Bulk Flow meter for Process Control Market Size (2023 - 2030)

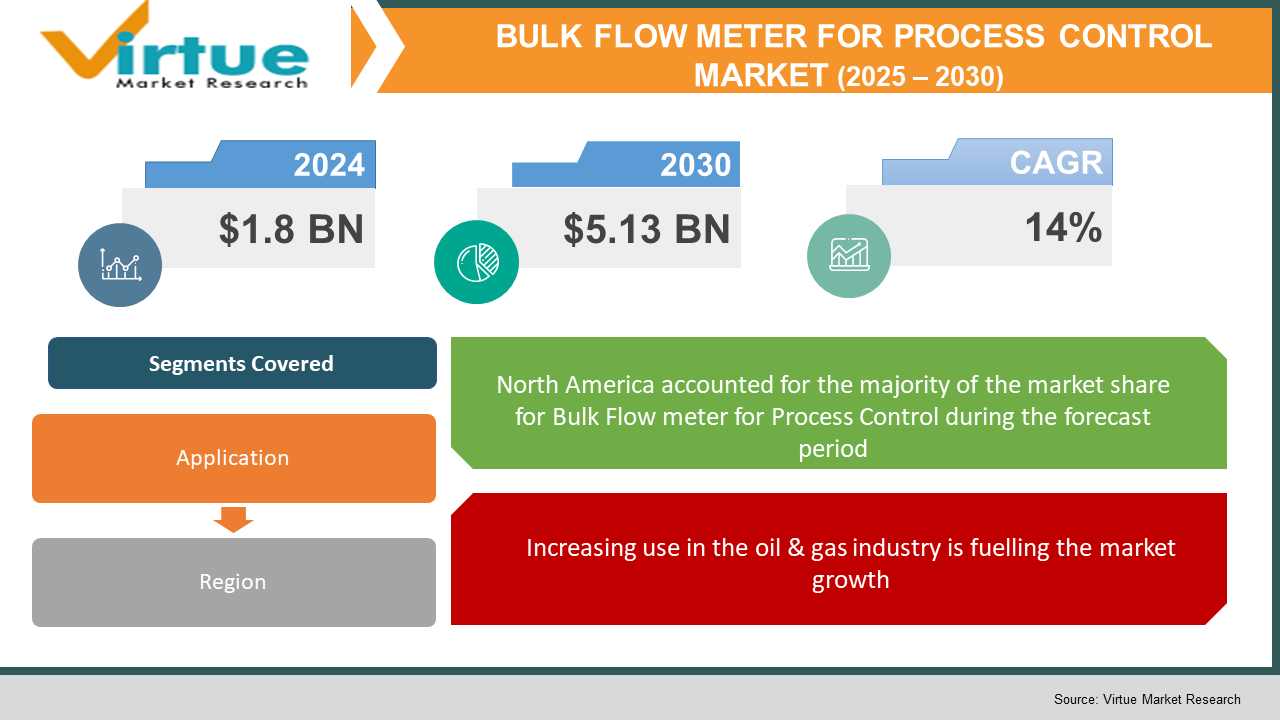

In 2022, the Global Bulk Flow meter for Process Control Market was valued at USD 1.8 billion and is projected to reach a market size of USD 5.13 billion by 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 14%.

Industry Overview:

A flow meter (also known as a flow sensor) is a device that measures linear, non-linear, mass, or volumetric flow rates to determine how much liquid, gas, or vapor is moving through a pipe or conduit. Since flow control is frequently crucial, measuring the flow of liquids and gases is a crucial requirement for many industrial applications. Numerous flow meter types can be employed, depending on the application. Bulk Flow Metering Systems are intended for top or bottom loading configurations at road and railcar tanker loading stations. The horizontal measuring unit's suitable size makes it simple to install in facilities with less space. Bulk flowmeters are frequently used for high-speed fueling on retail tank trucks or truck loading racks. Applications for fuel meters include the usage of heating oil, gasoline, diesel, and kerosene. Liquid flow measurement is a crucial requirement in many industrial applications. The capacity to take precise flow measurements is crucial in some processes and can be the difference between a profit and a loss. In other situations, taking measures incorrectly or failing to do so can have negative (or even disastrous) effects.

COVID-19 pandemic impact on the Bulk Flow meter for Process Control Market

The COVID-19 outbreak negatively impacted the market for flow meters. There are several restrictions on international trade as a result of the lockdown, which has caused a lack of raw resources in many nations. The slowdown in industrial activity also decreased demand for bulk flow meters, which led to negative growth for flow meters in 2020. Several end-use industries, including oil and gas, paper and pulp, and chemicals, temporarily halted output as a result of a decline in consumer demand, supply chain disruptions, and international trade restrictions. The impact was exacerbated by the decline in oil and gas prices, the wide supply-demand gap, the market's shifting raw material prices, and the rising cost of those resources.

MARKET DRIVERS:

Increasing use in the oil & gas industry is fuelling the market growth

The need for high-performance flow meters in the oil and gas and power generation sectors is predicted to contribute to the market growth for flow meters. These facilities require flow meters with improved precision, control, dependability, performance, and interoperability with various monitoring technologies. The market's participants are aggressively investing to provide cutting-edge products and solutions to monitor the flow rate of liquids, gases, and vapors. They are mostly focusing on the oil and gas industry.

Technology adoption and process automation are propelling the market's expansion

To cut down on lead times, waste, and unscheduled downtime, manufacturing facilities are focusing on automation. In the oil and gas industry and power generation, rapid industrialization and the deployment of measurement technology and tools are gaining ground. Given the recent discovery of shale gas deposits in North America, Europe, and the Asia Pacific, the adoption of products would be particularly significant in the oil and gas, chemical, and petroleum refinery industries. Technological advancements in areas like wireless monitoring and control, sophisticated sensors, and digital readouts are anticipated to propel market expansion throughout the forecast period. IoT sensors for smart metering solutions are being adopted by product manufacturers more frequently. Additionally, industry participants are consistently spending on R&D to create unique products.

MARKET RESTRAINTS:

Fluctuations in the cost of raw materials can affect the growth of bulk flow meters for the process control market

Flow meter prices are influenced by the material of construction and operating range. Metal, polymers, and alloys are just a few of the materials used to make flow meters. The working range and construction material of flow meters determine their price (MoC). Metal, polymers, and alloys are used in the construction of flow meters, among other materials. The difficulty OEMs have finding high-quality raw materials and managing supply schedules imposed by suppliers are factors that drive up the price of flow meters. The COVID-19 epidemic interrupted the global supply chain, which had an impact on the pricing of raw resources. Due to this, it is challenging to keep obligations, and manufacturers suffer significant losses.

Operational difficulties and high maintenance costs could limit market expansion

A few challenges that could impede the growth of the flow meter market include labor skill concerns related to the operational operations of smart systems and high initial prices associated with these cutting-edge technologies. In general, flow meters without moving components need less maintenance than devices with moving parts. But ultimately, all flow meters need some maintenance. When primary elements in differential pressure flowmeters are connected to their secondary elements, they require substantial pipes, valves, and fittings, therefore maintenance may be a recurring effort in such setups. Impulse lines need to be cleaned or replaced since they can corrode or plug. Periodic interior inspection is necessary for flowmeters with moving parts, especially if the liquid being metered is viscous.

BULK FLOW METER FOR PROCESS CONTROL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

14% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Honeywell International Inc., Siemens Group, Emerson Electric Co., ABB Ltd., Yokogawa Electric Corporation, Azbil Corporation. |

This research report on the global Bulk Flow meter for Process Control Market has been segmented based on application and region.

Bulk Flow meter for Process Control Market – By Applications

-

Refining & petrochemical

-

Oil & gas

-

Chemical

-

Power generation

-

Metals & Mining

-

Water & Wastewater

-

Others

Based on Applications, the Bulk Flow meter for Process Control Market is bifurcated into Refining & petrochemical, Oil & gas, Chemical, Power Generation, Metals & Mining, Water & Wastewater, and Others. Tanker loading and unloading of any types of liquids, as well as the manufacture of biofuel with batch blending, all use bulk flow meters. The oil and gas category is predicted to expand at the quickest rate with a CAGR of 6.6 % over the projected period. Additionally, it is anticipated that the growth of shale gas reserves would increase demand for the product in the oil and gas (O&G), chemical, and petroleum refinement industries. The rate of upstream and downstream operations, custody transfer, and liquid hydrocarbons within the O&G and chemical industries can all be measured effectively with flow meters.

Bulk Flow meter for Process Control Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

Geographically, the North American Bulk Flow meter for Process Control Market accounted for the maximum share of the global market. Continuous oil and gas exploration has increased the demand for flowmeters in this region. The European region is anticipated to see a growth in demand for magnetic, Coriolis, and ultrasonic flow meters for O&G management. The bulk flow meter for the process control market in Asia-Pacific is predicted to develop at the quickest rate during the forecast period. Increased demand from the oil & gas, water & wastewater, chemical, power generation, metals & mining, and other industries is fueling the flow meters market in the region.

Major Key Players in the Market

The key players operating in the global Bulk Flow meter for Process Control Market include

-

Honeywell International Inc.

-

Siemens Group

-

Emerson Electric Co.

-

ABB Ltd.

-

Yokogawa Electric Corporation

-

Azbil Corporation.

Notable happenings in the Global Bulk Flow meter for Process Control Market in the recent past:

-

Acquisition- In January 2021, Badger Meter, Inc. acquired Analytical Technology, Inc., for USD 44 million.

-

Product Launch- In February 2020, Siemens Digital Industries unveiled the SITRANS FS230 clamp-on ultrasonic flow meter with improved capabilities for measuring gas flow. The user-friendly operation and best-in-class performance of the FS230 allow it to handle natural, specialized, and system gas and fluid flow implementations.

Chapter 1. Bulk Flow meter for Process Control Market – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Bulk Flow meter for Process Control Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2023 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. Bulk Flow meter for Process Control Market – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. Bulk Flow meter for Process Control Market Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Bulk Flow meter for Process Control Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Bulk Flow meter for Process Control Market – By Application

6.1. Refining & petrochemical

6.2. Oil & gas

6.3. Chemical

6.4. Power generation

6.5. Metals & Mining

6.6. Water & Wastewater

6.7. Others

Chapter 7. Bulk Flow meter for Process Control Market - By Region

7.1. North America

7.2. Europe

7.3. Asia-Pacific

7.4. Latin America

7.5. The Middle East

7.6. Africa

Chapter8. Bulk Flow meter for Process Control Market – key players

8.1 Honeywell International Inc.

8.2 Siemens Group

8.3 Emerson Electric Co.

8.4 ABB Ltd.

8.5 Yokogawa Electric Corporation

8.6 Azbil Corporation.

Download Sample

Choose License Type

2500

4250

5250

6900