Burner Management System Market Size (2025 – 2030)

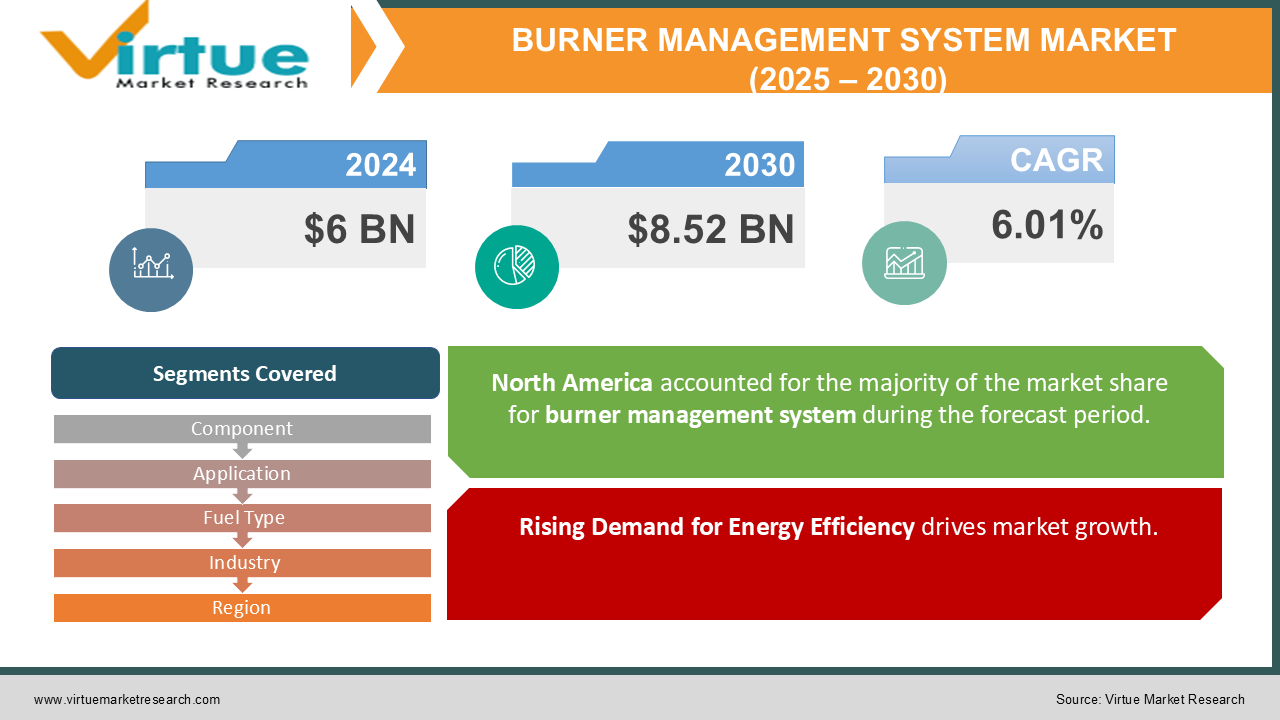

The Burner Management System Market was valued at USD 6 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 8.52 billion by 2030, growing at a CAGR of 6.01%.

A Burner Management System (BMS) is a comprehensive control system designed to oversee, regulate, and ensure the safe operation of combustion equipment. This system is utilized in various industrial processes, including furnaces, ovens, boilers, and heaters. The primary function of a BMS is to guarantee the safe and efficient operation of the burner, minimizing the risk of accidents, optimizing combustion performance, and ensuring compliance with safety regulations.

Key Market Insights:

Emerging economies are undergoing rapid industrialization and urbanization, driving a heightened demand for dependable Burner Management Systems (BMSs). As the market continues to grow, there is an increasing need for sophisticated solutions that improve safety and operational efficiency. Additionally, the transition to renewable energy sources creates new opportunities for BMS applications in the production of cleaner energy, further strengthening the burner management system sector. Furthermore, growing awareness of the advantages offered by automated BMSs—such as reduced downtime, enhanced safety, and improved regulatory compliance—is accelerating their adoption across various industries. Ongoing investments in research and development, aimed at enhancing system capabilities and integrating advanced technologies, are expected to fuel continued growth in the BMS market.

Burner Management System Market Drivers:

Rising Demand for Energy Efficiency drives market growth.

The increasing demand for energy efficiency is a key factor propelling the growth of the Burner Management System (BMS) market. As both businesses and consumers become more conscious of the need to conserve energy, there is a growing interest in solutions that can help minimize energy consumption. Burner management systems play a crucial role in enhancing the efficiency of combustion processes, leading to substantial energy savings. Additionally, tightening government regulations are pushing businesses to adopt energy-efficient technologies, further boosting the demand for BMS solutions. The rising cost of energy also makes energy efficiency a more attractive option, as companies and consumers seek ways to lower operational expenses.

Burner Management System Market Restraints and Challenges: High costs hinder market growth.

Several factors are hindering the growth of the Burner Management System (BMS) market, including high initial investment costs, challenges in integrating with existing systems, compatibility issues with legacy infrastructure, and a lack of specialized skills and training. Concerns regarding system reliability, legal compliance, limited awareness among end-users, operational complexities, resistance to change, and intense market competition also contribute to

these obstacles. To overcome these barriers, collaboration between BMS vendors, end users, industry associations, and regulators is essential. Efforts should focus on raising awareness, encouraging adoption, and addressing issues such as cost, integration challenges, skills shortages, reliability, compliance, and market competition. Key strategies for unlocking the full potential of BMS solutions include simplifying user interfaces, offering training programs, ensuring compatibility with legacy systems, and overcoming resistance to change.

Burner Management System Market Opportunities:

Technological advancements in automation and control systems are creating significant opportunities in the Burner Management System (BMS) market.

The incorporation of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML) into Burner Management Systems (BMS) is significantly driving market growth. These innovations enable capabilities such as predictive maintenance, efficient fuel management, and remote monitoring, enhancing the overall effectiveness and intelligence of BMS solutions. As industries embrace digital transformation, the adoption of these advanced BMS technologies aligns with their objectives of achieving smart automation and data-driven decision-making. These technological advancements not only improve burner operational efficiency but also help businesses meet environmental regulations by optimizing fuel usage and minimizing emissions. This trend is further fueled by the widespread availability of high-speed internet and the push toward Industry 4.0 standards, leading to an increased demand for smart, connected BMS solutions.

BURNER MANAGEMENT SYSTEM MARKET REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.01% |

|

Segments Covered |

By Component, Application, Fuel Type, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Emerson Electric, Bosch, Yokogawa, Mitsubishi Electric , Grundfos, Siemens Spirax , Sarco, Schneider Electric, Honeywell , Johnson Control |

Burner Management System Market Segmentation: By Component

-

Hardware

-

Software

-

Services

The hardware segment of the Burner Management System (BMS) industry currently holds the largest revenue share, largely due to the essential role hardware components play in ensuring the safe and efficient operation of burners across industries such as oil and gas, power generation, and chemicals. As businesses continue to prioritize safety and regulatory compliance, the demand for dependable hardware solutions has risen sharply. Additionally, technological advancements have improved the functionality and efficiency of these hardware systems, making them indispensable for modern industrial applications. The integration of cutting-edge technologies within BMS solutions has further fueled the growth of this segment, as companies strive to optimize performance and minimize operational risks. Consequently, the hardware segment is expected to maintain its leadership in the BMS industry in the foreseeable future.

On the other hand, the software segment is anticipated to experience the highest compound annual growth rate (CAGR) in the coming years. This growth is driven by the increasing demand for advanced software solutions that enhance the monitoring and control of burner operations. As safety and efficiency become top priorities for companies, there is a growing emphasis on real-time data analysis and automation capabilities. Innovations such as enhanced Human-Machine Interfaces (HMIs) and diagnostic tools are also contributing to improved system performance. Additionally, the integration of sophisticated algorithms into safety interlocks underscores the crucial role of software in the evolution of modern BMS applications.

Burner Management System Market Segmentation: By Application

-

Multiple-Burner

-

Single-Burner

The multiple-burner segment of the Burner Management System (BMS) industry holds the largest revenue share and is expected to grow at the fastest compound annual growth rate (CAGR) during the forecast period. This growth is driven by the increasing complexity of industrial operations that require multiple burners to optimize performance and efficiency. Sectors such as oil and gas, power generation, and chemicals frequently rely on these systems to enhance operational capabilities and improve safety. Managing multiple burners allows for better combustion control, reduced emissions, and increased energy efficiency. The integration of advanced technologies has further enhanced the appeal of these systems by offering sophisticated monitoring and control features. As safety and operational efficiency remain top priorities, the demand for multiple-burner systems is anticipated to grow significantly.

The single-burner segment is also projected to experience notable growth, especially in smaller-scale applications where simplicity and cost-efficiency are paramount. These systems are straightforward to install and integrate, making them an attractive option for businesses looking to optimize their processes with minimal changes. Additionally, the growing emphasis on energy efficiency has led many organizations to adopt single-burner solutions, which help optimize fuel consumption while maintaining stringent safety standards. This segment caters to a wide range of industrial needs, offering practical, efficient solutions that drive ongoing demand and maintain its relevance in the market.

Burner Management System Market Segmentation: By Fuel Type

-

Gas

-

Oil

-

Others

The gas segment holds the largest revenue share in the Burner Management System (BMS) industry, primarily due to the extensive use of natural gas across various industrial applications, such as power generation and manufacturing. Gas burners are preferred for their high efficiency, lower emissions, and cost-effectiveness compared to other fuel types. Additionally, the increasing focus on reducing carbon footprints has driven many industries to shift from coal and oil to cleaner-burning natural gas. The reliability and high performance of gas burners further enhance their attractiveness in modern industrial settings. As a result, the gas segment is expected to maintain its dominant position in the BMS market.

The oil segment, on the other hand, is projected to experience a significant compound annual growth rate (CAGR) in the coming years. This growth is attributed to the versatility of oil as a critical energy source for a wide range of industries. Ongoing innovations in oil burner technology are improving fuel efficiency and reducing emissions, which helps sustain the demand for oil-based systems. As businesses continue to seek dependable energy solutions, the oil segment remains poised to play a significant role in the market. The segment is evolving to meet changing market dynamics and advancements in technology.

Burner Management System Market Segmentation: By Industry

-

Oil & Gas

-

Chemical & Petrochemical

-

Power

-

Metals & Mining

-

Food & Beverages

-

Others

The oil and gas segment holds the largest revenue share in the Burner Management System (BMS) industry, largely due to the widespread use of oil and gas in various industries, such as power generation and manufacturing. There is a strong demand for efficient and reliable burner management solutions within this sector. Furthermore, the ongoing shift toward cleaner energy sources has prompted many companies to invest in advanced burner systems that enhance fuel efficiency and reduce emissions. The established infrastructure and technological advancements within the oil and gas industry also play a crucial role in maintaining its dominant market position. As a result, the oil and gas segment is expected to continue leading the BMS market.

The chemical and petrochemical sector, however, is projected to experience the highest compound annual growth rate (CAGR) during the forecast period. This growth is driven by the increasing demand for chemical products used in sectors such as pharmaceuticals and agriculture. As industries focus on improving operational efficiency and safety, there is a rising need for advanced burner management systems specifically designed for chemical processes.

Additionally, stringent environmental regulations are prompting companies to adopt cleaner technologies to minimize emissions. Innovations in burner technology are enabling more precise control over combustion processes, which is critical for chemical manufacturing. Therefore, the chemical and petrochemical sector represents a significant growth opportunity within the BMS market.

Burner Management System Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America is expected to hold a significant revenue share in the Burner Management System (BMS) market. The presence of numerous BMS providers in the region will support market growth in the coming years. Additionally, government regulations and mandatory safety standards will drive the adoption of burner management systems across various industries. This adoption will help ensure health and safety measures in hazardous industrial environments.

The Middle East and Africa (MEA) region is projected to experience substantial growth in the BMS market. The higher number of oil and gas plants, along with major energy power projects in the region, is driving the adoption of burners and industrial boilers. This, in turn, is encouraging the implementation of burner management systems to enhance efficiency and safety.

The Asia Pacific region is anticipated to witness the highest compound annual growth rate (CAGR) in the BMS market. This growth is largely driven by rapid industrialization and increasing investments in safety systems across different sectors. In 2023, the Indian government introduced stricter safety standards for industrial operations, prompting companies to adopt burner management systems to ensure compliance and improve operational safety. Similarly, governments in China, India, and Japan are focused on reducing emissions, which is further driving the adoption of BMS solutions in the region.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has had a significant impact on the global economy, leading to reduced investments and capital expenditures across various industries. Many companies have faced financial difficulties, resulting in delayed or canceled projects, which in turn affected the demand for Burner Management Systems (BMS). As businesses focused on essential expenditures, non-essential projects, including BMS installations, were put on hold.

The pandemic also disrupted global supply chains, which affected the production and delivery of BMS components and equipment. Manufacturing facilities and logistics networks experienced closures, restrictions, and reduced capacities, causing production delays, shortages, and increased costs. These disruptions impacted the availability and timely delivery of burner management systems.

Furthermore, the uncertainty and volatility created by the pandemic led companies to adopt a more cautious approach to spending, prioritizing essential operations and implementing cost-cutting measures. This shift in focus has influenced decision-making processes, slowing down the adoption of new BMS solutions.

Latest Trends/ Developments:

In April 2024, Emerson Electric Co. launched the ASCO Series 148/149, a state-of-the-art motorized actuator and shutoff valve designed to enhance the safety and reliability of combustion systems. This system ensures rapid shutoff in less than a second, providing critical safety improvements for industrial fuel burners, even under extreme conditions. By boosting operational efficiency and meeting rigorous safety standards, this innovation aligns with the growing demand for advanced burner management solutions across various industries.

In February 2022, Babcock & Wilcox Enterprises, Inc. acquired Fossil Power Systems (FPS), strengthening its capabilities in combustion and emissions control technologies. This acquisition is part of Babcock & Wilcox's strategic plan to expand its footprint in the BMS market and enhance its technological expertise in these critical areas.

Key Players:

These are top 10 players in the Burner Management System Market :-

-

Emerson Electric

-

Bosch

-

Yokogawa

-

Mitsubishi Electric

-

Grundfos

-

Siemens Spirax

-

Sarco

-

Schneider Electric

-

Honeywell

-

Johnson Control

Chapter 1. Burner Management System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Burner Management System Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Burner Management System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Burner Management System Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Burner Management System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Burner Management System Market – By Component

6.1 Introduction/Key Findings

6.2 Hardware

6.3 Software

6.4 Services

6.5 Y-O-Y Growth trend Analysis By Component

6.6 Absolute $ Opportunity Analysis By Component, 2025-2030

Chapter 7. Burner Management System Market – By Application

7.1 Introduction/Key Findings

7.2 Multiple-Burner

7.3 Single-Burner

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Burner Management System Market – By Fuel Type

8.1 Introduction/Key Findings

8.2 Gas

8.3 Oil

8.4 Others

8.5 Y-O-Y Growth trend Analysis By Fuel Type

8.6 Absolute $ Opportunity Analysis By Fuel Type, 2025-2030

Chapter 9. Burner Management System Market – By Industry

9.1 Introduction/Key Findings

9.2 Oil & Gas

9.3 Chemical & Petrochemical

9.4 Power

9.5 Metals & Mining

9.6 Food & Beverages

9.7 Others

9.8 Y-O-Y Growth trend Analysis By Industry

9.9 Absolute $ Opportunity Analysis By Industry, 2025-2030

Chapter 10. Burner Management System Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Component

10.1.2.1 By Application

10.1.3 By By Fuel Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Component

10.2.3 By Application

10.2.4 By By Fuel Type

10.2.5 By By Industry

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Component

10.3.3 By Application

10.3.4 By By Fuel Type

10.3.5 By By Industry

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Component

10.4.3 By Application

10.4.4 By By Fuel Type

10.4.5 By By Industry

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Component

10.5.3 By Application

10.5.4 By By Fuel Type

10.5.5 By By Industry

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Burner Management System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Emerson Electric

11.2 Bosch

11.3 Yokogawa

11.4 Mitsubishi Electric

11.5 Grundfos

11.6 Siemens

11.7 Spirax Sarco

11.8 Schneider Electric

11.9 Honeywell

11.10 Johnson Control

Download Sample

Choose License Type

2500

4250

5250

6900