Cable and Accessories Testing and Certification Services Market Size (2024 – 2030)

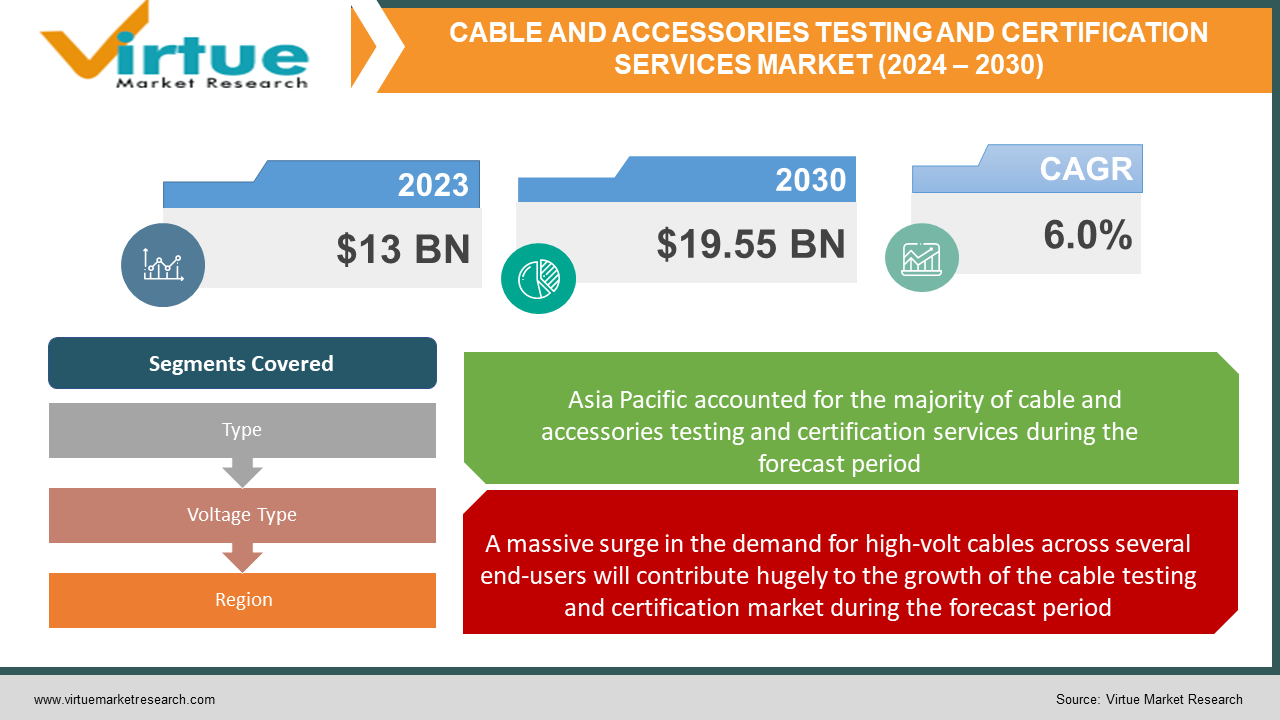

The Cable and Accessories Testing and Certification Services Market was valued at USD 13 billion in 2023 and is projected to reach a market size of USD 19.55 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 6.0%.

The industry that offers testing, inspection, and certification services for different types of cables used in various applications is referred to as the Global Cable Testing and Certification Market. In this market, cables, which are pivotal parts of electrical systems, telecommunications networks, and other infrastructure, are ensured to be of the highest possible quality, safety, and compliance. Testing cables includes examining them to determine their functionality, electrical characteristics, mechanical strength, and durability. It holds a wide range of tests, including those for signal integrity, conductor resistance, insulation resistance, capacitance, and dielectric strength. These examinations are done to find any flaws, errors, or deviations from industry norms. In the market for cable testing certification services, cables that abide by a few norms and laws are marked with compliance certificates or marks. These certificates show that the cables have been thoroughly checked and have been confirmed to meet the required performance and safety requirements. Power transmission and distribution, telecommunications, oil and gas, the automobile, aerospace, and construction segments are just a few of the industries that the cable testing and certification industry serves.

In order to assure the dependability, effectiveness, and safety of cable installations as well as to comply with international and domestic norms and laws, there is a demand for these services. Increased deployment in infrastructure development, rising demand for high-speed data transmission, rising safety and quality issues and the need for adherence to regulations and industry standards are some of the elements propelling the Cable Testing and Certification Market’s expansion. The development of this market is also helped by technological developments like the appearance of new testing procedures and tools.

Key Market Insights:

-

The widespread adoption of renewable energy sources like wind and solar power requires a huge infrastructure of cabling. Cable testing and certification make sure of the integrity of these cables, promoting their adoption and driving the market.

-

The development of power distribution networks is necessary due to the rapid industrialization and urbanization of developing economies. By ensuring the cabling used in these networks is trustworthy and of high quality, cable testing and certification promote market expansion.

-

Europe is estimated to grow with a CAGR of 5.7% during the forecast period. The European Union has put in several measures for cable testing to ensure the quality of the cable to minimise serious electrical hazards.

Cable and Accessories Testing and Certification Services Market Drivers:

A massive surge in the demand for high-volt cables across several end-users will contribute hugely to the growth of the cable testing and certification market during the forecast period.

The cable testing and certification market growth is expected to gain traction in the future years subject to factors such as increasing use of cables as an impact of the rise in power generation in the OECD and non-OECD countries, development in the global electronics and IT sectors, and rise in industrialization and globalization. The rise in ask for cable testing & certification across electrical & electronics, railway, automotive, marine, roadways, aerospace, and energy generation & distribution sectors will shake up the cable testing and certification market over the projected years. Massive demand for high-volt cables by myriad end-users involving transmission & distribution utilities, offshore wind farms, and the energy sector will majorly persuade the growth of the cable testing and certification market during the forecast timeline.

Cable and Accessories Testing and Certification Services Market Restraints and Challenges:

There are several restraints that are detrimental to the growth of the Cable and Accessories Testing and Certification market. Some of these restraints are:

-

The high initial investment costs involved with the deployment and maintenance of cable infrastructure. Infrastructure for Cable Testing and Certification necessitates to be set up with a large capital investment. This can act as a bottleneck, especially for small and medium-sized businesses (SMEs) and emerging economies, inhibiting market expansion.

-

Service providers charge quite a humungous amount for their Testing and Certification work.

-

It is observed that Testing and Certifying requires really skilled personnel and the lack of them poses a serious threat to the market.

-

In addition, like most other markets, there is a fear of facing competition from alternative testing methods.

Cable and Accessories Testing and Certification Services Market Opportunities:

There are several market opportunities for Cable Testing and Certification, including in the cable television and telecommunications industries, such as:

-

Cable testing certification can assist verify the quality of cable television and telecommunications products.

-

Certification can also help identify potential concerns with products and help ensure that they meet customer needs.

-

The cable television and telecommunications industries are growing exponentially, and cable testing certification is required to ensure the quality of products.

CABLE AND ACCESSORIES TESTING AND CERTIFICATION SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.0% |

|

Segments Covered |

By Type, Voltage Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Dekra, Underwriters Laboratories, British Approvals Service for Cables (BASC), Bureau Veritas, Tv Rheinland, Eurofins Scientific, SGS, DNV GL (Kema Laboratories), Intertek, Kinectric |

Cable and Accessories Testing and Certification Services Market Segmentation: By Type

-

Routine test

-

Sample test

-

Type test

The Sample Test type segment holds the dominating market share and is estimated to witness the highest CAGR during the forecast period. A sample test is a collection of tests carried out on samples of finished cables at a predetermined frequency to see if the cables comply with the requirements. This test is run to evaluate the capability of cables made in the same factory but in various batches and at different times. The major objective of the tests carried out under this segment is to examine the cables’ construction. Crush resistance testing, flexing, high voltage (water immersion) testing, oil & tear testing, tensile strength and elongation at break testing, and water absorption testing are a few key tests carried out under this section. During the expected period, there will likely be a rise in the import and export of high-quality cables, which will push demand for these tests.

Cable and Accessories Testing and Certification Services Market Segmentation: By Voltage Type

-

Low

-

Medium

-

High

The segment for low-voltage cable has the biggest market share and is anticipated to grow at the fastest rate over the future years. The International Electro-Technical Commission defines low-voltage cables as holding a voltage of less than 1 kV. These cables are the key element in the secondary distribution of electricity. Due to their numerous applications in commercial, industrial, and utility settings, low-voltage cables have the largest share of the global cable testing and certification industry. The price of these low-voltage cables is also minimal compared to the medium and high-voltage cables. The expansion of this market is connected to regional growth in infrastructure development and industrial automation.

Cable and Accessories Testing and Certification Services Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia Pacific has the dominating market share, and it is expected to continue expanding steadily over the forecast period. Due to the growth in cable manufacturing and application in nations like China, Japan, India, South Korea, and Australia, the area has become the biggest consumer of cable testing and certification. During the estimated period, these countries’ rapid industrialization is anticipated to boost the region’s market for Cable Testing and Certification.

COVID-19 Impact Analysis on the Cable and Accessories Testing and Certification Services Market:

The outbreak of COVID-19 posed crucial challenges in all sectors including Cable and Accessories Testing and Certification Services Market sector across the globe. It has resulted in the negative growth of the Cable and Accessories Testing and Certification services as supply chain disruptions due to trade regulations and restrictions affected the product demand.

Latest Trends:

-

The telecommunication industry uses different types of cables like fibre optic, copper conductors, coaxial cables, and twisted pairs for data transmitting and receiving signals. The quality of these cable testing industry is determined to make sure of the efficiency of the cables produced by the cable manufacturers.

-

The cable testing and certification market is witnessing a growing demand from the machine and tool manufacturing sectors and the automotive industry since this sector utilizes cables for various purposes. The cable testing and certification sectors confirm that these cables are resistant to oils and chemicals, UV lights, flame, and many others.

-

Concerns regarding the effect of faulty cables have transformed the focus of cable manufacturers to test the quality of the cables before supplying them to consumers. Thus, it is helping the cable testing and certification market develop rapidly.

-

The high voltage type cable testing assists in finding tolerance errors in the IDC cables, terminal safety concerns, crushed insulation, terminal spacing, corrosive contaminants around the conductors, conductivity, and braided shielding.

Key Players:

-

Dekra

-

Underwriters Laboratories

-

British Approvals Service for Cables (BASC)

-

Bureau Veritas

-

Tv Rheinland

-

Eurofins Scientific

-

SGS

-

DNV GL (Kema Laboratories)

-

Intertek

-

Kinectric

Recent Developments

- In May 2022, Electrical equipment for medical use is now a new segment of items that DEKRA Testing and Certification S.A.U. have added to its accreditation as a Testing Laboratory (CBTL) for the IECEE CB Scheme. To guarantee the safety of electrical and electronic components, this certification program is handled by the IEC System of Conformity Assessment Schemes for Electrotechnical Equipment and Components (IECEE).

Chapter 1. Cable and Accessories Testing and Certification Services Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Cable and Accessories Testing and Certification Services Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Cable and Accessories Testing and Certification Services Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Cable and Accessories Testing and Certification Services Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Cable and Accessories Testing and Certification Services Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Cable and Accessories Testing and Certification Services Market – By type

6.1 Introduction/Key Findings

6.2 Routine test

6.3 Sample test

6.4 Type test

6.5 Y-O-Y Growth trend Analysis By type

6.6 Absolute $ Opportunity Analysis By type, 2024-2030

Chapter 7. Cable and Accessories Testing and Certification Services Market – By Voltage Type

7.1 Introduction/Key Findings

7.2 Low

7.3 Medium

7.4 High

7.5 Y-O-Y Growth trend Analysis By Voltage Type

7.6 Absolute $ Opportunity Analysis By Voltage Type, 2024-2030

Chapter 8. Cable and Accessories Testing and Certification Services Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Voltage Type

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Voltage Type

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Voltage Type

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Voltage Type

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Voltage Type

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Cable and Accessories Testing and Certification Services Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Dekra

9.2 Underwriters Laboratories

9.3 British Approvals Service for Cables (BASC)

9.4 Bureau Veritas

9.5 Tv Rheinland

9.6 Eurofins Scientific

9.7 SGS

9.8 DNV GL (Kema Laboratories)

9.9 Intertek

9.10 Kinectric

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Cable and Accessories Testing and Certification Services Market was valued at USD 13 billion in 2023 and is projected to reach a market size of USD 19.55 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 6.0%.

The increasing use of cables among consumers is propelling the Cable and Accessories Testing and Certification Services Market.

Cable and Accessories Testing and Certification Services Market is segmented based on Type, Voltage Type, and Region.

Asia- Pacific is the most dominant region for the Cable and Accessories Testing and Certification Services Market.

Dekra, Underwriters Laboratories, British Approvals Service for Cables (BASC), Bureau Veritas, Tv Rheinland, Eurofins Scientific, SGS, DNV GL (Kema Laboratories), Intertek, and Kinectric are the few of the key players operating in the Cable and Accessories Testing and Certification Services Market.