BPANI Based Metal Packaging Coatings Market Size (2024 – 2030)

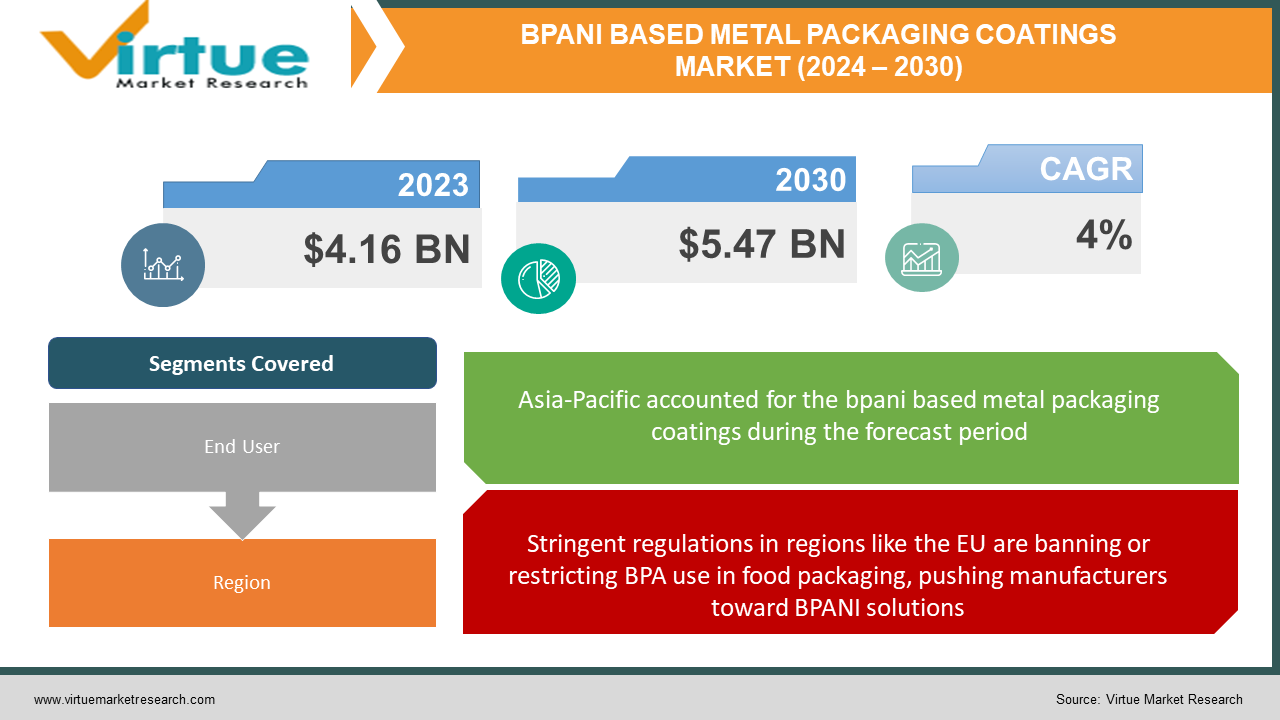

The global BPANI Based Metal Packaging Coatings Market was valued at USD 4.16 billion in 2023 and grew at a CAGR of 4% from 2024 to 2030. The market is expected to reach USD 5.47 billion by 2030.

Bisphenol A (BPA) is a chemical used in the production of certain plastics and epoxy resins. While its safety for food contact remains debated, concerns have led to a growing demand for BPA-free alternatives. BPANI coatings are formulated without intentional BPA usage, ensuring minimal to no BPA migration into food or beverages.

Key Market Insights:

Driven by health concerns, stricter regulations, and premium product demands, the BPANI-based metal packaging coatings market is poised for growth. Consumers seek safer alternatives to BPA, and BPANI offers a solution while aligning with sustainability trends. However, cost competitiveness, performance optimization, and a limited supplier base pose challenges. Technological advancements, regional variations in regulations and preferences, and evolving consumer needs for convenience and shelf life are shaping the market. The beverage sector and Asia-Pacific region are expected to see significant growth, with collaboration across the industry key to unlocking BPANI's full potential.

BPANI-Based Metal Packaging Coatings Market Drivers:

Stringent regulations in regions like the EU are banning or restricting BPA use in food packaging, pushing manufacturers toward BPANI solutions.

The EU, a major player in the global food market, has enacted stringent regulations, effectively banning BPA in certain food containers and significantly limiting its presence in others. This regulatory pressure creates a ripple effect, pushing manufacturers beyond the EU to adopt BPA-free alternatives like BPANI to comply with stricter standards and maintain access to the European market. This regulatory domino effect is a significant driver for the BPANI market, shaping the landscape for manufacturers worldwide.

Consumers are increasingly aware of the potential health risks associated with BPA exposure, driving demand for safer alternatives like BPANI.

Health reports about BPA are dominant, which makes consumers want safer substitutes like BPANI. The media has been exposing risks, while the clean label movement is being prioritized for transparency and minimal processing. Increased health awareness fuels the shift, with consumers actively seeking BPA-free options aligned with their preventative approaches. This trend pushes manufacturers to embrace BPANI and adapt to evolving regulations, shaping the market for safer packaging solutions.

The growing demand for high-quality food and beverages creates opportunities for premium packaging solutions.

Premium food and beverage consumers seek not just exceptional taste but also packaging that reflects and elevates the product's quality. BPANI coatings tap into this trend by offering a perceived safety advantage over traditional options, potentially aligning with the brand's clean or natural image. Additionally, BPANI's potential for improved printability and aesthetics allows for more sophisticated and visually appealing packaging, further enhancing the premium experience. This creates a lucrative opportunity for manufacturers to cater to discerning consumers willing to pay extra for both quality and peace of mind.

BPANI-Based Metal Packaging Coatings Market Challenges and Restraints:

BPANI coatings are often more expensive than traditional BPA-containing options.

BPANI's higher cost compared to traditional options poses a major adoption hurdle. Budget-conscious consumers, cost-constrained manufacturers, bulk packaging users, and price-sensitive emerging markets prioritize affordability, often opting for cheaper BPA-containing alternatives. This dynamic requires creative solutions like cost reductions, targeted marketing, and emphasizing BPANI's long-term value proposition to bridge the gap and achieve wider market penetration.

Compared to traditional coatings, the BPANI supplier landscape is less established.

The limited BPANI supplier landscape, compared to traditional coatings, throws a wrench in several areas. Securing consistent supply can be difficult, especially for large manufacturers. Limited competition restricts price negotiation, potentially inflating costs. A less mature supplier base means slower advancements in BPANI technology, hampering performance and application versatility. To overcome these hurdles, manufacturers can unite their voices, attract new players to the market, and actively collaborate on R&D, ultimately accelerating BPANI innovation and fostering a more robust supplier ecosystem.

Other emerging BPA-free options, like BPS or PET-based coatings, could pose competition.

BPANI isn't alone in the race for BPA-free dominance. Alternatives like BPS and PET-based coatings are emerging contenders, each with its strengths and weaknesses. BPS, chemically similar to BPA, raises concerns about potential endocrine disruption, clouding its safety halo. PET-based coatings offer good barrier properties but might lack flexibility and printability, limiting their application range. This competitive landscape presents both challenges and opportunities. BPANI needs to continuously demonstrate its value proposition in terms of safety, performance, and cost compared to these alternatives. Collaboration across the industry, from research institutions to manufacturers, can accelerate innovation and help BPANI solidify its position in the evolving BPA-free market.

Market Opportunities:

BPANI-based metal packaging coatings offer exciting opportunities despite facing challenges. Consumer concerns about BPA drive demand for safer options, with regulations pushing manufacturers towards BPANI. Its perceived sustainability and potential for performance improvements through R&D open doors in premium and emerging markets. BPANI can enhance branding and align with evolving consumer preferences for convenience and aesthetics. Collaboration across the industry can address supply chain issues and accelerate wider adoption, positioning BPANI as a major player in the food and beverage packaging market.

BPANI BASED METAL PACKAGING COATINGS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4% |

|

Segments Covered |

By End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AkzoNobel N.V., PPG Industries, Inc., Teijin Limited, Nippon Steel & Sumitomo Metal Corporation, The Sherwin-Williams Company, Axalta Coating Systems Ltd., Jotun Group, RPM International, Inc., Hempel A/S, Teknos Group, Tikkurila Oyj |

BPANI Based Metal Packaging Coatings Market Segmentation: by End User

-

Food and Beverage Industry

-

Pharmaceuticals Industry

-

Personal Care and Cosmetics Industry

-

Industrial Sector

Food and beverage is both the largest and fastest-growing segment in this market. It is further segmented into canned goods, beverages, dairy, sauces, and ready-to-eat. Among these, ready-to-eat meals are the most popular, witnessing the fastest growth fueled by convenience and safety concerns. While canned goods are still significant, their maturity and competition from flexible packaging limit their BPANI adoption pace. Beyond food, BPANI serves pharmaceuticals for many needs and personal care for creams and lotions, while industrial applications remain niche. Understanding these dynamics is crucial for market players to target the rising stars and navigate the evolving BPANI landscape. Latin America is expected to witness the fastest growth in the BPANI market. Growing urban populations are driving demand for convenient and shelf-stable packaged food, creating opportunities for BPANI-coated metal packaging. They seek alternatives like BPANI to address consumer concerns about BPA and comply with evolving regulations, particularly in regions like the EU. Metal packaging is the fastest-growing end-user. They bridge the gap, acting as the engineers who integrate BPANI coatings into their production processes. Their ability to adopt and adapt BPANI technology efficiently is crucial for wider market penetration. Finally, brand owners see BPANI as a powerful tool for differentiation and premiumization. They leverage their safety and sustainability credentials to enhance brand image and attract consumers willing to pay more for products perceived as higher quality and environmentally responsible. This dynamic interdependence creates a win-win situation: food and beverage companies gain peace of mind with compliant packaging, manufacturers secure new business opportunities, and brand owners elevate their products in the marketplace. As the BPANI market evolves, collaboration and innovation among these key players will be essential to unlocking its full potential and delivering safer, more sustainable packaging solutions for the future.

BPANI Based Metal Packaging Coatings Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is both the largest and fastest-growing region in the BPANI-based metal packaging coatings market during the forecast period. Urbanization is one of the major reasons for this. Rising disposable incomes in countries like China and India are increasing demand for packaged food and beverages, creating a larger market for BPANI-coated packaging. The region has seen significant progress regarding the economy. As such, funding for projects has become much easier. R&D activities are being emphasized to improve the existing ones and find new ones. This region offers more flexibility for BPANI adoption. Besides, this area has some of the most well-developed key players who are involved in bulk manufacturing. This makes accessibility easier. These companies have a global presence, which results in greater revenue generation. A few prominent ones include Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Asian Paints Limited, PPG Industries, Inc., and Akzo Nobel N.V. Countries like China, India, and Japan are at the forefront. Latin America and Africa exhibit promising growth potential due to rising disposable incomes and increasing awareness. Despite being a mature market with established BPANI adoption, North America and Europe’s growth is expected to be slower compared to Asia and Africa.

COVID-19 Impact Analysis on the BPANI-Based Metal Packaging Coatings Market

The COVID-19 pandemic threw a curveball at the BPANI market, creating a mixed bag of challenges and opportunities. Initial disruptions due to lockdowns and trade restrictions choked supply chains, impacting raw material availability and BPANI production, leading to longer lead times. Additionally, shifting consumer preferences towards home-cooked meals and e-commerce purchases fueled a rise in flexible packaging, potentially posing a threat to metal packaging demand in certain segments. The economic slowdown further dampened overall demand for packaged goods, indirectly impacting the BPANI market. Furthermore, most of the investments were shifted toward healthcare applications, delaying launches and collaborations.

However, amidst these challenges, the market has numerous opportunities. Heightened hygiene concerns during the pandemic triggered a demand for packaging perceived as cleaner and safer, potentially benefiting BPANI's image as a BPA-free alternative. This focus on safety, coupled with growing environmental consciousness, might bolster BPANI's appeal due to its perceived sustainability advantages. The e-commerce boom also presents a significant opportunity, as the surge in online purchases drives demand for packaging with superior barrier properties and extended shelf life, both strengths associated with BPANI-coated metal containers.

Latest trends/Developments

The BPANI market is subjected to a lot of advancements. Performance is improving through nanotech and R&D collaborations, aiming to match traditional coatings and expand applications. Cost-reduction strategies like alternative materials and collaborations are underway to make BPANI more competitive. Sustainability takes center stage with bio-based options and life cycle assessments highlighting BPANI's eco-friendliness. Digital printing and smart packaging features are integrated for eye-catching and interactive experiences. Regulations push for safer alternatives, while regional growth is projected in Asia Pacific, Africa, and Latin America. Adapting to diverse preferences and regulations will be key for players to thrive in

this dynamic market.

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Key Players:

-

AkzoNobel N.V.

-

PPG Industries, Inc.

-

Teijin Limited

-

Nippon Steel & Sumitomo Metal Corporation

-

The Sherwin-Williams Company

-

Axalta Coating Systems Ltd.

-

Jotun Group

-

RPM International, Inc.

-

Hempel A/S

-

Teknos Group

-

Tikkurila Oyj

Chapter 1. BPANI Based Metal Packaging Coatings Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. BPANI Based Metal Packaging Coatings Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. BPANI Based Metal Packaging Coatings Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. BPANI Based Metal Packaging Coatings Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. BPANI Based Metal Packaging Coatings Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. BPANI Based Metal Packaging Coatings Market – By End User

6.1 Introduction/Key Findings

6.2 Food and Beverage Industry

6.3 Pharmaceuticals Industry

6.4 Personal Care and Cosmetics Industry

6.5 Industrial Sector

6.6 Y-O-Y Growth trend Analysis By End User

6.7 Absolute $ Opportunity Analysis By End User, 2024-2030

Chapter 7. BPANI Based Metal Packaging Coatings Market, By Geography – Market Size, Forecast, Trends & Insights

7.1 North America

7.1.1 By Country

7.1.1.1 U.S.A.

7.1.1.2 Canada

7.1.1.3 Mexico

7.1.2 By End User

7.1.3 Countries & Segments - Market Attractiveness Analysis

7.2 Europe

7.2.1 By Country

7.2.1.1 U.K

7.2.1.2 Germany

7.2.1.3 France

7.2.1.4 Italy

7.2.1.5 Spain

7.2.1.6 Rest of Europe

7.2.2 By End User

7.2.3 Countries & Segments - Market Attractiveness Analysis

7.3 Asia Pacific

7.3.1 By Country

7.3.1.1 China

7.3.1.2 Japan

7.3.1.3 South Korea

7.3.1.4 India

7.3.1.5 Australia & New Zealand

7.3.1.6 Rest of Asia-Pacific

7.3.2 By End User

7.3.3 Countries & Segments - Market Attractiveness Analysis

7.4 South America

7.4.1 By Country

7.4.1.1 Brazil

7.4.1.2 Argentina

7.4.1.3 Colombia

7.4.1.4 Chile

7.4.1.5 Rest of South America

7.4.2 By End User

7.4.3 Countries & Segments - Market Attractiveness Analysis

7.5 Middle East & Africa

7.5.1 By Country

7.5.1.1 United Arab Emirates (UAE)

7.5.1.2 Saudi Arabia

7.5.1.3 Qatar

7.5.1.4 Israel

7.5.1.5 South Africa

7.5.1.6 Nigeria

7.5.1.7 Kenya

7.5.1.8 Egypt

7.5.1.9 Rest of MEA

7.5.2 By End User

7.5.3 Countries & Segments - Market Attractiveness Analysis

Chapter 8. BPANI Based Metal Packaging Coatings Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

8.1 AkzoNobel N.V.

8.2 PPG Industries, Inc.

8.3 Teijin Limited

8.4 Nippon Steel & Sumitomo Metal Corporation

8.5 The Sherwin-Williams Company

8.6 Axalta Coating Systems Ltd.

8.7 Jotun Group

8.8 RPM International, Inc.

8.9 Hempel A/S

8.10 Teknos Group

8.11 Tikkurila Oyj

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global BPANI-based packaging coatings market was valued at USD 4.16 billion in 2023 and grew at a CAGR of 4% from 2024 to 2030. The market is expected to reach USD 5.47 billion by 2030.

Stringent regulations in regions like the EU are banning or restricting BPA use in food packaging, pushing manufacturers towards BPANI solutions. Consumers are increasingly aware of the potential health risks associated with BPA exposure, driving demand for safer alternatives like BPANI. Growing demand for high-quality food and beverages creates opportunities for premium packaging solutions, which is driving the market.

Based on application, it is divided into four segments: food and beverage, pharmaceuticals, personal care and cosmetics, and industrial.

Asia-Pacific is the most dominant region for the BPANI-based metal packaging coatings market.

AkzoNobel N.V., PPG Industries, Inc., Teijin Limited, and Nippon Steel & Sumitomo Metal Corporation are the major players.