Botanical Drug Market Size (2024-2030)

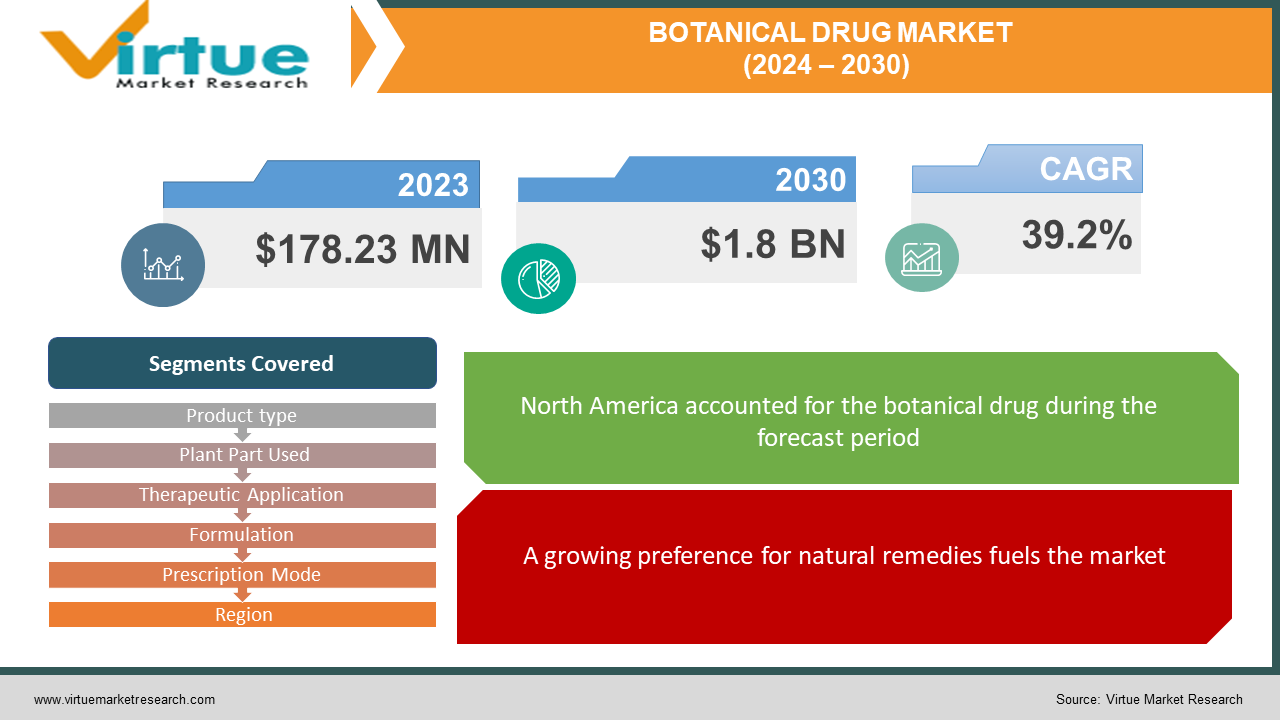

The Botanical Drug Market was valued at USD 178.23 million in 2023 and is projected to reach a market size of USD 1.8 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 39.2%.

The botanical drug market is blooming. Consumers are increasingly interested in natural remedies, driving a surge in botanical medicines. This growth is fueled by a desire for alternatives to synthetic drugs, a rise in chronic diseases, and an aging population seeking treatments for age-related ailments. Governments are even recognizing the potential of traditional medicine systems, lending further support to the market. Botanical drugs come in various forms, targeting a range of health concerns. From capsules and tablets to powders and topical applications, plant-based ingredients are finding their way into many treatment options. Even established pharmaceutical companies are taking notice, investing in research and development alongside dedicated herbal medicine players. The botanical drug market offers a glimpse into a greener path for pharmaceuticals, but it's important to consult with qualified healthcare professionals before using these products due to potential interactions with other medications and varying effectiveness.

Key Market Insights:

The botanical drug market is flourishing due to a confluence of factors. Consumers are increasingly seeking natural alternatives to synthetic medications, perceiving them as gentler and safer. This shift in preference, coupled with the rising prevalence of chronic diseases like diabetes and heart disease, is creating a demand for new treatment options. Botanical drugs are emerging as potential solutions, either for standalone use or alongside conventional treatments. Additionally, governments are recognizing the value of traditional medicine systems, fostering research and development of botanical drugs based on historical knowledge. This integration with modern healthcare holds significant promise for the future of botanical medicine.

The market itself is undergoing exciting transformations. Innovation is driving the creation of convenient and accessible formats for botanical drugs. Gone are the days of solely relying on powders and teas. Today, patients can choose from capsules, tablets, liquids, and even topical applications, making it easier to incorporate botanical remedies into their routines. Furthermore, established pharmaceutical companies are entering the playing field, collaborating with dedicated herbal medicine players. This blend of expertise could lead to wider acceptance of botanical drugs and the development of more standardized formulations.

While the botanical drug market offers a glimpse into a greener path for pharmaceuticals, it's crucial to approach it with caution. The effectiveness of these drugs can vary, and potential interactions with other medications exist. Consulting with a qualified healthcare professional is essential before incorporating botanical drugs into your regimen. They can help you navigate the options and ensure these natural remedies complement your existing healthcare plan.

The Botanical Drug Market Drivers:

A growing preference for natural remedies fuels the market.

A growing segment of the population is seeking natural alternatives to synthetic medications. This shift in preference is driven by a perception of botanical drugs being safer and gentler on the body, with potentially fewer side effects.

Rising chronic illness rates create a need for new treatment options.

The rising prevalence of chronic conditions like diabetes, heart disease, and cancer is creating a significant demand for new treatment options. Botanical drugs offer a potential solution, either as standalone therapies or complementary treatments alongside conventional medicine.

Official support for traditional medicine fosters botanical drug development.

Governments worldwide are starting to acknowledge the value of traditional medicine systems. This recognition fosters research and development of botanical drugs based on historical knowledge and practices. This integration with modern healthcare holds significant promise for the future of botanical medicine.

Convenient formats and delivery methods make botanical drugs more accessible.

The market is witnessing a wave of innovation in drug formats and delivery methods. Gone are the days of solely relying on powders and teas. Today, patients have access to convenient and user-friendly options like capsules, tablets, liquids, and even topical applications. This makes it easier to incorporate botanical remedies into daily routines.

Collaboration between established companies and herbal medicine players accelerates progress.

Established pharmaceutical companies are taking notice of the botanical drug market's potential. They are actively investing in research and development, collaborating with dedicated herbal medicine players. This blend of expertise could lead to wider acceptance of botanical drugs and the development of more standardized formulations.

The Botanical Drug Market Restraints and Challenges:

Despite its promising growth, the botanical drug market faces some significant hurdles. Stringent regulations, particularly in developed countries like the US and Europe, can act as a barrier to entry. These regulations focus on ensuring safety and efficacy, requiring extensive clinical trials that can be expensive and time-consuming for botanical drug development. This often results in insufficient research and development funding, hindering the ability of botanical drugs to meet the rigorous standards for approval. Additionally, the inherent variability of natural products poses a challenge. Unlike synthetic drugs with a consistent composition, botanical drugs can have fluctuations in potency and active ingredients due to factors like plant source, growing conditions, and processing methods. This variability makes it difficult to standardize formulations and ensure consistent results. Furthermore, concerns exist regarding potential interactions with other medications and the possibility of adverse effects, especially with limited safety data on some botanical drugs. Overcoming these challenges will require collaboration between researchers, regulators, and the botanical drug industry. Streamlining the regulatory process while maintaining safety standards, coupled with increased investment in research and quality control, are crucial steps forward. With a focus on transparency and evidence-based practices, the botanical drug market can navigate these restraints and unlock its full potential as a complementary or alternative healthcare approach.

The Botanical Drug Market Opportunities:

The future of the botanical drug market is brimming with possibilities. One key area of focus is building trust through evidence-based research. Rigorous clinical trials demonstrating safety and efficacy are essential to convince healthcare professionals and consumers alike. Standardization and quality control are equally important. Developing consistent formulations with reliable potency and active ingredients will boost market confidence. The vast potential of medicinal plants remains largely untapped, so exploration of new plant sources and their therapeutic properties could lead to groundbreaking discoveries. Bridging the gap between traditional herbal medicine and modern healthcare offers another exciting opportunity. Collaboration could lead to innovative combination therapies that combine the strengths of both approaches. Technological advancements can also play a significant role. Utilizing technology to streamline cultivation, extraction, and delivery methods can improve efficiency and affordability. Finally, there's immense potential in targeted product development. Focusing on botanical drugs for specific conditions with high unmet medical needs could address critical healthcare challenges and significantly improve patient outcomes. By seizing these opportunities and adhering to responsible practices, ethical sourcing, and a commitment to patient well-being, the botanical drug market can establish itself as a vital and respected force in the healthcare industry.

BOTANICAL DRUG MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

39.2% |

|

Segments Covered |

By Product type, Plant Part Used, Therapeutic Application, Formulation, Prescription Mode, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Buchang Pharmaceuticals, China TCM, Tsumura, Schwabe, Tong Ren Tang, Jumpcan Pharmaceutical, Guangzhou Baiyunshan pharmaceutical, Yunnan Baiyao, Tasly Holding Group |

Botanical Drug Market Segmentation: By Product Type

-

Herbal Medicines

-

Plant Extract Drugs

-

Phytochemicals

-

Terpenes

-

Steroids

-

Glycosides

-

Phenols

-

Other Phytochemicals

-

The most dominant segment in the botanical drug market by product type is likely herbal medicines. These encompass traditional remedies like teas and tinctures and are popular due to their familiarity and ease of use. However, the fastest-growing segment is expected to be plant extract drugs. These refined products with concentrated active ingredients are gaining traction due to increased focus on standardization and the potential for integration with modern medicine.

Botanical Drug Market Segmentation: By Plant Part Used

-

Stem/Bark

-

Sap

-

Leaf

-

Others

Leaves are likely the most dominant segment due to their rich content of active ingredients like flavonoids and terpenes. These parts are easily cultivated and processed, making them a practical choice for many botanical drugs. Phytochemicals, on the other hand, are expected to be the fastest-growing segment due to the increasing focus on isolated plant chemicals with specific therapeutic benefits. This segment offers a more targeted approach and potentially higher efficacy.

Botanical Drug Market Segmentation: By Therapeutic Application

-

Neurological Disorders

-

Infectious Diseases

-

Digestive Diseases

-

Respiratory Diseases

-

Oncology

-

Dermatological Disorders

-

Cardiovascular Disorders

-

Others

While the dominant segment of the botanical drug market by therapeutic application is likely Digestive Diseases due to its prevalence and historical use of botanical remedies, the fastest-growing segment is expected to be Neurological Disorders. This is driven by the rising incidence of neurological conditions and increasing interest in natural approaches to managing these complex issues.

Botanical Drug Market Segmentation: By Formulation

-

Tablets

-

Ointments

-

Sprays

-

Oral Solutions

-

Other Forms

The dominant segment in the botanical drug market by formulation is likely Tablets. Their ease of consumption, controlled dosage, and long shelf life make them a popular choice. However, the fastest-growing segment is expected to be Oral Solutions. This is due to their convenience, faster absorption rates, and suitability for children or those with swallowing difficulties. As the market caters to a wider range of consumers, these liquid formulations are expected to gain significant traction.

Botanical Drug Market Segmentation: By Prescription Mode

-

Prescription

-

Over The Counter (OTC)

The dominant segment of the botanical drug market by prescription mode is likely Over The Counter (OTC). This is due to the historical use of botanical remedies for self-care and the generally lower regulatory burden for OTC products. However, the Prescription segment is expected to be the fastest-growing segment. This is driven by increasing research on the efficacy of botanical ingredients for specific conditions and a growing acceptance of botanical drugs as complementary or alternative therapies alongside conventional medicine.

Botanical Drug Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America: This region holds a significant market share, driven by a growing consumer preference for natural remedies and a well-established infrastructure for herbal products. The US market, in particular, benefits from a strong research base and established regulations.

Europe: Europe is another major player, with a long history of traditional herbal medicine. The regulatory framework in Europe is stringent, promoting high-quality botanical drugs. Additionally, a growing focus on preventive healthcare fuels market growth.

Asia-Pacific: This region is expected to experience the fastest growth due to a rich heritage of traditional medicine systems like Ayurveda and Chinese medicine. Furthermore, a large and growing population with rising disposable income presents a significant market opportunity.

COVID-19 Impact Analysis on the Botanical Drug Market:

The COVID-19 pandemic's impact on the botanical drug market was a mixed bag. On the one hand, global lockdowns disrupted supply chains for botanical ingredients, leading to shortages and price hikes. Additionally, regulatory bodies tightened their grip due to potential interactions with COVID-19 medications or unsubstantiated claims, slowing market growth in some areas. Consumer hesitation might have also played a role, with conflicting information regarding the effectiveness of botanical drugs for COVID-19 treatment causing some to hold back.

However, the pandemic also presented opportunities. The heightened focus on immunity during this time led to increased interest in botanical drugs perceived to support the immune system, even if not a direct COVID-19 cure. The general trend towards natural wellness solutions also benefited the market, with consumers seeking alternatives to conventional medications. Furthermore, the rise of e-commerce platforms due to lockdowns and social distancing provided greater convenience and accessibility for purchasing botanical drugs.

While the long-term effects of COVID-19 on this market remain to be seen, its focus on natural well-being positions it well to potentially capitalize on a growing interest in preventive healthcare in a post-pandemic world. Remember though, consulting with qualified healthcare professionals before using botanical drugs, especially during a pandemic, is crucial. They can guide you through the options and ensure these remedies work alongside your existing healthcare plan, particularly if you have underlying health conditions.

Latest Trends/ Developments:

The botanical drug market is buzzing with innovation. One exciting trend is the move towards personalized medicine. By tailoring treatment plans to individual genetic profiles and health needs, botanical drugs could become even more effective. Technology is also playing a growing role, with AI analyzing vast datasets on plant properties and machine learning predicting individual responses to different botanical drugs. Adaptogens, a class of botanicals believed to help manage stress, are gaining popularity due to their potential mood-balancing and stress-relieving properties. Microdosing botanicals in capsules or tinctures is another emerging trend, with potential benefits for anxiety, focus, and cognitive function, although further research is needed. Consumers are also becoming more environmentally conscious, driving a demand for sustainably sourced and ethically harvested botanical ingredients. Finally, partnerships between established pharmaceutical companies and traditional herbal medicine players are on the rise, combining expertise for research, development, and commercialization of botanical drugs. The future of botanical medicine looks promising, with innovation and personalization paving the way for a more targeted and effective approach to harnessing the power of plants for health and well-being.

Key Players:

-

Buchang Pharmaceuticals

-

China TCM

-

Tsumura

-

Schwabe

-

Tong Ren Tang

-

Jumpcan Pharmaceutical

-

Guangzhou Baiyunshan Pharmaceutical

-

Yunnan Baiyao

-

Tasly Holding Group

Chapter 1. Botanical Drug Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Botanical Drug Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Botanical Drug Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Botanical Drug Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Botanical Drug Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Botanical Drug Market – By Product Type

6.1 Introduction/Key Findings

6.2 Herbal Medicines

6.3 Plant Extract Drugs

6.4 Phytochemicals

6.5 Terpenes

6.6 Steroids

6.7 Glycosides

6.8 Phenols

6.9 Other Phytochemicals

6.10 Y-O-Y Growth trend Analysis By Product Type

6.11 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Botanical Drug Market – By Plant Part Used

7.1 Introduction/Key Findings

7.2 Stem/Bark

7.3 Sap

7.4 Leaf

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Plant Part Used

7.7 Absolute $ Opportunity Analysis By Plant Part Used, 2024-2030

Chapter 8. Botanical Drug Market – By Therapeutic Application

8.1 Introduction/Key Findings

8.2 Neurological Disorders

8.3 Infectious Diseases

8.4 Digestive Diseases

8.5 Respiratory Diseases

8.6 Oncology

8.7 Dermatological Disorders

8.8 Cardiovascular Disorders

8.9 Others

8.10 Y-O-Y Growth trend Analysis By Therapeutic Application

8.11 Absolute $ Opportunity Analysis By Therapeutic Application, 2024-2030

Chapter 9. Botanical Drug Market – By Formulation

9.1 Introduction/Key Findings

9.2 Tablets

9.3 Ointments

9.4 Sprays

9.5 Oral Solutions

9.6 Other Forms

9.7 Y-O-Y Growth trend Analysis By Formulation

9.8 Absolute $ Opportunity Analysis By Formulation, 2024-2030

Chapter 10. Botanical Drug Market – By Prescription Mode

10.1 Introduction/Key Findings

10.2 Prescription

10.3 Over The Counter (OTC)

10.4 Y-O-Y Growth trend Analysis By Prescription Mode

10.5 Absolute $ Opportunity Analysis By Prescription Mode, 2024-2030

Chapter 11. Botanical Drug Market , By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Product Type

11.1.2.1 By Plant Part Used

11.1.3 By Therapeutic Application

11.1.4 By Texture

11.1.5 By Prescription Mode

11.1.6 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Product Type

11.2.3 By Plant Part Used

11.2.4 By Therapeutic Application

11.2.5 By Formulation

11.2.6 By Texture

11.2.7 By Prescription Mode

11.2.8 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Product Type

11.3.3 By Plant Part Used

11.3.4 By Therapeutic Application

11.3.5 By Formulation

11.3.6 By Texture

11.3.7 By Prescription Mode

11.3.8 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Product Type

11.4.3 By Plant Part Used

11.4.4 By Therapeutic Application

11.4.5 By Formulation

11.4.6 By Texture

11.4.7 By Prescription Mode

11.4.8 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Product Type

11.5.3 By Plant Part Used

11.5.4 By Therapeutic Application

11.5.5 By Formulation

11.5.6 By Texture

11.5.7 By Prescription Mode

11.5.8 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Botanical Drug Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Buchang Pharmaceuticals

12.2 China TCM

12.3 Tsumura

12.4 Schwabe

12.5 Tong Ren Tang

12.6 Jumpcan Pharmaceutical

12.7 Guangzhou Baiyunshan Pharmaceutical

12.8 Yunnan Baiyao

12.9 Tasly Holding Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Botanical Drug Market was valued at USD 178.23 million in 2023 and is projected to reach a market size of USD 1.8 billion by the end of 2030. Over the cast period of 2024 – 2030, the request is projected to grow at a CAGR of 39.2%.

Consumer Desire for Natural Solutions, Chronic Disease Burden, Government Recognition of Traditional Medicine, Innovation in Drug Formats and Delivery, Big Pharma Joins the Game.

Neurological Disorders, Infectious Diseases, Digestive Diseases, Respiratory Diseases, Oncology, Dermatological Disorders, Others.

While the Asia-Pacific region is expected to experience the fastest growth, currently the most dominant region for the Botanical Drug Market is likely Europe due to its long history of herbal medicine and established regulations.

Buchang Pharmaceuticals, China TCM, Tsumura, Schwabe, Tong Ren Tang, Jumpcan Pharmaceutical, Guangzhou Baiyunshan Pharmaceutical, Yunnan Baiyao, Tasly Holding Group.