Buckwheat Products Market Size (2025-2030)

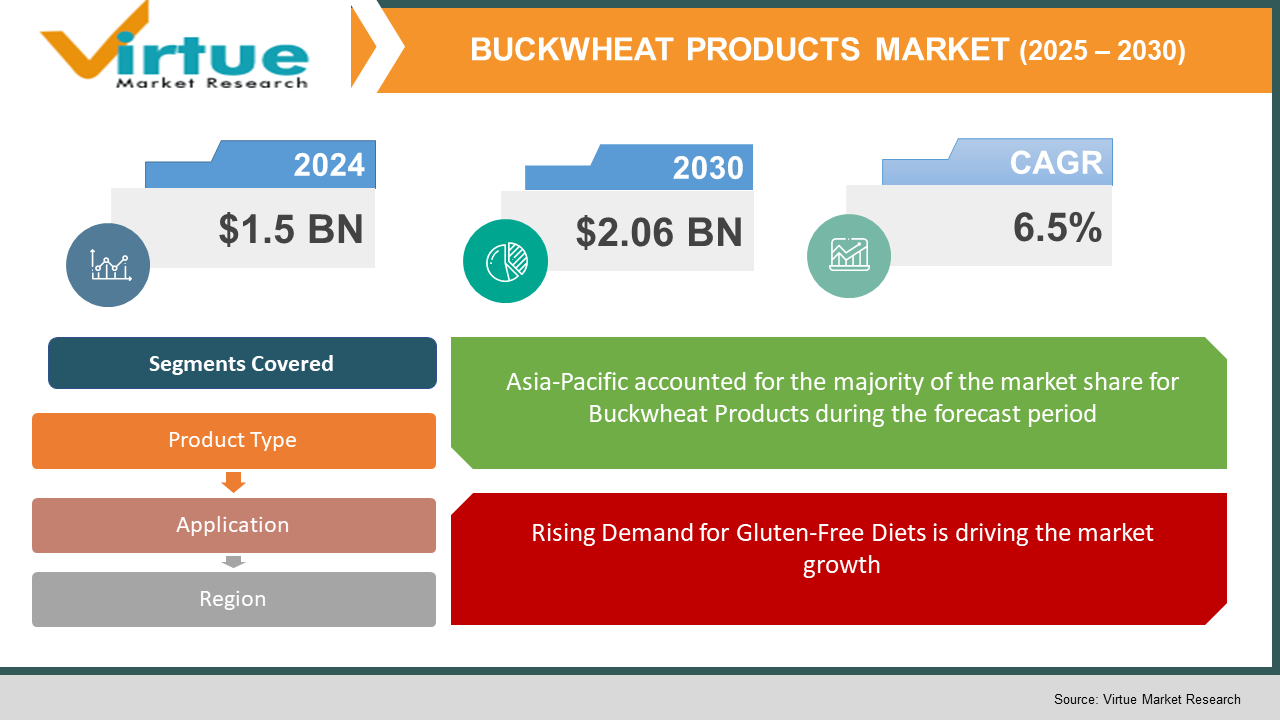

The Global Buckwheat Products Market was valued at USD 1.5 billion in 2024 and will grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 2.06 billion by 2030.

The Buckwheat Products Market focuses on various food items derived from buckwheat, including groats, flour, noodles, and beverages. Buckwheat is a pseudo-cereal known for its high nutritional value, being gluten-free, and rich in protein, fiber, and antioxidants. The increasing consumer preference for healthy and organic food products has led to significant market growth. The rising demand for gluten-free and plant-based diets has further boosted the adoption of buckwheat products in different food applications. The market is also benefiting from the growing trend of functional foods, with buckwheat being recognized for its potential cardiovascular and digestive health benefits.

Key Market Insights:

- The demand for buckwheat flour is increasing significantly due to its use in gluten-free baking, with sales rising by 20% in the past three years.

- The foodservice industry is expanding its use of buckwheat-based products, with restaurants and cafes offering gluten-free and plant-based menu options. Organic buckwheat products are gaining traction, with a 15% annual growth rate in organic food markets due to rising consumer awareness about pesticide-free foods.

- Buckwheat noodles, or soba, are a staple in Japanese cuisine and are witnessing a surge in global demand, especially in the U.S. and Europe.

- Online retail sales of buckwheat products have grown by 25% in the last two years, as e-commerce platforms provide better accessibility to specialty and health-focused food items.

Global Buckwheat Products Market Drivers

Rising Demand for Gluten-Free Diets is driving the market growth

The increasing prevalence of gluten intolerance, celiac disease, and a general shift toward gluten-free diets are major factors driving the growth of the buckwheat products market. Consumers are more aware of the potential health issues linked to gluten, including digestive disorders and inflammation. As a result, the demand for gluten-free alternatives has surged, and buckwheat, being naturally gluten-free, has become a preferred choice. Food manufacturers are responding to this trend by incorporating buckwheat flour, groats, and noodles into their product lines. Additionally, the popularity of paleo, keto, and plant-based diets further supports buckwheat’s market expansion, as it offers high protein and fiber content, making it a nutritious option.

Growing Consumer Preference for Organic and Functional Foods is driving the market growth

Consumers are increasingly shifting toward organic and functional foods due to rising health concerns and awareness of synthetic additives. Buckwheat is recognized for its rich nutrient profile, including antioxidants, magnesium, and fiber, making it a sought-after ingredient in functional foods. Additionally, organic buckwheat products are witnessing strong demand, as consumers prefer pesticide-free and non-GMO foods. The expanding trend of superfoods, which includes quinoa, chia seeds, and buckwheat, is driving product innovation and market growth. Governments and regulatory bodies are also promoting organic farming, ensuring stable growth for organic buckwheat products.

Expansion of E-commerce and Online Retailing is driving the market growth

The rise of online retail platforms has significantly contributed to the growth of the buckwheat products market. E-commerce has made specialty food items, including gluten-free and organic buckwheat products, more accessible to consumers worldwide. Online marketplaces offer a diverse range of products, from buckwheat flour and noodles to ready-to-eat meals, catering to health-conscious individuals. Additionally, digital marketing and influencer campaigns highlighting the benefits of buckwheat-based foods have further increased their popularity. Subscription-based food services and direct-to-consumer brands are also playing a crucial role in expanding the global reach of buckwheat products.

Global Buckwheat Products Market Challenges and Restraints

Fluctuating Raw Material Prices and Supply Chain Issues is restricting the market growth

Buckwheat production is highly dependent on climatic conditions, and any disruptions can lead to price volatility. Unfavorable weather patterns, such as droughts or excessive rainfall, can impact yield, affecting overall supply and pricing. Additionally, geopolitical tensions and trade restrictions in major buckwheat-producing countries like China and Russia can create supply chain constraints. These fluctuations make it challenging for manufacturers to maintain consistent pricing and supply, affecting market stability.

Limited Consumer Awareness in Emerging Markets is restricting the market growth

While buckwheat products are gaining traction in developed markets, their adoption in emerging economies remains limited due to a lack of awareness. Many consumers are unfamiliar with the nutritional benefits of buckwheat and continue to rely on traditional staple foods. Additionally, the higher price point of buckwheat-based products compared to conventional grains like wheat and rice poses a barrier to mass adoption. Targeted marketing campaigns, educational initiatives, and increased product availability are necessary to drive growth in these regions.

Market Opportunities

The growing focus on plant-based and functional foods presents a significant opportunity for buckwheat products. With consumers increasingly prioritizing health and wellness, buckwheat’s high protein, fiber, and antioxidant content make it an attractive ingredient. The expansion of foodservice offerings, including gluten-free and plant-based menu items, further drives demand. Moreover, advancements in food processing and packaging technologies are enhancing product shelf life, making buckwheat-based products more accessible. Government initiatives promoting sustainable agriculture and organic farming also contribute to market growth. As the awareness of buckwheat’s health benefits increases, new product developments, such as buckwheat-based energy bars, breakfast cereals, and plant-based protein blends, are expected to drive further market expansion.

BUCKWHEAT PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Bob’s Red Mill, The Birkett Mills, King Arthur Baking Company, Arrowhead Mills, and Eden Foods. |

Buckwheat Products Market Segmentation

Buckwheat Products Market Segmentation By Product Type:

- Groats

- Flour

- Noodles

- Beverages

- Others

The most dominant segment in the buckwheat products market is buckwheat flour. Buckwheat flour is widely used in baking, noodles, and gluten-free food products, making it a preferred choice among consumers. The rising demand for gluten-free and functional foods has propelled the adoption of buckwheat flour in both retail and foodservice industries. Its nutritional benefits, including high protein and fiber content, further enhance its appeal.

Buckwheat Products Market Segmentation By Application:

- Retail

- Foodservice

- Household

The most dominant application segment is foodservice. Restaurants, cafes, and bakeries are increasingly incorporating buckwheat-based products into their offerings, particularly in gluten-free and health-conscious menus. The popularity of buckwheat noodles, pancakes, and baked goods in international cuisines has further boosted its use in the foodservice industry.

Buckwheat Products Market Regional Segmentation:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific is the dominant region in the global buckwheat products market. Countries like China, Japan, and India are major producers and consumers of buckwheat-based foods. The cultural significance of buckwheat in traditional diets, such as Japanese soba noodles, drives strong demand. Additionally, growing health awareness and increasing disposable income levels in the region further support market growth.

COVID-19 Impact Analysis on the Buckwheat Products Market

The onset of the COVID-19 pandemic introduced significant turbulence into the buckwheat product market, initially manifesting as disruptions in established supply chains and a consequential fluctuation in raw material prices. These initial challenges created a period of uncertainty for producers and distributors, as the global health crisis impacted logistics and trade. However, this period of instability was followed by a notable shift in consumer behavior, as individuals increasingly prioritized healthier eating habits in response to the pandemic. This heightened focus on wellness catalyzed a surge in demand for buckwheat-based foods, positioning buckwheat as a key ingredient in the evolving dietary landscape. The pandemic served as an accelerator for the adoption of gluten-free and plant-based diets, trends that had already been gaining momentum. Buckwheat, with its inherent gluten-free properties and nutritional richness, became a central component in these dietary shifts. Consequently, sales of buckwheat flour, groats, and ready-to-eat buckwheat products witnessed a substantial increase, reflecting the growing consumer preference for wholesome and functional foods. Furthermore, the pandemic profoundly altered consumer shopping patterns, leading to a significant boost in online retail sales of buckwheat products. As consumers sought to minimize physical contact and adhere to social distancing guidelines, e-commerce platforms became the preferred channel for purchasing groceries and specialty food items. This shift towards online shopping enabled consumers to conveniently access a wide range of buckwheat products, contributing to the overall growth of the market. The convenience and accessibility offered by online retailers, coupled with the rising consumer interest in healthy eating, created a synergistic effect that propelled the sales of buckwheat products during the pandemic. In essence, while the pandemic initially posed challenges to the buckwheat market, it ultimately acted as a catalyst for growth, driving consumer demand and reshaping distribution channels.

Latest Trends/Developments

The burgeoning landscape of the food industry is witnessing a notable surge in the popularity of buckwheat, a versatile and nutritious pseudocereal, evidenced by the rising demand for buckwheat-based snacks. Consumers are increasingly drawn to products like granola bars and chips that incorporate buckwheat, driven by a growing awareness of its health benefits and gluten-free nature. This shift in dietary preferences reflects a broader trend towards healthier snacking options and a desire for diverse, nutrient-rich foods. Simultaneously, there's a significant uptick in investment dedicated to sustainable and organic buckwheat farming practices. This investment is fueled by the recognition of buckwheat's environmental advantages, including its ability to thrive in poor soil conditions and its minimal need for chemical inputs, aligning with the rising consumer demand for environmentally conscious products. The focus on organic farming further accentuates the appeal of buckwheat, catering to the growing segment of consumers who prioritize clean and sustainable food sources. Beyond snacks and raw ingredient sourcing, innovation in gluten-free bakery products is pushing buckwheat to the forefront of culinary creativity. Buckwheat flour, known for its distinct nutty flavor and nutritional profile, is becoming a staple in the development of gluten-free breads, pancakes, and pastries. This innovation addresses the dietary needs of individuals with celiac disease or gluten sensitivities, while also attracting health-conscious consumers seeking alternatives to traditional wheat-based products. The versatility of buckwheat flour allows for the creation of diverse and palatable gluten-free options, expanding the market and driving further interest in buckwheat as a primary ingredient. The convergence of these trends—rising snack popularity, investment in sustainable farming, and bakery innovation—underscores buckwheat's growing significance in the modern food industry. As consumers continue to prioritize health, sustainability, and dietary diversity, buckwheat is poised to play an increasingly prominent role in shaping the future of food.

Key Players:

- Bob’s Red Mill

- The Birkett Mills

- King Arthur Baking Company

- Arrowhead Mills

- Eden Foods

- Anthony’s Goods

- Haldeman Mills

Chapter 1. BUCKWHEAT PRODUCTS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. BUCKWHEAT PRODUCTS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. BUCKWHEAT PRODUCTS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. BUCKWHEAT PRODUCTS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. BUCKWHEAT PRODUCTS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. BUCKWHEAT PRODUCTS MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Groats

6.3 Flour

6.4 Noodles

6.5 Beverages

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Product Type

6.8 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. BUCKWHEAT PRODUCTS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Retail

7.3 Foodservice

7.4 Household

7.5 Y-O-Y Growth trend Analysis By Application

7.6 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. BUCKWHEAT PRODUCTS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. BUCKWHEAT PRODUCTS MARKET – Company Profiles – (Overview, Packaging Type, Portfolio, Financials, Strategies & Developments)

9.1 Bob’s Red Mill

9.2 The Birkett Mills

9.3 King Arthur Baking Company

9.4 Arrowhead Mills

9.5 Eden Foods

9.6 Anthony’s Goods

9.7 Haldeman Mills

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Buckwheat Products Market was valued at USD 1.5 billion in 2024 and will grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 2.06 billion by 2030.

Rising demand for gluten-free diets, growth in organic food consumption, and the expansion of e-commerce platforms.

By product type (groats, flour, noodles, beverages, others) and by application (retail, foodservice, household).

Asia-Pacific, due to high production and consumption in China, Japan, and India.

Bob’s Red Mill, The Birkett Mills, King Arthur Baking Company, Arrowhead Mills, and Eden Foods.