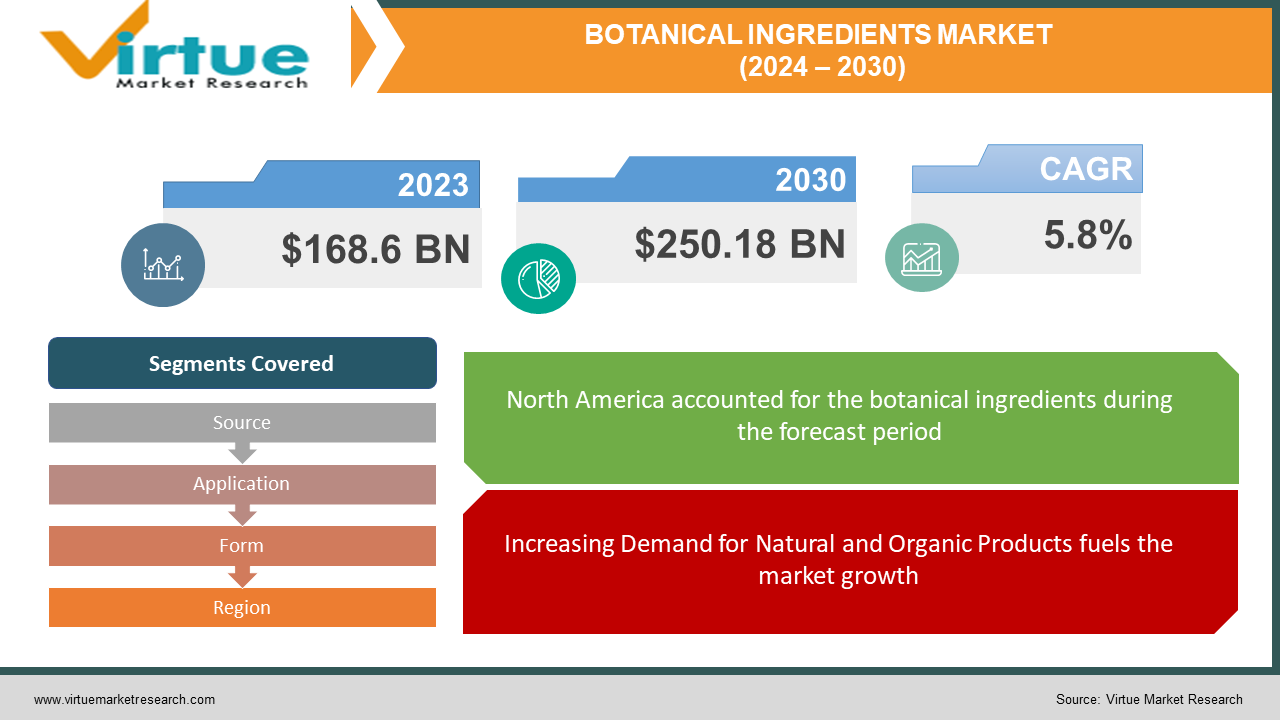

Botanical Ingredients Market Size (2024 – 2030)

The Global Botanical Ingredients Market was valued at USD 168.6 billion in 2023 and is projected to reach a market size of USD 250.18 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.8%.

Botanical ingredients are derived from plants and are valued primarily for their taste and aroma, as well as for their medicinal and natural properties. Botanicals come in many forms and often include herbs, spices, fruits, and vegetables. The market for herbal ingredients in food and beverages is expanding because they are rich in bioactive compounds and provide many biological effects.

Key Market Insights:

Demand for botanical ingredients in the U.S. is largely driven by a growing vegan population, a focus on the use of natural ingredients and organic foods, and large, widely distributed companies. The increasing demand for sports nutrition in the country will also increase the demand for nutritional products that are useful for the market. Clean pages eliminate excess data clutter. The shift to cleaner labels has directly increased the number of herbal ingredients available in the food, supplement, and pharmaceutical industries.

The global market is highly fragmented and competitive due to well-known and established players. These companies have strong partnerships and partnerships with farmers to achieve better results across the board. Large companies constantly engage in mergers, acquisitions, and joint ventures to gain advantages over other companies. Merger and acquisition activities allow companies to expand their investment portfolios and geographic presence.

Botanical Ingredients Market Drivers:

Increasing Demand for Natural and Organic Products fuels the market growth.

Consumers around the world are looking for more natural and organic products, including plant-based products. They are more aware of the health benefits and safety of botanical ingredients. This demand is causing the botanical ingredient market to grow.

Growth in the Functional Foods and Nutraceuticals Sector accelerates the market growth.

The food and supplement industry has shown great growth in recent years. Botanical ingredients are known for their nutritional and health benefits and are widely used in this field. Increasing awareness of health protection and desire for alternatives to synthetic ingredients are increasing the demand for plant-based ingredients in food and nutritional products.

Expansion of the Herbal Supplements Market accelerates the market growth.

The global herbal medicine market has experienced significant growth. Consumers are turning to herbal medicine to protect their health, manage specific health conditions, and find alternative treatments. Botanical ingredients are the main components of herbal medicines and lead to demand and economic growth.

Rising Focus on Personal Care and Natural Cosmetics helps in market to move forward.

The personal care and cosmetics industry is seeing a shift towards natural ingredients and botanicals. Botanical ingredients bring many benefits to skin care, hair care, and other personal care products. Interest in beauty and sustainable production is driving demand for plant-based ingredients in the personal care industry.

Growing Research and Development Activities helps in the market growth.

Research and development in the botanical products industry focuses on identifying new sources of botanical ingredients, discovering their bioactive compounds, and understanding their potential uses. These conditions aim to unlock the potential of botanical ingredients and create new products for various industries.

Botanical Ingredients Market Restraints and Challenges:

Maintaining quality and Standardization provides a challenge to market growth.

Maintaining consistency in quality and standardization of botanical compositions can be difficult due to differences between plants, growth, extraction, and processing. Ensure batch-to-batch consistency and compatibility requirements, especially for companies sourcing botanical ingredients from multiple suppliers or regions.

Supply Chain Snags hinder the market growth.

The market for agricultural products is based on international products, often involving many intermediaries and international suppliers. Managing product risks, ensuring traceability, and maintaining the stability and reliability of botanical ingredients can be challenging. Issues such as crop failures, climate change, geopolitical events, and limited supplies of certain plants can disrupt the supply chain.

The volatility in Botanical Ingredients prices brings a challenge to market growth.

Global Botanical Ingredients prices fluctuate significantly due to factors like currency fluctuations, and speculation. This uncertainty can discourage investment and harm smaller players.

Sustainability and Environmental Impact restrains market growth.

The increasing demand for herbal ingredients has led to concerns about the sustainability and environmental impact of their products. Overharvesting, deforestation, and ecosystem destruction can threaten certain plants and ecosystems. Maintaining sustainable practices, promoting biodiversity conservation, and supporting local communities are key challenges facing the botanical ingredients industry.

Intellectual Property and Patent Issues can hinder market growth.

Protecting intellectual property can be challenging in the botanical ingredients industry, especially when it comes to unique botanicals or designs. Ensuring proper identification and protection of valuable assets, preventing misuse or infringement, and navigating the complex terrain of patents and trademarks requires administrative and legal knowledge.

Botanical Ingredients Market Opportunities:

Demand for natural and clean-label foods and beverages continues to grow as consumers seek greater health and wellness. Botanical ingredients such as herbal extracts, natural sweeteners, and active botanical ingredients are used to improve the nutritional value and feel of foods and beverages. The market for botanical ingredients in food and beverages is expected to grow.

The nutraceutical and dietary supplement industry has experienced significant growth as consumers increasingly seek greater health protection and overall wellness. Botanicals are essential components of nutraceutical formulations and have a variety of health benefits, including antioxidant, anti-inflammatory and immunological properties. The demand for botanical ingredients in nutraceuticals and food products is expected to increase.

The market for nutritious and energy-rich foods is expanding as consumers seek products that provide more health benefits. Botanical ingredients such as superfoods, plant extracts, and natural supplements are incorporated into nutritional products designed to provide specific nutrition. Increasing consumer interest in nutritional supplements presents a growth opportunity for herbal ingredients.

BOTANICAL INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Source, Application, Form, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Indesso, Lipoid Kosmetic AG, The Herbarie at Stoney Hill Farm, Inc., International Flavors & Fragrances, Inc., Bell Flavors & Fragrances, Rutland Biodynamics Ltd., Prakruti Sources Pvt. Ltd. AmbePhytoextractsPvt. Ltd., The Green Labs LLC, Berje, Inc. |

Botanical Ingredients Market Segmentation - by Source

-

Spices

-

Flowers

-

Herbs

-

Others

In 2023, the spice segment dominated the global market and held the largest share, accounting for more than 32.10% of total revenue. The segment will continue to expand at a stable CAGR to maintain its leadership position throughout the forecast period. This is due to changing lifestyles that require simple and healthy meals, as well as popular trends to explore new foods. The flower segment is expected to register the fastest growth during the forecast period.

Fresh flowers are used not only for the beauty of home and office but also for medicinal purposes. Cosmetics, dried herbs, natural dyes, potpourri, and medicine. The herbal medicine market is also expected to grow significantly during the forecast period due to the increasing use of herbs in traditional medicine. Herbal products based on medicinal plants have become important worldwide due to their health benefits such as improving metabolism and immunity and improving hormones. Many concepts such as Ayurveda, Yoga, Homeopathy, and Sadhana gained importance and encouraged the development of herbal ingredients.

Botanical Ingredients Market Segmentation - by Application

-

Food & Beverage

-

Personal Care & Cosmetics

-

Pharmaceutical

-

Others

The food and beverage segment dominated the market in 2023 and will take the largest share of total revenue with 34.18%. This is because of the increasing use of these ingredients in various foods and beverages due to their taste and various health benefits. Food manufacturers are fortifying their sources with nutrients such as vitamins, minerals, and prebiotics to increase the effectiveness of their products. This trend will increase access to herbal ingredients in food and beverages. Beverages will constitute the majority of the application segment by 2023 due to changing consumer demand for RTD products.

In addition, increasing efforts of manufacturers to produce ready-to-drink products with different ingredients and fortified botanical ingredients will benefit the growth of this segment. Botanical ingredients are widely used by cosmetic companies in the preparation of skin care procedures due to their antibacterial, antifungal, antibacterial, skin care, healing properties, and moisturizing properties. Additionally, the increasing demand for natural and clean cosmetic products is expected to create growth opportunities for the segment.

The use of botanical ingredients in medicine is a future phenomenon in the current market. Rising demand for botanical medicines and growing awareness about the benefits of botanical ingredients are likely to be the key factors driving the growth of this segment during the forecast period. The increasing prevalence of chronic diseases such as arthritis, diabetes, and heart disease, as well as the benefits of botanicals over synthetic drugs, are expected to increase the demand for nutritional supplement applications.

Botanical Ingredients Market Segmentation - by Form

-

Powder

-

Liquid

In 2023, the powder segment dominated the global market, capturing more than 60.45% of the total revenue. This is attributed to the powder's botanical ingredients' properties such as texture consistency and skin care. Botanical ingredients extracted in powder form are widely used to enhance the flavor of food and beverages as well as food products. In the US, demand from HUM Nutrition and ESI Beauty sources for beauty products containing collagen, including American ginseng, eleuthero root powder, and ashwagandha root powder, drives business growth.

The liquid materials segment is estimated to record the fastest CAGR from 2024 to 2030. Suitable for liquid products, ready-to-drink (RTD) beverages, cold drinks, and mixed drinks. The increasing popularity of ready-to-eat beverages due to their ease of consumption, nutritional value, and practicality will increase the demand for liquid ingredients. However, bulk liquid packaging is not easy to transport and takes up a lot of space. In contrast, the powder form has a high shelf life, high solubility, cost-effectiveness, and similar nutrient concentration. This may affect the growth of the liquid-form segment to some extent.

Botanical Ingredients Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America dominates the market with 40% revenue by 2023. This is due to many lifestyle diseases in the United States and Mexico due to the rise of obesity. Demand is increasing in Europe due to rising consumer spending, increasing disposable income, and the growth of the middle class. Additionally, the baking industry in Europe has contributed to the demand for phytonutrients such as dietary fiber, and natural and healthy ingredients containing dietary fiber are very popular.

Asia Pacific is expected to record the fastest CAGR during the forecast year. Factors such as the proliferation of e-commerce stores are increasing the consumption of ready-made foods containing plant-based ingredients. The region is characterized by many suppliers. For example, India, China, and Sri Lanka are the world's largest tea producers. Many other medicinal and non-medicinal plants such as amla, hibiscus, and ginger are also grown in the Asia-Pacific region.

COVID-19 Impact Analysis on the Global Botanical Ingredients Market:

The COVID-19 pandemic has had a significant impact on shipping, retail, and behavior across many areas and services worldwide. However, demand for botanical ingredients has increased due to consumers' increased interest in health and wellness during the global pandemic, which supports overall health. Many areas of nutrition related to health, obesity, stress, and the vascular system are made from plant ingredients.

Latest Trends/ Developments:

The use of technology in the extraction and processing process increases the quality, efficiency, and diversity of botanical ingredients. Advanced techniques such as supercritical fluid extraction, nanotechnology, and biotechnology can remove certain elements, preserve biological functions, and create new structures. This technology opens up new possibilities for using herbal ingredients in various applications and expands their functions.

The lines between food and medicine are blurred. Consumers are looking for foods rich in plant ingredients to achieve specific results. Adaptogens like ashwagandha and ginseng are gaining traction in stress management, while others like elderberry and echinacea are valued for their anti-inflammatory powers. This trend is driving innovation in product development, with new functional snacks, beverages, and even supplements coming to market.

As environmental concerns increase, the beneficial ingredients of beneficial plants are also becoming popular. Traceability and fair trade are becoming key differentiators as companies focus on responsible collection and processing. This is in line with the needs of environmentally conscious consumers who want their purchases to reflect their values.

Key Players:

-

Indesso

-

Lipoid Kosmetic AG

-

The Herbarie at Stoney Hill Farm, Inc.

-

International Flavors & Fragrances, Inc.

-

Bell Flavors & Fragrances

-

Rutland Biodynamics Ltd.

-

Prakruti Sources Pvt. Ltd.

-

AmbePhytoextractsPvt. Ltd.

-

The Green Labs LLC

-

Berje, Inc.

-

In June 2022, Archer Daniels Midland Company (ADM) invested in expanding its botanical extraction capabilities and launched new plant-based protein innovations.

-

In August 2022, International Flavors & Fragrances, Inc. (IFF) acquired Frutarom, a leading manufacturer of natural flavors and ingredients, significantly expanding its botanical portfolio.

-

In October 2022, Bell Flavors & Fragrances expanded its product line of organic and natural botanical ingredients, catering to the clean label trend.

Chapter 1. Botanical Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Botanical Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Botanical Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Botanical Ingredients Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Botanical Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Botanical Ingredients Market – By Source

6.1 Introduction/Key Findings

6.2 Spices

6.3 Flowers

6.4 Herbs

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Source

6.7 Absolute $ Opportunity Analysis By Source, 2024-2030

Chapter 7. Botanical Ingredients Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverage

7.3 Personal Care & Cosmetics

7.4 Pharmaceutical

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Botanical Ingredients Market – By Form

8.1 Introduction/Key Findings

8.2 Powder

8.3 Liquid

8.4 Y-O-Y Growth trend Analysis By Form

8.5 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 9. Botanical Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Source

9.1.3 By Application

9.1.4 By Form

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Source

9.2.3 By Application

9.2.4 By Form

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Source

9.3.3 By Application

9.3.4 By Form

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Source

9.4.3 By Application

9.4.4 By Form

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Source

9.5.3 By Application

9.5.4 By Form

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Botanical Ingredients Market – Company Profiles – (Overview, By Source Portfolio, Financials, Strategies & Developments)

10.1 Indesso

10.2 Lipoid Kosmetic AG

10.3 The Herbarie at Stoney Hill Farm, Inc.

10.4 International Flavors & Fragrances, Inc.

10.5 Bell Flavors & Fragrances

10.6 Rutland Biodynamics Ltd.

10.7 Prakruti Sources Pvt. Ltd.

10.8 AmbePhytoextractsPvt. Ltd.

10.9 The Green Labs LLC

10.10 Berje, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Botanical Ingredients Market was valued at USD 168.6 billion in 2023 and is projected to reach a market size of USD 250.18 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.8%.

The segments under the Global Botanical Ingredients Market based on Sources are Spices, Flowers, Herbs, and Others.

The North American region is the dominant Global Botanical Ingredients Market.

Indesso, Lipoid Kosmetic AG, The Herbarie at Stoney Hill Farm, Inc., International Flavors & Fragrances, Inc., Bell Flavors & Fragrances, etc.

The COVID-19 pandemic has had a significant impact on shipping, retail, and behavior across many areas and services worldwide. However, demand for botanical ingredients has increased due to consumers' increased interest in health and wellness during the global pandemic, which supports overall health. Many areas of nutrition related to health, obesity, stress and the vascular system are made from plant ingredients.