Boron-based Biocides Market Size (2024 – 2030)

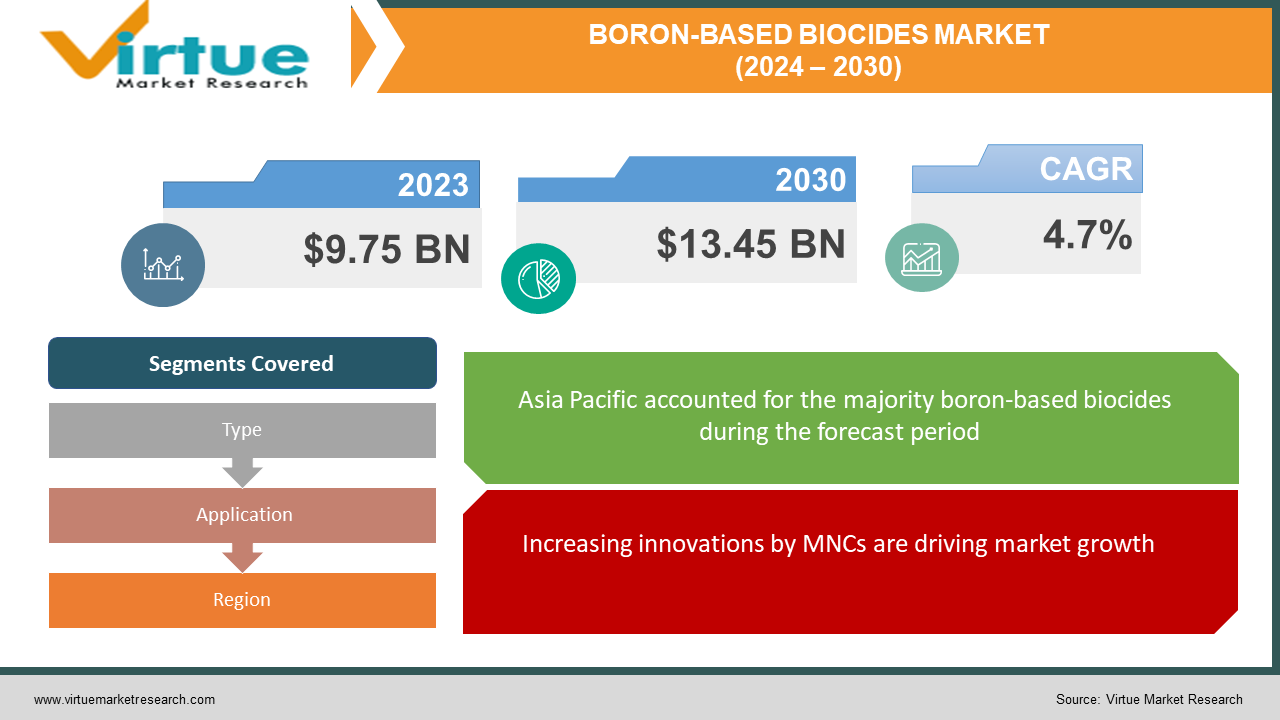

The Boron-based Biocides Market was valued at USD 9.75 billion in 2023 and is projected to reach a market size of USD 13.45 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 4.7%.

Biocides are used to cleanse, eradicate, and prevent germs like fungi, bacteria, and viruses. For diverse uses in the consumer goods, paints & coatings, and water treatment industries, this substance is typically mixed with other materials. Depending on where the raw materials arrive from, they can be divided into natural biocide and synthetic biocide. Growing consumer awareness of personal hygiene and cleanliness is a factor driving up demand for the product. Also, the sensitivity of people to allergens and dust is strengthening the demand for biocides. The market's expansion may also be ascribed to manufacturer investments from both established and developing economies, product expansion, and improving performance for expanding applications. Also, this product type has been chosen by many industries due to its efficient characteristics and relatively inexpensive expense.

Key Market Insights:

Biocides are applied in water cleaning programs to control biofouling in reverse osmosis membranes. These biocides are applied before the RO system to control bio-growth in the membrane. As per a UNICEF report, nearly 74% of the global population can approach safe drinking water, which is likely to reach 81% by 2030, abandoning 1.6 billion without any safe drinking water.

India has been producing a crucial quantity of industrial and urban wastes annually. The disposal of sewage sludge has now become a serious concern due to rapid industrialization and urbanization during the last few decades. Approximately 38,354 million litres of sewage with an equivalent amount of sludge per day is presently generated in India. The nutrient potential of available wastewater in India is guessed to be more than 350,000-ton N, 150,000-ton P, and 200,000-ton K per year.

The minister of energy in the United Arab Emirates has made it official regarding investments in water treatment plants and new desalination plants in Abu Dhabi, Dubai, and Umm Al Qaiwain amounting to AED 7.63 billion (~USD 2.08 billion), in line with the directives and regulations of the UAE's leadership to achieve water security. With rising demand from water treatment applications, the demand for biocides is also rapidly growing.

Boron-based Biocides Market Drivers:

Increasing innovations by MNCs are driving market growth.

In the future years, the product's consumption will increase owing to increasing innovations made by different multinational corporations to diversify their product portfolio and reduce the risks associated with biocides, as well as the increasing preference for natural biocides. The market from the water and sewage water and wood conservation businesses continues to make the U.S. the leading nation in the North American regional market. U.S. water quality laws are severe, and they support the use of EPA-registered biocides in water treatment facilities. On

e of the most significant water treatment facilities in the US that utilises biocides is Blue Plains Advanced WWTP. The widespread application of wood in residential, commercial, and industrial buildings has benefited the widening of biocides' usage in wood preservation.

When compared to their use, there is a 15-20% increase in tree planting, which sustains the environment. The U.S. market development for Boron-based Biocides has been further driven by the significant demand for paints and coatings. Globally, the growing demand for biocides from sectors including cleaning and sanitation, water treatment, paints and coatings, and others has sparked a growth in the production and creation of different biocide formulations. Since biocides have an oxidizing ability that is more than twice that of chlorine, they are highly consumed by wastewater treatment options around the world. Biocides, such as chlorine dioxide, are utilized in wastewater treatment operations at lower concentrations and are very effective as water sanitizers and disinfectants.

Growing demand for wastewater treatment is propelling growth.

By filtering impurities, wastewater treatment produces effluent that can be recycled back into the water cycle. The treatment takes place at a wastewater treatment facility. Sewage treatment plants are utilized to treat household wastewater, sometimes referred to as municipal wastewater or sewage. Either a different industrial wastewater treatment facility or a sewage treatment plant treats industrial wastewater (usually post some form of pre-treatment). Leachate treatment plants and agricultural wastewater treatment facilities are additional types of wastewater treatment facilities. Phase transformation (such as sedimentation), chemical and biological procedures (such as oxidation), and sanitizing are examples of procedures that are frequently used to clean water.

The halogen group of chemical elements has boron, chlorine, fluorine, bromine, iodine, astatine, and other elements. These biocides, which are used in municipal applications, are made using a variety of halogens to take advantage of their disinfectant characteristics. Halogen biocides are substances that are used to deter, get rid of, make harmless, or control harmful organisms. Chlorine and bromine are biocides that destroy bacteria by oxidizing them through an electrochemical method. These are the most popular processes for removing organic susceptibilities from water, according to halogen biocides market statistics, because they are budget-friendly and have beneficial germ-killing properties that can be applied in both municipal and industrial applications.

Boron-based Biocides Market Restraints and Challenges:

Rising costs of raw materials will impact the market.

Biocides are made up of a variety of substances, including phenols, halogens, ammonium compounds, and iodine. These chemicals' accelerating costs are making it difficult for the market to widen. Additionally, it is expected that government limitations on the import and export of specific chemicals will curtail output, thus restricting market expansion. These rules are put in place to reduce the damaging effects that these chemicals have on the human body and health, as well as to safeguard water bodies and cease the spread of water pollution. For instance, the introduction of the Biocidal Product Regulation, REACH, classification, and labeling and packaging regulation assisted in ensuring the highest level of protection for the environment and human health

Time-consuming and expensive registration process restraining market growth.

In Europe, there is a strict regulatory environment when it comes to the usage of Boron-based Biocides. The Biocidal Products Regulation focuses on improving the usage and functioning of Biocidal products in the European Union, by ensuring a high level of security for humans, animals, and the environment. However, all Biocidal products require authorization before they can be introduced in the market. Additionally, the active substances contained in a Biocidal product must be approved before it is dropped in the market.

Boron-based Biocides Market Opportunities:

Escalating demand from the Paints and Coatings Market

One important aspect boosting the market is an expansion in the paints and coatings sector. In this industry, the product is utilized to protect the painted surface from microbiological contamination caused by fungal or bacterial development through exposure to the outside environment and air pollution. The surfaces involve the exteriors of cars, consumer products, and the walls of buildings and other infrastructure. The market for these goods has also grown due to the rising preference for water-based paints over oil-based paints. Once the paint has dried, this product is coated to the set with a formulator over the painted surface. The market is also widening as a result of expanding applications in the automotive sector to protect the body, brakes, handle, and other interior and exterior auto elements.

Emerging applications of Boron-based Biocidal products

The water treatment demand is indirectly driving the Boron-based Biocides Market on account of the rising consumption of water due to population growth, modifying food habits, and climate change. Newer biocides help treat drinking water and wastewater, many wastewater treatment plants are substituting chlorine since several microsomes can survive chlorine treatment and hence lead to the risk of outbreaks that affect negatively.

BORON-BASED BIOCIDES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lanxess AG, BASF SE, Albemarle Corporation, Hubei Jinghong Chemicals Co. Ltd., Shanghai Zhongxin Yuxiang Chemicals Co. Ltd., Neogen Corporation, Troy Corporation, Lonza, Solvay SA, Lubrizol |

Boron-based Biocides Market Segmentation: By Type

-

Halogen Compounds

-

Quaternary Ammonium Compounds

-

Metallic Compounds

-

Phenolic

-

Organic Acids

-

Organosulfur

-

Others

Chemicals like chlorine, Boron, and iodine are examples of halogen compounds. They are used in the food and beverage sector for preservation as well as in wastewater treatment facilities and swimming pool water treatments. Halogen compounds are widely used in a variety of industrial applications, which is supporting market expansion.

In surface cleansers, disinfectants, shampoo, personal care items, detergents, and fabric softeners, quaternary ammonium compounds such as benzalkonium chloride and benzethonium chloride are combined with surfactants. These substances can stop the growth of microorganisms without affecting human health. This is helping the segment to develop, along with the rising need for consumer goods. Organosulfur compounds lack chlorine, making them suitable for applications requiring non-corrosive materials. These substances are invested in engineering products, home goods, air conditioning, and autos. A significant driver pushing the market is the high demand for these applications.

Boron-based Biocides Market Segmentation: By Application

-

Water Treatment

-

Food and Personal Care Products

-

Cleaning Products

-

Furniture and Furnishings

-

Clothing and Textiles

-

Leather and Suede

-

Paints and Coatings

-

Fuel Preservatives

-

Others

The air purification category is expected to develop more quickly throughout the forecast period, 2024–2030, whereas the water treatment area dominated the market in 2023. The need for safe drinking water is growing due to population rise and pollution, which is expected to raise demand for graphene. The WHO/UNICEF Joint Monitoring Program for Water Supply and Sanitation guesses that at least 1.8 billion people consume tainted water worldwide.

Also, significant manufacturing sectors generate a lot of wastewater every day, including chemicals, oil and gas, food and beverage, mining, and textiles. Many pollutants, including non-biodegradable compounds, organic waste, and minute amounts of metals and oxides, are found in this water. Since the polluted water may otherwise result in gastrointestinal issues, diarrhea, nausea, dehydration, and even death, cleansing the effluent water is necessary. Hence, rising Biocide usage in water purification will have a beneficial impact on market expansion.

Boron-based Biocides Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Over the estimated period, the worldwide market is expected to generate the most value in the Asia-Pacific region. The demand from the area's constantly widening population can be credited with driving up construction activity. Updated technologies are being further embraced by developing economies like China, Japan, and India to improve product development in the paints and coatings sector. Additionally, the need for industrial and consumer applications is expected to result in higher utilization of cleaning and water treatment goods. Due to its wide population, which must be fed, housed, and maintained while keeping the environment neat for people. China is the largest customer of all the products. North America is expected to experience slow growth during the projected time.

The market is being directed by quick technological development and innovation due to regional economic development. The main market for this product is the United States, where there is a considerable necessity for both wood preservation and paints & and coatings. Construction, furniture, home and personal care, and kitchenware all use wood, which opens up markets for the products. Also, the shift towards bio-based and natural biocides is anticipated to support market expansion.

COVID-19 Impact Analysis on the Boron-based Biocides Market:

The global coronavirus outbreak has had an impact on several end-users in the industry, including paints and coatings, food and drink, textiles, and wood. Boron-based Biocide finds extensive use in paints and coatings, which are also employed in the automobile and construction industries. The manufacture of the aforementioned industries has ceased as a result of the worldwide lockdown. This has detrimentally impacted the growth of the biocides market by causing a drop in product demand, a disturbance in the supply chain, and a halt to painting and automotive exports.

However, because this commodity is a pivotal raw ingredient used to make disinfectants, cleaners, and preservatives, the market is expected to settle rather quickly. Consumer awareness of cleaners and disinfectants to reduce virus spread has increased as a result of the epidemic. The desire for packaged, high-quality foods with longer shelf lives is another force boosting the use of this product in food and beverage preservation. The increase in virus transmission also fuelled this market's need for medical and hospital cleaning and disinfection services.

Latest Trends:

Rising focus on eco-friendly and multi-functional biocides and increasing application in Paints and Coatings industry

With growing consumer awareness and the move of the industry towards sustainability and environment-friendly methods, there is an evident increasing demand for eco-friendly and natural sources of biocides in the market. There is an increasing preference for biocides that have low toxicity and relatively lesser environmental impact as well as biodegradable products. With increasingly strict regulations and environmental protection laws being implemented the choice of the market is increasingly moving towards eco-friendly and also multi-functional biocides. Producers in the market are focusing on developing products that can potentially be utilized for a variety of applications such as anti-corrosion and anti-scaling attributes along with antimicrobial prevention and control.

Additionally, the increasing application of biocides by various end users, especially in the paints & coatings industry is estimated to boost market growth. Biocides are increasingly being adapted to protect the painted surface against microbial contamination happening by air pollution and exposure to the outside environment, such as fungal or bacterial development. Biocides are applied as a form of protection against germs and bacteria as well as aquatic creatures and algae because the bulk of paints are water-based and packed in cans for distribution and handling. This grew paint products' shelf-life and paint film durability over time. Fungi, algae, and bacteria offer the most biological hazards to paints and surface coatings, hence fungicides, algicides, and bactericides are typically utilised as biocide additions in paints. With the launch of powder coatings, the paints and coatings business, which is currently in upheaval because of the presence of lead in paints, has extended its portfolio. With an expanding fresh front, this has widened the application of biocide in the paints and coatings sector. It is a major growth driver for the necessity for biocides as the powder coatings industry develops. Due to labor and cost-effectiveness, automobile OEMs are shifting to powder-form coatings. This category is a big wave and has a favorable impact on the market. Resultantly, Biocides Market revenue expansion is expected to be fuelled by an increasing focus on eco-friendly and multi-functional biocides and increasing application in the paints & coatings industry.

Key Players:

-

Lanxess AG

-

BASF SE

-

Albemarle Corporation

-

Hubei Jinghong Chemicals Co. Ltd.

-

Shanghai Zhongxin Yuxiang Chemicals Co. Ltd.

-

Neogen Corporation

-

Troy Corporation

-

Lonza

-

Solvay SA

-

Lubrizol

Recent Developments

-

In January 2022, Veolia Group purchased Suez which has its expertise in water and waste management. This merger allows Veolia Group to increase its development in terms of Biocides market and Company revenue.

Chapter 1. Boron-based Biocides Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Boron-based Biocides Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Boron-based Biocides Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Boron-based Biocides Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Boron-based Biocides Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Boron-based Biocides Market – By Type

6.1 Introduction/Key Findings

6.2 Halogen Compounds

6.3 Quaternary Ammonium Compounds

6.4 Metallic Compounds

6.5 Phenolic

6.6 Organic Acids

6.7 Organosulfur

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Type

6.10 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Boron-based Biocides Market – By Application

7.1 Introduction/Key Findings

7.2 Water Treatment

7.3 Food and Personal Care Products

7.4 Cleaning Products

7.5 Furniture and Furnishings

7.6 Clothing and Textiles

7.7 Leather and Suede

7.8 Paints and Coatings

7.9 Fuel Preservatives

7.10 Others

7.11 Y-O-Y Growth trend Analysis By Application

7.12 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Boron-based Biocides Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Boron-based Biocides Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Lanxess AG

9.2 BASF SE

9.3 Albemarle Corporation

9.4 Hubei Jinghong Chemicals Co. Ltd.

9.5 Shanghai Zhongxin Yuxiang Chemicals Co. Ltd.

9.6 Neogen Corporation

9.7 Troy Corporation

9.8 Lonza

9.9 Solvay SA

9.10 Lubrizol

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Boron-based Biocides Market was valued at USD 9.75 billion in 2023 and is projected to reach a market size of USD 13.45 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 4.7%.

The increasing innovations by MNCs and consciousness among customers for clean water are propelling the Boron-based Biocides Market.

Boron-based Biocides Market is segmented based on Product type, Form, Application, and Region.

Asia-Pacific is the most dominant region for the Boron-based Biocides Market.

Lanxess AG, BASF SE, Albemarle Corporation, Hubei Jinghong Chemicals Co. Ltd., Shanghai Zhongxin Yuxiang Chemicals Co. Ltd., Neogen Corporation, Troy Corporation, and Lonza are a few of the key players operating in the Boron-based Biocides Market.