Building Insulation Market Size (2025-2030)

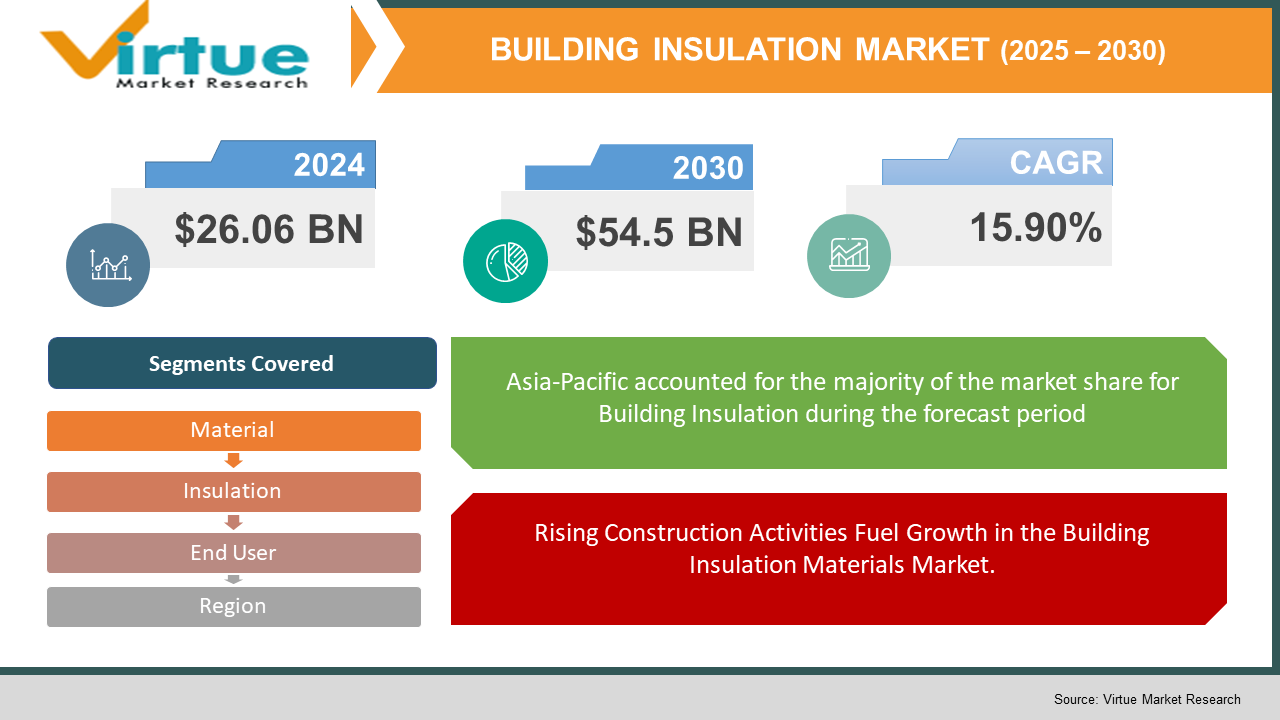

The Global Building Insulation Market was valued at USD 26.06 billion in 2024 and is projected to reach a market size of USD 54.5 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.90%.

Insulation materials for buildings are materials used for keeping heat or sound from passing from place to place. It is used often to insulate and/or soundproof particular parts of a home or to keep them inside or outside. The substances employed to make insulation building products include fibreglass, mineral wool, expanded polystyrene, extruded polystyrene, cellulose, etc. Fibreglass is a lightweight, durable material of extremely fine glass fibres that may be woven or employed for reinforcement. The various types of insulation such as bulk and reflective used in wall insulation, underfloor insulation, roof or ceiling insulation, window insulation, etc. The different end users are residential, commercial, and industrial.

Key Market Insights:

- Asia-Pacific accounted for 49.12% of the global market share in 2023, driven by rapid urbanization and energy-efficient construction initiatives.

- In 2023, Asia Pacific dominated the building thermal insulation market, accounting for a market share of 49.12%.

- The demand for fibreglass insulation is increasing, making up approximately 40% of the total market, due to its cost-effectiveness and fire resistance.

- Proper insulation in buildings can reduce heating and cooling costs by 30% to 50%, making it a key factor in energy conservation strategies. Wall insulation is the most widely used application and is expected to see a growth rate of 6.1% due to its effectiveness in maintaining indoor temperature.

- The adoption of high-performance insulation materials could lead to a reduction of up to 2 gigatons of CO₂ emissions annually by 2050.

Global Building Insulation Market Drivers:

Rising Construction Activities Fuel Growth in the Building Insulation Materials Market.

The projected expansion in the construction of buildings is expected to propel the growth of the building insulation future materials market. The construction activities consist of any work that is required for construction or building construction, destruction, assembly, alteration, installation, or equipment. Construction activities have been on the rise due to increasing industrialization and urbanization. The constant building processes are creating a tremendous demand for insulation products for the construction of houses and business buildings, as insulation is an energy-saving measure that reduces heat excess in hot weather or climate and reduces loss of heat from buildings in cold weather or cold climates. For instance, in November 2023, according to the Office of National Statistics, a UK statistics agency, the overall new work building production jumped by 15.8%, an all-time high at a value of £132,989 million in 2023. Additionally, in 2022, new work in total grew by £18,161 million, with 16.8% growth in the private sector and the public sector growth at 13.1%. Thus, rising building and construction works across the world will drive the thermoplastic elastomers market.

Increasing Infrastructure Investments Propel Growth in Building Insulation Materials Market.

Increased investment in the development of infrastructure will be seen to boost the growth of the building insulation materials market in the future. Infrastructure development is a process of constructing core foundation facilities for the stimulation of economic development and improvement of the quality of life. Increased infrastructural development will be likely to create demand for building products like exterior and interior insulation materials. For example, in June 2022, the Government of Canada revealed money for climate-resilient infrastructure projects. The Minister of Intergovernmental Affairs, Infrastructure and Communities, the Minister of Innovation, Science and Industry, and the CEO of the Standards Council of Canada released $46.7 million of funding for two key climate resilience projects; the Climate Resilient Built Environment initiative and the Standards to Support Resilience in Infrastructure Program. Moreover, in February 2022, the government of Brazil disclosed that IT would be investing in tourism, with BRL866 million ($51.36 million) in 762 infrastructure projects, to enhance the conditions of Brazilian tourist cities and increase the sector's potential, to attract even more visitors and welcome them with more comfort. The enhancements comprise renovations and construction of event spaces, public squares, waterfronts, asphalt paving, and viewpoints, among other interventions. Thus, increasing investment in infrastructure development will facilitate the growth of various housing and commercial projects, propelling the expansion of the building insulation materials market.

Global Building Insulation Market Restraints and Challenges:

The high cost of green insulation materials and health risks associated with usage of building insulation materials affects its growth negatively.

Growth in flexibility and high availability of green and sustainable materials are challenges that the Buildings Thermal Insulation Market is bound to encounter. The high availability is associated with quality concerns as well as with cost implications that will constrain the potential of the market to achieve growth about projections to the forecast period, which reaches 2028. Furthermore, the market is also affected by insufficient awareness on the part of the target population, which is spread all over the world, and increasing demand for high-energy modules, which is inhibiting the market from growing in the forecast period. The health hazards involved with using some of the insulation materials are a significant challenge to the development of the building insulation materials market. When used during the laying process, glass wool, for example, may irritate the eyes and respiratory tract. Carcinogen-expanding and extruding polystyrenes have been banned during the production process for their release of styrene. The safety risks related to such insulating solutions and stringent regulations for using them might curb their acceptance, hindering market growth.

Global Building Insulation Market Opportunities:

The growing need for building insulation materials because of the strict energy efficiency legislation is driving the market. Following this, the regulatory bodies of different countries are adopting strict rules to address climate change. Regulations tend to include specific insulation levels to minimize heat loss and enhance energy efficiency in buildings. Furthermore, these regulations not only pose a demand for insulation materials but also encourage construction companies and homeowners to invest in better insulation to ensure compliance. Accordingly, insulation material manufacturers are orienting themselves toward producing products that are industry standards and compliant. Apart from this, the growing emphasis on better insulation and lower energy use is contributing to the market growth. Additionally, contractors and builders are complying with building codes and energy efficiency requirements while choosing and installing insulation materials. In addition to this, regulations are promoting the application of new insulation technologies, like spray foam, rigid foam, or high-performance fibreglass insulation, that provide enhanced thermal performance.

BUILDING INSULATION MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

15.90% |

|

Segments Covered |

By material, end use, indulation, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Berkshire Hathaway, China National Building Material Company Limited, Compagnie de Saint-Gobain S.A., Holcim Group, Huntsman Corporation, Kaneka Corporation, and Recticel Group |

Global Building Insulation Market Segmentation:

Building Insulation Market Segmentation: By Material

- Fiberglass

- Mineral Wool

- Expanded Polystyrene

- Extruded Polystyrene

- Cellulose

- Others

Fiberglass is among the most widely used insulation materials due to its cost-effectiveness, fire resistance, and longevity. Mineral wool, such as rock wool and slag wool, is a good soundproof and fire-resistant material, making it suitable for commercial and industrial structures. Expanded polystyrene (EPS) is light and inexpensive, commonly applied in wall insulation and roof systems. Extruded polystyrene (XPS) offers increased compressive strength and moisture resistance and is suited for ground insulation. Cellulose insulation, produced using recycled paper, is green and ensures enhanced thermal performance. There are specialized products available, including aerogels, spray foam, and polyurethane, designed for specific applications requiring high-performance insulation. Material selection would also consider factors such as climate, efficiency in terms of energy use, and economy. Increasing demand for energy-efficient and sustainable buildings is fueling innovations in insulation materials. Regulatory requirements are also forcing manufacturers to create non-toxic and eco-friendly alternatives. New materials like vacuum insulation panels (VIPs) are being seen as game-changers in the sector.

Building Insulation Market Segmentation: By Insulation

- Bulk

- Reflective

Bulk insulation functions by capturing pockets of air within its material, limiting heat flow through conduction and convection. It contains products such as fibreglass batts, mineral wool rolls, and cellulose that are typically applied on walls, ceilings, and floors. Reflective insulation, however, works by reflecting radiant heat, hence suitable for application in hot weather conditions where solar heat gain is a factor. They are generally constructed with aluminium foils, polyethene bubbles, or foam boards and installed in attics and on roofs. Reflective insulation, on the other hand, excels when laid in an air gap. In total, mixing the two has better overall energy efficiency in structures. Insulation types by geographical area are diverse, with cold places preferring bulk insulation and hot regions preferring reflective insulation. With increasing energy regulations, hybrid insulation systems that integrate bulk and reflective properties are becoming popular. High-radiation environments such as industrial facilities and data centres are benefiting from enhanced insulation performance provided by advanced reflective technologies. The market is also seeing a growing uptake of smart insulation solutions with built-in thermal monitoring features.

Building Insulation Market Segmentation: By End User

- Residential

- Commercial

- Industrial

Residential is the largest market for building insulation, stimulated by the desire for energy conservation and indoor comfort. Homeowners are increasingly turning to insulation options to reduce heating and cooling expenses while increasing sustainability. The commercial market, which comprises offices, shopping malls, and hotels, is turning to insulation to meet green building standards and minimize operating costs. Industrial buildings need specialized insulation for temperature regulation, equipment protection, and fire resistance, especially in manufacturing facilities and warehouses. Increasing urbanization and government subsidies for energy-efficient homes are driving demand for residential insulation products. The commercial market is seeing a move towards green insulation materials to address corporate sustainability initiatives. In industrial use, high-performance insulation is essential for ensuring safe working conditions and enhancing energy efficiency. Retrofitting older buildings with improved insulation is becoming the preference to achieve worldwide carbon reduction goals. The increasing use of prefabricated construction techniques is also impacting insulation options in residential, commercial, and industrial applications. Intelligent insulation technologies combined with IoT sensors are becoming the next-generation insulation for residential, commercial, and industrial use.

Building Insulation Market Segmentation: Regional Analysis:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

The global building insulation market has strong regional differences, with Asia-Pacific dominating as a result of strong urbanization, infrastructure growth, and increasing energy-efficient building demand, especially in China and India. Europe is a close second, propelled by strict energy efficiency policies, green building strategies, and a strong impetus for sustainable construction. In North America, there is growing awareness of energy savings, smart insulation developments, and tax credits for green buildings driving the market forward. The Middle East & Africa region is becoming a developing market driven by infrastructure growth, industrialization, and the increased adoption of thermal insulation solutions in industrial and commercial sectors. Likewise, South America is also facing moderate growth through growing construction work and government initiatives for better building standards. Overall, all regions have a growing demand for sustainable insulation products, intelligent monitoring systems, and novel thermal solutions to fulfil global sustainability requirements.

COVID-19 Impact Analysis on the Global Building Insulation Market:

The COVID-19 pandemic had a mixed effect on the worldwide building insulation market. At first, disruptions to supply chains, shortages of labour, and suspended construction activity caused demand to reduce, postponing production and delivery of insulation materials. Nevertheless, as economies began to open up, governments made energy efficiency and green buildings the top priority to revive economic growth, fostering renewed market expansion. The pandemic also spurred the use of sustainable and smart insulation solutions, as companies and homeowners invested in minimizing energy expenditures and enhancing indoor air quality. Trends in remote working enhanced the demand for residential insulation upgrades, whereas industrial and commercial sectors experienced transitory slowdowns but subsequently recovered with tighter energy regulations. Despite short-term setbacks, the crisis reinforced the significance of energy-efficient buildings, placing insulation as one of the most important components in post-pandemic sustainable construction.

Latest Trends/ Developments:

The world-building insulation market is experiencing tremendous growth fueled by sustainability, integration of smart technology, and regulatory reforms. The increasing focus on net-zero energy buildings is driving the use of environmentally friendly insulation materials like aerogels, vacuum insulation panels (VIPs), and recycled cellulose. Smart insulation products with IoT-integrated sensors are becoming popular, enabling real-time monitoring of thermal efficiency and energy performance. The market is also moving toward non-toxic and bio-based insulation materials, lowering environmental footprints and improving indoor air quality. Modular and prefabricated construction trends are generating higher demand for pre-installed insulation systems, allowing for faster and more efficient installation. Further, tighter building energy codes and government incentives are driving the use of high-performance insulation in new and retrofit construction alike. The emphasis on moisture-resistant and fire-resistant insulation is also increasing, especially for commercial and industrial uses. With the evolution of nanotechnology and phase-change materials, the industry is likely to see increased innovation in high-efficiency thermal insulation products.

Key Players:

- Berkshire Hathaway Inc.

- China National Building Material Company Limited

- Compagnie de Sainy-Gobain S.A.

- Holcim Group

- Huntsman Corporation

- Kaneka Corporation

- Owens Corning

- Kingspan Group PLC

- Recticel Group

- Rockwool International A/S

Chapter 1. Building Insulation Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Building Insulation Market – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Building Insulation Market – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Insulation Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Building Insulation Market - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. Building Insulation Market - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Building Insulation Market – By Material

6.1 Introduction/Key Findings

6.2 Fiberglass

6.3 Mineral Wool

6.4 Expanded Polystyrene

6.5 Extruded Polystyrene

6.6 Cellulose

6.7 Others

6.8 Y-O-Y Growth trend Analysis By Material :

6.9 Absolute $ Opportunity Analysis By Material :, 2025-2030

Chapter 7. Building Insulation Market – By Insulation

7.1 Introduction/Key Findings

7.2 Bulk

7.3 Reflective

7.4 Y-O-Y Growth trend Analysis By Insulation

7.5 Absolute $ Opportunity Analysis By Insulation , 2025-2030

Chapter 8. Building Insulation Market – By End-Use

8.1 Introduction/Key Findings

8.2 Residential

8.3 Commercial

8.4 Industrial

8.5 Y-O-Y Growth trend Analysis End-Use

8.6 Absolute $ Opportunity Analysis End-Use, 2025-2030

Chapter 9. Building Insulation Market, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Insulation

9.1.3. By End-Use

9.1.4. By Material

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Insulation

9.2.3. By End-Use

9.2.4. By Material

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By Insulation

9.3.3. By End-Use

9.3.4. By Material

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By END-USE

9.4.3. By Insulation

9.4.4. By Material

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By END-USE

9.5.3. By Insulation

9.5.4. By Material

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Building Insulation Market – Company Profiles – (Overview, Packaging Product Portfolio, Financials, Strategies & Developments)

10.1 Berkshire Hathaway Inc.

10.2 China National Building Material Company Limited

10.3 Compagnie de Sainy-Gobain S.A.

10.4 Holcim Group

10.5 Huntsman Corporation

10.6 Kaneka Corporation

10.7 Owens Corning

10.8 Kingspan Group PLC

10.9 Recticel Group

10.10 Rockwool International A/S

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Building Insulation Market was valued at USD 26.06 billion in 2024 and is projected to reach a market size of USD 54.5 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 15.90%.

Rising energy efficiency regulations, growing demand for sustainable construction, and rapid urbanization are key drivers shaping the global building insulation market. Governments are enforcing stricter building codes, while the push for green buildings and expanding infrastructure projects—especially in emerging economies—is fueling the need for high-performance insulation solutions.

Based on Service Provider, the Global Building Insulation Market is segmented into material manufacturers, Raw Material Suppliers, Distributors & Wholesalers, and End-to-End Solution Providers.

Asia-Pacific is the most dominant region for the Global Building Insulation Market.

Berkshire Hathaway, China National Building Material Company Limited, Compagnie de Saint-Gobain S.A., Holcim Group, Huntsman Corporation, Kaneka Corporation, and Recticel Group are the key players in the Global Building Insulation Market.