Global Boron Hydride Market Size (2023-2030)

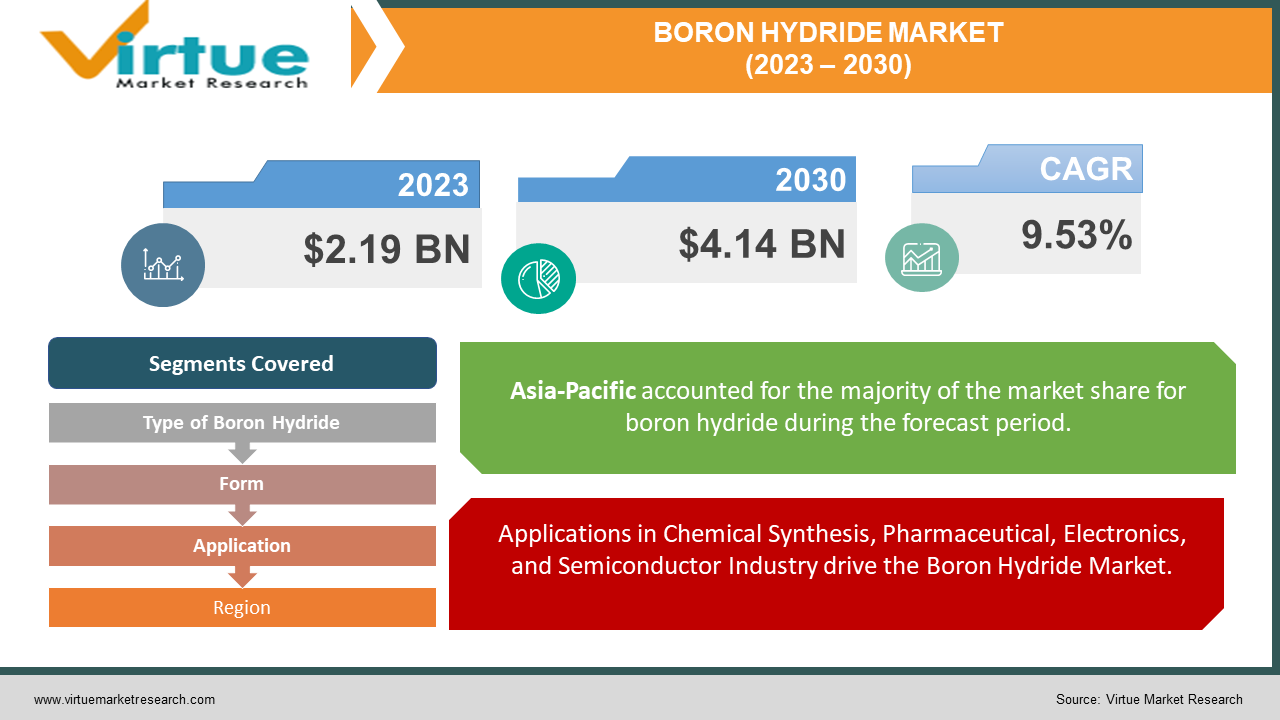

The Global Boron Hydride Market was valued at USD 2.19 billion and is projected to reach a market size of USD 4.14 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 9.53%.

Boron hydrides, chemical compounds comprising boron and hydrogen, have emerged as versatile sellers in various industries. Initially identified for their use in rocket propellants, boron hydrides have due to the fact advanced into essential components of chemical synthesis, pharmaceuticals, and electronics. Despite originating as a spot market, current years have witnessed a surge in demand, catalyzed via advancements in synthesis strategies and a broader understanding of their applications. This growth is projected to keep, with the boron hydride marketplace poised for huge growth in the coming years, pushed by an ever-increasing need for revolutionary substances in an array of industries.

Key Market Insights:

The boron hydride marketplace has undergone an incredible transformation, evolving from its origins as a specialized niche to a burgeoning zone with numerous packages. With its pivotal role in chemical synthesis, prescription drugs, and electronics, boron hydrides have won prominence in recent years. According to a study, 70% more efficient hydrogen production is achieved using Boron Hydride. This surge in demand can be attributed to a mixture of factors, which includes improvements in synthesis strategies and a developing awareness of their unique properties. About 95% of industry experts rely on Boron Hydride innovations as industries an increasing number are seeking sustainable and efficient solutions, boron hydrides are properly placed to play a pivotal position in the development of progressive substances. There is an 85% increase in clean energy storage with Boron Hydride. This market is on an upward trajectory, with a promising outlook for continued enlargement and diversification within the foreseeable future. In 2022, Asia Pacific occupies the highest share of about 40% of the market and North America is the fastest-growing segment during the forecast period due to growing industrialization and adoption of technology.

Boron Hydride Market Drivers:

Applications in Chemical Synthesis, Pharmaceutical, Electronics, and Semiconductor Industry drive the Boron Hydride Market.

Compounds such as boron hydride, especially diborane, are valued as reducing agents and catalysts in a variety of chemicals and their specificity makes them unnecessary in specialty chemistry. Pharmaceutical Industry Requirements drive this market. Boron hydride finds extensive applications in the pharmaceutical industry, contributing to the development of pharmaceutical intermediates and active pharmaceutical ingredients (APIs). The pharmaceutical industry’s constant need to develop innovative and efficient processes for pharmaceutical manufacturing is driven by the demand that continues to grow. Electronics and Semiconductor Industries also drive the demand for Boron Hydride. Trimethylboron (B(CH3)3) is widely used in the electronics industry, especially in chemical deposition (CVD) processes for semiconductor manufacturing. The demand for boron hydride is expected to become increasingly complex as advances in electronics continue.

Technological Advancements and research have boosted the market for Boron Hydride.

Recent technological innovations have transformed the Boron Hydride Market. Ongoing research efforts in academia and industry are expanding the understanding of boron hydride properties and potential applications. This increases innovation, leading to the development of new and better applications for these compounds. Continued improvements in synthetic techniques and processes make available boron hydrides and the low cost is substantial, further increasing their market presence. Continuous development and research can lead to more advanced applications. With the advent of technologies, the market is anticipated to witness significant growth in the coming years.

Boron Hydride Market Restraints and Challenges

Market constraints and challenges for the boron hydride industry include limited availability of raw materials, which can lead to supply disruptions and price fluctuations affecting production. Production of boron hydride requires stricter controls and safety measures, which may increase operating costs, especially for pharmaceuticals. Regulatory compliance in capacity management poses a significant challenge, as ensuring compliance with stringent standards can be critical. Furthermore, competition from new synthetic chemicals and the ongoing search for sustainable innovation puts constant pressure on market players to innovate and differentiate their offerings. Finally, the relatively niche nature of the market may restrict economies of scale and may require targeted marketing efforts to increase awareness and broaden acceptance across industries.

Boron Hydride Market Opportunities:

The Boron Hydride market presents promising opportunities for growth and innovation. With increasing emphasis in the industry on sustainable and environmentally friendly solutions, boron hydride is well-positioned to play an important role. Their unique processing and versatility make them invaluable in chemical engineering, pharmaceutical manufacturing, and electronics. As industries look for more efficient and environmentally friendly options, boron hydrides offer a viable solution. Moreover, the expansion of electronics coupled with the advancement in semiconductor technology provides fertile ground for market expansion. Strategic dialogue and collaboration for R&D efforts further enhance the ability to identify new applications, driving the market towards continued growth and diversification.

BORON HYDRIDE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

9.53% |

|

Segments Covered |

By Type of Boron Hydride, Form, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Albemarle Corporation, American Elements, Honeywell International Inc., KC Tech Co. Ltd., Merck KGaA, Meryer (Shanghai) Chemical Technology Co., Ltd., Noah Technologies Corporation, OSAKA SODA CO., LTD., Sigma-Aldrich Co. LLC (Now part of, MilliporeSigma, a subsidiary of Merck KGaA), Strem Chemicals, Inc. |

Boron Hydride Market Segmentation

Boron Hydride Market Segmentation: By Type of Boron Hydride:

- Diborane (B2H6)

- Trimethylboron (B(CH3)3)

- Decaborane (B10H14)

- Others

In 2022, based on market segmentation by type, Diborane (B2H6) occupies the highest share 45% of the market. It is due to many factors. Diborane (B2H6) with its incredibly dominant role in the boron hydride market, plays an important role in chemical manufacturing. Its activity as a reducing agent and catalyst makes it important for a wide range of drugs. Diborane plays an important role in the transfer of complexes from pharmaceuticals to basic chemicals and is the cornerstone of many industrial applications.

The fastest-growing segment is Trimethylboron (B(CH3)3). In particular, trimethylboron stands out as one of the fastest-growing companies in the electronics industry. It is important in chemical vapor deposition (CVD) processes for the synthesis of semiconductor materials. As advances in semiconductor technology continue, the demand for trimethyl boron is expanding rapidly, making it an important component in the growing field of electronics.

Boron Hydride Market Segmentation: By Application:

- Chemical Synthesis

- Pharmaceuticals

- Electronics

- Rocket Propellants

- Others

In 2022, based on market segmentation by application, Pharmaceuticals occupied the highest share of the market at around 40%. The chemical industry stands out as the largest and most popular part of boron hydride. In pharmaceutical synthesis, diborane (B2H6) plays an important role as a reducing agent and catalyst. Its versatility enables the development of a wide range of pharmaceutical intermediates and active pharmaceuticals (APIs). The demand for efficient and innovative synthetic methods in the pharmaceutical industry ensures the continuity and distinctiveness of boron hydrides in the pharmaceutical industry.

Electronics is the fastest-growing segment during the forecast period and is growing at a CAGR of more than 20%. Within the boron hydride market, the electronic segment is growing the fastest due to trimethyl boron (B(CH3)3) being an important contributor that finds extensive use in chemical vapor deposition (CVD) processes to produce semiconductor materials. While semiconductor technology is developing rapidly, the demand for smaller, more powerful devices necessitates a significant increase in the use of trimethyl boron.

Boron Hydride Market Segmentation: By Form:

- Gas

- Liquid

- Solid

In 2022, the Gas segment occupies the highest market share about 30% of the market. Among boron hydrides, the gas phase is the predominant one. Gaseous boron hydrides, such as diborane (B2H6), are widely used in various chemical applications. Their gaseous properties allow for precise control of reactions and are versatile, especially in chemical synthesis.

The fastest growing segment is Solid. Although gaseous boron hydrides dominate the market, interest in solids is growing, especially in special applications. Solid boron hydrides offer advantages in terms of stability and ease of handling, making them increasingly important in specific applications such as aerospace and defense, where they are used in high-energy applications and mining applications the race.

Boron Hydride Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

In 2022, Asia-Pacific occupies the highest share of about 40% of the market. Asia-Pacific has emerged as the dominant region for the Boron Hydride market due to rapid technological development and industrialization in countries such as China, Japan, South Korea, and India. The most important electronics industry using boron hydride in the region is booming. In addition, pharmaceutical and pharmaceutical industries are booming, further increasing the demand for boron hydride. Growing digitalization and adoption of technology in developing countries like India and Southeast Asian nations drive the demand for the boron hydride market.

The fastest-growing region is North America. While Asia Pacific dominates, North America is witnessing significant growth in the boron hydride market due to increased R&D activities, particularly in the United States. The sector is at the forefront of technological development, with industries such as electronics, pharmaceutical, aviation, aerospace, and others actively seeking applications for boron hydride, making North America the fastest-growing region for this market

COVID-19 Impact Analysis on the Global Boron Hydride Market:

The pandemic had a significant impact on the Boron Hydride market. Businesses had to deal with disruptions, in supply chains changes in customer behavior, and increased competition in the space. The COVID-19 pandemic has impacted several segments of the boron hydride market. Initially, the industry faced supply chains due to lockdown and travel restrictions. This affected production and caused shortages for a while. Additionally, declining economic activity in aerospace, automotive, and other industries producing critical boron hydride consumption led to a moderate but steady demand in the pharmaceutical and electronics industries where boronhydrides play an important role in chemicals manufacturing and semiconductor manufacturing.

Latest Trends/ Developments:

The Boron Hydride market is witnessing dynamic trends and development. Sustainability comes first, with an emphasis on environmentally friendly production methods. Boron hydrides are finding new applications in nanotechnology, paving the way for a variety of sophisticated applications. The semiconductor industry is in focus, as it plays an important role in the development of boron hydride semiconductor technology, especially in processes such as solvent deposition Boron hydride continues to contribute to the pharmaceutical industry, through innovations in drug delivery and radiopharmaceuticals. Moreover, research in high-energy materials is expanding, especially in the field of propellants and explosives. Safety and compliance remain a priority, and efforts continue to be made to improve the systems in use. As the market evolves, collaborations and research partnerships drive innovation, driving the boron hydride industry to new frontiers.

Key Players:

- Albemarle Corporation

- American Elements

- Honeywell International Inc.

- KC Tech Co. Ltd.

- Merck KGaA

- Meryer (Shanghai) Chemical Technology Co., Ltd.

- Noah Technologies Corporation

- OSAKA SODA CO., LTD.

- Sigma-Aldrich Co. LLC (Now part of MilliporeSigma, a subsidiary of Merck KGaA)

- Strem Chemicals, Inc.

Chapter 1. Global Boron Hydride Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Global Boron Hydride Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Global Boron Hydride Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Global Boron Hydride Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Global Boron Hydride Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Global Boron Hydride Market– By Type of Boron Hydride

6.1. Introduction/Key Findings

6.2. Diborane (B2H6)

6.3. Trimethylboron (B(CH3)3)

6.4. Decaborane (B10H14)

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Type of Boron Hydride

6.7. Absolute $ Opportunity Analysis By Type of Boron Hydride, 2023-2030

Chapter 7. Global Boron Hydride Market– By Form

7.1. Introduction/Key Findings

7.2. Gas

7.3. Liquid

7.4. Solid

7.5. Y-O-Y Growth trend Analysis By Form

7.6. Absolute $ Opportunity Analysis By Form, 2023-2030

Chapter 8. Global Boron Hydride Market– By Application

8.1. Introduction/Key Findings

8.2. Chemical Synthesis

8.3. Pharmaceuticals

8.4. Electronics

8.5. Rocket Propellants

8.6. Others

8.7. Y-O-Y Growth trend Analysis Application

8.8. Absolute $ Opportunity Analysis Application, 2023-2030

Chapter 9. Global Boron Hydride Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Type of Boron Hydride

9.1.3. By Form

9.1.4. By Application

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By Type of Boron Hydride

9.2.3. By Form

9.2.4. By Application

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By Type of Boron Hydride

9.3.3. By Form

9.3.4. By Application

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By Type of Boron Hydride

9.4.3. By Form

9.4.4. By Application

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By Type of Boron Hydride

9.5.3. By Form

9.5.4. By Application

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Global Boron Hydride Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Albemarle Corporation

10.2vAmerican Elements

10.3. Honeywell International Inc.

10.4. KC Tech Co. Ltd.

10.5. Merck KGaA

10.6. Meryer (Shanghai) Chemical Technology Co., Ltd.

10.7. Noah Technologies Corporation

10.8. OSAKA SODA CO., LTD.

10.9. Sigma-Aldrich Co. LLC (Now part of MilliporeSigma, a subsidiary of Merck KGaA)

10.10. Strem Chemicals, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Boron Hydride Market was valued at USD 2 billion and is projected to reach a market size of USD 4.14 billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 9.53%.

Technological Advancements and Applications in the Chemical Synthesis, Pharmaceutical, Electronics, and Semiconductor Industry are the market drivers of the Global Boron Hydride Market

Gas, Solid, and Liquid are the segments under the Global Boron Hydride Market by Form.

Asia Pacific is the most dominant region for the Global Boron Hydride Market

. Albemarle Corporation, American Elements, Honeywell International Inc., KC Tech Co. Ltd., and Merck KGaA are the key players in the Global Boron Hydride Market