Bread Improvers Market Size (2024 – 2030)

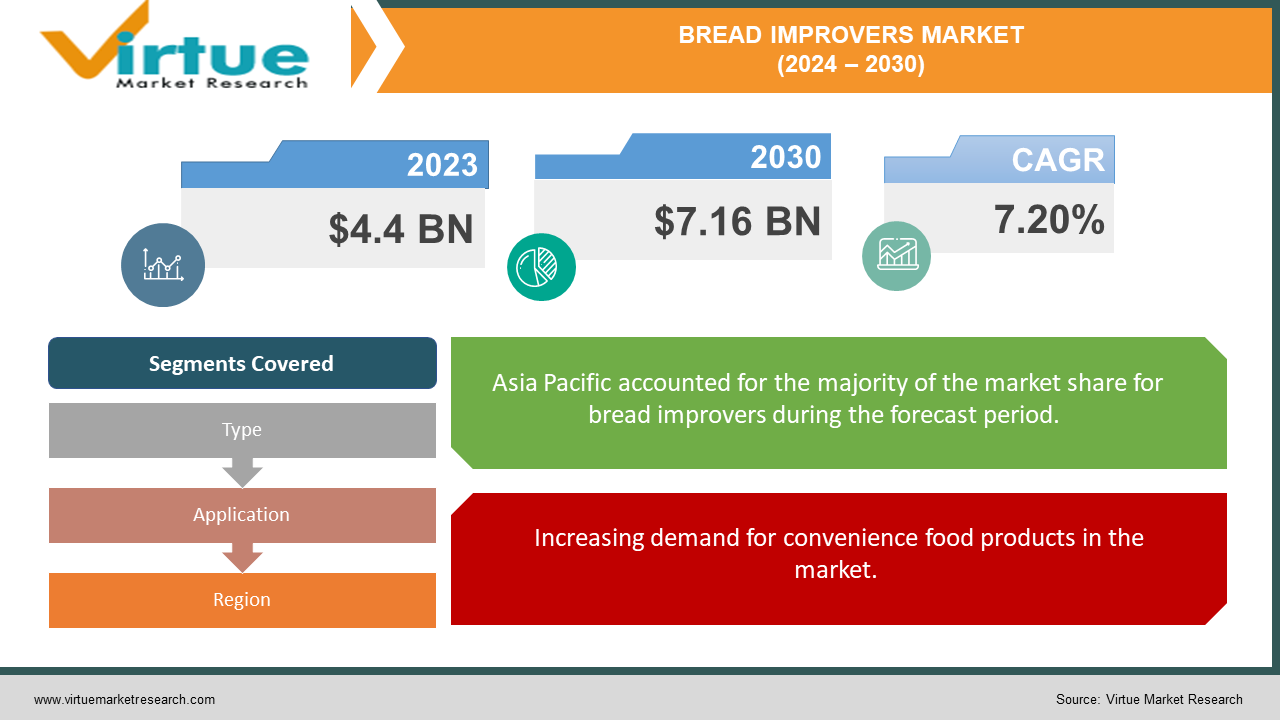

The Bread Improvers Market was valued at USD 4.4 billion in 2023 and is projected to reach a market size of USD 7.16 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.20%.

The bakery market is experiencing significant growth worldwide, due to a combination of changing consumer preferences, technological advancements, and the proliferation of high-quality bakery products. These improvers, including various enzymes, emulsifiers, and other active ingredients, are designed to improve dough stability, texture, and shelf life, while also addressing nutritional issues. With the increasing popularity of artisan and specialty bakeries, as well as the convenience of packaging, the demand for bakers is witnessing an increase in both the commercial and home sectors.

Key Market Insights:

Rapid growth has led consumers to demand higher-quality baked goods. A growing interest in clean-label materials. Innovation drives competition among major players for market dominance.

In addition, as health consumers seek products with clean labels and manufacturers strive to have clean processes, there is a noticeable shift in the way clean bread is processed. and clean. This market environment offers many opportunities for innovation and expansion, with key players focusing on product development, strategic partnerships, and regional expansion to capitalize on growing demand and remain competitive in a tough sector. the power of the bakery.

Bread Improvers Market Drivers:

Increasing demand for convenience food products in the market.

The market area is changing significantly due to increasing consumer preference for healthy food. The demand for food products that are easy to prepare, easy to eat, and easy to transport is increasing as modern lifestyles develop rapidly. Consumers are increasingly looking for ready-to-eat food solutions that easily fit into their busy schedules, and this trend is particularly evident in the bakery industry. Bakers are important for improving the quality, texture, and shelf life of baked goods. As a result, bakers are focusing on creating new products to meet this need.

In addition, the rise of online shopping and food delivery services has led to consumers looking for quality fried foods. Consumers are turning to e-commerce platforms and mobile apps to buy their favorite baked goods, looking for convenient options that can be delivered right to their doorstep. In this competitive environment, bakers are making bakers improve their bread to ensure that their products not only meet consumer expectations for quality but also stand out for quality and freshness in the market.

Bread Improvers Market Restraints and Challenges:

Adherence to international quality standards and regulations for baking ingredients products

Bakeries, especially bread makers, are facing major challenges in meeting global regulatory requirements. Maintaining compliance with different regulatory frameworks across different regions can be difficult and resource-intensive in the case of a globally expanding company. International quality standards, such as ISO certification and food safety regulations, impose strict limits on the content, production methods, and labeling of bakery products, including bread makers. Operational costs and regulatory burdens for manufacturers increase when meeting these standards often requires continuous testing, documentation, and monitoring throughout the manufacturing process. In general, compliance with international quality standards and regulations is a major obstacle for improved bread producers, requiring careful management and strategic planning to reduce negative risks maintain the product, and compete in the market.

Bread Improvers Market Opportunities:

Expanding applications of bread improvers present opportunities for bakery manufacturers

There are many opportunities for bakers to expand their product lines and enter new market niches and growing applications of bakers. Bread improvers have been used for a long time to improve the quality and stability of bread products, but now they are found in a variety of food products, such as pastries, rolls, rolls, and special cakes. By using bakers in multiple locations, bakery companies can satisfy changing customer demands for different products, resulting in greater productivity and variety in their product line.

In addition, the bakery industry is benefiting greatly from the use of bakery products due to the consumer preference for healthier and more nutritious baked goods. This gives bakers a competitive edge in the market and meets the growing consumer demand for healthier food options. The development of gluten-free, low-carb, and other special products to meet the needs of customers with dietary restrictions or preferences is made possible by the change of bakers, which makes the market available for bread.

BREAD IMPROVERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.20% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Puratos (Belgium), Corbion (Netherlands), AB Mauri (US), Lesaffre (France), DSM (Netherlands), International Flavors & Fragrances Inc. IFF (US), ADM (US), Kerry Group plc. (Ireland), Bakels Worldwide (Switzerland), Oy Karl Fazer Ab. (Finland) |

Bread Improvers Market Segmentation: By Type

-

Emulsifiers

-

Enzymes

-

Oxidizing Agents

-

Reducing Agents

-

Acidulants

Emulsifiers play a central role in the global bakery market, serving as an important ingredient in perfecting the texture, volume, and quality of the product. Their ability to create stable emulsions between water and fat molecules improves the control of the dough, making bread soft, yellow, and with a long shelf life. Growing consumer demand for better and cleaner cooking products has led to a demand for emulsifiers from natural sources such as vegetable oils. In addition, technological advances in the emulsifier process have allowed manufacturers to create new solutions that meet specific customer preferences, such as gluten-free or vegan bread options. However, regulatory concerns for some synthetic emulsifiers and their potential health effects have led to a shift to natural alternatives. As a result, the emulsifier market is experiencing significant growth, resulting in the expansion of the bakery industry as manufacturers strive to meet changing consumer demand for flavored products.

Enzymes play an important role in the global bakery market, driving innovation and shaping consumer preferences. Their growing use stems from their ability to improve the quality, texture, and shelf life of dough while meeting the needs of clean ingredients and labels. As consumers increasingly demand healthier, natural baking options, enzymes provide a solution by improving bread production with a better nutritional profile and a cleaner process. In addition, the modification of enzymes allows the creation of special types of bread, meeting the needs of different diets and tastes. This trend is very important in terms of the global market, where factors such as urbanization, lifestyle changes, and increasing disposable income are contributing to the growth of bread products. As a result, enzymes are emerging as a critical component of growth and innovation in the bakery industry, shaping its status and future.

Bread Improvers Market Segmentation: By Application

-

Bread, Buns, and Rolls

-

Cakes

-

Pastries

-

Pizza Dough

-

Other Bakery Products

Bread, a staple food that is rooted in cultures around the world, is experiencing a resurgence in the face of changing tastes and consumer preferences. Factors such as urbanization, busy lifestyles, and the quality of packaged goods have resulted in a constant demand for bread. In addition, the rise of artisan bakeries and specialty cakes reflects a growing appreciation for diverse, high-quality products. However, alongside this growth, challenges persist in maintaining product quality, consistency, and innovation, particularly in mass production settings. Here, bakers play an important role, in addressing these concerns by improving dough texture, shelf life, and overall baking performance. As the bakery industry continues to innovate and adapt to consumer expectations, the global bakery market is witnessing similar changes. Manufacturers are responding by developing advanced systems, including natural and clean label options, to meet the demand for quality and high-quality bakery products, thereby shaping the landscape of the global bakery market.

Pizza Dough, an Italian staple, has transcended borders to become a global favorite. Its popularity is boosted by factors such as convenience, variety of profiles, and the rise of the fast-food industry. As demand for pizza continues to rise around the world, so does the need for efficient and high-quality dough production. This increase in demand is affecting the global bakery market, where manufacturers are looking for new ways to improve dough performance, stability, and shelf life. Bread improvers, along with their enzymes, emulsifiers, and stabilizers, play an important role in meeting these requirements by improving dough structure, shape, and rise. Additionally, as consumers increasingly prioritize healthier options, the market is seeing a shift to cleaner brands and natural ingredients in pizza dough. Thus, the pizza dough segment serves as an important growth driver for the bakery market, driving innovation and shaping its future trends.

Bread Improvers Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region is emerging as a central force in the global bakery market, whose position is influenced by several growing factors. With the growing population and changing food preferences towards Western-style baking, the demand for bakers is on the rise. Rapid urbanization, coupled with increasing disposable income, is driving the consumption of baked goods, creating a need for innovators to ensure the availability of consistent quality and longevity. In addition, the growing influence of Western food habits and the increase of fast food chains in the region contribute to the growing demand for bakery products, thus strengthening the bakery market. In addition, as more and more consumers become health conscious, there is a growing demand for clean-label baked goods with natural ingredients, prompting manufacturers to innovate and adapt their offerings to respond. These interests are changing. Thus, the Asia Pacific region is serving as a proud growth driver, shaping the dynamics of the global bakery market.

North America is a pivotal area to suit the world's form of food. The development of the area is used by many things, including hard-for-product products, which move from the beginning of the customer. Increases increasingly increase and healthy and healthy bread, letting answers for promoting products, texture, and shelf life when he meets healthy. Also, increasing the artisanal strategies and food industry makes the increase in market sales, creating land producers for product development and development products. In addition, stricter food regulations and increased awareness of clean-label materials are driving manufacturers to invest in natural and sustainable solutions, reshaping the competitive landscape. Thus, North America's impact on the global bakery market reflects its important role in driving innovation, consumer trends, and market dynamics.

COVID-19 Impact Analysis on the Bread Improvers Market:

The COVID-19 pandemic has had a significant impact on the bakery industry, reshaping consumer behavior and market changes. Initially, sudden shutdowns and restrictions disrupted supply chains, causing urgent issues and resource shortages, and affecting the production and distribution of bakery products. In addition, the closure of restaurants, cafes, and bakeries has led to a shift to home baking, increasing the demand for bakers and wholesalers as people 'everyone wants to recreate their favorite bread at home. This increase in home baking has also led to an increased interest in healthy and clean products, affecting product and market preferences. In addition, the economic downturn and uncertainty have led consumers to prioritize purchases of essential items, thereby affecting discretionary spending on baked goods. However, as the economy has slowly recovered and the food service industry has resumed operations, the market has shown resilience, adapting to changing consumer preferences and new emphasis to meet changing needs for quality and quality of food.

Latest Trends/ Developments:

In recent years, the bakery market has seen significant changes and developments that have reshaped the industry landscape. A notable trend is the growing emphasis on clean label design, which is leading to an increase in consumer demand for natural products. Manufacturers are responding by reformulating their products to remove artificial additives and preservatives while adding cleaner alternatives such as plant enzymes and emulsifiers. In addition, the focus is on health and well-being, making the bakers include active ingredients such as vitamins, minerals, and fiber to improve the nutritional profile and meet consumers who are concerned about their health. In addition, technological progress has helped to create ready-made ingredients for different types of bread, helping bakers to achieve the desired qualities such as good shape, volume, and color. As the industry continues to grow, collaboration between suppliers, bakers, and retailers is becoming increasingly important to promote innovation and meet customer preferences. changes in the food processing market.

Key Players:

-

Puratos (Belgium)

-

Corbion (Netherlands)

-

AB Mauri (US)

-

Lesaffre (France)

-

DSM (Netherlands)

-

International Flavors & Fragrances Inc. IFF (US)

-

ADM (US)

-

Kerry Group plc. (Ireland)

-

Bakels Worldwide (Switzerland)

-

Oy Karl Fazer Ab. (Finland)

-

In June 2023, Kerry Group plc. Introduced Biobake, an innovative enzyme solution designed to reduce the reliance on eggs in baking applications. By replacing up to 30% of egg content while maintaining baking performance and sensory attributes, this enzyme solution addresses both regulatory concerns and consumer preferences for ethical and environmentally friendly products.

-

In July 2022, Corbion announced a significant development in expanding its presence in the Asia Pacific region with the inauguration of a customer support and innovation center in Singapore. This new facility, spanning over 350 square meters, underscores Corbion's commitment to enhancing collaboration with its customers across various food categories, including, baked goods, and more.

Chapter 1. Bread Improvers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bread Improvers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bread Improvers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bread Improvers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bread Improvers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bread Improvers Market – By Type

6.1 Introduction/Key Findings

6.2 Emulsifiers

6.3 Enzymes

6.4 Oxidizing Agents

6.5 Reducing Agents

6.6 Acidulants

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Bread Improvers Market – By Application

7.1 Introduction/Key Findings

7.2 Bread, Buns, and Rolls

7.3 Cakes

7.4 Pastries

7.5 Pizza Dough

7.6 Other Bakery Products

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Bread Improvers Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Bread Improvers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Puratos (Belgium)

9.2 Corbion (Netherlands)

9.3 AB Mauri (US)

9.4 Lesaffre (France)

9.5 DSM (Netherlands)

9.6 International Flavors & Fragrances Inc. IFF (US)

9.7 ADM (US)

9.8 Kerry Group plc. (Ireland)

9.9 Bakels Worldwide (Switzerland)

9.10 Oy Karl Fazer Ab. (Finland)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Bread Improvers Market was valued at USD 4.4 billion in 2023 and is projected to reach a market size of USD 7.16 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.20%.

Increasing demand for convenience food products in the market is the main driving factor of the Bread Improvers Market.

Based on Type, the Bread Improvers Market is segmented into Emulsifiers, Enzymes, Oxidizing Agents, Reducing Agents, & Acidulants.

Asia-Pacific is the most dominant region for the Bread Improvers Market.

The key players in this market include Puratos (Belgium), Corbion (Netherlands), AB Mauri (US), Lesaffre (France), DSM (Netherlands), International Flavors & Fragrances Inc. IFF (US), ADM (US), Kerry Group plc. (Ireland), Bakels Worldwide (Switzerland), and Oy Karl Fazer Ab. (Finland).