Bread Maker Market Size (2024-2030)

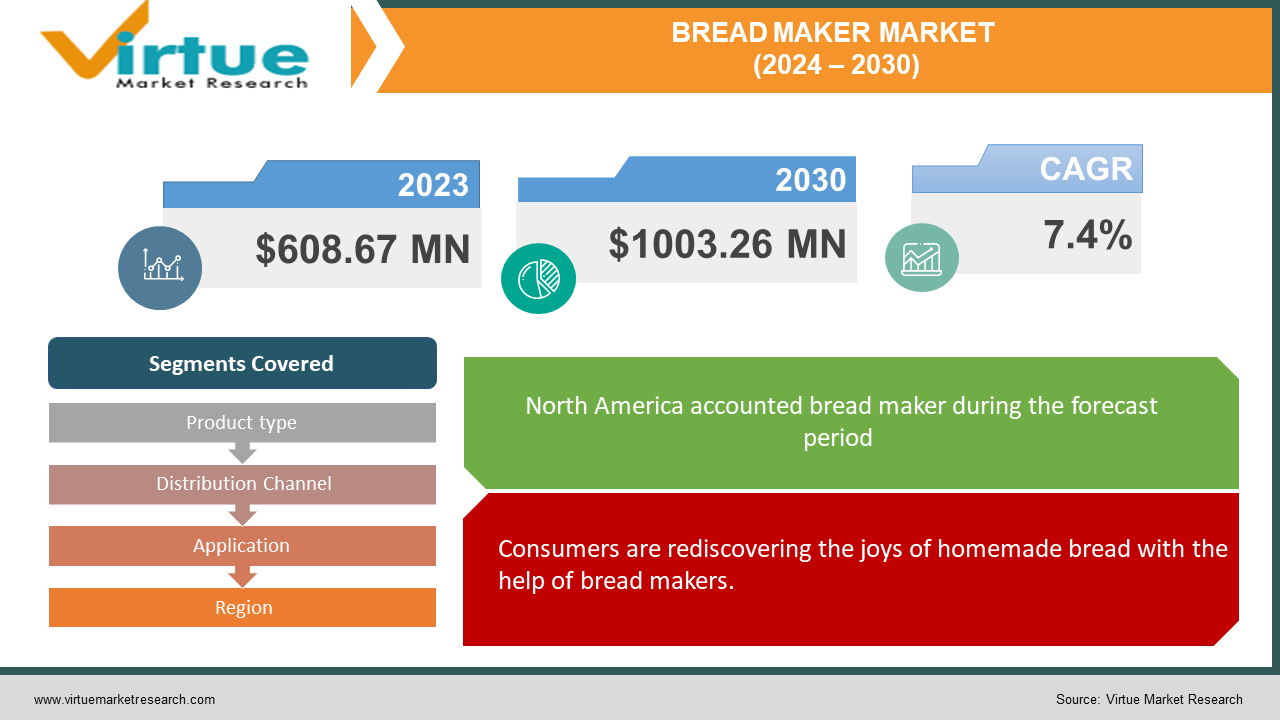

The bread maker market was valued at USD 608.67 million in 2023 and is projected to reach a market size of USD 1003.26 million by the end of 2030. Over the forecast period of 2024–2030, the number is projected to grow at a CAGR of 7.4%.

The bread maker market is on the rise, driven by people's love for fresh-baked bread and the convenience these appliances offer. Home bakers are enjoying the satisfaction of creating their loaves, while busy schedules are met with the ease of automated baking. Bread makers cater to various dietary needs and preferences, allowing for healthier choices and control over ingredients. This trend is reaching kitchens worldwide, with online retailers leading the way in distribution due to their wide selection and competitive pricing. From horizontal loaves ideal for bigger families to vertical models for smaller spaces, the bread maker market offers a slice of deliciousness and convenience for everyone.

Key Market Insights:

Bread Maker Market Drivers:

According to market segmentation, the fastest-growing distribution channel is online retail, driven by expanding customer demand and convenience, while the largest and fastest-growing category is horizontal loaf bread makers, which are preferred for their larger capacity. Subscription services, dietary-specific settings, smart technology, and sustainability initiatives are just a few of the innovations that are influencing industry trends, guaranteeing growth, and meeting changing customer needs.

Bread Maker Market Drivers:

Consumers are rediscovering the joys of homemade bread with the help of bread makers.

There's a renewed love affair with the aroma and satisfaction of freshly baked bread at home. Bread makers act as a bridge for those who may not have extensive baking experience. These appliances simplify the process, allowing anyone to create delicious loaves. Additionally, the ability to control ingredients is a major draw for those with specific dietary needs or a desire to explore different grains and flours.

Busy lifestyles find solace in the automated baking offered by breadmakers.

Busy schedules often leave little time for elaborate baking projects. Breadmakers are a game-changer for time-pressed individuals and families. They automate the entire process, from kneading the dough to controlling the rise and baking. With minimal effort, fresh bread can be enjoyed at home, offering a delicious and comforting alternative to store-bought options.

Bread makers empower users to customize ingredients for healthier bread options.

The focus on health and wellness is influencing every aspect of our lives, and bread consumption is no exception. Bread makers empower users to take charge of their bread's ingredients. This allows for healthier choices, such as using whole wheat flour or omitting allergens like gluten. For people with specific dietary needs or preferences, bread makers offer the flexibility to create loaves that cater to their health goals without sacrificing the taste of homemade bread.

The breadmaker market sees growth across regions, catering to households and businesses alike.

The desire for fresh bread isn't limited to any one region. The bread-making market is experiencing growth across the globe, with North America, Europe, and Asia Pacific leading the charge. This trend expands beyond households as well. Bakeries and restaurants are finding bread makers valuable tools for consistently producing fresh bread for their customers, ensuring a delightful and in-demand menu item.

Bread Maker Market Restraints and Challenges:

The bread-making market's rise isn't without its challenges. While the initial cost might be higher compared to store-bought bread, some consumers are swayed by the long-term savings of homemade loaves. However, the initial price tag can be a hurdle, especially for budget-conscious shoppers. Additionally, some bread makers, despite simplifying the process, might have features or settings that appear complex to new users. Unintuitive interfaces or overwhelming instructions can discourage potential buyers, particularly those unfamiliar with baking. Another hurdle is the countertop real estate these appliances occupy. In kitchens with limited space, the bulky design of bread makers can be a deal-breaker. Manufacturers need to consider space-saving designs or offer compact models to cater to smaller kitchens. Finally, there's the issue of limited functionality. Basic models might only offer a few pre-programmed settings, restricting the variety of breads one can create. This simplicity might appeal to some, but others crave the ability to explore diverse bread styles or incorporate specialty ingredients. Striking a balance between user-friendliness and catering to a wider range of baking preferences is crucial for manufacturers in this market.

Bread Maker Market Opportunities:

The bread-making market's potential extends far beyond its current popularity. As consumers gain confidence in these appliances, there's a growing appetite for premium features. These features cater to a sophisticated audience seeking a luxurious and hassle-free experience. Additionally, the market can expand by targeting specific dietary needs. Gluten-free bread makers with specialized settings can attract health-conscious bakers, while machines designed for artisan breads or regional specialties can cater to niche baking enthusiasts. Furthermore, smart technology is integrating seamlessly into appliances, and breadmakers can benefit from this trend. Voice control, recipe downloads, and automated troubleshooting can attract tech-savvy consumers who value convenience and control. Finally, manufacturers can address the challenge of limited space by creating compact and stylish bread makers that fit neatly into smaller kitchens. Even multi-functional models that can double as cake makers or dough mixers can broaden their appeal. By capitalizing on these opportunities, the bread-making market can ensure a slice of success for everyone involved, from manufacturers to baking enthusiasts seeking fresh and delicious homemade bread.

BREAD MAKER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.4% |

|

Segments Covered |

By Product type, Distribution Channel, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Panasonic Corporation, Koninklijke Philips N.V., Breville Group Limited, Midea Group Co., Ltd., Zojirushi Corporation, Newell Brands Inc., Cuisinart, Stanley Black & Decker, Inc. |

Bread Maker Market Segmentation: By Product Type

-

Horizontal Loaf Bread Makers

-

Vertical Loaf Bread Makers

The largest and fastest-growing segment in the bread maker market by product type is horizontal loaf bread makers, favored for their larger capacity to suit families and those who prefer bigger loaves. Vertical loaf bread makers are still a growing segment. Their compact size caters to smaller kitchens and those who prefer individual-sized loaves.

Bread Maker Market Segmentation: By Distribution Channel

-

Online Retail

-

Specialty Stores

-

Supermarkets & Hypermarkets

-

Others

The dominant distribution channels for bread makers are supermarkets and hypermarkets. They offer a wide selection and competitive prices, making them a convenient option for consumers. However, the fastest-growing segment is expected to be online retail. With increasing consumer preference for online shopping and the ability for retailers to offer a wider variety of bread makers with detailed information and reviews, online channels are poised for continued growth.

Bread Maker Market Segmentation: By Application

-

Household Use

-

Commercial Use

The largest growing segment is commercial use. The number of food service establishments expanding globally is driving the segment's expansion at an incredibly fast rate. The food service industry is adopting bread makers at a much higher rate because of the growing demand for a wider range of breads to match the changing tastes of clients across the board. Bakeries and restaurants are increasingly recognizing the efficiency and consistency that breadmakers bring to their bread production. The fastest-growing segment in the bread maker market by application is household use. This segment is driven by consumers seeking fresh bread at home and the convenience these appliances offer.

Bread Maker Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America reigns supreme. A strong culture of home baking is deeply ingrained, and busy lifestyles make these appliances a perfect solution. People enjoy the satisfaction of creating homemade loaves while appreciating the convenience these machines offer. Europe follows closely, making them a natural fit for the bread-making market. Additionally, a growing health-conscious population is driving the market further. European consumers value the ability to control ingredients in their bread, allowing them to explore healthier options and cater to specific dietary needs. The Asia-Pacific region is experiencing the fastest growth in the bread-making market. Rising disposable incomes and a growing desire for convenience are key factors. Busy professionals and families are increasingly turning to bread makers as a time-saving solution for enjoying fresh bread at home. While not yet a major player, South America shows promise for future growth in the bread-making market. The increasing adoption of modern appliances and a growing middle class are creating fertile ground for these machines. As the region develops further, we can expect to see a rise in breadmaker popularity. Similar to South America, this region is in the early stages of breadmaker market development. However, with rising urbanization and a growing awareness of health and wellness, the potential for future growth is significant. As these trends continue, breadmakers have the potential to become a popular appliance in these regions as well.

COVID-19 Impact Analysis on the Bread Maker Market:

The COVID-19 pandemic's impact on the bread-making market was mixed. Lockdowns and social distancing measures during the early stages triggered a surge in demand. Confined to their homes, people sought new activities and craved fresh food, leading many to discover (or rediscover) the joys of home baking. Breadmakers became a popular solution, experiencing a significant rise in sales. However, this initial boom was met with a challenge: global supply chain disruptions. Shortages of raw materials and manufacturing slowdowns caused by the pandemic limited the availability of bread makers in some regions. This temporary hurdle could have been frustrating for consumers eager to capitalize on the home baking trend. Despite the initial disruption, the long-term impact of COVID-19 on the bread-making market might be positive. The pandemic has brought about a renewed focus on health and hygiene, potentially leading some consumers to bake their bread for greater control over ingredients. This trend, coupled with the enduring appeal of convenience for busy lifestyles (including those who continue working from home), suggests there might be sustained growth in the breadmaker market. The ability of manufacturers to adapt and cater to these evolving needs will be crucial for continued success in the post-pandemic era. By focusing on innovative features that address health-conscious baking (think gluten-free or allergen-friendly settings) and emphasizing the time-saving benefits for busy schedules, the bread maker market can continue to rise and cater to the evolving needs of a diverse range of consumers.

Latest Trends/ Developments:

The bread-making market isn't just about satisfying our cravings for fresh bread anymore; it's embracing the future with innovations. Smart bread makers are being prioritized, boasting features like Wi-Fi connectivity, voice control operation, and recipe downloads. This focus on technology extends beyond mere convenience. The health and wellness movement is influencing the development of breadmakers with features that cater to specific dietary needs and preferences. Gluten-free settings, nut, and seed dispensers for adding healthy ingredients, and even options for creating sugar-controlled or high-fiber loaves are becoming increasingly common. Subscription services are also entering the scene, offering a layer of convenience and exploration. This eliminates the hassle of measuring and sourcing ingredients, opening doors to a world of new bread-baking possibilities. Finally, sustainability efforts are gaining traction, with breadmaker manufacturers taking environmental consciousness into account. There is a rise in bread makers made from recycled materials or featuring energy-efficient designs. Some manufacturers might even explore options for using leftover ingredients or creating less waste during the bread-making process. These trends highlight the dynamic nature of the bread-making market. By embracing innovation, catering to health-conscious consumers, offering convenient solutions, and keeping sustainability in mind, bread makers are poised to continue their rise and cater to the ever-evolving needs of a diverse range of bread enthusiasts around the world.

Key Players:

-

Panasonic Corporation

-

Koninklijke Philips N.V.

-

Breville Group Limited

-

Midea Group Co., Ltd.

-

Zojirushi Corporation

-

Newell Brands Inc.

-

Cuisinart

-

Stanley Black & Decker, Inc.

Chapter 1. BREAD MAKER MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. BREAD MAKER MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. BREAD MAKER MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. BREAD MAKER MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. BREAD MAKER MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. BREAD MAKER MARKET – By Distribution Channel

6.1 Introduction/Key Findings

6.2 Online Retail

6.3 Specialty Stores

6.4 Supermarkets & Hypermarkets

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Distribution Channel

6.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 7. BREAD MAKER MARKET – By Product

7.1 Introduction/Key Findings

7.2 Horizontal Loaf Bread Makers

7.3 Vertical Loaf Bread Makers

7.4 Y-O-Y Growth trend Analysis By Product

7.5 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 8. BREAD MAKER MARKET – By Application

8.1 Introduction/Key Findings

8.2 Household Use

8.3 Commercial Use

8.4 Y-O-Y Growth trend Analysis By Application

8.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. BREAD MAKER MARKET , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Distribution Channel

9.1.3 By Product

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Distribution Channel

9.2.3 By Product

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Distribution Channel

9.3.3 By Product

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Distribution Channel

9.4.3 By Product

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Distribution Channel

9.5.3 By Product

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. BREAD MAKER MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Panasonic Corporation

10.2 Koninklijke Philips N.V.

10.3 Breville Group Limited

10.4 Midea Group Co., Ltd.

10.5 Zojirushi Corporation

10.6 Newell Brands Inc.

10.7 Cuisinart

10.8 Stanley Black & Decker, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The bread maker market was valued at USD 608.67 million in 2023 and is projected to reach a market size of USD 1003.26 million by the end of 2030. Over the forecast period of 2024–2030, the number is projected to grow at a CAGR of 7.4%.

Rise in home baking, convenience, health-conscious choices, and global craving for freshness are the main drivers.

Based on distribution channels, the market is divided into online retail, specialty stores, supermarkets & hypermarkets, and others.

The most dominant region for the bread maker market is currently North America, driven by a strong culture of home baking and busy lifestyles.

Panasonic Corporation, Koninklijke Philips N.V., Breville Group Limited, Midea Group Co., Ltd., Zojirushi Corporation, Newell Brands Inc., Cuisinart, and Stanley Black & Decker Inc. are the leading players in this market.