GLOBAL BUBBLE TEA MARKET (2024 - 2030)

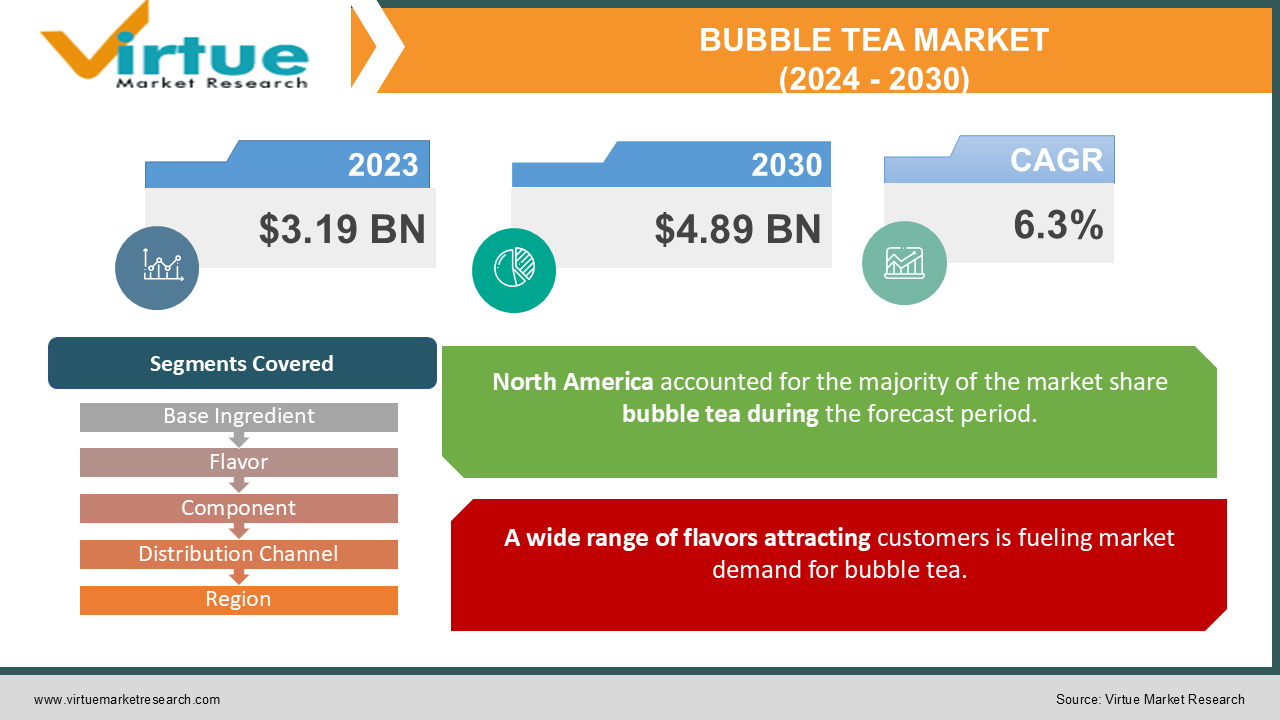

The Global Bubble Tea market was valued at USD 3.19 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 4.89 billion by 2030, growing at a CAGR of 6.3%.

Tea is a refreshing drink that helps in reducing stress and is also consumed around the world. Tea contains a lot of antioxidants and flavonoids which have medicinal benefits. People's continuously changing lifestyles are increasing the demand for varieties in tea flavors, and the majority of the population now prefers different flavors like fruit teas to caffeinated tea forms.

Key Market Insights:

- The bubble tea is prepared with ice, flavored syrups, and sugar. Increasing demand for tea, coffee, and other beverages more than carbonated drinks is expected to boost product demand.

- Raw ingredients used for preparing bubble tea are made with sugars, which cannot be considered beneficial for health if consumed in excessive amounts. In addition, the amount of sugar consumed along with bubble tea like sugar syrup while preparing can pose various health diseases like obesity, heart disease, and also some forms of cancer. These factors are responsible for restraining market growth. The popularity of bubble tea trends among the young generation is creating new opportunities for the players to offer a wide range of beverages.

Global Bubble Tea market Drivers:

Growing quick service in the food industry increases the demand for bubble tea

Continuous growth in the food and beverage industry around the world is one of the major factors driving the market's growth. Restaurants and cafes providing quick service, fast food, and casual dining are experimenting with bubble tea flavors to provide their customers with beverage variations.

A wide range of flavors attracting customers is fueling market demand for bubble tea.

Bubble tea drinks are low in calories and can help in concentration, motivation, and learning. Various developments in products, such as the introduction of bubble teas in new exotic flavors and aesthetic packaging, are increasing the market growth. Promoting bubble tea on social media platforms and retail e-commerce platforms are also the factors driving the market growth.

Global Bubble Tea market Restraints and Challenges:

Artificial preservatives and excess use of sugar syrup hamper the market growth.

The major restraint in the market is the use of artificial preservatives, color, and excess sugar in bubble tea. People can replace milk with other healthier types of milk like almond milk, low-fat milk, oat milk, etc considering their health but sugar syrup can’t be replaced. Not just that there is also artificial preservative available in the tea. An increase in the consumption of caffeine is hindering the market.

Global Bubble Tea market Opportunities:

Several manufacturers are working on tea bags with organic and biodegradable outer packaging to reduce their carbon footprint. They are also introducing a ready-to-drink product portfolio to boost sales.

They are investing in marketing strategies and celebrities promoting bubble tea such as Filipino-American celebrity Ivan Dorschner promoting Chatime’s Taiwanese bubble milk tea brand in the Philippines. Such opportunities are expected to boost market growth in the forecasted years.

GLOBAL BUBBLE TEA MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.3% |

|

Segments Covered |

By Base Ingredient, Flavor, Component, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

CuppoTee Company, ShareTea , Ten Ren’s Teatime , Gong Cha , Bubble Tea House Company , Chatime,Boba Box Limited Kuai Ke Li Enterprise Co., Ltd. , COCO International Co., Ltd. , Troika JC. |

Global Bubble Tea market Segmentation:

By Base Ingredient:

- Black Tea

- Green Tea

- Oolong Tea

- White Tea

In Base Ingredients, Black tea is the largest ingredient segment due to its authentic natural flavor. Bubble tea with green tea as a base ingredient is a growing popular drink among health-conscious consumers, it has various health benefits, like reducing inflammation and helping fight cancer. Consuming Green tea increases fat burning and improves the immunity of the body. Green tea can kill bacteria, which improves dental health and reduces the risk of oral infection. There are loads of antioxidants present in green tea, which is known for providing good health. In addition, green tea contains less caffeine compared to coffee. Therefore, green tea is leading to a rise in its demand in the forecasted period.

By Flavor:

- Original Flavor

- Coffee Flavor

- Fruit Flavor

- Chocolate Flavor

- Taro flavor

- Others

In the flavor segment, the fruit flavor is the dominating segment in the market with a maximum share of more than 37.85% of the overall revenue. It is expected to maintain its position throughout the forecast year. The wide range of fruit flavors, namely strawberry, mango, passion fruit, pineapple, cantaloupe, avocado, peach, coconut, lychee, grape, honeydew, kiwi, and banana, is the main factor driving the segment growth. Moreover, the fruit flavor of the tea is loaded with lots of antioxidants & vitamins and helps in cleansing the toxins from the body.

The taro flavor segment is considered to register the fastest growing segment due to the vanilla-like taste and creamy & starchy texture. In addition, the mild sweetness that the flavor offers makes it a suitable drink. The Taro milk tea does not have caffeine, which is another major factor that drives its demand.

The chocolate flavor segment has considerable growth in the market. Chocolate helps to stimulate the function of the brain and helps to release stress. Chocolate-flavored beverages are getting popular among people due to its flavor. In addition, chocolate-flavored bubble tea improves heart health and burns excess body fat. Therefore, the health benefits of chocolate and bubble tea and the rise in demand for chocolate-flavored beverages among consumers are expected to increase the growth of the market.

By Component:

- Flavor

- Creamer

- Sweetener

- Liquid

- Tapioca Pearls

- Others

In the Component, the tapioca pearls segment is the dominating segment in the market and is expected to grow at a CAGR of 8.0% during the forecast period. Tapioca pearls are the basic and primary components of bubble tea. They come with different health benefits such as easy to digest and weight gain for malnourished people. Moreover, it is rich in calcium and also improves blood clotting capacity. Hence, such health benefits increase the demand for bubble tea with tapioca pearls among consumers, which helps in the growth of the market.

By Distribution Channel:

- Supermarkets And Hypermarkets

- Convenience Store

- Online Retail

- Others

In the distribution channel, the online retail segment is the dominating segment in the market. Easy accessibility offered by online retail platforms boosts their demand for bubble tea, thus becoming a popular medium for the purchase of bubble tea kits. Easy availability of information, a wide range of products, and online demo videos of making bubble tea at home are increasing the growth of the bubble tea market during the forecast period.

Global Bubble Tea market Segmentation - By Region:

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

In the region, North America has the largest share with over 36% of the revenue, which makes it the dominating region in the industry. The high share can be considered due to the high demand & also due to consumption of fruity flavors-based tea beverages. Past few years, The U.S. has seen an increase in the number of bubble tea shops across the country. The U.S. is considered to capture the dominant market share in the North American regional market.

Asia-Pacific (APAC) dominates the bubble tea market and is also the fastest-growing region due to the high consumption of bubble tea within the region. Asia Pacific is anticipated to have the fastest growth rate for the forecasted period due to the increasing demand for healthy hot beverages. Bubble tea was first introduced in Taiwan in the early 80s. Thailand is one of the major consumers of bubble tea and according to the ASEAN Post, each citizen in the nation consumes six cups of bubble tea on an average per month. The product demand in this region is increased by social media influencers.

Europe is expected to witness growth during the forecast period due to the increase in the demand for healthy hot beverages in the region.

COVID-19 Pandemic: Impact Analysis

COVID-19 has impacted the bubble tea market. The investment costs and lack of employees affected the sales and production of beverages. However, manufacturers adopted new safety measures for developing the products. The online distribution channel is changing the consumer’s habits as it offers benefits such as easy payment methods, a wide range of products available, doorstep delivery, and discounts. This factor helped in the growth of the market during the pandemic and also increased the growth during the post-pandemic situation.

Latest Trends/ Developments:

- In 2019, TA Associates announced an investment in Gong Cha Group (Taiwan). The company aims to gain high business growth opportunities.

- In 2019, Secret Recipe announced a series of boba tea flavors including flavors, such as caramel, boba brown sugar milk tea, boba milk tea, boba signature tea, and boba midnight blue which provide quality tea to the customers.

Key Players:

These are the top 10 players in the Global Bubble Tea market:-

- CuppoTee Company

- ShareTea

- Ten Ren’s Teatime

- Gong Cha

- Bubble Tea House Company

- Chatime

- Boba Box Limited

- Kuai Ke Li Enterprise Co., Ltd.

- COCO International Co., Ltd.

- Troika JC.

Chapter 1. Global Bubble Tea Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Bubble Tea Market – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. Global Bubble Tea Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Bubble Tea Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Bubble Tea Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Bubble Tea Market – By Base Ingredient

Black Tea

Green Tea

Oolong Tea

White Tea

Chapter 7. Global Bubble Tea Market – By Flavor

7.1. Original Flavor

7.2. Coffee Flavor

7.3. Fruit Flavor

7.4. Chocolate Flavor

7.5. Taro flavor

7.6. Others

Chapter 8. Global Bubble Tea Market – By Component

8.1. Flavor

8.2. Creamer

8.3. Sweetener

8.4. Liquid

8.5. Tapioca Pearls

8.6. Others

Chapter 9. Global Bubble Tea Market – By Distribution Channel

9.1. Supermarkets And Hypermarkets

9.2. Convenience Store

9.3. Online Retail

9.4. Others

Chapter 10. Global Bubble Tea Market, By Geography – Market Size, Forecast, Trends & Insights

10.1. North America

10.1.1. By Country

10.1.1.1. U.S.A.

10.1.1.2. Canada

10.1.1.3. Mexico

10.1.2. By Base Ingredient

10.1.3. By Flavor

10.1.4. By Component

10.1.5. Distribution Channel

10.1.6. Countries & Segments - Market Attractiveness Analysis

10.2. Europe

10.2.1. By Country

10.2.1.1. U.K.

10.2.1.2. Germany

10.2.1.3. France

10.2.1.4. Italy

10.2.1.5. Spain

10.2.1.6. Rest of Europe

10.2.2. By Base Ingredient

10.2.3. By Flavor

10.2.4. By Component

10.2.5. Distribution Channel

10.2.6. Countries & Segments - Market Attractiveness Analysis

10.3. Asia Pacific

10.3.2. By Country

10.3.2.2. China

10.3.2.2. Japan

10.3.2.3. South Korea

10.3.2.4. India

10.3.2.5. Australia & New Zealand

10.3. Asia-Pacific

10.3.2. By Base Ingredient

10.3.3. By Flavor

10.3.4. By Component

10.3.5. Distribution Channel

10.3.6. Countries & Segments - Market Attractiveness Analysis

10.4. South America

10.4.3. By Country

10.4.3.3. Brazil

10.4.3.2. Argentina

10.4.3.3. Colombia

10.4.3.4. Chile

10.4.3.5. Rest of South America

10.4.2. By Base Ingredient

10.4.3. By Flavor

10.4.4. By Component

10.4.5. Distribution Channel

10.4.6. Countries & Segments - Market Attractiveness Analysis

10.5. Middle East & Africa

10.5.4. By Country

10.5.4.4. United Arab Emirates (UAE)

10.5.4.2. Saudi Arabia

10.5.4.3. Qatar

10.5.4.4. Israel

10.5.4.5. South Africa

10.5.4.6. Nigeria

10.5.4.7. Kenya

10.5.4.10. Egypt

10.5.4.10. Rest of MEA

10.5.2. By Base Ingredient

10.5.3. By Flavor

10.5.4. By Component

10.6.5. Distribution Channel

10.5.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Global Bubble Tea Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1. CuppoTee Company

11.2. ShareTea

11.3. Ten Ren’s Teatime

11.4. Gong Cha

11.5. Bubble Tea House Company

11.6. Chatime

11.7. Boba Box Limited

11.8. Kuai Ke Li Enterprise Co., Ltd.

11.9. COCO International Co., Ltd.

11.10. Troika JC.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Continuous growth in the food and beverage industry around the world is one of the major factors driving the market's growth. Restaurants and cafes providing quick service, fast food, and casual dining are experimenting with bubble tea flavors to provide their customers with beverage variations.

The top players operating in the Bubble Tea Market are - CuppoTee Company

ShareTea, Ten Ren’s Teatime, Gong Cha, Bubble Tea House Company, Chatime, Boba Box Limited, Kuai Ke Li Enterprise Co., Ltd., COCO International Co., Ltd., Troika JC.

The COVID-19 has impacted the bubble tea market. The investment costs and lack of employees affected the sales and production of beverages. However, manufacturers adopted new safety measures for developing the products. The online distribution channel is changing the consumer’s habits as it offers benefits such as easy payment methods, a wide range of products available, doorstep delivery, and discounts.

In 2019, TA Associates announced an investment in Gong Cha Group (Taiwan). The company aims to gain high business growth opportunities. Secret Recipe announced a series of boba tea flavors which include flavors, such as caramel, boba brown sugar milk tea, boba milk tea, boba signature tea, and boba midnight blue which provide quality tea to the customers.

Asia-Pacific (APAC) dominates the bubble tea market and is also the fastest-growing region due to the high consumption of bubble tea within the region. Asia Pacific is anticipated to have the fastest growth rate for the forecasted period due to the increasing demand for healthy hot beverages.