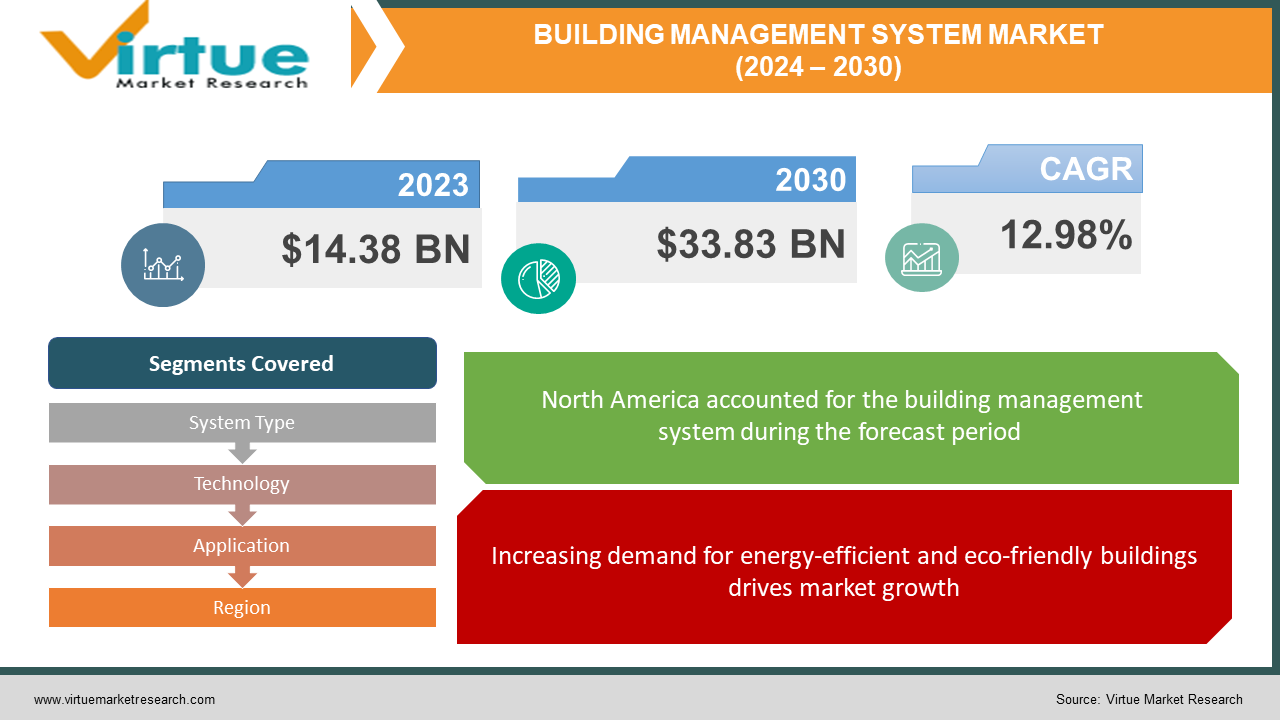

Building Management System Market Size (2024 – 2030)

The Building Management System Market was valued at USD 14.38 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 33.83 billion by 2030, growing at a CAGR of 12.98%.

The Building Management System (BMS) constitutes a computerized framework responsible for overseeing and supervising a range of building systems, encompassing heating, ventilation, air conditioning, lighting, security, fire prevention, and energy provision. The utilization of data gathered by sensors and meters, facilitates the adjustment of building system configurations, thereby contributing to the mitigation of energy consumption, maintenance expenses, and environmental footprint. Moreover, the BMS furnishes building operators and managers with instantaneous data and notifications, empowering them to regulate and enhance the building's operational efficiency.

Key Market Insights:

Several key factors are propelling the market growth, including heightened emphasis on crafting energy-efficient and environmentally sustainable buildings, increased integration of automated security systems within commercial structures, and the burgeoning acceptance of Building Automation Systems (BASs) leveraging Internet of Things (IoT) technology.

Building Management System Market Drivers:

Increasing demand for energy-efficient and eco-friendly buildings drives market growth.

Energy conservation through enhanced energy efficiency in buildings has emerged as a paramount concern on a global scale. Key elements of promoting energy efficiency in building projects encompass the adoption of energy-passive architectural designs before construction commencement and the utilization of low-energy building materials throughout the construction phase. The central thrust of sustainable building practices revolves around the seamless integration of renewable energy technologies and the deployment of energy-efficient equipment characterized by minimal operational energy requirements.

The escalating trajectory of energy consumption in both buildings and infrastructure underscores the imperative to devise alternative approaches aimed at conserving energy and fostering sustainable building operations. Attaining energy efficiency objectives entails implementing measures such as insulation enhancements, refining building methodologies, and adapting construction techniques to align with sustainable practices, thereby fueling the demand for eco-friendly automation systems. Consequently, this surge in demand for building management systems catalyzes market expansion.

Adopting Automated Security Systems in Commercial Buildings increases market growth.

Security systems represent indispensable components for all types of buildings, particularly within the realm of commercial establishments. They play a pivotal role in ensuring the uninterrupted continuity of business operations and safeguarding both physical assets and intellectual property. Diverse commercial properties, ranging from industrial complexes to financial institutions, governmental agencies, educational institutions, healthcare facilities, and oil and gas enterprises, necessitate tailored safety and security protocols owing to their unique susceptibility to various hazards.

In contrast to conventional apartment building security setups, security systems designed for commercial buildings offer a more comprehensive suite of solutions, incorporating a diverse array of automation technologies. These encompass multifaceted commercial access control mechanisms, an assortment of sensors and detectors such as infrared, microwave, or laser-based sensors, and perimeter security systems like Closed-Circuit Television (CCTV). Integration of these disparate elements into a cohesive security infrastructure endows commercial entities with enhanced flexibility and scalability, thereby fostering market expansion.

Building Management System Market Restraints and Challenges:

In recent years, the proliferation of two-way communication systems in buildings, facilitating advanced resource monitoring and control from centralized data centers, has spurred the demand for automation systems. Consequently, the widespread adoption of Building Management Systems (BMSs) has led to an increase in cyberattacks targeting companies, governmental entities, and newly constructed buildings, prompting legitimate concerns regarding the security of building systems.

Malicious software poses a significant threat by exploiting vulnerabilities in unsecured networks, potentially causing disruptions to building systems. Technical glitches and other viral threats may result in communication breakdowns and restricted access to sensitive data, adversely impacting the functionality of devices such as video surveillance systems within buildings.

While the market for automation systems continues to expand, the emergence of security challenges poses a significant hindrance to its progress. Failure to adequately address cybersecurity vulnerabilities could jeopardize the safety, privacy, and operational integrity of buildings. To sustain market growth and safeguard critical infrastructure, stakeholders must prioritize investment in robust cybersecurity measures.

Moreover, the consolidation of all system devices within a single control network within a building introduces a heightened risk of unauthorized access by malicious actors, potentially undermining confidence in building management systems and impeding market growth.

Building Management System Market Opportunities:

Smart buildings incorporate advanced building automation and management technology aimed at enhancing the monitoring and control of machinery, heating, cooling, and lighting systems within federal buildings across various countries, thereby bolstering system efficiency. Utilizing building management system technology, raw data from mechanical or electrical systems is collected, analyzed, and leveraged to pinpoint inefficiencies that can be promptly addressed.

The implementation of the smart buildings initiative empowers governments to effect tangible improvements through the adoption of innovative technologies and the identification of energy-saving opportunities. This initiative represents a concerted effort by governments to elevate energy performance management within federal buildings, ultimately resulting in diminished environmental impact and reduced energy expenditure through the deployment of intelligent BMSs.

By spearheading the smart buildings initiative, governments worldwide are enhancing the energy performance management of federal buildings, thereby curbing greenhouse gas emissions and mitigating energy costs. This concerted effort is poised to catalyze significant opportunities for market growth within the smart building sector.

BUILDING MANAGEMENT SYSTEM MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.98% |

|

Segments Covered |

By System Type, Technology, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Acuity Brands, Inc., Technovator International Limited, Arloid Automation Ltd., Honeywell International Inc., BuildingIQ, Inc., Azbil Corporation, Lutron Electronics Co., Inc., Johnson Controls International PLC, Crestron Electronics, Inc., GridPoint, Inc. |

Building Management System Market Segmentation: By System Type

-

Facility Management Systems (FMS)

-

Security and Access Control Systems

-

Energy Management Systems

-

Building Management Software (BMS)

-

Fire Protection Systems

-

Others

The global building management system market is categorized into various segments based on system type, which include Facility Management Systems (FMS), fire protection systems, security and access control systems, energy management systems, Building Management Software (BMS), and other specialized systems.

Building Management System Market Segmentation: By Technology

-

Wireless Technologies

-

Wired Technologies

The global building management system market is classified into two primary segments based on technology: wireless technologies and wired technologies. Wired technologies currently dominate the market as the largest segment, while they also exhibit the fastest growth trajectory within the market.

Building Management System Market Segmentation: By Application

-

Residential

-

Commercial

-

Industrial

The commercial sub-segment has emerged as the dominant force in the global building automation system market share. A commercial building automation system entails a network of switches and sensors that interface with the primary internal systems of a building, encompassing lighting, ventilation, heating, and cooling, as well as fire prevention measures, among other functionalities. These systems centralize the operation of all associated systems through a centralized control system, streamlining the management of current building automation systems. The proliferation of such applications within the automation sector is poised to fuel significant growth opportunities for the commercial sub-segment throughout the forecast period for the building automation system market.

Building Management System Market Segmentation- by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America has asserted its dominance in the global market and is anticipated to maintain its position as the fastest-growing sub-segment throughout the forecast period. The region benefits from a surge in construction activities and economic growth across various nations, thereby propelling market growth. Consumers in North America are particularly inclined towards achieving energy efficiency through the adoption of building automation systems, leading to tangible cost savings. Moreover, the rapid development of smart cities in countries like the U.S. and Canada is poised to create lucrative investment opportunities for stakeholders in the foreseeable future.

In Europe, significant market dominance is expected due to the presence of major manufacturers and a robust demand for Building Management Systems (BMSs). Germany, in particular, is anticipated to lead the region owing to an uptick in security breaches and an increasing demand for innovative safety and security solutions.

Within North America, the United States is poised to take the lead, fueled by heightened consumer spending capacity aimed at digitizing building facilities, consequently driving market demand.

In the Asia-Pacific region, China is anticipated to emerge as the dominant player, driven by a rising demand for eco-friendly building solutions.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has had a notable positive impact on the building automation industry, particularly within the industrial and residential sectors. The widespread adoption of work-from-home arrangements and home offices has elevated living standards, fostering a heightened desire among consumers for automated and seamless home and living experiences. However, the pandemic has led to a decrease in per capita income for many individuals.

Despite the economic challenges posed by COVID-19, the pandemic has spurred increased demand for intelligent building automation systems, driven by the adoption of green initiatives and the pursuit of enhanced energy efficiency in smart building management. Lockdown measures implemented in response to the pandemic have necessitated physical distancing protocols, influencing both individual and market behavior and contributing to shifts in economies and communities worldwide.

Latest Trends/ Developments:

-

In October 2023, Hangzhou Hikvision Digital Technology Co., Ltd. formed a partnership focused on green-building efficiency through the utilization of 'digital twins.' Hikvision introduced an innovative digital twin solution designed to address the growing demand for intelligent and environmentally conscious construction practices. This solution generates a virtual representation of buildings, enabling real-time monitoring of critical metrics such as energy efficiency and security. By facilitating prompt interventions during incidents or technical issues, the solution enhances overall operational efficiency.

-

In June 2023, Atrius, a division of ACUITY BRANDS, INC., unveiled its latest building automation platform, Atrius DataLab. This cutting-edge product revolutionizes operations within constructed spaces by providing centralized control. Atrius DataLab streamlines the automation of applications for scalable control, leveraging a data-agnostic architecture built on Microsoft Azure. Empowering users to develop customized applications, the platform assists facilities, energy, and sustainability managers in monitoring and reporting resource consumption.

-

In May 2023, ACUITY BRANDS, INC. completed its acquisition of KE2 Therm Solutions, Inc. This strategic move saw the integration of KE2 Therm, renowned for its intelligent refrigeration control solutions, into Distech Controls within the Intelligent Spaces Group business segment. The integration aims to enhance system efficiency, thereby reducing operational and service costs and ultimately contributing to improved profitability. This acquisition has expanded the company's product offerings and broadened its reach to new customers within the commercial market.

Key Players:

These are the top 10 players in the Building Management System Market: -

-

Acuity Brands, Inc.

-

Technovator International Limited

-

Arloid Automation Ltd.

-

Honeywell International Inc.

-

BuildingIQ, Inc.

-

Azbil Corporation

-

Lutron Electronics Co., Inc.

-

Johnson Controls International PLC

-

Crestron Electronics, Inc.

-

GridPoint, Inc.

Chapter 1. Building Management System Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Building Management System Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Building Management System Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Building Management System Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Building Management System Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Building Management System Market – By Application

6.1 Introduction/Key Findings

6.2 Residential

6.3 Commercial

6.4 Industrial

6.5 Y-O-Y Growth trend Analysis By Application

6.6 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Building Management System Market – By System Type

7.1 Introduction/Key Findings

7.2 Facility Management Systems (FMS)

7.3 Security and Access Control Systems

7.4 Energy Management Systems

7.5 Building Management Software (BMS)

7.6 Fire Protection Systems

7.7 Others

7.8 Y-O-Y Growth trend Analysis By System Type

7.9 Absolute $ Opportunity Analysis By System Type, 2024-2030

Chapter 8. Building Management System Market – By Technology

8.1 Introduction/Key Findings

8.2 Wireless Technologies

8.3 Wired Technologies

8.4 Y-O-Y Growth trend Analysis By Technology

8.5 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 9. Building Management System Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By System Type

9.1.4 By By Technology

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By System Type

9.2.4 By Technology

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By System Type

9.3.4 By Technology

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By System Type

9.4.4 By Technology

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By System Type

9.5.4 By Technology

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Building Management System Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Acuity Brands, Inc.

10.2 Technovator International Limited

10.3 Arloid Automation Ltd.

10.4 Honeywell International Inc.

10.5 BuildingIQ, Inc.

10.6 Azbil Corporation

10.7 Lutron Electronics Co., Inc.

10.8 Johnson Controls International PLC

10.9 Crestron Electronics, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Energy conservation through enhanced energy efficiency in buildings has emerged as a paramount concern on a global scale. Key elements of promoting energy efficiency in building projects encompass the adoption of energy-passive architectural designs before construction commencement and the utilization of low-energy building materials throughout the construction phase.

The top players operating in the Building Management System Market are - Acuity, Brands, Inc., Technovator International Limited, Arloid Automation Ltd., Honeywell International Inc., BuildingIQ, Inc., Azbil Corporation, Lutron Electronics Co., Inc., Johnson Controls International PLC, Crestron Electronics, Inc., GridPoint, Inc.

The COVID-19 pandemic has had a notable positive impact on the building automation industry, particularly within the industrial and residential sectors.

The implementation of the smart buildings initiative empowers governments to effect tangible improvements through the adoption of innovative technologies and the identification of energy-saving opportunities.

In Europe, significant market dominance is expected due to the presence of major manufacturers and a robust demand for Building Management Systems (BMSs). Germany, in particular, is anticipated to lead the region owing to an uptick in security breaches and an increasing demand for innovative safety and security solutions.