Business Management Consulting Service Market Size (2024 – 2030)

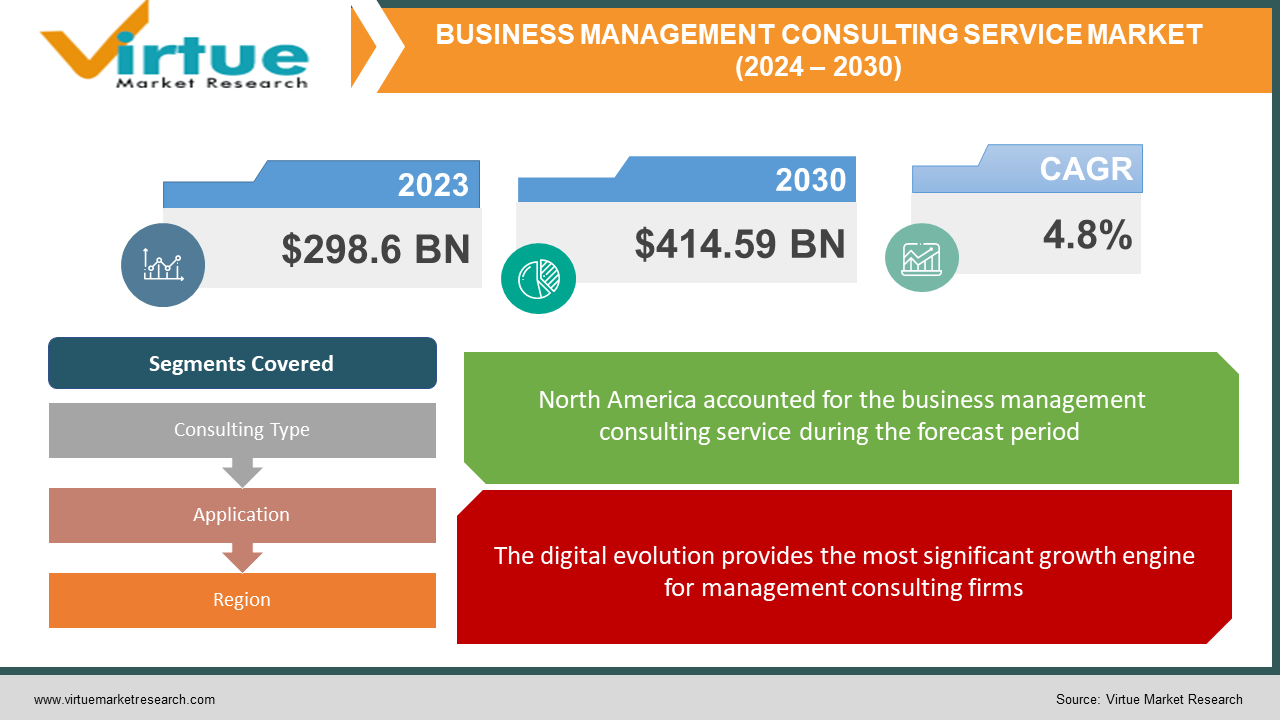

The business management consulting service market was valued at USD 298.6 billion in 2023 and is projected to reach a market size of USD 414.59 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 4.8%.

The business management consulting services industry has grown steadily in recent years, driven by businesses' need for expert advice and solutions to complex organizational issues. Consulting firms provide strategies, operational improvement plans, technology implementations, and more to help companies adapt and succeed in competitive markets. The main services provided include strategic management consulting, operations management consulting, financial advisory, HR consulting, and IT consulting. Strategic advisors guide executive leadership teams on long-term planning, market growth opportunities, mergers and acquisitions, new initiatives, and more. Operations consultants focus on boosting efficiency, productivity, and cost-savings through analysis of internal processes, supply chains, etc. Financial advisory services guide accounting, transactions, investment decisions, and risk management. HR consultants enhance talent recruitment, retention policies, leadership training, and organizational culture. IT consultants handle technology strategy, systems integration, cybersecurity, and digital transformations. Key drivers fueling strong demand are digital disruption of business models, data analytics adoption, pressures of globalization, and other complex market forces compelling companies to seek outside expertise. The industry provides strategic value in solving challenges, steering productivity, enhancing competitiveness, identifying opportunities, and enabling change. Spending on consulting services has endured, despite economic fluctuations, as an important investment for profitable growth.

Key Market Insights:

The global management consulting services market is expected to exhibit impressive growth over the coming years, expanding by 4.8%. Several major factors and trends are driving demand for consulting expertise that offers strategic advice and operating enhancements. One growth catalyst is escalating complexity stemming from forces like emerging technologies, data proliferation, and the pressures of globalized markets. As the competitive landscape evolves faster, executives have an intense need for guidance on capitalizing on opportunities and innovating business models. Consulting firms provide specialized knowledge, change management, and outside perspectives that prove vital for adaptation and growth initiatives. Digital disruption of organizations and leadership is another demand driver, requiring realignment of priorities, processes, investments, and even company culture. Few businesses today have fully tapped into game-changing technologies like the cloud, advanced analytics, IoT platforms, and AI capabilities. Management consultants deliver technology roadmaps, system implementation oversight, and training that turn these into tangible competitive advantages. The rise of big data also fuels growth potential, as most companies struggle to convert their growing mounds of data into meaningful business intelligence. Management advisors supply advanced data analytics fluency, lacking internally, to inform strategic decisions and reveal operational improvements grounded in empirical evidence.

Business Management Consulting Service Market Drivers:

The digital evolution provides the most significant growth engine for management consulting firms.

The ascendance of disruptive digital technologies in the 21st century has compelled businesses across every industry to pursue organizational change initiatives. Yet most leadership teams lack specialized skills, objective insights, and execution roadmaps to successfully transform entrenched companies into digitally savvy enterprises. This profound gap fuels a soaring demand for management consulting services that guide clients through the effective adoption of emerging technologies. Migrating legacy IT infrastructure onto cloud-based software-as-a-service platforms ranks among the most urgent and complex digital initiatives enterprises now undertake. Consultants offer vital support spanning cloud readiness assessments, vendor selection, roadmap development, and change management planning crucial for migration success. Advisors provide system integration oversight, enabling data and application interoperability across old and new environments during lengthy transition periods. They also equip staff with skills to leverage cloud efficacy benefits around flexibility, cost savings, and faster innovation. Implementing customer-centric analytics, machine learning, and AI likewise represents an enormous opportunity where most businesses fall short without external guidance. Management advisors help construct big data pipelines, identifying high-value use cases to target first. Consultants design customized analytics strategies aligned to strategic goals, ensuring data insights get translated into actions driving growth. For AI integration, advisors manage lengthy testing, training data preparation, ethics risk evaluation, and other complex pre-launch steps while conveying best practices to build internal capabilities.

The success associated with using business management strategy consulting services has been driving the demand.

Beyond widespread digital disruption, the increasingly complex competitive environment represents a pivotal demand catalyst as management teams seek outside expertise in charting business growth strategies. Dynamism introduced by forces like globalization, shifting consumer behaviors, and political tensions produces an atmosphere of uncertainty that internal leadership alone often proves ill-equipped to traverse. Savvy executives instead enlist management consulting partners to help decipher external chaos and plot definitive paths ahead. The interconnection of worldwide markets has conferred immense opportunities, but also constant fluctuations and new exposures. As supply chains stretch globally and multinational interdependencies rise, once-distant events now create unforeseen domino effects, disrupting operations everywhere. Continual political tensions between major economies further key unpredictable policy shifts regarding issues like trade rules, tariffs, sanctions, data governance, and more that quickly cascade across borders. This backdrop of perpetual motion means strategy consultants have become go-to partners for keeping a finger on the global pulse. Advisors apply geopolitical and macroeconomic expertise to supply real-time market clarity, anticipation of shifts that may impact clients, and recommendations to harness or mitigate turbulence. Consulting experts are enlisted to continually re-evaluate value propositions and enhance engagement models to satisfy target customers at any given moment. The scope and pace of worldwide variables impacting competitiveness will only increase, ensuring business management strategy consulting services provide an increasingly critical lifeline for companies navigating complexity and embracing disruption as a launchpad for the future.

Business Management Consulting Service Market Restraints and Challenges:

One constant barrier slowing consulting spending momentum is budget restrictions, especially among smaller firms lacking slack resources.

While the strategic expertise and implementation support management consulting firms provide remain invaluable for organizational competitiveness, steep advisory fees inevitably give some corporate leadership pause. Funding large consulting contracts requires allocating scarce capital away from other priorities. Even executives fully appreciating prospective benefits must justify sizable consulting tabulations crossing their desks. This fundamental budgeting friction will continue to slow otherwise boundless demand growth. The onus falls on management consultants to compellingly demonstrate engagement value, eclipsing costs in both hard and soft terms. Skilled advisors apply financial modeling tools that quantify consulting services' impact on vital performance indicators like reduced spending, increased revenue, market share gains, risk mitigation, and competitive positioning over multi-year projections. Featured metrics should directly connect to a client's top strategic and operating priorities. Advisors must also highlight less quantifiable but equally critical outcomes like improved leadership decision-making, optimized organizational structures, and enhanced workplace culture. Presenting immersive simulations illustrating hypothetical business trajectory divergence with and without the consulting partnership provides a powerful visualization of money left on the table and progress impeded. This value-focused selling based on numbers and vision crystallization shifts conversations from haggling over advisory fees towards strategically assessing consulting services' total ROI.

Business Management Consulting Service Market Opportunities:

As digital migration reaches a fever pitch across industries, most internal leadership teams struggle to drive comprehensive change alone. This reliance on consultants' specialized technology insights and implementation oversight across pivotal emerging spheres like cloud, analytics, IoT, and AI will persist for years as ubiquitous tools continue to advance faster than corporate aptitudes. Beyond supporting complex migrations, advisors should deepen collaborative innovation partnerships with clients, providing external perspectives on capitalizing early on the next game-changing digital capabilities before rivals. With data analytics and business intelligence competitiveness growing more crucial by the day, a huge market potential exists to help clients activate value from the burgeoning information inputs they now passively accumulate. Beyond initial dashboard building and training support, advisors can provide managed analytics services, handling continuous data synthesis and insight delivery on clients' behalf. SOW expansion potential also lies in devising data monetization business models and IP licensing strategies.

BUSINESS MANAGEMENT CONSULTING SERVICE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Consulting Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

McKinsey & Company, Bain & Company, Boston Consulting Group (BCG), Deloitte, PwC, KPMG, LEK Consulting, The BridgeSpan Group |

Business Management Consulting Service Market Segmentation: By Consulting Type

-

Strategy Consulting

-

Operations Consulting

-

Human Resources Consulting

-

Financial Advisory Consulting

-

Technology Consulting

-

Others

Strategy consulting holds the largest share, around 40–45% in 2023. This reflects the ongoing need for companies to define their direction, navigate market shifts, and achieve competitive advantage. Strategy consulting has traditionally been the most dominant type within the business management consulting service market. Companies consistently need assistance with high-level direction, market analysis, and long-term planning to stay ahead in a competitive environment. Technology consulting is rapidly becoming the fastest-growing segment. Technology consulting reflects the critical need for digital transformation initiatives in the modern business landscape. This surge highlights the importance of digital transformation, IT strategy, cloud adoption, and data analytics for businesses of all sizes. The increasing prominence of AI, automation, and other emerging technologies further drives growth in this sector.

Business Management Consulting Service Market Segmentation: By Application

-

Project-Based Consulting

-

Retainer-Based Consulting

-

Staff Augmentation

Project-based consulting is the largest and fastest-growing, holding an estimated 60–70% of the market share in 2023. Companies often prefer this well-defined form of consulting engagement to achieve specific goals or address specific challenges within a determined timeframe. Retainer-based consulting accounts for approximately 20–30% of the market. This model offers companies ongoing access to specialized expertise and strategic guidance on an as-needed basis. Staff augmentation represents a smaller portion of the market, around 10–20%. This model is preferred for filling short-term skill gaps, managing workload fluctuations, or accessing a talent pool without making permanent hires.

Business Management Consulting Service Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America stands as the largest regional market for management consulting services, commanding around a 40% global share or roughly $100 billion in annual spending. Multinational firms dominate the competitive landscape, serving North American powerhouses. Europe represents the second-largest consulting market, holding a 32%, or $80 billion, portion globally. The presence of numerous developed economies, including powerhouse Germany and the UK, fuels robust demand, especially across enterprise IT enhancements. Widespread digital transformation efforts may drive 6% of yearly European growth. The Asia-Pacific market has emerged as the fastest-growing, projected to exhibit an 8% CAGR in the coming years to represent over 20% of the total global industry by 2025 at over $63 billion. The potent expansion owes its success to rising enterprise spending and major government modernization initiatives across China, Japan, India, and Australia. Latin America and the Middle East & Africa currently reflect smaller markets on the global stage, with respective 5% and 3% shares collectively representing $38 billion in annual consulting spending. However, the rapid development of major economies like Brazil, the UAE, and Saudi Arabia provides upside potential despite higher volatility. Double-digit growth could propel these regions to a combined 20% share by 2025, valued at over $63 billion.

COVID-19 Impact Analysis on the Business Management Consulting Service Market:

The onset of the COVID-19 pandemic and subsequent economic shockwaves initially posed major demand challenges for the management consulting industry but also opened doors for advisors to showcase vital crisis support value. Leading firms have since rebounded strongly from these setbacks as clients seek guidance on navigating still-tenuous landscapes. When national lockdowns grounded business activity, most discretionary spending, like external advisory engagements, faced immediate freezes. Mandated work-from-home policies also complicated consulting delivery, requiring onsite field work, data access, and stakeholder meetings. Revenue declined for the first time in years. However, many corporations soon regained an appreciation for outside experts helping steer leadership decisions through immense uncertainty. Consultants aided urgent shifts to remote operations, risk monitoring, workforce policies, and cost contingency planning required for business continuity. Firms also provided vital insights on pivoting strategy and operations to capitalize on pandemic-fueled market changes around digital commerce, supply chains, and new customer behaviors.

Latest Trends/ Developments:

Already a catalyst behind swelling consulting demand, intensifying technology disruption simultaneously modernizes delivery models as advisors race to respond to digital expectations. Cloud-based collaboration platforms enabling virtual expert networks forge new engagement flexibility. Artificial intelligence and analytics integration improve data handling efficiency. APIs and microservices expand modular solution reconfigurability. Many pure-play strategy consultancies now acquire digital design agencies, while IT integrators make strategic capability purchases. Specialist boutiques also proliferate around sub-sectors like smart manufacturing, telehealth, and fintech. Hybrid advisory blends grow prevalent. The overarching drive sees digital & strategic skill convergence, aiming to provide clients with seamless business transformation guidance. Another growing consulting arena helps clients improve environment, social, and governance (ESG) frameworks to meet rising stakeholder demands for corporate ethics, sustainability, and social equity. Increasingly mandatory disclosure requirements also compel enhanced transparency. Consultants offer tailored roadmaps, executive education, and even certified standards around embedding ESGs through policies, technologies, metrics tracking, and disclosure procedures. The specialization reaches across risk, operations, and HR practices.

Key Players:

-

McKinsey & Company

-

Bain & Company

-

Boston Consulting Group (BCG)

-

Deloitte

-

PwC

-

KPMG

-

LEK Consulting

-

The BridgeSpan Group

Chapter 1. Business Management Consulting Service Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Business Management Consulting Service Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Business Management Consulting Service Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Business Management Consulting Service Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Business Management Consulting Service Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Business Management Consulting Service Market – By Consulting Type

6.1 Introduction/Key Findings

6.2 Strategy Consulting

6.3 Operations Consulting

6.4 Human Resources Consulting

6.5 Financial Advisory Consulting

6.6 Technology Consulting

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Consulting Type

6.9 Absolute $ Opportunity Analysis By Consulting Type, 2024-2030

Chapter 7. Business Management Consulting Service Market – By Application

7.1 Introduction/Key Findings

7.2 Project-Based Consulting

7.3 Retainer-Based Consulting

7.4 Staff Augmentation

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Business Management Consulting Service Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Consulting Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Consulting Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Consulting Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Consulting Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Consulting Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Business Management Consulting Service Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 McKinsey & Company

9.2 Bain & Company

9.3 Boston Consulting Group (BCG)

9.4 Deloitte

9.5 PwC

9.6 KPMG

9.7 LEK Consulting

9.8 The BridgeSpan Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Digital evolution and associated success are the main key factors in this market.

Consulting services, especially those provided by top-tier firms, can be very expensive. This can be a significant barrier for smaller businesses and might lead to perceptions of exclusivity.

McKinsey & Company, Bain & Company, Boston Consulting Group (BCG), Deloitte, PwC, KPMG, and LEK Consulting are the key players.

North America currently holds the largest market share, estimated at around 40%.

Asia-Pacific exhibits the fastest growth, driven by its increasing population and expanding economy.