Border Security Market Size (2025-2030)

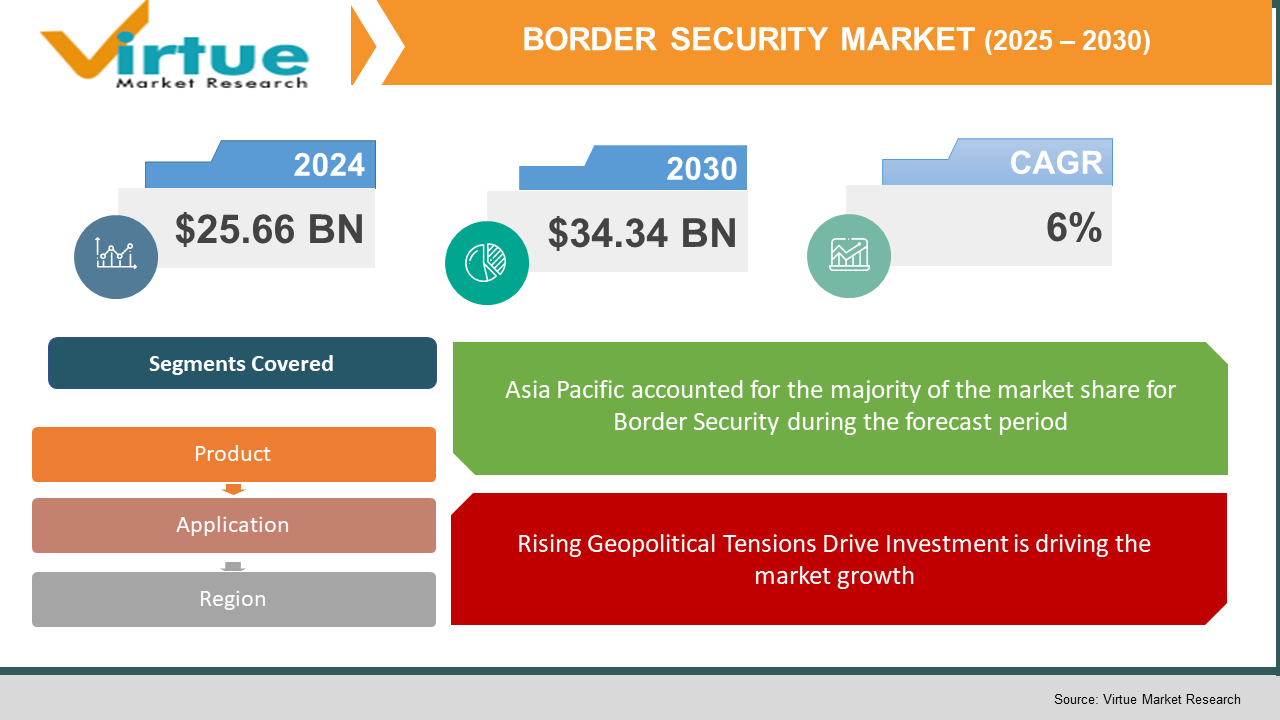

The Global Border Security Market was valued at USD 25.66 billion in 2024 and will grow at a CAGR of 6% from 2025 to 2030. The market is expected to reach approximately USD 34.34 billion by 2030.

Border security encompasses comprehensive solutions including physical barriers, advanced surveillance systems, sensor networks, and integrated command and control platforms. Rising geopolitical tensions, increasing migration concerns, and emerging transnational threats drive the demand for robust border security infrastructure. Governments are investing heavily in state‑of‑the‑art technology deployments to enhance national security, improve situational awareness, and ensure timely threat detection. The market offers diverse opportunities driven by rapid technological innovation and strong policy support. This dynamic landscape continues to evolve as new challenges emerge and security technologies advance, solidifying the market’s role as a critical component of national defense strategies.

Key Market Insights:

Surveillance systems account for a substantial share of security investments due to their role in real‑time threat detection.Advanced sensor networks are increasingly integrated with analytics for improved situational awareness.

Biometric authentication systems are growing rapidly, driven by the need for precise identity verification.

Unmanned systems, such as drones and robotics, contribute significantly to monitoring challenging terrains.

Communication and command systems enhance the interoperability of multiple security platforms.

Investments in software solutions streamline data fusion and decision‑making processes. Government budgets are expanding to support holistic, integrated border security systems. Continuous innovation in technology underpins the market’s long‑term growth prospects.

Global Border Security Market Drivers

Rising Geopolitical Tensions Drive Investment is driving the market growth

The intensifying geopolitical landscape has spurred a significant reallocation of national security budgets toward robust border security solutions. Governments face unprecedented challenges from transnational threats, irregular migration, and emerging terrorist networks. These multifaceted challenges necessitate a comprehensive approach, blending traditional physical barriers with advanced technological integrations. Consequently, increased investments in surveillance, detection, and command systems have become a priority for many nations. A combination of political instability in neighboring regions, resource competition, and historical territorial disputes contributes to sustained demand for enhanced border security infrastructure. Policymakers are compelled to balance the need for stringent security measures with public concerns over privacy and cross‑border commerce. The resulting focus on upgrading outdated security protocols and adopting state‑of‑the‑art technologies has catalyzed a period of rapid market expansion. Additionally, alliances and strategic partnerships among countries facing similar security threats have encouraged collaborative investments in research and development. This drive not only supports the deployment of cutting‑edge systems but also fosters innovation in artificial intelligence, sensor integration, and data analysis techniques designed to predict and preempt security breaches. As these advancements mature, their integration into national defense strategies further reinforces market stability. All these dynamics have created an environment where political, economic, and social factors converge, making geopolitical tensions a crucial driver for expanding investment in border security measures. Governments are likely to continue increasing expenditure in this area to safeguard national interests, maintain public order, and ensure the integrity of their territorial boundaries. Such investments fortify resilience and underpin long‑term security frameworks globally significant.

Accelerating Technological Innovation Enhances Systems is driving the market growth

Modern technological advancements have revolutionized border security operations by enabling faster threat detection and smarter responses. Innovations in sensor technology, machine learning, and data analytics have resulted in systems that can monitor vast border areas with minimal human intervention. Integrated platforms combining artificial intelligence with real‑time video feeds and radar data now allow security agencies to predict potential breaches and respond proactively. The continuous evolution of unmanned aerial vehicles, robotics, and automated surveillance systems has reduced operational costs and improved accuracy in threat identification. Increasing investments in research and development have led to the creation of multi‑sensor networks and advanced communication systems that seamlessly connect ground installations with central command centers. The rapid pace of digital transformation drives adoption of cloud‑based analytics and IoT‑enabled devices, further enhancing operational intelligence. These innovations not only streamline monitoring efforts but also enable rapid deployment and scalability of systems across diverse terrains and climates. As technological integration deepens, system interoperability and data fusion become critical for maintaining situational awareness. Such progress encourages further research, drives competitive market dynamics, and fosters public‑private partnerships. Together, these factors elevate the efficiency and reliability of border security, ensuring a responsive and adaptive infrastructure. The cumulative impact of these innovative technologies is a significant boost in the overall capability of border security systems, ensuring enhanced protection, faster resolution of security incidents, and reduced response times that are crucial for maintaining national safety and stability worldwide. This technological leap advances operational readiness and transforms national security frameworks remarkably well.

Expanding Funding Through Strategic Policy Measures is driving the market growth

Governmental policy frameworks have increasingly prioritized border security by directing substantial funds toward modernization and integration efforts. National budgets now allocate dedicated resources for upgrading surveillance systems, enhancing detection technologies, and establishing comprehensive command centers. Policy‑driven funding has been spurred by heightened concerns over illegal migration, smuggling, and transnational terrorism. Legislators are endorsing strategic partnerships between public institutions and private sector innovators to support advanced development projects. This systematic injection of capital encourages the deployment of technologies that incorporate automation, artificial intelligence, and robust data analytics. Fiscal incentives and tax breaks are often provided to firms developing next‑generation security solutions, helping reduce the barrier to adoption. In addition, government‑sponsored research programs are fostering innovation in sensor technology, unmanned systems, and cyber‑physical integration of border control measures. These initiatives are designed to enhance interoperability among various security components and streamline operational communications. The surge in public investments fosters a competitive environment that drives cost efficiencies and accelerates technology transfer from military applications to civilian border security implementations. This policy‑driven funding model not only safeguards national interests but also stimulates economic activity within the defense and technology sectors. As public expenditure rises, infrastructure modernization and digital transformation efforts gain momentum. These measures aim to create secure, resilient border environments that can adapt to evolving threats in a dynamic geopolitical landscape. Strategic policy interventions thus serve as a crucial enabler for sustained market growth and operational excellence in border security systems. Such comprehensive funding initiatives drive innovation and reinforce global security.

Global Border Security Market Challenges and Restraints

High Capital Expenditure and Complex Procurement is restricting the market growth

Implementing advanced border security measures requires significant financial outlay, posing a major barrier for many nations. The high capital expenditure is largely due to the cost‑intensive nature of integrated surveillance, sensor networks, and secure communication systems. Budget constraints force governments to prioritize immediate concerns over long‑term security infrastructure upgrades. The procurement process in public sectors is often lengthy, characterized by rigorous bidding procedures, regulatory approvals, and multiple stages of compliance checks. Additionally, the complexity in coordinating various vendors and ensuring system interoperability further inflates costs and delays implementation timelines. Such barriers are exacerbated in regions with political instability or limited fiscal resources, making it challenging to invest in cutting‑edge technologies. Manufacturers must therefore balance innovation with affordability to capture a wider market share. Moreover, the rapid pace of technological change necessitates frequent upgrades and maintenance, which add recurrent expenses over time. The uncertainty in return on investment further complicates decision‑making processes for policymakers. As fiscal pressures persist, the challenge of justifying high upfront costs against uncertain long‑term benefits continues to restrain market expansion. This restraint is particularly pronounced in emerging economies, where limited budgets and competing priorities often stall procurement processes. Consequently, the high cost barrier impedes widespread adoption, requiring both innovative financing solutions and policy interventions to drive market growth in border security deployments. Without strategic measures to reduce expenditure or provide financial incentives, the cost challenge remains a significant hurdle in the evolution of border security infrastructure and technology integration. This issue demands creative fiscal management strategies urgently.

Privacy Concerns and Regulatory Hurdles Restricting Rollout is restricting the market growth

Intensifying privacy debates and strict regulations pose significant challenges to the implementation of border security systems. The deployment of advanced surveillance technologies often triggers concerns about individual rights, data protection, and potential governmental overreach. Regulatory frameworks, designed to protect civil liberties, can inadvertently create delays in system rollouts due to extensive review processes and compliance requirements. Laws governing data collection, storage, and sharing necessitate high levels of transparency, often complicating the integration of automated analytics and facial recognition modules. The balance between ensuring national security and preserving personal freedoms remains delicate and contentious. Concerns over misuse of surveillance data or wrongful profiling have led to heightened scrutiny from both public and private stakeholders. As a result, system providers must invest significant resources in establishing ethical standards and transparent operational protocols that satisfy regulatory bodies. These measures, while essential, can increase costs and limit the speed at which innovative systems are adopted. Moreover, ever‑evolving legal landscapes require continuous updates and modifications to existing technologies to stay compliant. This dynamic regulatory environment creates uncertainty, reducing investor confidence and potentially stalling market growth. In parallel, public opinion plays a crucial role in shaping regulatory decisions, with citizens demanding rigorous oversight of surveillance practices. Overcoming this challenge requires a collaborative approach involving governments, technology developers, and civil society organizations, working together to ensure that security solutions do not compromise fundamental rights. This collaboration must be continuously improved remarkably.

Market opportunities

Emerging opportunities in the border security market are driven by evolving security needs and technological advancements that redefine operational effectiveness. Nations across the globe are increasingly recognizing the necessity of modernizing their border infrastructures to address new threats such as cyber‑enabled smuggling, advanced terrorism tactics, and sophisticated cross‑border criminal networks. As governments expand their security budgets, investments in integrated systems that combine physical surveillance with digital analytics are rising. Opportunities also exist for the development of interoperable platforms that merge traditional detection equipment with state‑of‑the‑art sensors, artificial intelligence, and big data. These advancements not only enhance the accuracy of threat identification but also improve response times through automated alerts and predictive analytics. Additionally, there is significant growth potential in the development of unmanned systems, including drones and robotics, which offer versatile surveillance capabilities over vast and challenging terrains. The market is further augmented by the rising demand for decentralized command and control centers that enable real‑time monitoring across multiple border points. Moreover, public‑private partnerships are emerging as a critical factor, as governments collaborate with technology firms to pilot innovative security solutions that are both scalable and cost‑effective. This collaborative approach reduces the burden on public finances while leveraging private sector expertise in cutting‑edge technology. Investment in research and development is fostering a new generation of border security solutions that focus on sustainability, energy efficiency, and long‑term operational cost reduction. Furthermore, as the global political landscape becomes increasingly unpredictable, nations are more inclined to adopt advanced surveillance systems to prevent illicit activities while ensuring smooth and legal cross‑border movement. Overall, the convergence of innovative technologies, strategic government policies, and heightened security concerns is creating a fertile environment for market expansion. Vendors who can deliver reliable, interoperable, and future‑ready solutions stand to benefit significantly, turning border security challenges into lucrative opportunities for sustained growth and modernization. In addition, emerging markets in less developed regions are beginning to adopt these advanced systems, further expanding the global footprint of border security solutions. This expansion not only increases market volume but also drives competitive pricing and encourages further technological refinement across the industry, significantly worldwide.

BORDER SECURITY MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

6% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Lockheed Martin, BAE Systems, Northrop Grumman, General Dynamics, Raytheon Technologies, Thales Group, Leonardo, L3Harris Technologies, Saab AB, and Elbit Systems |

Border Security Market segmentation

Border Security Market segmentation By Products:

• Surveillance hardware

• Detection equipment

• Communication systems

• Biometric authentication systems

• Unmanned systems

• Software solutions

Among the product segments, surveillance hardware emerges as the most dominant component in the border security market. This category includes advanced cameras, radar systems, and sensor arrays that provide real‑time monitoring and situational awareness across extensive border areas. The high adoption rate of surveillance hardware is driven by its critical role in detecting and deterring unauthorized crossings, while its integration with modern analytics software enhances overall system performance. Significant investments in innovative imaging technologies and automated detection algorithms have further reinforced its market position. As nations continue to upgrade their physical security infrastructure, the importance of reliable, high‑resolution surveillance equipment remains paramount for effective border monitoring and threat assessment. Strong governmental mandates and continuous technological enhancements sustain its lead remarkably.

Border Security Market segmentation By Application:

• Land border monitoring

• Maritime port and coastline surveillance

• Airborne surveillance

• Urban security integration

• Cyber‑physical border control

• Integrated command and control operations

Among the application segments, land border monitoring is the most dominant area in the border security market. This application focuses on securing extensive land frontiers through integrated physical barriers, advanced sensor networks, and real‑time surveillance systems. Land border monitoring is critical due to its direct impact on national sovereignty and the prevention of illegal crossings. Enhanced by smart analytics and automated detection systems, it provides effective situational awareness and rapid response capabilities. Government investments in technology upgrades and infrastructure improvements have reinforced the prominence of land‑based solutions. As geopolitical tensions persist and migration challenges intensify, the significance of robust, ground‑level security systems continues to grow, making land border monitoring an indispensable component of overall border protection strategies. It remains critically vital.

Border Security Market Regional segmentation

• North America

• Asia‑Pacific

• Europe

• South America

• Middle East and Africa

Asia‑Pacific stands out as the most dominant region in the global border security market. This region is characterized by rapid economic growth, increasing geopolitical tensions, and significant investments in modern security infrastructure. Countries across Asia‑Pacific are modernizing their border systems to address challenges from illegal immigration, cross‑border smuggling, and evolving terrorist threats. The region benefits from a vast expanse of land borders, diverse terrain, and a mix of advanced and emerging economies. Ongoing government initiatives to upgrade surveillance technologies, install integrated command centers, and adopt unmanned systems have accelerated market growth. Collaborative efforts between neighboring countries further bolster regional security measures. Enhanced focus on interoperability and real‑time data analytics has created an ecosystem that supports continuous innovation. The strategic emphasis on both physical and cyber‑border protection highlights the region’s commitment to maintaining national sovereignty and promoting economic stability. Consequently, this blend of technological adoption, robust policy support, and rising security concerns positions Asia‑Pacific at the forefront of border security advancements. The significant allocation of budget towards border modernization and the increasing role of private sector partnerships have further reinforced its leading market position. As nations in the region confront unique security challenges, the demand for integrated and adaptive border security solutions is expected to grow steadily, making Asia‑Pacific the pivotal arena for industry growth through 2025‑2030. Such continuous progress strengthens regional defense and inspires global best practices in border security management.

COVID‑19 Impact Analysis on the Border Security Market

The COVID‑19 pandemic significantly altered the dynamics of the border security market, influencing both short‑term operations and long‑term strategic investments. In the early stages of the pandemic, many governments experienced disruptions in routine border operations, as travel restrictions and lockdown measures led to reduced cross‑border movement. This decrease in physical border traffic temporarily alleviated some immediate security pressures, yet highlighted vulnerabilities in existing surveillance and monitoring systems. At the same time, the urgency to manage public health crises prompted a swift integration of health screening technologies at border checkpoints. These included thermal scanners, biometric health verifications, and automated data collection systems designed to monitor the spread of the virus. The pandemic accelerated the digital transformation in border management, with increased reliance on remote monitoring and cloud‑based command centers. Budget reallocations favored investments in technologies that could provide simultaneous security and health surveillance capabilities. While supply chains faced initial setbacks and delays in the deployment of new systems, recovery efforts emphasized building more resilient and adaptable border infrastructures. Collaborative projects emerged between governments and technology firms to streamline innovations and fast‑track the adoption of contactless and automated solutions. As normal travel gradually resumed, the lessons learned during the pandemic led to lasting changes in border security protocols, with an increased focus on integrating health indicators into overall security strategies. In retrospect, COVID‑19 acted as a catalyst for modernization, forcing stakeholders to revisit traditional security paradigms and to invest more heavily in versatile, technology‑driven systems. This transformative period has reshaped the market landscape and set a precedent for future crisis response, ensuring that border security solutions are better equipped to handle both conventional threats and unprecedented global health emergencies. In response, industry leaders have accelerated the research and development of hybrid security systems that combine biometric, sensor, and artificial intelligence capabilities, ensuring swift adaptability and enhanced resilience. These innovative systems are now being integrated into broader national security strategies, effectively bridging the gap between health crisis management and traditional border defense, and thereby reinforcing long‑term stability and public confidence across all regions.

Latest trends/Developments

Recent developments in the border security market are characterized by rapid technological innovation and increasing system integration. Advanced analytics, artificial intelligence, and machine learning are now embedded in surveillance systems, enhancing real‑time threat detection and predictive maintenance capabilities. The emergence of smart cameras, thermal sensors, and IoT devices has enabled border agencies to integrate data from multiple sources into unified command centers. There is a significant trend toward modular, scalable solutions that allow seamless upgrades and interoperability among diverse hardware and software platforms. Moreover, unmanned systems such as drones and autonomous vehicles are becoming integral components of monitoring operations. These platforms provide extensive coverage over difficult terrain and reduce the need for constant human oversight. Additionally, trends in cloud computing and cybersecurity integration are driving the evolution of border security solutions by ensuring that data remains secure and accessible. Manufacturers are increasingly focusing on sustainability and energy efficiency, incorporating renewable power sources into remote surveillance installations. Emerging market players are leveraging partnerships with technology startups to accelerate innovation and streamline system deployment. This ongoing digital transformation is reshaping the competitive landscape, pushing established players to adopt more agile and adaptive strategies. Furthermore, policy reforms and international collaboration are fostering an environment conducive to technology transfer and standardization across borders. These trends not only enhance operational effectiveness but also contribute to cost reductions over time. Overall, the confluence of technological, regulatory, and market forces is driving the next phase of evolution in border security systems, promising more intelligent, versatile, and resilient solutions for national defense. The continuous push for integration of next‑generation communication protocols and real‑time data processing capabilities is setting new industry benchmarks, as global security agencies adopt these innovations to stay ahead of evolving threats in an increasingly complex international landscape. Additionally, industry conferences and cross‑border collaborations are emerging platforms for sharing best practices and unveiling next‑generation security technologies. These developments are steering the market towards unified, smart border ecosystems that integrate multiple functionalities, setting a transformative agenda for future security innovations. Such proactive collaboration and innovation ensure enduring resilience and a secure future for nations worldwide, indeed robustly.

Key Players:

- Lockheed Martin Corporation

- BAE Systems

- Northrop Grumman

- General Dynamics

- Raytheon Technologies

- Thales Group

- Leonardo

- L3Harris Technologies

- Saab AB

- Elbit Systems

Chapter 1. Border Security Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Application

1.5. Secondary Application

Chapter 2. BORDER SECURITY MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. BORDER SECURITY MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. BORDER SECURITY MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. BORDER SECURITY MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. BORDER SECURITY MARKET – By Product

6.1 Introduction/Key Findings

6.2 Surveillance hardware

6.3 Detection equipment

6.4 Communication systems

6.5 Biometric authentication systems

6.6 Unmanned systems

6.7 Software solutions

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. BORDER SECURITY MARKET – By Application

7.1 Introduction/Key Findings

7.2 Land border monitoring

7.3 Maritime port and coastline surveillance

7.4 Airborne surveillance

7.5 Urban security integration

7.6 Cyber physical border control

7.7 Integrated command and control operations

7.8 Y-O-Y Growth trend Analysis By Application

7.9 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. BORDER SECURITY MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. BORDER SECURITY MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Lockheed Martin Corporation

9.2 BAE Systems

9.3 Northrop Grumman

9.4 General Dynamics

9.5 Raytheon Technologies

9.6 Thales Group

9.7 LeonardoL3Harris Technologies

9.8 Saab AB

9.9 Elbit Systems

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Border Security Market was valued at USD 25.66 billion in 2024 and will grow at a CAGR of 6% from 2025 to 2030. The market is expected to reach approximately USD 34.34 billion by 2030.

Key drivers include rising geopolitical tensions, rapid technological innovation, and increased governmental funding through strategic policies, all of which drive investments in advanced surveillance, detection, and command systems.

The market segments include product categories such as surveillance hardware, detection equipment, communication systems, biometric systems, unmanned systems, and software solutions, as well as application areas like land, maritime, and airborne border monitoring

Asia‑Pacific is the most dominant region, driven by rapid economic growth, extensive border infrastructure upgrades, and significant investments in advanced surveillance and unmanned systems, making it the key growth area through 2025‑2030.

Leading players include industry giants such as Lockheed Martin, BAE Systems, Northrop Grumman, General Dynamics, Raytheon Technologies, Thales Group, Leonardo, L3Harris Technologies, Saab AB, and Elbit Systems.