Building Materials Market Size (2025 – 2030)

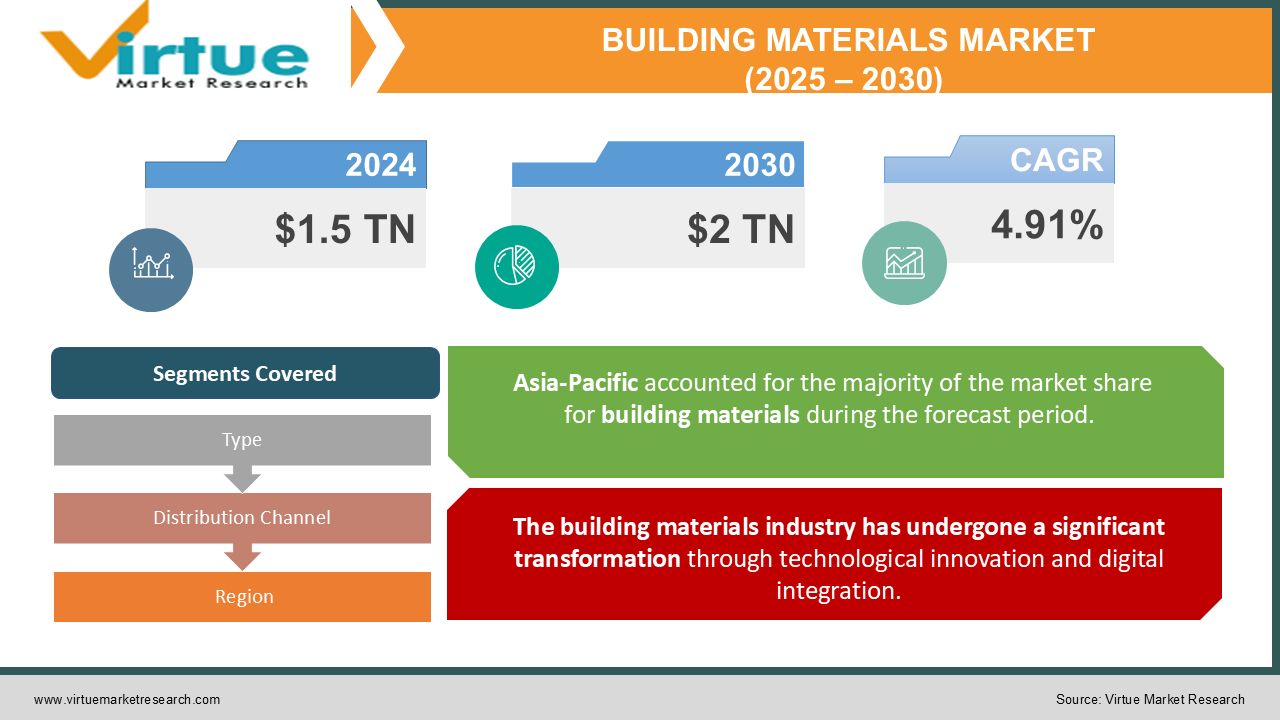

The Building Materials Market was valued at USD 1.5 trillion and is projected to reach a Market size of USD 2 trillion by the end of 2030. Over the forecast period of 2025-2030, the Market is projected to grow at a CAGR of 4.91%.

The building materials market has demonstrated remarkable resilience and growth in 2023, driven by rapid urbanization, infrastructure development, and increasing focus on sustainable construction practices. The industry encompasses a wide range of products from traditional materials like cement, steel, and timber to innovative sustainable alternatives and smart building components. The sector has witnessed significant technological advancements, particularly in developing eco-friendly materials and improving manufacturing processes to reduce environmental impact. The market has shown strong recovery post-pandemic, with increased construction activities across residential, commercial, and industrial sectors. Sustainable building materials have gained particular traction, reflecting growing environmental consciousness among consumers and stricter regulatory requirements for green building practices. The industry has also seen increased adoption of prefabricated and modular construction materials, responding to demands for faster construction timelines and cost efficiency.

Key Market Insights:

-

Concrete remained the most widely used construction material, with over 30 billion tons used worldwide in 2023.

-

Green building materials accounted for around 20% of the total market demand in 2023.

-

Recycled building materials saw a 15% increase in usage, driven by sustainability efforts.

-

Prefabricated materials contributed $150 billion to the building materials market in 2023.

-

The demand for structural steel surpassed 1.7 billion tons in 2023 due to urbanization projects.

-

Wood-based building materials saw a 10% rise in demand, totaling over 500 million cubic meters in 2023.

-

Concrete block production alone was valued at $75 billion in 2023.

-

Approximately 5% of the building materials market revenue came from sustainable insulation products.

-

Ready-mix concrete accounted for over 60% of all concrete used in construction projects in 2023.

-

Over 500 million square meters of roofing materials were sold globally in 2023.

Building Materials Market Drivers:

The building materials industry has undergone a significant transformation through technological innovation and digital integration.

Advanced manufacturing processes, including artificial intelligence and automation, have revolutionized production efficiency and quality control. Smart sensors and IoT integration enable real-time monitoring of material performance and durability, leading to improved product development and customer satisfaction. Digital twin technology has become instrumental in testing and optimizing building materials before physical production, reducing waste and improving cost-effectiveness. The integration of nanotechnology has led to the development of superior materials with enhanced properties such as self-cleaning surfaces, improved strength-to-weight ratios, and better thermal insulation capabilities. Manufacturers have adopted digital platforms for inventory management, supply chain optimization, and customer relationship management, resulting in streamlined operations and reduced operational costs. The implementation of blockchain technology has improved transparency in material sourcing and supply chain management, addressing concerns about sustainability and ethical procurement.

Environmental consciousness and stringent regulations have emerged as powerful drivers in the building materials market.

Manufacturers are increasingly focusing on developing eco-friendly materials and implementing sustainable production processes in response to growing environmental concerns and regulatory requirements. The industry has witnessed a significant shift toward circular economy principles, with increased emphasis on recycling and reusing materials. Companies are investing in research and development to create innovative materials with lower carbon footprints and reduced environmental impact. The adoption of renewable energy sources in manufacturing processes and the development of carbon-neutral production facilities demonstrate the industry's commitment to sustainability. Government regulations and green building certifications have created a strong market pull for sustainable building materials. Tax incentives and environmental credits have encouraged manufacturers to invest in cleaner technologies and sustainable practices. The growing awareness among consumers about environmental issues has created a premium market for eco-friendly building materials, driving innovation and competition in this sector.

Building Materials Market Restraints and Challenges:

The building materials market faces several significant challenges that impact its growth and development. Raw material price volatility remains a primary concern, with fluctuating costs of essential materials like steel, cement, and timber affecting profit margins and pricing stability. Supply chain disruptions, exacerbated by global events and geopolitical tensions, have created uncertainty in material availability and delivery timelines. Labor shortages in manufacturing and skilled workforce gaps present ongoing challenges for the industry. The technical expertise required for producing advanced building materials and operating sophisticated manufacturing equipment often exceeds available talent pools. Additionally, the high capital investment required for upgrading manufacturing facilities and implementing new technologies creates barriers for smaller players and market entrants. Regulatory compliance costs and environmental standards pose significant challenges, particularly for traditional materials manufacturers transitioning to sustainable practices. The industry also faces challenges in standardization and quality control across different regions and markets. The cyclical nature of the construction industry creates demand uncertainties, affecting production planning and inventory management. Market fragmentation and intense competition have led to price pressures and reduced profit margins. The need to constantly innovate while maintaining cost competitiveness stretches research and development budgets. Additionally, the industry faces challenges in managing waste reduction and implementing effective recycling programs while maintaining product quality and performance standards.

Building Materials Market Opportunities:

The building materials market presents numerous opportunities for growth and innovation. The increasing demand for sustainable and eco-friendly materials opens new markets for innovative products and solutions. The growing trend toward smart buildings and intelligent construction materials creates opportunities for developing integrated building solutions with embedded technology. Emerging markets and rapid urbanization in developing countries offer significant growth potential for building materials manufacturers. The rise of modular and prefabricated construction methods creates opportunities for specialized material development and manufacturing processes. Digital transformation in the construction industry presents opportunities for developing materials with enhanced connectivity and monitoring capabilities. The focus on energy efficiency and green building certifications creates markets for high-performance insulation materials and energy-saving building components. The growing renovation and retrofitting market offers opportunities for specialized materials designed for upgrading existing structures. Additionally, the increasing adoption of 3D printing in construction creates opportunities for developing specialized printing materials and composites. Research in biomimetic materials and nature-inspired solutions offers the potential for developing innovative building materials with superior properties. The trend toward localization of production presents opportunities for establishing regional manufacturing facilities and developing market-specific products. The growing emphasis on disaster-resistant construction creates markets for specialized materials with enhanced durability and resistance properties.

BUILDING MATERIALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By Type, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

CRH plc., Martin Marietta Materials, Inc., Vulcan Materials Company, Heidelberg Materials AG, Anhui Conch Cement Company Ltd., James Hardie Industries plc., CEMEX, S.A.B. de C.V., Taiwan Cement Corp., Eagle Materials Inc., Buzzi Unicem S.p.A. |

Building Materials Market Segmentation: By Type

-

Aggregates

-

Bricks

-

Cement

-

Others

Concrete and cement continue to dominate the market due to their versatility, durability, and cost-effectiveness. The segment accounts for approximately 35% of the total market share.

Composite materials are experiencing the highest growth rate due to their superior properties, including strength-to-weight ratio, durability, and customization possibilities.

Building Materials Market Segmentation: By Application

-

Residential

-

Commercial

-

Industrial

Distributors remain the primary channel, accounting for 40% of sales due to their established networks and ability to handle bulk orders.

E-commerce platforms are showing the highest growth rate, driven by digital transformation and changing customer preferences.

Building Materials Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

Asia-Pacific emerges as both the dominant and fastest-growing region, driven by rapid urbanization, infrastructure development, and economic growth in countries like China and India. The region's dominance is attributed to massive construction projects, government investments in infrastructure, and growing urbanization rates. Strong manufacturing capabilities, cost-competitive production, and increasing domestic demand contribute to its market leadership.

The region's construction boom, particularly in residential and commercial sectors, fuels demand for various building materials. Local manufacturing capabilities, technological advancement, and strategic government initiatives support market growth. The presence of large-scale infrastructure projects, including smart cities and transportation networks, creates sustained demand for building materials

COVID-19 Impact Analysis on the Building Materials Market :

The COVID-19 pandemic significantly impacted the building materials market, causing initial disruptions in supply chains and manufacturing operations. Production facilities faced temporary shutdowns, reduced workforce capacity, and logistics challenges during the early stages of the pandemic. However, the sector demonstrated remarkable resilience and adaptation to the new normal. The pandemic accelerated several trends in the industry, including digitalization of operations and increased focus on sustainable materials. Companies implemented remote monitoring systems and automated processes to maintain operations while ensuring worker safety. The shift toward home improvement projects during lockdowns created unexpected demand in the residential segment. Supply chain disruptions led to increased focus on local sourcing and inventory management strategies. Manufacturers adopted new safety protocols and workplace arrangements, leading to long-term improvements in operational efficiency. The pandemic also highlighted the importance of risk management and supply chain diversification in the industry. Digital transformation initiatives, including e-commerce platforms and virtual customer service, gained momentum during this period. The industry saw increased investment in research and development for antimicrobial materials and touchless solutions. Recovery strategies focused on building resilient supply chains and adopting flexible manufacturing processes.

Latest Trends/ Developments:

The building materials market is experiencing rapid evolution with several emerging trends. Smart building materials with integrated sensors and monitoring capabilities are gaining popularity. These materials can provide real-time data about structural health, environmental conditions, and energy efficiency. Sustainable and bio-based materials are becoming mainstream, with an increased focus on carbon-neutral products. Advanced manufacturing techniques, including 3D printing and automated production, are transforming traditional manufacturing processes. The industry is witnessing the growing adoption of circular economy principles, emphasizing material recycling and waste reduction. Digital transformation continues to reshape the industry through improved supply chain management and customer service. Innovation in nanomaterials and advanced composites is creating new possibilities for high-performance building materials. The trend toward prefabrication and modular construction is driving demand for standardized, pre-engineered materials. Energy-efficient and climate-responsive materials are gaining prominence in response to environmental concerns. The industry is seeing increased integration of renewable energy components in building materials. Developments in self-healing materials and adaptive building components represent cutting-edge innovations in the

Key Players:

-

CRH plc.

-

Martin Marietta Materials, Inc.

-

Vulcan Materials Company

-

Heidelberg Materials AG

-

Anhui Conch Cement Company Ltd.

-

James Hardie Industries plc.

-

CEMEX, S.A.B. de C.V.

-

Taiwan Cement Corp.

-

Eagle Materials Inc.

-

Buzzi Unicem S.p.A.

Chapter 1. Building Materials Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Building Materials Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Building Materials Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Building Materials Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Building Materials Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Building Materials Market – By Type

6.1 Introduction/Key Findings

6.2 Aggregates

6.3 Bricks

6.4 Cement

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Building Materials Market – By Application

7.1 Introduction/Key Findings

7.2 Residential

7.3 Commercial

7.4 Industrial

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Building Materials Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Building Materials Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 CRH plc.

9.2 Martin Marietta Materials, Inc.

9.3 Vulcan Materials Company

9.4 Heidelberg Materials AG

9.5 Anhui Conch Cement Company Ltd.

9.6 James Hardie Industries plc.

9.7 CEMEX, S.A.B. de C.V.

9.8 Taiwan Cement Corp.

9.9 Eagle Materials Inc.

9.10 Buzzi Unicem S.p.A.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Rapid urbanization and increasing infrastructure projects in both developed and developing regions are propelling the demand for building materials.

The production of traditional building materials, like cement and steel, generates significant carbon emissions, contributing to climate change.

The building materials market is led by several prominent global players who dominate various segments. Lafarge Holcim, Saint-Gobain, HeidelbergCement, CEMEX, and Dow Chemical Company stand out as major contributors to market innovation and growth. Other significant players include CRH plc, Kingspan Group, Owens Corning, BASF SE, and Armstrong World Industries. The market also sees strong competition from companies like Boral Limited, Knauf Gips KG, Guardian Industries, Nippon Sheet Glass Co., and Vulcan Materials Company.

Asia Pacific is the most dominant region in the market, accounting for approximately 35% of the total market share.

Asia Pacific is the fastest-growing region in the market.