermal resistance, discoveries extensive custom in refractories, abrasives, and catalysts. The marketplace is detecting important growth owing to the escalating need for innovative materials in manufacturing processes. Besides, technological advancements and revolutions in production methods are further driving market growth. The market size is foreseeable to experience constant expansion, with key players joining on product development and planned associations to gain a competitive edge. Moreover, collective investments in research and development actions are anticipated to drive the market advance in the coming years.

Key Market Insights:

Key market insights into the worldwide calcined alumina oxide materials market reveal a robust trajectory categorized by numerous important trends and factors. The market is witnessing steady growth driven by increasing demand across immeasurable industries such as ceramics, electronics, and automotive. Calcined alumina oxide's high purity and thermal resistance make it crucial in applications ranging from refractories to abrasives and catalysts. Technological developments and innovations in production techniques are contributing to market enlargement, while planned associations and product development efforts by key players are enhancing competitiveness. Moreover, intensifying investments in research and development activities are anticipated to additional propel market growth. Geographically, emerging economies are becoming vital markets due to industrialization and infrastructural development, contributing lucrative opportunities for market players. In addition, sustainability apprehensions and supervisory initiatives are manipulating product innovation and market dynamics, with a growing prominence on eco-friendly manufacturing processes and materials. Overall, the global calcined alumina oxide materials market is poised for nonstop growth, driven by growing industry needs, technological advancements, and expanding application areas.

Global Calcined Alumina Oxide Materials Market Drivers:

Driving Forces: Global Calcined Alumina Oxide Market Growth:

Several key drivers are fueling the progress of the global calcined alumina oxide materials market. Initially, the increasing demand from industries such as ceramics, electronics, and automotive, where calcined alumina oxide is vital due to its high purity and thermal resistance properties, is an important driver. Next, technological advancements and innovations in production techniques are enhancing the competence and superiority of alumina oxide materials, further advancing market growth. Thirdly, the expansion of infrastructure and industrialization in evolving economies is producing new avenues for market expansion. Likewise, the budding emphasis on sustainability and eco-friendly manufacturing processes is driving the adoption of calcined alumina oxide materials, as they propose environmentally friendly substitutes in various applications. Also, regulatory initiatives and standards promoting the use of high-quality materials in manufacturing processes are inspiring market growth. Overall, these drivers are probable to continue propelling the growth of the global calcined alumina oxide materials market in the foreseeable future.

Technological Advancements and Production Innovations:

Technological advancements and innovations in production systems are instrumental in driving the development of the calcined alumina oxide materials market. Constant research and development efforts aim to improve the competence and quality of production processes, resulting in better product offerings and cost-effectiveness. Advanced manufacturing technologies, as well as calcination, sintering, and purification methods, are being employed to yield calcined alumina oxide with superior characteristics, meeting the evolving needs of end-users. These advancements not only enlarge the market's scope but also substitute competitiveness among manufacturers, driving supplementary innovation and market growth.

Strategic Partnerships and Product Development Initiatives:

Key players in the calcined alumina oxide materials market are increasingly focusing on strategic partnerships and product development initiatives to strengthen their market position and expand their product portfolios. Collaborations with research institutions, universities, and other industry stakeholders facilitate knowledge exchange and innovation, leading to the development of advanced materials and technologies. Moreover, companies invest in research and development activities to familiarize new product formulations, tailored to meet specific application requirements and address emergent market trends. By leveraging synergies and complementary capabilities through strategic alliances, market players can enhance their competitiveness and capitalize on budding market occasions.

Sustainability Concerns and Regulatory Initiatives:

Sustainability concerns and regulatory initiatives are increasingly shaping the dynamics of the calcined alumina oxide materials market. With growing prominence on environmental sustainability and resource conservation, there is an increasing mandate for eco-friendly manufacturing processes and materials. Producers are investing in sustainable practices, including energy-efficient production methods, waste reduction, and recycling initiatives, to diminish their environmental footprint and meet regulatory requirements. Furthermore, regulatory frameworks and standards governing the custom of materials in various trades impact product innovation and market dynamics, driving the adoption of environmentally friendly alternatives and shaping market trends.

Global Calcined Alumina Oxide Materials Market Restraints and Challenges:

The global calcined alumina oxide materials market faces numerous restraints and challenges that could impede its development trajectory. One noteworthy challenge is the volatility of raw material prices, which in a straight line disturbs production costs and profit margins for manufacturers. Also, stringent regulatory standards regarding emissions and environmental impact pose compliance challenges, particularly for smaller players in the market. Moreover, the market is susceptible to economic fluctuations and geopolitical tensions, which can disrupt supply chains and demand designs. Technological constraints and limitations in production procedures may also delay market growth, especially in terms of accomplishing higher purity stages and meeting specific customer requirements. Furthermore, competition from alternative materials and substitutes presents a continuous threat, imposing continuous innovation and differentiation strategies. Overall, directing these restraints and challenges involves strategic preparation, investment in research and development, and flexibility to change market dynamics for continued growth in the calcined alumina oxide materials market.

Global Calcined Alumina Oxide Materials Market Opportunities:

The global calcined alumina oxide materials market presents several capable opportunities for growth and expansion. Initially, the increasing demand for high-purity materials across industries such as electronics, ceramics, and automotive creates a significant market opportunity. Manufacturers can capitalize on this demand by investing in advanced production technologies to develop product quality and meet stringent industry standards. Then, the intensifying emphasis on sustainability and eco-friendly manufacturing procedures opens doors for modernization in the production of calcined alumina oxide materials, driving the development of greener alternatives and fostering a competitive edge. Moreover, the extension of infrastructure and construction actions in emerging economies grants a lucrative market opportunity for calcined alumina oxide materials, particularly in applications requiring high durability and thermal resistance. Additionally, strategic partnerships and collaborations with end-user industries can ease market penetration and product divergence, permitting companies to influence emerging trends and consumer preferences for sustainable growth in the global calcined alumina oxide materials market.

CALCINED ALUMINA OXIDE MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5% |

|

Segments Covered |

By Type, Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Almatis GmbH, Alteo Holding, Nabaltec AG, Sumitomo Chemical Co., Ltd., Hindalco Industries Limited, CHALCO Shandong Co., Ltd., AluChem, Inc., Yichuan Shengyu Abrasives Co., Ltd., Zhengzhou Sinocean Industrial Limited, RHI Magnesita GmbH |

Calcined Alumina Oxide Materials Market Segmentation: By Type

-

Tabular Alumina

-

Sintered Alumina

-

Reactive Alumina

-

Fused Alumina

-

Others

In the market segment categorized by type, fused alumina arises as the largest due to its multifaceted utility and widespread application across many industrial sectors. Alongside, reactive alumina stands out as the fastest-growing type, spurred by its expanding role in cutting-edge ceramics and catalyst technologies, underscoring its intensifying significance in modern industrial processes.

Calcined Alumina Oxide Materials Market Segmentation: By Application

-

Refractories

-

Ceramics

-

Abrasives

-

Catalysts

-

Polishing

-

Others

Within the application segment, refractories lead as the largest category, owing to their indispensable role in high-temperature applications predominant across industries like steel, cement, and glass manufacturing. In the meantime, catalysts emerge as the fastest-growing application category, driven by rising environmental guidelines and the burgeoning demand for maintainable solutions in the chemical and petrochemical sectors.

Calcined Alumina Oxide Materials Market Segmentation: By End-Use Industry

-

-

Automotive

-

Electronics

-

Construction

-

Aerospace

-

Pharmaceutical

-

Others

-

Examining end-use industries, automotive appears as the largest segment due to the extensive integration of alumina oxide materials in critical components such as spark plugs, brake pads, and engine parts. Contrariwise, the aerospace sector garners care as the fastest-growing segment, buoyed by the escalating demand for lightweight materials and advanced aerospace coatings, spurred by technological advancements and the soaring global air travel demand.

Calcined Alumina Oxide Materials Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region emerges as the largest market due to its prosperous industrial sectors, particularly in countries like China and India, which exhibit robust demand for calcined alumina oxide materials across various applications and end-use industries. Latin America is experiencing rapid growth in the calcined alumina oxide materials market, driven by increasing industrialization, infrastructural development, and the intensifying mandate from sectors such as construction, automotive, and electronics. This development is further fueled by favorable government policies, rising investments in manufacturing sectors, and expanding export opportunities, positioning Latin America as the fastest-growing region in the worldwide calcined alumina oxide materials market.

COVID-19 Impact Analysis on the Global Calcined Alumina Oxide Materials Market:

The COVID-19 pandemic has profoundly affected the global calcined alumina oxide materials market, disrupting supply chains and demand dynamics. Lockdown procedures and travel limitations led to production halts and labor shortages, affecting material availability. Reduced consumer spending and halted construction projects further diminished demand from key industries like automotive, construction, and electronics. However, amidst challenges, opportunities arose as increased hygiene awareness drove demand for disinfectants and medical equipment, sustaining demand for alumina oxide materials. As vaccination efforts progress and economic activities gradually resume, the market is poised for recovery. Yet, reservations regarding new virus variants and geopolitical tensions persist, necessitating adaptability and strategic planning for stakeholders to navigate the evolving landscape effectively.

Latest Trends/ Developments:

The latest trends and developments in the global calcined alumina oxide materials market include progressions in production technologies expected to enhance effectiveness and product quality. Also, there is a growing emphasis on sustainable manufacturing practices, driving innovation in eco-friendly production methods and materials. The market is witnessing increasing adoption of alumina oxide materials in emerging applications such as battery technology for electric vehicles and renewable energy storage, spurred by the global shift towards clean energy sources. Moreover, strategic collaborations and partnerships among key players are enabling technological exchange and market development efforts. Furthermore, customization and product distinction policies are ahead of prominence as companies seek to meet detailed customer necessities and gain a competitive edge in the market. Overall, these trends reflect the dynamic nature of the calcined alumina oxide materials market, characterized by innovation, sustainability, and strategic alliances aimed at meeting evolving industry demands and driving future growth.

Key Players:

-

Almatis GmbH

-

Alteo Holding

-

Nabaltec AG

-

Sumitomo Chemical Co., Ltd.

-

Hindalco Industries Limited

-

CHALCO Shandong Co., Ltd.

-

AluChem, Inc.

-

Yichuan Shengyu Abrasives Co., Ltd.

-

Zhengzhou Sinocean Industrial Limited

-

RHI Magnesita GmbH

Chapter 1. Calcined Alumina Oxide Materials Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Calcined Alumina Oxide Materials Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Calcined Alumina Oxide Materials Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Calcined Alumina Oxide Materials Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Calcined Alumina Oxide Materials Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Calcined Alumina Oxide Materials Market – By Type

6.1 Introduction/Key Findings

6.2 Tabular Alumina

6.3 Sintered Alumina

6.4 Reactive Alumina

6.5 Fused Alumina

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Calcined Alumina Oxide Materials Market – By Application

7.1 Introduction/Key Findings

7.2 Refractories

7.3 Ceramics

7.4 Abrasives

7.5 Catalysts

7.6 Polishing

7.7 Others

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Calcined Alumina Oxide Materials Market – By End-User

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Electronics

8.4 Construction

8.5 Aerospace

8.6 Pharmaceutical

8.7 Others

8.8 Y-O-Y Growth trend Analysis By End-User

8.9 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Calcined Alumina Oxide Materials Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Type

9.1.3 By Application

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Type

9.2.3 By Application

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Type

9.3.3 By Application

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Type

9.4.3 By Application

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Type

9.5.3 By Application

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Calcined Alumina Oxide Materials Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Almatis GmbH

10.2 Alteo Holding

10.3 Nabaltec AG

10.4 Sumitomo Chemical Co., Ltd.

10.5 Hindalco Industries Limited

10.6 CHALCO Shandong Co., Ltd.

10.7 AluChem, Inc.

10.8 Yichuan Shengyu Abrasives Co., Ltd.

10.9 Zhengzhou Sinocean Industrial Limited

10.10 RHI Magnesita GmbH

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Key factors driving growth include increasing demand across industries, technological advancements, expanding applications, infrastructure development, and emphasis on sustainability.

Main concerns include raw material price volatility, regulatory compliance, economic fluctuations, technological limitations, competition from substitutes, and supply chain disruptions.

Key players include Almatis GmbH, Alteo Holding, Nabaltec AG, Sumitomo Chemical Co., Ltd., Hindalco Industries Limited, and others.

Asia Pacific holds the largest share in the global calcined alumina oxide materials market due to its thriving industrial sectors.

Latin America is expanding at the highest rate in the global calcined alumina oxide materials market, driven by industrialization, infrastructure development, and increasing demand.