Buckwheat Market Size (2024 – 2030)

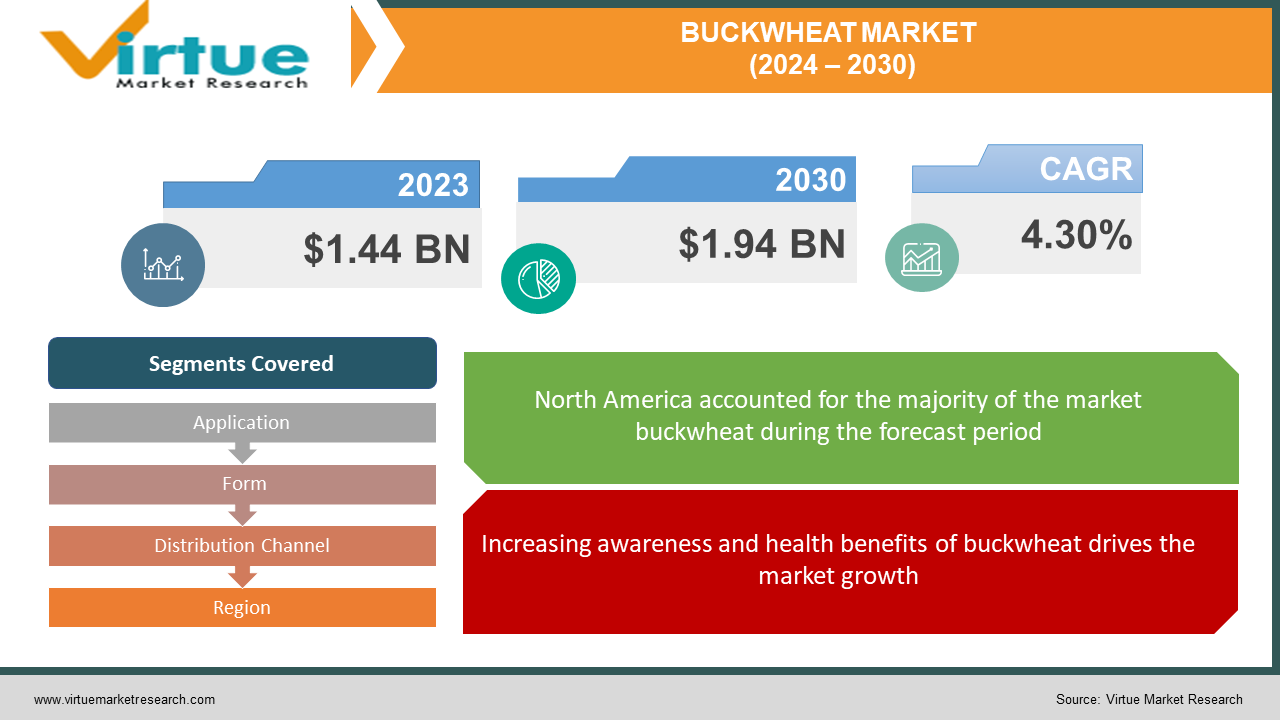

The Buckwheat Market was valued at USD 1.44 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 1.94 billion by 2030, growing at a CAGR of 4.30%.

Buckwheat, classified as a fruit seed, serves the purpose of a cover crop. Recognized as an excellent source of essential nutrients including manganese, copper, magnesium, dietary fiber, and phosphorus, among others, it boasts flavonoids like rutin and quercetin, contributing significantly to health-promoting functions. This nutritious food ingredient offers various health advantages, such as cholesterol reduction, mitigating the risk of high blood pressure and diabetes, preventing gallstones, shielding against heart disease, and aiding in the prevention of conditions like breast cancer and asthma. Additionally, buckwheat is acknowledged for its rich vitamin content, encompassing vitamin A, vitamin D, vitamin B12, vitamin B6, niacin, and more.

Key Market Insights:

Abundant in protein, buckwheat encompasses all eight essential amino acids, including lysine. Notably, it is gluten-free, positioning itself as a viable substitute for wheat, oats, rye, and barley in the context of nutritious foods. Beyond its dietary applications, buckwheat is employed in the formulation of various nutraceuticals, contributing to the prevention of blood clots and the reduction of histamine production. This, in turn, proves beneficial in alleviating airborne allergies and food intolerances. Consequently, the consistent demand for buckwheat is fueled by these health-related advantages. Moreover, the increasing number of health-conscious individuals is anticipated to propel the market's growth in the forthcoming years.

Buckwheat Market Drivers:

Increasing awareness and health benefits of buckwheat drives the market growth

The surge in demand for healthy, natural food ingredients, including buckwheat, is attributed to a shift in dietary patterns and consumer preferences toward healthier eating habits. Factors such as evolving lifestyles, altered work patterns, busy schedules, and sedentary routines have led to a heightened awareness of the health benefits associated with buckwheat. As consumers become more conscious of diseases like heart-related conditions, diabetes, and obesity, there is a notable inclination towards adopting healthier eating patterns that incorporate gluten-free and natural food ingredients, such as buckwheat and its derivatives.

Furthermore, the versatile use of buckwheat and its extracts in herbal formulations, offering diverse health advantages like fortifying blood vessels, enhancing blood circulation, and contributing to bone health management, drive market growth in the forecast years. The incorporation of buckwheat extract or flour into various food items enhances its application in the food and beverage sectors, acting as an additive and further propelling the global buckwheat industry.

The changing dietary preferences of consumers, coupled with a growing inclination toward nutritious food products, contribute to the increasing demand for buckwheat and its derivatives.

Buckwheat finds usage in a variety of food and beverage products, including snacks and healthy convenience foods, serving as a substitute for various flours like wheat and jowar. This multifaceted utilization aligns with changing consumer preferences, fostering the continued growth of the global buckwheat industry.

Buckwheat Market Restraints and Challenges:

Consumers with buckwheat allergies may experience adverse reactions, such as swelling in the mouth or hives, upon consumption of buckwheat. This allergic response is prevalent among individuals in the United States. In light of the inflammation and sensitivity-related side effects associated with buckwheat allergies, some consumers may opt for alternative healthy solutions, potentially impeding the growth of the market.

Furthermore, the market faces challenges stemming from a lack of consumer awareness regarding buckwheat and its associated health benefits. This limited understanding among consumers may hinder the overall growth potential of the market. Additionally, a notable constraint is the year-on-year decrease in buckwheat production, which poses a significant challenge for the market's sustained development.

Buckwheat Market Opportunities:

Given its natural gluten-free properties, buckwheat emerges as a robust contender in the rapidly growing gluten-free market. This surge is primarily propelled by the increasing diagnosis of celiac disease and a heightened awareness of health consciousness. Buckwheat has gained popularity across various products, including flours, cereals, and even pasta. Market research indicates a sustained upward trajectory in this sector, driven by the continual increase in consumer awareness and ongoing innovations in product development.

BUCKWHEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.30% |

|

Segments Covered |

By Application, Form, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Homestead Organics, Archer Daniels Midland Company, Birkett Mills, Ceres Organics, Krishna India, Doves Farm Foods Ltd., Galinta IR Partneriai, Homestead Organics Ltd, The Birkett Mills, Ningxia Newfield Foods |

Buckwheat Market Segmentation: By Application

-

Beverage Industry

-

Food Industry

-

Textile Industry

-

Cosmetics Industry

-

Others

The food & beverage segment secured the highest revenue share. Within this segment, establishments such as restaurants, cafes, hotels, and others contribute significantly to this share. Key manufacturing companies are strategically focusing on establishing a strong online product presence. Several of these companies not only offer their products on their own websites but also leverage various distribution channels. The market is further stimulated by the introduction of innovative buckwheat-based products in categories such as snacking items and breakfast. These offerings, infused with unique flavors, serve as a driving force for market growth, attracting and retaining consumers.

In the cosmetic and personal care industry, there is a growing popularity of buckwheat seed. This trend is attributed to consumers encountering skin and hair-related challenges due to factors like aging, improper diet, and environmental issues such as pollution and elevated temperatures. As a response to these concerns, there is an increasing demand for buckwheat seed among consumers, thereby contributing to enhanced business profitability for manufacturers operating in the buckwheat seed market.

Buckwheat Market Segmentation: By Form

-

Raw

-

Unhulled

-

Roasted

The organic buckwheat segment commanded the highest revenue share, signifying its prominence in the market. Organic buckwheat has emerged as the preferred choice among consumers, driven by the increasing global demand for organic and chemical-free food products. This preference aligns with a rising consumer interest in adopting healthier and more nutritious dietary choices without compromising on taste. The market's focus on organic buckwheat underscores the convergence of health consciousness and a preference for natural, chemical-free options among consumers on a global scale.

Buckwheat Market Segmentation: By Distribution Channel

-

Retailers

-

Supermarkets

-

Convenience Stores

-

Online Stores

-

Others

Retailers and supermarkets serve as the primary distribution hubs for buckwheat flours and grains. Buckwheat holds significant importance in the food industry, where it is utilized in the production of various food products, driven by the escalating demand for low-calorie and gluten-free food options. The landscape of distribution channels has been evolving, with the rapid growth of online stores offering home delivery services. This growth can be attributed to the widespread use of smartphones and the impact of the COVID-19 pandemic, which has accelerated the adoption of online shopping and home delivery services.

Buckwheat Market Segmentation: by Region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

North America dominated the market with the highest revenue share. The region boasts well-developed food service sectors, including bakery and confectionery, where there is a growing demand for healthier and nutritious food options. In the U.S., the Buckwheat market is estimated to be valued at US$373.3 Million in the year 2022.

Asia-Pacific is experiencing significant demand for buckwheat, primarily driven by shifts in consumer eating habits and increased awareness of the health benefits associated with buckwheat. Key industry players, such as Homestead Organics, Wels Ltd., Birkett Mills, Krishna India, and Ladoga LLC, contribute to the substantial market share in countries like China, Japan, and India. These players strategically employ merger and acquisition strategies to expand their business. China, as the world's second-largest economy, is projected to achieve a market size of US$428.9 Million by the year 2030, reflecting a compound annual growth rate (CAGR) of 6.8% over the analysis period.

In other geographic markets, Japan and Canada are expected to grow at rates of 2.8% and 3.6%, respectively, over the specified period. Within Europe, Germany is forecasted to grow at an approximate CAGR of 3.3%. These trends highlight the diverse and dynamic growth patterns across different regions in the global buckwheat market.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic has exerted a negative impact on the buckwheat market. Stringent import-export restrictions implemented by governments across North America, Asia, and Europe have impeded geographical expansion, business collaboration, and partnership opportunities. These limitations have posed obstacles to the growth of the buckwheat market within the food and beverage industry.

Despite these challenges, there has been a notable shift in consumer preferences towards natural plant-based foods, personal care items, and animal feed products during and after the COVID-19 pandemic. This change has contributed to a heightened global demand for buckwheat. The adaptability of buckwheat to align with the trend towards natural and plant-based products has positioned it favorably in meeting the evolving consumer needs in the post-pandemic landscape.

Latest Trends/ Developments:

- On July 01, 2022, Kröner-Stärke introduced a sustainable buckwheat flour designed specifically for bakery applications. Boasting high nutritional value and sensory quality, the product addresses consumers' preferences for clean labels. Its unique cold and swelling properties simplify the thickening of dough mixes without the need for heating.

- On March 28, 2022, Else Nutrition unveiled plant-based baby cereals in the market. These gluten-free cereals offer nine amino acids along with over 20 essential minerals and vitamins, catering to the nutritional needs of infants.

- In February 2022, ADM strengthened its position in South Africa by acquiring the South African Business Comhan, establishing itself as a leading flavor distributor in the region. This strategic move is expected to create new opportunities for customers in the South African market.

Key Players:

These are top 10 players in the Buckwheat Market: -

-

Homestead Organics,

-

Archer Daniels Midland Company

-

Birkett Mills,

-

Ceres Organics

-

Krishna India

-

Doves Farm Foods Ltd.

-

Galinta IR Partneriai,

-

Homestead Organics Ltd

-

The Birkett Mills

-

Ningxia Newfield Foods

Chapter 1. Buckwheat Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Buckwheat Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Buckwheat Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Buckwheat Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Buckwheat Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Buckwheat Market – By Application

6.1 Introduction/Key Findings

6.2 Beverage Industry

6.3 Food Industry

6.4 Textile Industry

6.5 Cosmetics Industry

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Application

6.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Buckwheat Market – By Form

7.1 Introduction/Key Findings

7.2 Raw

7.3 Unhulled

7.4 Roasted

7.5 Y-O-Y Growth trend Analysis By Form

7.6 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 8. Buckwheat Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Retailers

8.3 Supermarkets

8.4 Convenience Stores

8.5 Online Stores

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Buckwheat Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Application

9.1.3 By Form

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Application

9.2.3 By Form

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Application

9.3.3 By Form

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Application

9.4.3 By Form

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Application

9.5.3 By Form

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Buckwheat Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Homestead Organics,

10.2 Archer Daniels Midland Company

10.3 Birkett Mills,

10.4 Ceres Organics

10.5 Krishna India

10.6 Doves Farm Foods Ltd.

10.7 Galinta IR Partneriai,

10.8 Homestead Organics Ltd

10.9 The Birkett Mills

10.10 Ningxia Newfield Foods

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The surge in demand for healthy, natural food ingredients, including buckwheat, is attributed to a shift in dietary patterns and consumer preferences toward healthier eating habits.

Top Players operating in the Buckwheat Market are - Homestead Organics, Archer Daniels Midland Company, Birkett Mills, Ceres Organics, Krishna India, Doves Farm Foods Ltd., Galinta IR Partneriai, Homestead Organics Ltd, The Birkett Mills, and Ningxia Newfield Foods.

The COVID-19 pandemic has exerted a negative impact on the buckwheat market. Stringent import-export restrictions implemented by governments across North America, Asia, and Europe have impeded geographical expansion, business collaboration, and partnership opportunities.

Kröner-Stärke introduced a sustainable buckwheat flour designed specifically for bakery applications. Boasting high nutritional value and sensory quality, the product addresses consumers' preferences for clean labels. Its unique cold and swelling properties simplify the thickening of dough mixes without the need for heating.

Asia-Pacific is experiencing significant demand for buckwheat, primarily driven by shifts in consumer eating habits and increased awareness of the health benefits associated with buckwheat.