Caesar Market Size (2024-2030)

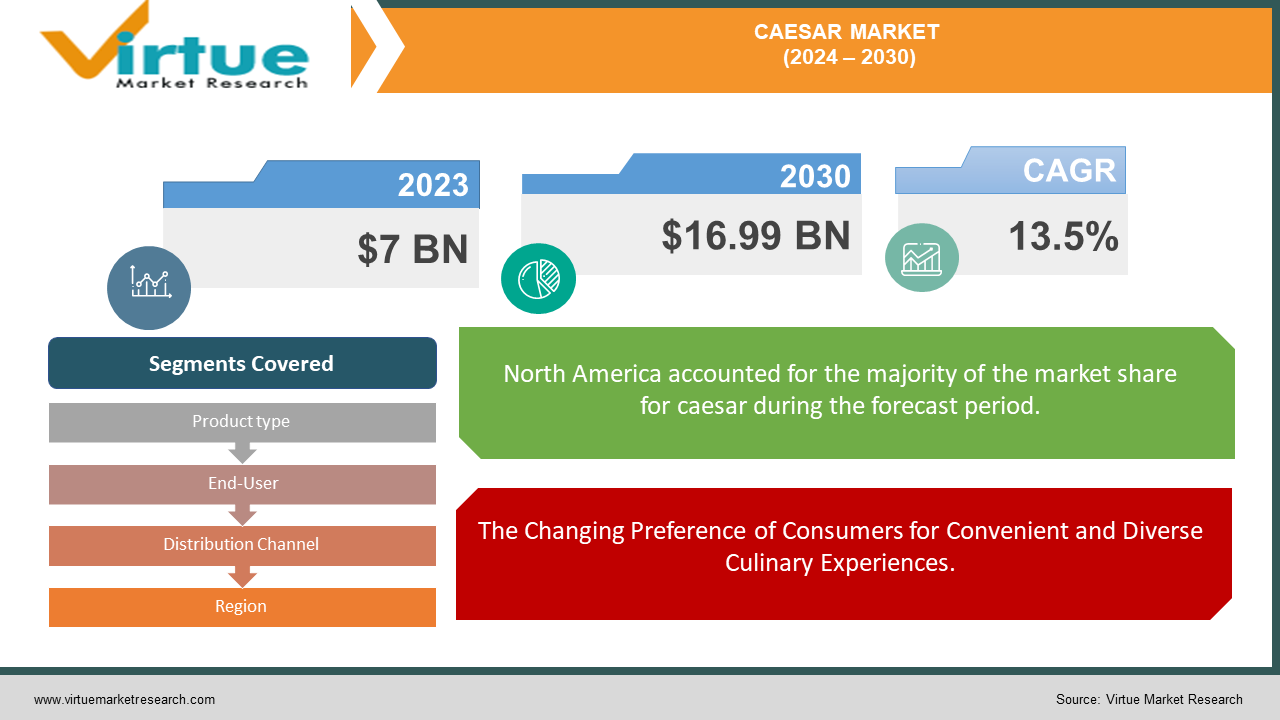

The Global Caesar Market was valued at USD 7 billion in 2023 and is projected to reach a market size of USD 16.99 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 13.5%.

Caesar Market is a multipurpose facility that provides a wide variety of goods and services. It has a supermarket filled with necessities, a restaurant selling authentic Middle Eastern food called Halal, and a Mediterranean restaurant that serves tasty food. The market also has a wholesale bakery, which guarantees that fresh bread and pastries are always available. Caesar Market serves a broad audience and is an all-in-one facility for a variety of needs thanks to its extensive offers and handy location.

Key Market Insights:

Caesar Market can look for ways to boost its food service income given the rising popularity of takeaway and delivery. Sales could increase by 15% to 20% if you allow online ordering, collaborate with delivery services, and add popular delivery products to your menu.

Caesar Market's multifaceted business approach enables it to draw in many clients, including individuals, families, and companies. By reducing the risks associated with relying just on one good or service, this diversification may result in a more steady source of revenue.

There has been a 10% annual increase in the introduction of new Caesar dressing formulations, including organic, low-fat, and dairy-free options, aligning with the rising consumer demand for healthier and sustainable food products.

Caesar Market Drivers:

The Changing Preference of Consumers for Convenient and Diverse Culinary Experiences.

Contemporary consumers desire a diverse range of food options that satisfy their different nutritional needs, tastes, and lifestyle preferences. Caesar Market is positioned as a multipurpose culinary hub that is in perfect harmony with these changing tastes thanks to its clever combination of a grocery store, Mediterranean bistro, Halal restaurant, and wholesale bakery. Caesar Market is an appealing option for people and families looking for a one-stop shop for all of their culinary needs because of the fast-paced nature of modern life, which is marked by dual-income homes and time restrictions.

The Increasing Priority of Health and Wellbeing as Lifestyle Decisions.

Customers now have a strong preference for fresh, organic, and healthful food goods as a result of a significant shift in lifestyle toward health consciousness. By highlighting its premium products, fresh produce, and open sourcing policies, Caesar Market may profitably capitalize on this trend. Marketers can build a devoted clientele of people who value health and well-being by establishing themselves as purveyors of wellness. In addition, Caesar Market has a large window of opportunity to extend its product line and accommodate dietary requirements given the growing trend of plant-based and gluten-free diets.

Retail and Consumer Behavior's Digital Transformation.

Consumer expectations and behavior have changed significantly since the introduction of digital technologies. By developing an omnichannel experience that combines online and offline touchpoints seamlessly, Caesar Market can take advantage of these improvements. The market may improve accessibility and customer interaction by investing in strong e-commerce platforms, mobile applications, and social media presence. Data-driven decision-making and customized marketing tactics are made possible by the use of data analytics, which may also be used to obtain insightful knowledge about customer preferences and behavior.

Caesar Market Restraints and Challenges:

Caesar Market has an attractive business plan, but it also faces a number of serious obstacles in a fast-paced, cutthroat industry. Traditional grocery stores and specialty food stores are oversaturated in the retail market, fiercely competing with one another for customers. Economic turbulence, encompassing recessions and inflationary demands, can profoundly influence consumer expenditure, so influencing sales in every product category within the industry.

It is extremely difficult to maintain constant product quality and freshness, especially for perishables, which calls for careful attention to detail and effective supply chain management. Additionally, stockouts and overstocking must be avoided since both can have a detrimental effect on customer satisfaction and financial performance. This is why inventory management requires a careful balance. The labor shortage in the business increases the need for a trained workforce in the market. The industry-wide labor shortages exacerbate the market's dependence on a skilled labor force and could have an effect on customer service standards and operational effectiveness.

Strict adherence to food safety and hygiene rules is required, requiring large investments in training and compliance methods. A strong brand identity and market differentiation from competitors necessitate significant marketing initiatives and continuous investments in brand development. Product development and menu planning are under strain because to the constantly changing dietary trends and customer preferences, which call for constant innovation and adaptation.

Caesar Market Opportunities:

By leveraging several important market trends, Caesar Market is well-positioned for substantial development. There is a significant chance to increase the market's selection of fresh, organic, and locally sourced goods due to the growing emphasis placed by consumers on health and wellbeing. Caesar Market can stand out from rivals and draw in a devoted clientele by promoting itself as a health-conscious location. Furthermore, it is essential to use technology to improve the client experience. Convenience and consumer happiness can rise with the implementation of online ordering, delivery, and loyalty programs. Understanding client preferences through data analytics helps improve marketing campaigns, operational effectiveness, and product selection.

The market has more opportunities to profit from the expanding trend of experiential retail. Establishing a distinctive and captivating retail space via activities, culinary demos, and collaborations with nearby craftspeople may cultivate a robust feeling of community and draw in new patrons. Adding new services or product categories, including meal preparation, personal shopping, or catering, can increase revenue streams and reach new markets. Caesar Market may spot and seize new possibilities to promote growth and profitability by closely examining consumer demands and market trends.

CAESAR MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.5% |

|

Segments Covered |

By Product type, End-User, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fresh Express, Taylor Farms, Dole Food Company, Inc., Earthbound Farm, Ready Pac Foods, Inc. |

Caesar Market Segmentation: By Product Type

-

Fresh Caesar Salad

-

Packaged Caesar Salad

-

Caesar Dressing

-

Caesar Salad Kits

In the Caesar Market, fresh Caesar salad is the largest segment, driven by its popularity in restaurants and households for its fresh ingredients and convenience. Packaged Caesar salad is the fastest-growing segment, as it appeals to health-conscious consumers seeking ready-to-eat, nutritious meal options. This growth is fueled by the increasing demand for convenient, healthy food choices and the rising trend of meal kits in the food market..

Caesar Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Online Retailers

-

Convenience Stores

-

Specialty Stores

-

Foodservice (Restaurants, Cafes, etc.)

In the Caesar market, supermarkets/hypermarkets dominate as the largest distribution channel, owing to their extensive reach and variety of products. Online retailers are the fastest-growing segment, driven by the increasing trend of e-commerce and consumer preference for convenient home delivery options. This growth is supported by advancements in logistics and the growing adoption of digital shopping platforms..

Caesar Market Segmentation: By End-User

-

Household

-

Commercial

the household segment is the largest end-user category, driven by the widespread popularity of Caesar salads and dressings for home consumption. The commercial segment, encompassing restaurants and cafes, is the fastest-growing, fueled by the increasing demand for Caesar salads and related products in the foodservice industry, which is expanding due to the rising trend of dining out and the inclusion of healthier menu options.

Caesar Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In the Caesar market, North America is the largest region due to high consumption rates of Caesar salads and dressings, driven by health-conscious consumers and established market presence. The Asia-Pacific region is the fastest-growing segment, fueled by increasing urbanization, rising disposable incomes, and the growing influence of Western cuisine, which is boosting the demand for Caesar products in countries like China and India.

COVID-19 Impact Analysis on the Caesar Market:

Caesar Market was not exempt from the COVID-19 pandemic's severe repercussions on the culinary and retail sectors. The grocery portion of the market benefited from the growth in demand for online shopping and grocery delivery caused by lockdowns and the trend towards remote employment. But the dining area closures and social gathering prohibitions had a negative impact on the restaurant and bakery industries. Uncertainty in the economy also decreased consumer spending and foot traffic, which affected overall sales.

Caesar Market probably adopted tactics like improved grocery offerings, cost-cutting initiatives, and online ordering and delivery services to lessen these difficulties. Convenient eating options and necessities took center stage. The epidemic brought about challenges, but it also brought to light development prospects in sectors such as contactless services and e-commerce.

Caesar Market probably put initiatives like improved online ordering and delivery, increased grocery selection, and cost-cutting measures into place to lessen these difficulties. The emphasis turned to necessities and easy-to-eat foods. In addition to posing challenges, the pandemic brought to light potential prospects in industries including contactless services and e-commerce. With the relaxation of limitations, the market began to slowly rebound, exhibiting signs of life in the restaurant and bakery segments as customers felt more comfortable eating out.

Latest Trends/ Developments:

Caesar Market can leverage several emerging trends to enhance its offerings and customer experience. The growing emphasis on health and sustainability presents an opportunity to expand organic, plant-based, and locally sourced products. Additionally, the rise of e-commerce and online ordering demands a robust digital presence and efficient delivery services. To create a unique shopping experience, incorporating interactive elements like cooking demonstrations or virtual reality food tours can be explored.

Furthermore, catering to specific dietary needs such as gluten-free, vegan, or keto options can expand the customer base. Leveraging data analytics to understand customer preferences and behaviors is crucial for personalized marketing and product recommendations. By staying updated on these trends and adapting accordingly, Caesar Market can maintain its competitive edge and cater to the evolving needs of its customers.

Key Players:

-

Fresh Express

-

Taylor Farms

-

Dole Food Company, Inc.

-

Earthbound Farm

-

Ready Pac Foods, Inc.

Chapter 1. Caesar Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Caesar Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Caesar Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Caesar Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Caesar Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Caesar Market – By Product Type

6.1 Introduction/Key Findings

6.2 Fresh Caesar Salad

6.3 Packaged Caesar Salad

6.4 Caesar Dressing

6.5 Caesar Salad Kits

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Caesar Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Supermarkets/Hypermarkets

7.3 Online Retailers

7.4 Convenience Stores

7.5 Specialty Stores

7.6 Foodservice (Restaurants, Cafes, etc.)

7.7 Y-O-Y Growth trend Analysis By Distribution Channel

7.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Caesar Market – By End User

8.1 Introduction/Key Findings

8.2 Household

8.3 Commercial

8.4 Y-O-Y Growth trend Analysis By End User

8.5 Absolute $ Opportunity Analysis By End User , 2024-2030

Chapter 9. Caesar Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By Distribution Channel

9.1.4 By End User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By Distribution Channel

9.2.4 By End User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By Distribution Channel

9.3.4 By End User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By Distribution Channel

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By Distribution Channel

9.5.4 By End User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Caesar Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Fresh Express

10.2 Taylor Farms

10.3 Dole Food Company, Inc.

10.4 Earthbound Farm

10.5 Ready Pac Foods, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Caesar Market was valued at USD 7 billion in 2023 and is projected to reach a market size of USD 16.99 billion by the end of 2030. Over the cast period of 2024 – 2030, the figure for requests is projected to grow at a CAGR of 13.5%.

The Changing Preference of Consumers for Convenient and Diverse Culinary Experiences Increasing the Priority of Health and well-being as Lifestyle Decisions, and Retail and Consumer Behavior's Digital Transformation.

Household, Commercial.

North America leads the Caesar Market, fueled by strong consumer demand and an extensive network of food service providers. The region's established food industry infrastructure plays a crucial role in maintaining its market dominance.

Fresh Express, Taylor Farms, Dole Food Company, Inc., Earthbound Farm, Ready Pac Foods, Inc.