Business Mobility Market Size (2025-2030)

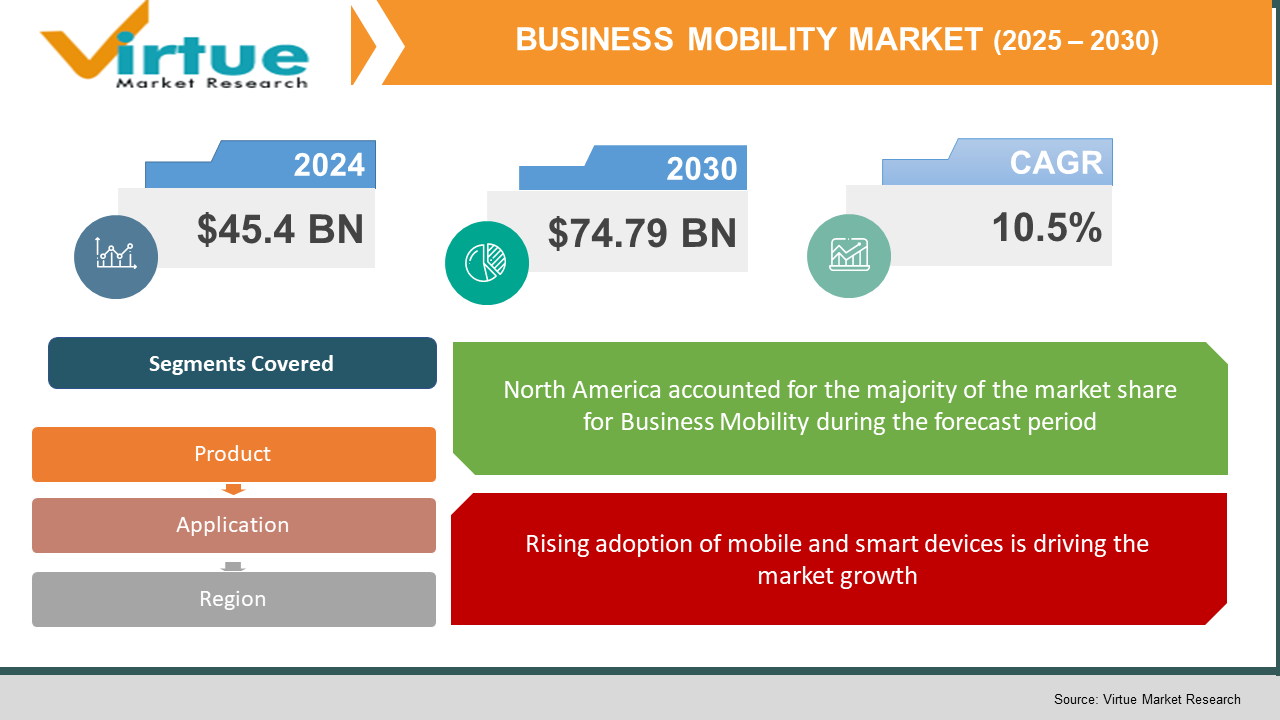

The Global Business Mobility Market was valued at USD 45.4 billion in 2024 and will grow at a CAGR of 10.5% from 2025 to 2030. The market is expected to reach USD 74.79 billion by 2030.

The Business Mobility Market involves solutions and services that enable employees to perform work-related tasks using mobile technologies, irrespective of location. These solutions include mobile device management (MDM), enterprise mobility management (EMM), virtual desktop infrastructure (VDI), secure remote access, and mobile applications designed for business operations. Business mobility has become an essential strategy for enterprises seeking to enhance productivity, agility, and workforce satisfaction. With a growing emphasis on digital transformation and flexible work models, organizations are increasingly investing in mobility solutions that support secure access to business data and applications. The proliferation of smartphones, tablets, and wearable technologies, along with advancements in 5G and cloud computing, have further accelerated the adoption of business mobility across industries. Enterprises today seek seamless integration between mobile platforms and legacy systems, enabling a hybrid work environment that boosts efficiency and responsiveness. Business mobility not only enhances communication and collaboration but also reduces operational costs by enabling remote work, streamlining workflows, and automating field operations. As cybersecurity threats evolve, companies are also prioritizing secure mobility strategies to protect sensitive business information on mobile devices. The market is poised for significant growth as more businesses embrace mobile-first strategies and deploy comprehensive mobility frameworks that empower a distributed, digitally connected workforce.

Key market insights:

The number of mobile-connected enterprise endpoints surpassed 3.4 billion globally in 2024, indicating widespread enterprise reliance on mobile communication tools.

74% of enterprises implemented enterprise mobility management (EMM) solutions by 2024 to manage devices, applications, and secure data access remotely.

Remote and hybrid work models now account for 60% of the workforce globally, significantly increasing the demand for secure mobile collaboration tools.

The deployment of 5G technology contributed to a 35% increase in the performance of mobile business applications, enhancing real-time data exchange and connectivity.

Cloud-based mobility solutions accounted for over 58% of the total business mobility deployments in 2024, owing to their scalability and ease of integration.

The adoption of mobile virtual desktop infrastructure (VDI) rose by 21% in 2024, allowing businesses to provide employees with access to enterprise environments from any device.

Healthcare, BFSI, and IT & telecom emerged as the top three sectors using mobile-first strategies to streamline operations, improve service delivery, and enable real-time decision-making.

Security spending on mobile endpoints grew by 26% in 2024, reflecting growing concerns about data breaches and compliance in mobile work environments.

Global Business Mobility Market Drivers

Expansion of remote and hybrid work models is driving the market growth

The shift toward remote and hybrid work environments has fundamentally reshaped the way organizations operate and interact with their employees. This transformation has emerged as one of the primary drivers of the business mobility market. With a growing number of enterprises adopting flexible work arrangements, there is an increasing demand for technologies that enable seamless access to business applications, data, and collaboration tools from any location. Business mobility solutions bridge the gap between physical offices and distributed workforces, allowing employees to remain productive regardless of geography. These platforms include mobile device management (MDM), virtual private networks (VPNs), secure messaging systems, and cloud-based collaboration tools. Organizations benefit from greater employee satisfaction, reduced overhead costs, and increased operational resilience. Additionally, remote work models have highlighted the importance of cybersecurity, prompting companies to invest in mobile security frameworks that ensure compliance and protect sensitive information. The pandemic accelerated this trend, demonstrating that business continuity can be maintained through digital infrastructure and mobile-enabled workflows. As hybrid work becomes a long-term strategy, enterprises are increasingly prioritizing investments in mobility frameworks that support scalability, flexibility, and robust remote access. From real-time file sharing to mobile video conferencing and remote desktop solutions, the modern workplace is being redefined by mobility technologies. The sustained growth of the remote workforce, along with the rising expectation of location-independent productivity, will continue to drive the adoption of business mobility tools across industries, positioning mobility as a core component of enterprise digital transformation strategies.

Rising adoption of mobile and smart devices is driving the market growth

The widespread use of smartphones, tablets, laptops, and wearables has significantly influenced the business mobility landscape. Today’s workforce relies heavily on mobile devices not only for communication but also for accessing business-critical applications, data analytics tools, and workflow automation platforms. The proliferation of mobile devices has enabled enterprises to extend operations beyond traditional office environments, allowing field workers, sales personnel, and remote teams to stay connected and productive. As the global mobile device user base continues to expand, so does the need for unified mobility solutions that can manage, monitor, and secure a diverse range of devices. Organizations are adopting mobile-first strategies that prioritize mobile access in application development, employee engagement, and IT infrastructure design. This trend is particularly prevalent in sectors such as logistics, retail, healthcare, and construction, where on-the-go access to information is crucial for efficiency and decision-making. Furthermore, technological advancements in mobile hardware and software, including high-resolution displays, biometrics, AI integration, and cloud synchronization, are enhancing the capability of these devices for business applications. The integration of Internet of Things (IoT) devices and wearable technologies is further expanding the scope of mobile operations. For instance, smartwatches are increasingly used for real-time alerts and task tracking in service-oriented industries. As businesses strive to deliver faster, more flexible services, mobile and smart device adoption becomes a strategic enabler. The growing demand for seamless and secure device connectivity, combined with the need for responsive and mobile-accessible platforms, continues to fuel the expansion of the business mobility market.

Digital transformation and cloud infrastructure growth is driving the market growth

The acceleration of digital transformation initiatives across enterprises has significantly contributed to the growth of the business mobility market. Organizations are increasingly investing in cloud-native applications, software-as-a-service (SaaS) models, and scalable IT infrastructure to support agile operations and innovation. Business mobility is an essential component of this transformation, enabling organizations to extend their digital capabilities to mobile endpoints. Cloud-based mobility platforms offer businesses the flexibility to deploy applications rapidly, manage devices remotely, and scale operations based on evolving demands. These solutions eliminate the constraints of on-premise systems, reduce capital expenditures, and enhance collaboration among geographically dispersed teams. Moreover, cloud platforms provide real-time data access and centralized control, which are crucial for effective decision-making and operational continuity. As companies move towards digitizing workflows, mobility tools such as mobile enterprise resource planning (ERP), customer relationship management (CRM), and mobile business intelligence (BI) become indispensable. These tools allow executives, field workers, and frontline employees to access critical insights and perform tasks while on the move. The convergence of cloud computing with mobile technologies is also driving innovation in mobile application development and cross-platform compatibility. In addition, cloud infrastructure enhances the security and compliance posture of mobile deployments by offering encrypted storage, role-based access controls, and disaster recovery mechanisms. Enterprises undergoing digital transformation are therefore aligning their mobility strategies with cloud adoption to achieve improved agility, customer responsiveness, and workforce empowerment. The symbiotic relationship between cloud infrastructure and business mobility continues to strengthen, propelling the market toward sustained growth.

Global Business Mobility Market Challenges and Restraints

Security vulnerabilities and data privacy concerns is restricting the market growth

One of the most significant challenges facing the business mobility market is the growing threat of cybersecurity vulnerabilities and data privacy breaches. As employees access corporate resources through mobile devices, the potential for data exposure, unauthorized access, and malware infiltration increases. Mobile devices are often more susceptible to loss or theft, making them a primary target for cybercriminals. Furthermore, employees frequently use personal devices for business purposes under Bring Your Own Device (BYOD) policies, which complicates security management due to inconsistent configurations, outdated software, or lack of proper encryption. The diversity of devices and operating systems also introduces compatibility issues and increases the risk of security loopholes. Enterprises must invest in robust mobile security frameworks that include multi-factor authentication, end-to-end encryption, mobile threat defense, and real-time monitoring to ensure data integrity. Regulatory compliance further adds to the complexity. Industries such as healthcare and finance must adhere to strict regulations like HIPAA and GDPR, which mandate data protection and user consent practices. Failure to comply can result in significant legal and financial penalties. Despite the availability of advanced security solutions, a large number of businesses struggle to implement consistent security policies across devices and departments. This is especially true for small and medium-sized enterprises that lack dedicated IT resources. As business mobility continues to expand, the industry must address these concerns with scalable and user-friendly security solutions that balance protection with usability. Overcoming these challenges is essential for maintaining user trust, safeguarding sensitive information, and supporting the continued adoption of mobile business operations.

Complexity in integration with legacy systems is restricting the market growth

A major restraint in the widespread adoption of business mobility solutions is the complexity involved in integrating them with legacy IT infrastructure. Many enterprises, particularly those in traditional industries such as manufacturing, insurance, and public administration, operate on legacy systems that were not designed with mobile accessibility or cloud compatibility in mind. These older systems often lack APIs, modern security protocols, or real-time data processing capabilities, which makes it difficult to create seamless connections with mobile platforms. Integration issues can lead to data silos, inefficient workflows, and inconsistent user experiences, undermining the benefits of business mobility. Additionally, migration from legacy to mobile-ready platforms can be expensive, time-consuming, and disruptive to ongoing operations. Organizations may face challenges in terms of compatibility, data formatting, and system downtime during integration. Training employees on new mobile applications while managing legacy processes adds another layer of complexity. The lack of standardization across devices and software platforms further complicates the integration process. While some enterprises opt for phased modernization strategies, others delay mobile adoption due to perceived risks and costs. This resistance hampers digital transformation efforts and slows the overall progress of business mobility. Overcoming this challenge requires strategic planning, investment in middleware solutions, and the selection of flexible mobility platforms that support hybrid environments. Vendors are also responding by offering modular and interoperable mobility tools that facilitate smoother integration. However, until legacy compatibility issues are addressed on a larger scale, integration complexity will remain a key restraint in realizing the full potential of business mobility.

Market Opportunities

The business mobility market is ripe with opportunities driven by technological advancements, shifting workforce dynamics, and evolving enterprise priorities. One of the most compelling opportunities lies in the growing demand for industry-specific mobility solutions. Sectors such as healthcare, logistics, retail, manufacturing, and education are increasingly adopting mobile tools tailored to their unique operational requirements. These solutions not only streamline workflows but also enhance service delivery and customer engagement. For example, in healthcare, mobile applications for patient monitoring, electronic medical records access, and teleconsultations are transforming care delivery. In logistics, mobility tools enable real-time tracking, route optimization, and delivery confirmations, improving efficiency and customer satisfaction. Another major opportunity is the rise of edge computing and 5G technology, which enable faster data processing and ultra-low-latency communication for mobile applications. This is particularly beneficial for use cases such as real-time video conferencing, mobile IoT monitoring, and field service operations. Additionally, small and medium-sized enterprises (SMEs) represent an untapped market for business mobility vendors. With the availability of affordable cloud-based solutions, SMEs can now access the same level of mobile functionality as larger enterprises. The increasing availability of low-code and no-code mobile development platforms also empowers organizations to create custom applications without extensive technical expertise. Furthermore, as sustainability becomes a strategic priority, mobile solutions that reduce physical resource usage and travel are being favored by environmentally conscious organizations. The growing focus on employee well-being and productivity is encouraging the development of mobility tools that offer work-life balance features such as flexible scheduling, task management, and virtual wellness programs. Integration with artificial intelligence and machine learning opens the door for intelligent mobile assistants, predictive analytics, and personalized user experiences. Enterprises that proactively embrace these opportunities will be better positioned to innovate, differentiate themselves, and stay competitive in a rapidly evolving digital landscape.

BUSINESS MOBILITY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10.5% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Microsoft, IBM, Cisco, VMware, and Citrix Systems |

Business Mobility Market Segmentation

Business Mobility Market Segmentation By Product:

• Mobile Device Management (MDM)

• Enterprise Mobility Management (EMM)

• Mobile Application Management (MAM)

• Virtual Desktop Infrastructure (VDI)

• Mobile Content Management (MCM)

• Unified Endpoint Management (UEM)

Enterprise Mobility Management (EMM) is the most dominant segment in the business mobility market. EMM solutions offer a comprehensive approach to managing mobile devices, applications, and data security under a unified framework. Businesses increasingly favor EMM due to its ability to enforce security policies, monitor device compliance, and control application access from a central console. As remote and hybrid work environments expand, organizations prioritize EMM to ensure data protection, user authentication, and device tracking. The flexibility, scalability, and integration capabilities of EMM platforms make them indispensable for enterprises aiming to manage diverse device ecosystems and ensure secure mobile operations across departments.

Business Mobility Market Segmentation By Application:

• IT and Telecom

• Healthcare

• BFSI

• Retail

• Manufacturing

• Logistics and Transportation

• Education

• Government

The IT and Telecom segment is the most dominant in the business mobility market. This industry leads in digital adoption and relies heavily on mobility solutions to manage distributed teams, client interactions, and project execution. Companies in this sector use mobile technologies for technical support, application development, real-time collaboration, and remote network monitoring. Given their inherent need for secure and scalable infrastructure, IT and telecom organizations have been early adopters of business mobility tools such as VDI, EMM, and unified communication apps. Their emphasis on innovation and connectivity continues to drive high demand for mobile strategies that enhance agility and responsiveness.

Business Mobility Market Regional Segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America is the dominant region in the global business mobility market, accounting for the largest share of global revenues in 2024. The region benefits from a highly developed digital infrastructure, a strong presence of leading technology companies, and early adoption of remote work policies. Enterprises across the United States and Canada have been at the forefront of implementing enterprise mobility strategies to improve operational efficiency, employee engagement, and customer experience. The widespread use of smartphones, availability of high-speed internet, and growing 5G coverage contribute significantly to the region’s leadership in business mobility. Moreover, North America has seen extensive deployment of enterprise mobility management systems, cloud collaboration platforms, and secure communication tools, especially in sectors such as IT, finance, healthcare, and retail. Regulatory frameworks supporting data security and employee rights have also encouraged businesses to invest in secure and compliant mobility solutions. In addition, the region has witnessed strong growth in BYOD adoption, with companies recognizing the cost-saving and flexibility benefits it offers. High awareness of digital transformation and cybersecurity readiness further amplifies the adoption of advanced mobility solutions. North America’s innovation ecosystem, with consistent investment in R&D and startup activity, ensures continuous evolution of mobile technologies. As enterprises in the region continue to prioritize agility and remote enablement, North America is expected to maintain its dominant position in the business mobility market for the foreseeable future.

COVID-19 Impact Analysis on the Business Mobility Market

The COVID-19 pandemic served as a major catalyst for the growth and evolution of the business mobility market. As lockdowns and social distancing measures disrupted traditional office operations, organizations worldwide were forced to rapidly adopt remote work models to maintain business continuity. This sudden transition accelerated the demand for mobile solutions that enabled employees to access corporate resources securely from home or any remote location. Tools such as video conferencing apps, mobile email platforms, virtual private networks, and enterprise mobility management systems became essential overnight. Businesses that had previously delayed digital transformation initiatives found themselves compelled to invest in mobile technologies to support distributed teams. The healthcare, education, and IT sectors saw particularly strong growth in mobility adoption as they shifted operations to virtual formats. At the same time, cybersecurity became a top priority as the expansion of mobile endpoints introduced new vulnerabilities and increased the risk of data breaches. Organizations responded by deploying advanced mobile security solutions including multi-factor authentication, encrypted communication, and mobile threat detection. Cloud-based mobility services gained traction due to their scalability and ability to support real-time collaboration. The pandemic also normalized hybrid work as a long-term model, with many companies choosing to permanently reduce office footprints and adopt flexible work arrangements. As a result, business mobility transitioned from a temporary response to a strategic imperative. Enterprises began prioritizing employee experience, digital collaboration, and business agility through mobile-first strategies. The COVID-19 crisis thus reshaped corporate attitudes towards mobility, making it a foundational component of modern business infrastructure and operational resilience.

Latest trends/Developments

The business mobility market is witnessing several emerging trends and developments that are shaping its future trajectory. One key trend is the growing adoption of artificial intelligence and machine learning in mobility platforms, enabling predictive analytics, automated device management, and intelligent user experiences. Mobile solutions are becoming more adaptive, learning user behavior to optimize workflows and recommend actions. Another trend is the integration of 5G connectivity, which provides high-speed, low-latency communication, making mobile applications faster and more responsive. This is especially beneficial for applications in real-time communication, IoT integration, and mobile video conferencing. Additionally, zero-trust security models are gaining prominence in mobility frameworks, ensuring that every user and device is verified before accessing corporate networks. The rise of unified endpoint management (UEM) is streamlining IT operations by combining the management of mobile devices, desktops, and IoT systems under a single platform. Industry-specific mobility applications are also on the rise, offering tailored solutions for verticals such as retail, logistics, and healthcare. Furthermore, the development of low-code and no-code platforms is enabling faster deployment of custom mobile apps by business users without deep programming knowledge. Wearable technologies are increasingly being used in workplace settings for task tracking, health monitoring, and communication. Another notable development is the focus on employee experience, with mobile platforms incorporating wellness features, flexible scheduling, and intuitive interfaces. Vendors are also offering more bundled solutions combining mobile device management, collaboration tools, and analytics. These trends underscore the continuous evolution of business mobility from basic connectivity tools to strategic enablers of productivity, engagement, and innovation.

Key Players:

- IBM

- Microsoft

- Cisco

- VMware

- Citrix Systems

- Samsung

- BlackBerry

- Infosys

- AT&T

- Hewlett Packard Enterprise

- Oracle

- SAP

- MobileIron

- Ivanti

- Sophos

Chapter 1. Business Mobility Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Application

1.5. Secondary Application

Chapter 2. BUSINESS MOBILITY MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. BUSINESS MOBILITY MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. BUSINESS MOBILITY MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. BUSINESS MOBILITY MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. BUSINESS MOBILITY MARKET – By Product

6.1 Introduction/Key Findings

6.2 Mobile Device Management (MDM)

6.3 Enterprise Mobility Management (EMM)

6.4 Mobile Application Management (MAM)

6.5 Virtual Desktop Infrastructure (VDI)

6.6 Mobile Content Management (MCM)

6.7 Unified Endpoint Management (UEM)

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. BUSINESS MOBILITY MARKET – By Application

7.1 Introduction/Key Findings

7.2 IT and Telecom

7.3 Healthcare

7.4 BFSI

7.5 Retail

7.6 Manufacturing

7.7 Logistics and Transportation

7.8 Education

7.9 Government

7.10 Y-O-Y Growth trend Analysis By Application

7.11 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. BUSINESS MOBILITY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. BUSINESS MOBILITY MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 IBM

9.2 Microsoft

9.3 Cisco

9.4 VMware

9.5 Citrix Systems

9.6 Samsung

9.7 BlackBerry

9.8 Infosys

9.9 AT&T

9.10 Hewlett Packard Enterprise

9.11 Oracle

9.12 SAP

9.13 MobileIron

9.14 Ivanti

9.15 Sophos

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Business Mobility Market was valued at USD 45.4 billion in 2024 and will grow at a CAGR of 10.5% from 2025 to 2030. The market is expected to reach USD 74.79 billion by 2030.

Key drivers include remote work expansion, mobile device proliferation, and cloud infrastructure growth

Segments include mobile device management, enterprise mobility management, and applications in IT, healthcare, and retail.

North America is the dominant region, supported by digital infrastructure and early adoption.

Leading players include Microsoft, IBM, Cisco, VMware, and Citrix Systems.