GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET (2024 - 2030)

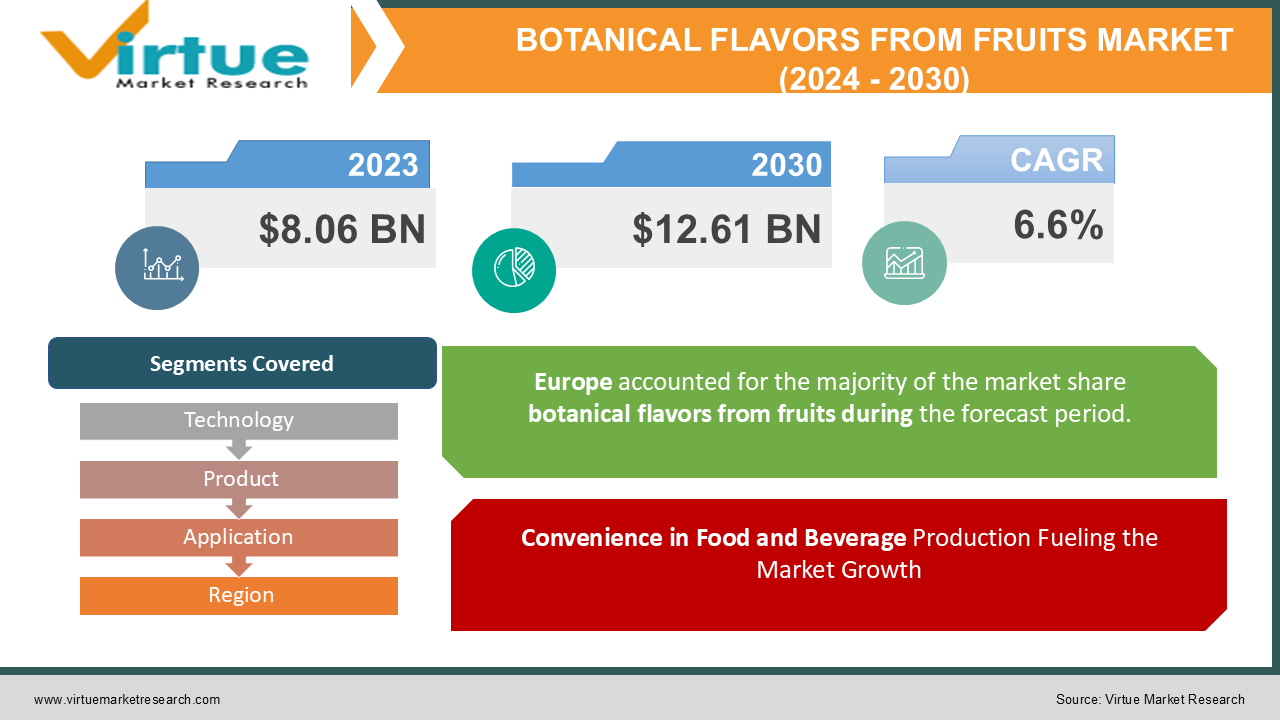

The Botanical Flavors from Fruits Market was valued at USD 8.06 billion in 2023 and is projected to reach a market size of USD 12.61 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 6.6%.

The botanical flavors from the fruit market have experienced significant growth in recent years, driven by consumer preferences for natural and authentic tastes. There was a surge in demand for exotic and unique flavors, leading to the widespread use of botanical extracts in various food and beverage products in the past. Presently, the market continues to thrive, with a focus on clean labels, global ingredient sourcing, and functional properties associated with certain fruits. The botanical flavors market is poised for further expansion, likely fueled by ongoing innovation in extraction methods, increased awareness of health benefits, and the ongoing quest for novel and diverse flavor profiles that align with evolving consumer preferences in the future.

Key Market Insights:

- The market is marked by the utilization of cutting-edge Carbon Dioxide (CO2) extraction techniques, producing highly pure fruit extracts known for superior quality in various applications.

- In 2021, the food and beverage sector hold the largest market share, driven by global demand for organic, healthy, and minimally processed food products. Botanical extracts' antimicrobial properties contribute to prolonged product shelf life.

- The increasing market demand for natural and nutritious goods has led food and beverage businesses to incorporate organic ingredients, aligning with consumers' preferences for healthier and more natural options.

- While botanical extracts are widely used, caution is essential, as highlighted by the FDA's recognition of certain essential oils, like eucalyptus, as potentially unsafe for internal consumption, emphasizing the importance of ensuring safety in food and beverage applications.

Botanical Flavors from Fruits Market Drivers:

Growing Health Consciousness and Shift in Treatment Preferences Drives the Market Growth:

The Botanical Flavors from Fruits Market is driven by a rising awareness of the health benefits associated with fruit extracts, positioning them as viable alternatives to conventional treatments. Consumers are increasingly seeking natural solutions, fostering the market's growth. The market benefits from a growing appetite for ready meals and a heightened understanding of the advantages offered by organic products compared to synthetic alternatives. The global consumption of fast-food products, including bakery items, sauces, ready-to-eat meals, and sports drinks, has surged in recent years, driven by changing lifestyles, an expanding working women population, innovative packaging, and the growth of retail channels, especially in emerging economies like India, China, and Brazil.

Convenience in Food and Beverage Production Fueling the Market Growth:

Botanical components play a crucial role in convenience foods, enhancing flavor and nutritive quality. The use of botanical extracts or concentrates over fresh botanicals is preferred by convenience food and beverage manufacturers due to the extended shelf life and intensified flavors they provide. Additionally, botanical extracts offer a more authentic taste as they are directly sourced from fruits, leaves, and flowers. The increasing consumption of convenience foods is expected to further propel the demand for botanical extracts in the coming years.

Rise of Botanical Pharmaceuticals and Natural Ingredient Sourcing:

Amid the growing prevalence of chronic and lifestyle diseases, there's a shift towards more natural and creative approaches to treatment. Botanical pharmaceuticals, derived from natural ingredients with therapeutic properties, are gaining traction as alternatives to allopathic medications. This shift is fueled by the rising awareness of the adverse effects associated with chemical-based substances used in personal care, cosmetics, and food and beverages. Moreover, the increasing concern for environmental and natural component sourcing, particularly in North America and Europe, is pushing producers to prioritize natural extracts. The extensive health benefits of natural extracts are expected to drive sales in the pharmaceutical and nutraceutical industries, shaping consumption trends in the years ahead.

Botanical Flavors from Fruits Market Restraints and Challenges:

Navigating Nature's Complexities: The intricate and unpredictable nature of working with botanical extracts

Despite the flourishing growth, the Botanical Flavors from the fruit market face its share of challenges and restraints. One notable hurdle is the intricate and unpredictable nature of working with botanical extracts, which can vary in flavor and composition based on factors like soil conditions and climate. This inherent complexity poses formulation challenges for manufacturers aiming to achieve consistent product quality. Additionally, the market contends with the need for sustainable and ethical sourcing of botanical ingredients, particularly in regions like North America and Europe, where environmental concerns are at the forefront. Meeting these sourcing criteria while maintaining cost-effectiveness poses a delicate balancing act. Furthermore, regulatory scrutiny and evolving standards in different regions add another layer of complexity, requiring industry players to navigate a complex regulatory landscape. These challenges underscore the intricate dance between nature's nuances and the demand for standardized, high-quality botanical flavors in the market.

Botanical Flavors from Fruits Market Opportunities:

The Botanical Flavors from Fruits Market presents promising opportunities in the coming years. With consumers increasingly gravitating towards natural and clean-label products, there is a significant opportunity for manufacturers to capitalize on this demand by offering innovative botanical flavor solutions. The market can explore avenues in the development of new flavor profiles, particularly those aligned with evolving consumer preferences for unique and authentic tastes. Moreover, the expanding applications of botanical flavors in functional and nutritious products, coupled with their potential integration into the pharmaceutical and nutraceutical industries, open new vistas for growth. The focus on sustainability and eco-friendly practices in the food and beverage sector further provides an opportunity for market players to align their offerings with these trends. As manufacturers invest in research and development to meet these diverse demands, the botanical flavors market is well-positioned to leverage these opportunities and witness substantial growth.

GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.6% |

|

Segments Covered |

By Technology, Product, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Synergy Flavors, Bell Flavors & Fragrances GmbH, Parker Flavors, Inc., Archer Daniels Midland Company, Kanegrade Limited, Carrubba Incorporated, Sapphire Flavors & Fragrances |

Botanical Flavors from Fruits Market Segmentation:

Market Segmentation: By Technology:

- CO2 Extraction

- Solvent Extraction

- Steam Distillation

- Enfleurage

- Others

The largest in this segment is CO2 Extraction and the fastest growing during the forecast period is also CO2 Extraction. The significant trend in the Botanical Flavors from Fruits Market is the widespread adoption of CO2 extraction technology. Solvent Extraction involves using solvents like ethanol to dissolve essential oils, providing versatility in extracting a wide range of flavor compounds. Steam Distillation utilizes steam to release and collect volatile compounds, a traditional yet effective method for obtaining nuanced fruit flavors. Enfleurage, although less common, involves soaking fruits in fatty compounds to absorb their aromatic constituents. Lastly, the category of "Others" encompasses diverse extraction methods, showcasing the industry's continual exploration of innovative techniques to capture and deliver the rich and diverse spectrum of botanical flavors derived from fruits.

Market Segmentation: By Product:

- Organic

- Conventional

The Conventional segment currently holds the largest market share, while the Organic segment is identified as the fastest-growing during the forecast period. This trend is indicative of a shift in consumer preferences towards organic and natural products. The Conventional segment reflects the dominant presence of traditionally produced botanical flavors. However, the accelerated growth of the Organic segment highlights a changing consumer landscape, marked by an increasing demand for products aligned with health and environmental consciousness. Consumers are showing a preference for organic botanical flavors, driven by factors such as a desire for cleaner labels, sustainable practices, and a heightened awareness of the potential health benefits associated with organic ingredients. As the Organic segment gains momentum, manufacturers in the Botanical Flavors from the Fruits Market are likely to adapt to this shift by offering a broader range of organic options. This trend underscores the importance of sustainability, health-conscious choices, and the evolving consumer perception towards natural and organically sourced products.

Market Segmentation: By Application:

- Personal Care

- Food & Beverage

- Medical

- Other

The largest in this segment is Food & Beverage and the fastest growing during the forecast period is also Food & Beverage. The surging global demand for organic, healthy, and minimally processed food products has become a major driving force, expanding the application scope of botanical extracts within the food and beverage sector. In the Medical field, botanical flavors contribute to pharmaceuticals and medicinal products, potentially offering both therapeutic and palatable qualities. The category labeled "Other" suggests a broader spectrum of applications, reflecting the adaptability and innovation in incorporating fruit-derived botanical flavors into diverse products beyond the more traditional segments.

Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East and Africa

The largest in this segment is Europe and the fastest growing during the forecast period is Asia-Pacific. This is attributed to the increasing growth of beverage products and the elevated consumption of ready-to-drink (RTD) beverages among certain demographics in the region. The expansion of the beverage industry is driven by the growing preference for RTD beverages, reflecting a shift away from carbonated drinks to those containing healthful and organic ingredients like kombucha, matcha, and tea in response to changing consumer preferences. The consumption of convenient food items, including prepared foods, RTD beverages, and snacks featuring botanical components, is influenced by the growth of organized and e-commerce retail channels. In North America, the application of botanical extracts in beverages is promising, driven by sustained demand for healthy drinks and increased awareness of the health benefits linked to bio-based ingredients for weight management and blood sugar control.

COVID-19 Impact Analysis on the Botanical Flavors from Fruits Market:

The global botanical flavors from the fruit market are experiencing challenges due to the COVID-19 pandemic. Trade restrictions, border closures, reduced production capacities, and disrupted supply chains have led to a decline in market growth. Manufacturing facility closures in various industries, coupled with import-export trade disruptions, have impacted the availability of raw materials and global demand for botanical extracts. Despite these challenges, the market shows resilience, with shifting consumer preferences toward natural products providing an opportunistic factor. The government's efforts to resume production with safety measures aim to mitigate the impact, but challenges persist, especially for developing countries adapting to stringent food safety standards amid the ongoing recession. The comprehensive COVID-19 impact analysis underscores the complexities faced by the botanical flavors from the fruit market during these unprecedented times.

Latest Trends/ Developments:

The Botanical Flavors from Fruits Market is evolving with several key trends. Rising demand for natural and organic products has fueled the adoption of botanical flavors, while consumers' interest in unique and exotic tastes encourages experimentation with lesser-known plants. Health and wellness considerations are driving the demand for botanical flavors with functional benefits. Technological advancements are enabling innovative extraction techniques, and enhancing the quality of botanical flavors. Additionally, a growing focus on sustainability is leading to the development of environmentally friendly and socially responsible botanical flavors, reflecting the industry's commitment to eco-conscious practices. These trends collectively shape the dynamic landscape of the market, meeting diverse consumer preferences and industry requirements.

Key Players:

- Synergy Flavors

- Bell Flavors & Fragrances GmbH

- Parker Flavors, Inc.

- Archer Daniels Midland Company

- Kanegrade Limited

- Carrubba Incorporated

- Sapphire Flavors & Fragrances

- Jan 2022: Firmenich has unveiled its Flavor of the Year for 2022, "Magical Botanical," catering to the creative and well-being desires of a society transforming. This marks the commencement of a fresh phase in innovative flavor development, with Magical Botanical serving as a tribute to Pantone's Color of the Year 2022 and the transformative characteristics associated with botanicals.

- April 2022: Kerry successfully concluded the acquisition of Natreon, a company specializing in botanical extracts and renowned for supplying branded ayurvedic botanical ingredients. This move not only enhances Kerry's ProActive Health portfolio by incorporating scientifically supported branded ingredients but also contributes to the company's advancements in technology.

Chapter 1. GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET – Executive Summary

2.1. Market Size & Forecast – (2023 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.4. Attractive Investment Propositions

2.5. COVID-19 Impact Analysis

Chapter 3. GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.5. PESTLE Analysis

4.4. Porters Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET – By Technology

6.1. CO2 Extraction

6.2. Solvent Extraction

6.3. Steam Distillation

6.4. Enfleurage

6.5. Others

Chapter 7. GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET – By Product

7.1. Organic

7.2. Conventional

Chapter 8. GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET – By Application

8.1. Personal Care

8.2. Food & Beverage

8.3. Medical

8.4. Other

Chapter 9. GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Technology

9.1.3. By Product

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Technology

9.2.3. By Product

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Technology

9.3.3. By Product

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest South America

9.4.2. By Technology

9.4.3. By Product

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Technology

9.5.3. By Product

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL BOTANICAL FLAVORS FROM FRUITS MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Synergy Flavors

10.2. Bell Flavors & Fragrances GmbH

10.3. Parker Flavors, Inc.

10.4. Archer Daniels Midland Company

10.5. Kanegrade Limited

10.6. Carrubba Incorporated

10.7. Sapphire Flavors & Fragrances

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Botanical Flavors from Fruits Market was valued at USD 8.06 billion in 2023 and is projected to reach a market size of USD 12.61 billion by the end of 2030, with a projected CAGR of 6.6% over the forecast period (2024-2030).

The market is driven by consumer preferences for natural and authentic tastes, innovation in extraction methods, increased awareness of health benefits, and the quest for novel flavor profiles. Additionally, the use of botanical extracts in the food and beverage sector, especially in organic and healthy products, contributes to market growth.

Cutting-edge Carbon Dioxide (CO2) extraction techniques are prominently utilized, producing highly pure fruit extracts known for superior quality. CO2 extraction is the largest and fastest-growing segment, valued for its versatility and application in various industries.

In 2021, the food and beverage sector held the largest market share, driven by global demand for organic, healthy, and minimally processed food products. Botanical extracts contribute to prolonged product shelf life, and their antimicrobial properties are crucial in this sector.

Europe is currently the largest segment, with Asia-Pacific being the fastest-growing. Factors contributing to the growth include the increasing growth of beverage products, elevated consumption of ready-to-drink beverages, and a shift towards healthful and organic ingredients.