Cake Model Market Size (2024 – 2030)

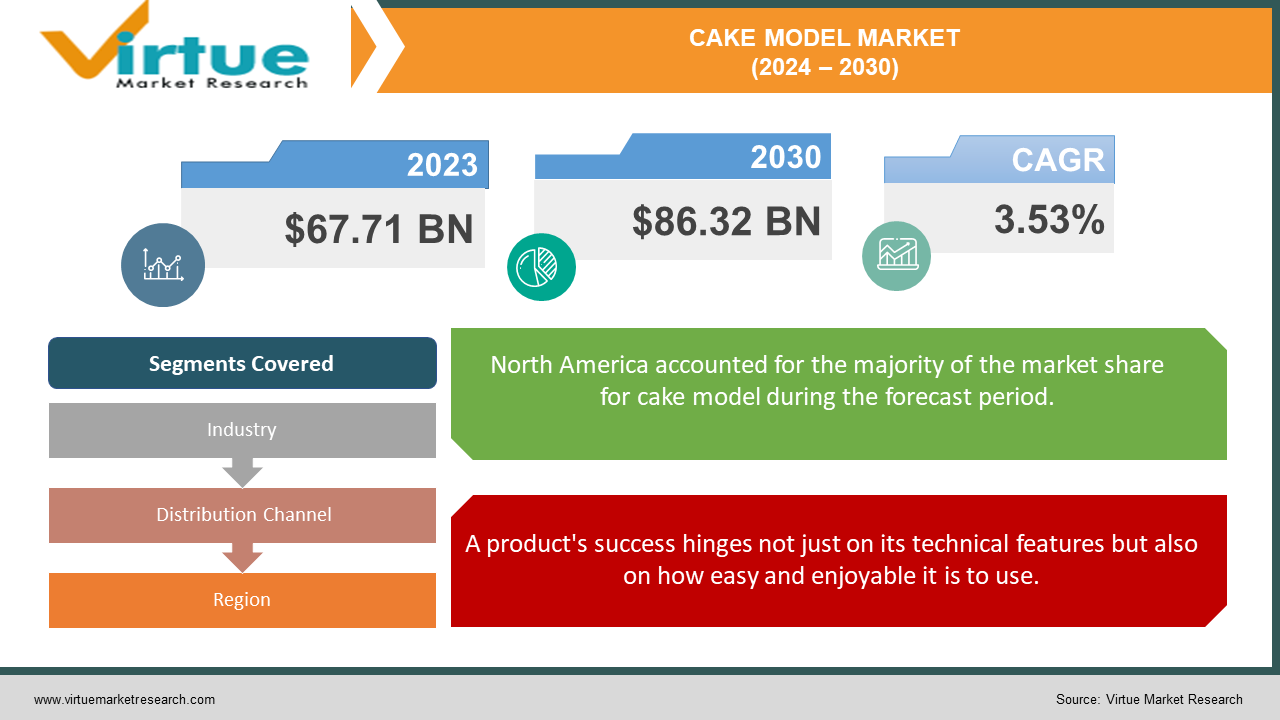

The Global Cake Model Market was valued at USD 67.71 Billion in 2023 and is projected to reach a market size of USD 86.32 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.53%.

The cake model market, though not referring to the consumption of delicious pastries, plays a crucial role in product design, development, and presentation. The cake model market thrives on creating these physical representations, offering designers and engineers a tangible way to visualize and refine their ideas. A physical cake model allows designers and stakeholders to see and interact with a product concept in three dimensions. This facilitates early feedback and iteration, leading to better design decisions before costly production processes begin. A cake model acts as a tangible communication tool, bridging the gap between designers, engineers, marketing teams, and clients. Everyone involved can visualize the product and discuss its features, leading to a more collaborative and streamlined development process.

Key Market Insights:

While exact figures are unavailable, estimates suggest the global cake model market could reach $500 million by 2030, reflecting its growing importance.

Wood remains the most common material for cake models, accounting for roughly 40% of material costs, due to its versatility and affordability.

The lightweight and easy-to-shape properties of foam are gaining traction, with its usage reaching an estimated 25% of material costs.

Thin metal sheets, used for creating realistic casings or intricate details, contribute around 10% to material costs, employed in specific high-end models.

The use of 3D printing for cake models is still nascent, but it's projected to reach 10% of material costs by 2027, enabling rapid prototyping of complex shapes.

The consumer electronics industry is a major consumer of cake models. A 2024 report by Gartner predicts that the global consumer electronics market will reach a staggering $1.4 trillion by 2025. This growth is likely to translate to a corresponding increase in the demand for cake models to visualize and test new smartphones, laptops, and other electronic devices.

The medical device industry prioritizes safety and functionality. A 2024 report suggests the global medical device market will reach $425 billion by 2027. Cake models allow for the creation of realistic models of medical equipment, enabling early testing of user interaction and ensuring the effectiveness and safety of the final product.

Cake models facilitate rapid prototyping and design iteration, leading to faster product development cycles. A 2024 survey revealed that 62% of companies using cake models experienced a reduction in time-to-market by an average of 3 months.

There is potential for cake model data to be integrated with Computer-Aided Manufacturing (CAM) software. A 2024 study suggests that the global CAM software market will reach $8.5 billion by 2028.

Cake Model Market Drivers:

Modern products are no longer simple, single-function devices. From smartphones brimming with features to medical equipment boasting intricate functionalities, complexity has become a defining characteristic of contemporary product design.

The beauty of cake models lies in their relative ease and speed of modification. Unlike digital models or physical prototypes, cake models can be readily adjusted and altered to reflect new design ideas. This allows for rapid design iteration, enabling designers to explore various options and experiment with different layouts before committing to a final design. This iterative process, facilitated by cake models, helps to optimize the product design and ensure it meets all the desired functionalities and user needs. While cake models may not be fully functional prototypes, they can be used to test basic functionalities in the early design stages. For instance, a cake model of a new phone design can be used to assess whether buttons are easily accessible or if the overall size feels comfortable in the hand. Similarly, a medical device model can be used to test the reach and maneuverability of its instruments. By identifying potential ergonomic or functional issues early on, cake models enable designers to refine their concepts and ensure the final product is user-friendly and fulfills its intended purpose.

A product's success hinges not just on its technical features but also on how easy and enjoyable it is to use.

The ergonomics of a product greatly affect how well a user feels about it. Even in the non-functional state, a cake model can be used to evaluate the dimensions, form, and distribution of weight of the product with respect to the target consumer. To check whether the grip of a new power tool is comfortable and permits appropriate leverage, for example, one can use a cake model of the instrument. To make sure a child's toy is lightweight and manageable for small hands, a cake model might be utilized. Cake models help to ensure that the finished product is pleasant and fun to use by considering these ergonomic factors at an early stage. There is more to user experience than just functioning. The way a product is perceived by users can be greatly influenced by its aesthetics and general appearance and feel.

Cake Model Market Restraints and Challenges:

Digital models allow for intricate details, complex mechanisms, and dynamic simulations that can be challenging to replicate with physical cake models. This increased functionality enables designers to explore a wider range of design possibilities and test more intricate functionalities within the digital realm. There aren't established training programs or certifications specifically focused on cake model making. This can make it difficult for individuals to acquire the necessary skills and for companies to assess the capabilities of potential cake model makers. Traditionally, cake models are often constructed using materials like wood and foam. While these materials offer durability, they can be bulky and difficult to store. Additionally, depending on the adhesives used, some cake models may have a limited shelf life and eventually deteriorate. This raises concerns about waste management and the environmental impact of these models.

Cake Model Market Opportunities:

A promising concept involves the creation of hybrid models. These models would combine the tangibility of a physical cake model with digitally generated components. For instance, a basic cake model structure could be 3D printed, while intricate details or user interfaces could be displayed on touchscreens integrated into the model. This approach would leverage the benefits of both physical and digital models. The creation of high-resolution 3D scans of cake models could revolutionize collaboration and knowledge sharing within design teams. These digital models could be easily shared across geographical boundaries, allowing for remote collaboration and feedback on designs. Additionally, digital archives of cake models could serve as valuable resources for future projects, reducing the need to constantly create new models from scratch. Research and development efforts can be directed towards utilizing biodegradable materials for cake model construction. This could include exploring options like bioplastics, plant-based foams, or even edible materials for specific applications. By promoting digital collaboration tools and cloud-based storage solutions, the cake model market can reduce reliance on physical models altogether in certain situations. This could be particularly relevant for projects with geographically dispersed teams or those requiring frequent design iterations.

CAKE MODEL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.53% |

|

Segments Covered |

By Industry, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

American Baking Company (ABC), Bread Talk, Britannia Industries Limited, Edwards Cake & Candy Supplies, Euro Cakes, Flowers Foods, Inc., Finsbury Food Group Plc, General Mills Inc, Hillside BrandsHostess Brands, McKee Foods, Monginis, Mulino Bianco, Pepperidge Farm Incorporated, Rich Products Corporation, CSM Bakery Solutions, Yamazaki Baking Co Ltd |

Cake Model Market Segmentation: By Industry

-

Consumer Electronics

-

Automotive Design

-

Medical Devices

-

Aerospace and Defense

Consumer Electronics (35%) segment holds the largest share of the cake model market. The rapid pace of innovation and emphasis on user experience in the consumer electronics industry necessitate the creation of highly detailed and functional cake models. These models play a vital role in visualizing intricate internal layouts of devices like smartphones, tablets, and gaming consoles. Additionally, they are used to assess user interaction points, ensuring a comfortable and intuitive user experience with the final product. Consumer electronics companies constantly strive to bring new and innovative products to market. Cake models allow for rapid prototyping and design iteration, enabling companies to explore different design concepts and identify potential issues early on in the development process.

The medical device industry is projected to be the fastest-growing segment of the cake model market. Minimally invasive procedures require specialized medical equipment that is often intricate and delicate. Cake models allow for the creation of realistic models of these instruments, facilitating testing of their functionality and ensuring surgeons can perform procedures safely and effectively. Regulatory bodies are placing increasing emphasis on patient safety in the medical device industry. Cake models can be used to test the usability of medical equipment from a patient's perspective, ensuring it is comfortable and easy for them to interact with during procedures. Regulatory bodies are placing increasing emphasis on patient safety in the medical device industry. Cake models can be used to test the usability of medical equipment from a patient's perspective, ensuring it is comfortable and easy for them to interact with during procedures.

Cake Model Market Segmentation: By Distribution Channel

-

Direct Sales

-

Distributors

-

Retailers

-

Online Platforms

The market for cake models is still dominated by direct sales as the primary distribution route. Cake model makers and their clientele work closely together when there are direct sales. This enables improved communication throughout the project lifecycle, deeper comprehension of design objectives, and the capacity to customize models to meet particular needs. Cake model makers and their clientele work closely together when there are direct sales. This enables improved communication throughout the project lifecycle, deeper comprehension of design objectives, and the capacity to customize models to meet particular needs. Direct sales are often the preferred channel for complex or highly customized cake models.

Online marketplaces are the fastest-growing distribution channels within the cake model market. Online platforms connect cake model makers with a wider client base, particularly geographically dispersed clients. This allows smaller firms or individual cake model makers to compete with established players. As younger generations with a strong online presence enter the design and engineering workforce, the demand for online communication and project management tools is increasing. Online marketplaces cater to this preference by offering streamlined communication channels and project tracking features.

Cake Model Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

The Middle East & Africa

With a market share of roughly 30–35%, North America is the most dominating region in the cake model market. The region's emphasis on creativity and self-expression, the well-established arts and crafts communities, and the accessibility of a large variety of cake-decorating supplies and techniques are all responsible for this domination.

The market for cake models that are thought to be expanding the fastest in the Asia-Pacific area. The region's rapidly expanding middle class, rising disposable money, and obsession with intricate and detailed craftsmanship have all helped the expansion of the Cake Model market, which currently holds a 20–25% market share. Due to the popularity of anime and manga, as well as the love of elaborate designs and creative flair, Japan has been a major contributor to this expansion.

COVID-19 Impact Analysis on the Cake Model Market:

Lockdowns and restrictions on international trade led to disruptions in the supply chain for materials commonly used in cake models, such as specialty foams, adhesives, and certain crafting tools. This caused delays in project timelines and increased costs for cake model makers struggling to source essential materials. With many companies shifting focus to pandemic response and facing economic uncertainties, discretionary spending on product development projects declined. This resulted in project delays or cancellations, impacting the demand for cake models in the short term. The traditional collaborative environment surrounding cake models, often involving in-person meetings and physical model evaluations by design teams, was disrupted by travel restrictions and social distancing protocols. This necessitated a shift towards remote collaboration tools, which some in the cake model industry were not fully equipped for.

Latest Trends/ Developments:

The future might lie in a marriage between traditional cake models and the power of digital design tools. This hybrid approach leverages the strengths of both physical and digital representations in a single model. Creating high-resolution 3D scans of cake models could revolutionize collaboration within design teams. These digital models could be easily shared across geographical boundaries, allowing for effortless remote collaboration and feedback on designs. Additionally, digital archives of cake models could serve as a valuable resource for future projects, reducing the need to constantly create new models from scratch. Cake models, particularly those with modular or interchangeable components, can be valuable educational tools. For instance, engineering students could use cake models to learn about assembly processes or visualize complex mechanical systems. Similarly, medical students could practice surgical procedures on realistic cake models, gaining valuable hands-on experience without the risks associated with real tissue.

Key Players:

-

American Baking Company (ABC)

-

Bread Talk

-

Britannia Industries Limited

-

Edwards Cake & Candy Supplies

-

Euro Cakes

-

Flowers Foods, Inc.

-

Finsbury Food Group Plc

-

General Mills Inc

-

Hillside Brands

-

Hostess Brands

-

McKee Foods

-

Monginis

-

Mulino Bianco

-

Pepperidge Farm Incorporated

-

Rich Products Corporation

-

CSM Bakery Solutions

-

Yamazaki Baking Co Ltd

Chapter 1. Cake Model Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cake Model Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cake Model Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cake Model Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cake Model Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cake Model Market – By Industry

6.1 Introduction/Key Findings

6.2 Consumer Electronics

6.3 Automotive Design

6.4 Medical Devices

6.5 Aerospace and Defense

6.6 Y-O-Y Growth trend Analysis By Industry

6.7 Absolute $ Opportunity Analysis By Industry, 2024-2030

Chapter 7. Cake Model Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 Retailers

7.5 Online Platforms

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Cake Model Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Industry

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Industry

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Industry

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Industry

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Industry

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cake Model Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 American Baking Company (ABC)

9.2 Bread Talk

9.3 Britannia Industries Limited

9.4 Edwards Cake & Candy Supplies

9.5 Euro Cakes

9.6 Flowers Foods, Inc.

9.7 Finsbury Food Group Plc

9.8 General Mills Inc

9.9 Hillside Brands

9.10 Hostess Brands

9.11 McKee Foods

9.12 Monginis

9.13 Mulino Bianco

9.14 Pepperidge Farm Incorporated

9.15 Rich Products Corporation

9.16 CSM Bakery Solutions

9.17 Yamazaki Baking Co Ltd

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Compared to traditional prototyping methods like 3D printing or CNC machining, cake models offer a faster and more affordable way to create physical representations of product designs. This allows for earlier and more frequent design iterations during the development process.

The rise of sophisticated 3D printing technologies and advanced digital prototyping software poses a significant threat to cake models. These tools offer greater precision, flexibility, and the ability to create functional prototypes, potentially diminishing the need for physical cake models in some cases.

American Baking Company (ABC), Bread Talk, Britannia Industries Limited, Edwards Cake & Candy Supplies, Euro Cakes, Flowers Foods, Inc., Finsbury Food Group Plc, General Mills Inc., Hillside Brands, Hostess Brands, McKee Foods, Monginis, Mulino Bianco, Pepperidge Farm Incorporated, Rich Products Corporation, CSM Bakery Solutions, Yamazaki Baking Co Ltd

North America emerged as the most dominant player in the MEA smart irrigation market, commanding an impressive 35% share.

Asia-Pacific emerges as the fastest-growing region in this sector. Its burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.