Bone Mineral Testing Market Size (2024 – 2030)

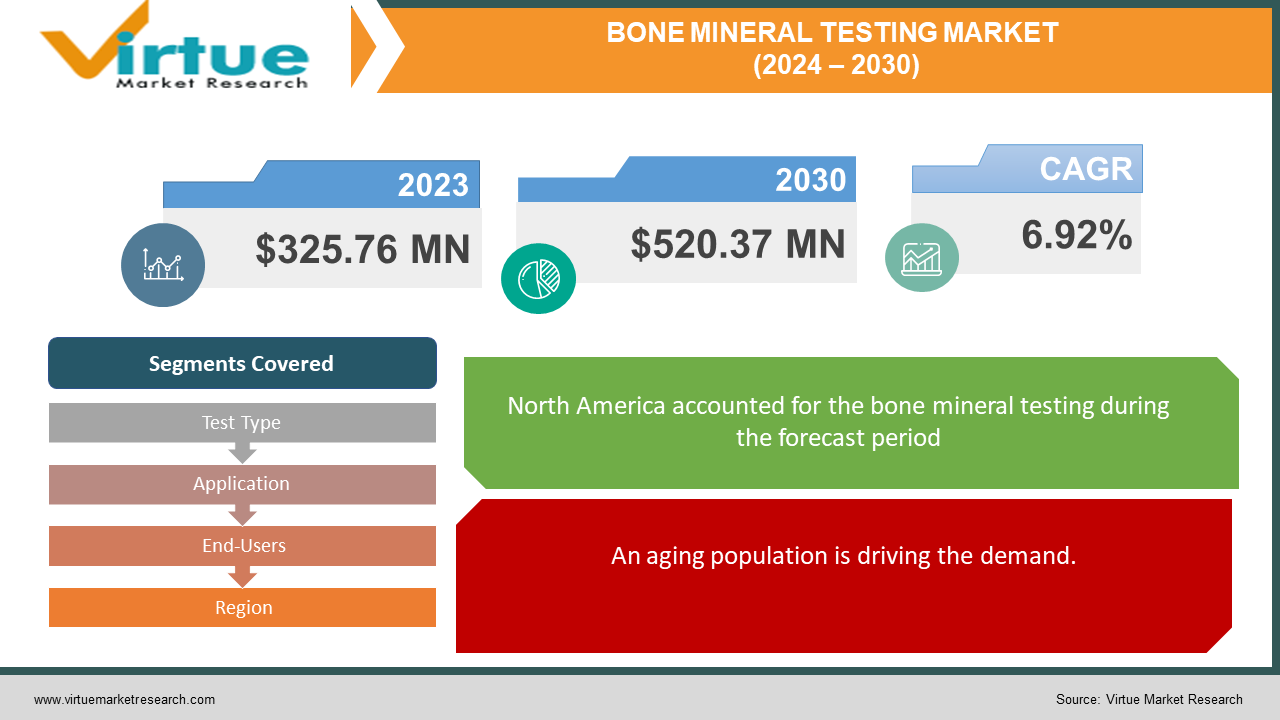

The global bone mineral testing market was valued at USD 325.76 million and is projected to reach a market size of USD 520.37 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.92%.

A test for bone mineral density (BMD) quantifies the concentration of calcium and other minerals in a particular region of the bone. The doctor can identify osteoporosis or bone loss and estimate our risk of bone fractures with the use of a BMD test. Because they are denser, bones with more mineral content are often stronger and less prone to shatter. As we age or if we have certain medical disorders, our bones may lose density. In the past, this test was performed by a dual-energy X-ray absorptiometry (DEXA) scan, which uses low-dose X-rays. Market growth was somewhat limited due to lesser accessibility and awareness. Presently, the market has seen a considerable upsurge owing to technological advancements and skilled expertise. In the future, with an extensive focus on R&D activities and the integration of emerging computer science fields, a notable elevation is anticipated.

Key Market Insights:

Technology breakthroughs and a greater emphasis on personalized care have led to improvements in bone mineral testing, which is essential for evaluating bone health and identifying diseases like osteoporosis. The market is dominated by immunoassays, especially chemiluminescence immunoassays (CLIA), which provide accurate measurement of bone turnover indicators. Because of the aging population, osteoporosis continues to be the most common and fastest-growing disease. Hospitals, which are backed by cutting-edge diagnostic technology and highly qualified medical staff, are the largest and fastest-growing end-user category. North America is leading the world in market share because of its sophisticated healthcare system and continuous research. Although the COVID-19 pandemic originally impeded business expansion, the sector has recovered quickly after the epidemic. Important companies like Siemens Healthineers, GE Healthcare, and Hologic, Inc. are advancing technology and making smart investments to stimulate innovation and market growth.

Bone Mineral Testing Market Drivers:

An aging population is driving the demand.

As people age, their bones become weaker. They lose their strength and become less dense due to the low availability of calcium. When too much bone is lost, osteoporosis can develop. As the population ages, the prevalence of bone-related diseases also increases. Women aged 65 and men aged 70 are prone to developing diseases. Additionally, people who have fractures after 50 have a higher incidence of developing deficiencies and bone loss.

The NCBI projects that by 2030, there will be 71.2 million people over 50 with reduced bone density, including osteoporosis. These numbers call for the need for mineral testing to assess bone health, diagnose osteoporosis, guide preventative measures, and suggest suitable treatments.

Technological advancements are contributing to the development.

Advancements in bone testing have helped in developing accurate and precise diagnostic tools that predict better outcomes. Dual-energy X-ray absorptiometry (DXA) is one of the best available methods. It is a specialized X-ray that uses less radiation to evaluate bone mineral density (BMD) at key locations such as the hip, forearm, and spine. Secondly, high-resolution peripheral quantitative computed tomography (HRpQCT) is another non-invasive method for evaluating the microarchitectural characteristics of the tibia and distal radius of bone. Thirdly, QUS is a non-ionizing technique for BMD detection based on acoustic vibrations. To represent the state of bone mass indirectly, QUS employs a variety of factors. Furthermore, vertebral fracture assessment (VFA), impact micro indentation (IMI), and trabecular bone score (TBS) are examples of advancements in bone health evaluation. TBS uses the spine trabecular microarchitecture acquired from the DXA picture to predict fracture risk, irrespective of bone mineral density. Although vertebral fractures are frequently missed, they can be seen using VFA, which is done on a densitometer. IMI, which has received FDA approval within the last two years, gauges the strength of bone material by measuring how far a probe penetrates the cortex of the tibial bone. The Menopause Society's 2023 Annual Conference reports that technological developments have enhanced evaluations of postmenopausal women's fracture risk and bone health.

Bone Mineral Testing Market Restraints and Challenges:

Associated costs, limited awareness & screening, testing inaccuracies, and clinical integration challenges are the main issues that the market is currently facing.

The initial expenses that are required for the equipment and other technologies are very high. This can take a toll on the price of reimbursement policies. A lot of rural and underdeveloped areas face this difficulty. Secondly, many people might not know the symptoms. This significant gap in understanding among the public can result in very few visits to the doctor. Thirdly, bone thinning can be identified by a bone mineral density test, but the reason cannot be determined. Determining the cause of poor bone density requires additional medical examinations. On the other hand, many bone mineral tests have raised concerns about overdiagnosis and overtreatment, especially in low-fracture-risk patients. An over-dependence on bone mineral density measures alone may lead to pharmaceutical therapies or other needless interventions without taking into account the individual fracture risk assessment or other clinical considerations. Furthermore, it takes specific knowledge and experience to interpret the findings of bone mineral testing, especially when using sophisticated methods like vertebral fracture assessment (VFA) or trabecular bone score (TBS). It can be difficult to incorporate these findings into clinical practice standards and therapeutic decision-making procedures; cooperation between medical specialists from a variety of disciplines, including radiology, endocrinology, and primary care, is necessary.

Bone Mineral Testing Market Opportunities:

Personalized medicine has been providing numerous possibilities for the market. Medicines are developed based on the genetic profile of an individual. Environmental and other lifestyle factors are taken into consideration. This is done using biomarkers. Biomarkers give constant updates about the activities that take place in the human cell. Many researchers are conducting studies to develop clinical testing protocols to broaden human understanding. Secondly, increasing emphasis on preventive healthcare is providing opportunities to integrate bone mineral testing with healthcare assessment tests. This helps in spreading better awareness among the public. Insurance providers are being approached through collaborations to cover the costs of screening and treatment. Thirdly, home monitoring devices and point-of-care testing are being researched. Volunteers are being approached for clinical trials. This allows patients to take a more active part in maintaining their bone health and early intervention by using portable and easily navigable equipment that makes it comfortable to test and monitor parameters related to bone health. Apart from this, digital health solutions are being implemented. This includes mobile applications that have chatbots and other virtual assistants. Through continuous monitoring, surveys, and dos and don'ts, an individual's health is being analyzed for early diagnosis and better understanding.

BONE MINERAL TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.92% |

|

Segments Covered |

By Test Type, Application, End-Users, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

GE Healthcare, Hologic, Inc., Siemens Healthineers, Swissray International, Inc., Medtronic plc, BeamMed Ltd., Lone Oak Medical Technologies, LLC, Osteometer MediTech, Inc., OsteoSys Co., Ltd., Medilink International Co., Ltd. |

Bone Mineral Testing Market Segmentation: By Test Type

-

Bone marker test

-

C Telopeptide Marker Test

-

P1NP Marker Test

-

N-Telopeptide Marker Test

-

Osteocalcin Test

-

Others

-

-

Immunoassay

-

Enzyme-linked Immunosorbent Assay

-

Radioimmunoassay

-

Chemiluminescence Immunoassay

-

Immunoassays are the largest and fastest-growing test type. These tests are essential for determining bone health and turnover as well as for identifying and tracking diseases linked to the bones, such as osteoporosis. The chemiluminescence immunoassay (CLIA) is the most popular and rapidly expanding form of immunoassay. The high sensitivity and specificity of CLIA make it possible to accurately quantify a wide range of analytes, including indicators of bone turnover such as P1NP and CTX-I. Clinical laboratories prefer CLIA due to its large assay menu, automation capabilities, and adaptability.

Bone Mineral Testing Market Segmentation: By Application

-

Hyperparathyroidism

-

Hypoparathyroidism

-

Osteoporosis

-

Paget's Disease

-

Others

Osteoporosis is the largest and fastest-growing application. This illness is characterized by deteriorating bone tissue and reduced bone density, which raises the risk of fractures. It is a serious issue for public health, especially for the elderly population. To diagnose osteoporosis, evaluate fracture risk, and track the effectiveness of treatment, bone mineral testing is necessary. The need for bone mineral testing in the context of osteoporosis care is significant and is only expected to increase due to the aging population worldwide and growing awareness of the disease.

Bone Mineral Testing Market Segmentation: By End-Users

-

Hospitals

-

Diagnostic Laboratories

-

Specialty Clinics

-

Research Institutions

Hospitals are the largest and fastest-growing end-users, with a share of around 45%. This is because of their modern diagnostic equipment and highly skilled healthcare personnel. Hospitals serve a wide range of patients and are frequently at the forefront of delivering complete healthcare services, which include managing and assessing bone health. Hospitals' demand for bone mineral testing services is rising significantly due to the aging population, the rising prevalence of bone-related illnesses, and the growing acceptance of bone mineral testing in standard clinical practice.

Bone Mineral Testing Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the largest market, with countries like the United States and Canada at the forefront. The healthcare system in this region is very advanced. A lot of prestigious hospitals are present here. Besides, many companies are involved in the manufacturing of equipment and other necessary resources. Prominent companies include GE Healthcare, Hologic, Inc., Siemens Healthineers, and Medtronic plc. Moreover, the economy in this area facilitates easier funding and investments. Research work about this disease is carried out by a lot of Ivy League universities. Asia-Pacific is the fastest-growing market. Countries like China, India, and Japan are the notable ones. Urbanization has led to a change in the standard of living. This has created a rising middle class and an increasing disposable income. The healthcare industry has undergone tremendous expansion due to governmental initiatives in the form of schemes and funds. A lot of renowned expertise is available in this region. All these factors are contributing to the success.

COVID-19 Impact Analysis on the Global Bone Mineral Testing Market:

The virus outbreak damaged the market. The new norms included social isolation, movement restrictions, and lockdowns. People stayed at home and delayed their hospital appointments to prevent any sort of contamination. This led to a delayed diagnosis and treatment. Besides, most of the healthcare facilities were filled with patients who were affected by the coronavirus. Many hospitals and clinics experienced a decline in bone testing due to this. Even though there was a rapid shift towards telehealth services, bone mineral testing procedures such as DXA scans required in-person visits. All collaborations and launches regarding this market were halted and postponed. Research and developmental activities were prioritizing studies about the virus and its possible impact on different people. Few studies were performed to analyze the effect of the virus on the bones. These articles prove that a few pandemic changes may have contributed to lower bone mineral density and content. However, no growth was seen in diagnosis and consultation services. Post-pandemic, the market picked up rapidly owing to the upliftment of rules and relaxation of regulations. People started to visit for routine checkups and consultations.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this. To improve personalized treatment planning, predictive modeling, and diagnostic accuracy, artificial intelligence (AI) and machine learning algorithms are being progressively included in bone mineral testing procedures. These technologies enhance fracture risk assessment and optimize treatment plans by analyzing large datasets of bone imaging and patient data.

Key Players:

-

GE Healthcare

-

Hologic, Inc.

-

Siemens Healthineers

-

Swissray International, Inc.

-

Medtronic plc

-

BeamMed Ltd.

-

Lone Oak Medical Technologies, LLC

-

Osteometer MediTech, Inc.

-

OsteoSys Co., Ltd.

-

Medilink International Co., Ltd.

In January 2023, the Board of Control for Cricket in India (BCCI) reinstated the Dexa scan as a requirement for selecting players for the Indian national squad. The hip, the spine, and occasionally the forearm are the two body parts that are often tested since they are the most likely to sustain a fracture.

Chapter 1. Bone Mineral Testing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Bone Mineral Testing Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Bone Mineral Testing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Bone Mineral Testing Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Bone Mineral Testing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Bone Mineral Testing Market – By Test Type

6.1 Introduction/Key Findings

6.2 Bone marker test

6.3 C Telopeptide Marker Test

6.4 P1NP Marker Test

6.5 N-Telopeptide Marker Test

6.6 Osteocalcin Test

6.7 Others

6.8 Immunoassay

6.9 Enzyme-linked Immunosorbent Assay

6.10 Radioimmunoassay

6.11 Chemiluminescence Immunoassay

6.12 Y-O-Y Growth trend Analysis By Test Type

6.13 Absolute $ Opportunity Analysis By Test Type, 2024-2030

Chapter 7. Bone Mineral Testing Market – By Application

7.1 Introduction/Key Findings

7.2 Hyperparathyroidism

7.3 Hypoparathyroidism

7.4 Osteoporosis

7.5 Paget's Disease

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Bone Mineral Testing Market – By End-Users

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Diagnostic Laboratories

8.4 Specialty Clinics

8.5 Research Institutions

8.6 Y-O-Y Growth trend Analysis By End-Users

8.7 Absolute $ Opportunity Analysis By End-Users, 2024-2030

Chapter 9. Bone Mineral Testing Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Test Type

9.1.3 By Application

9.1.4 By By End-Users

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Test Type

9.2.3 By Application

9.2.4 By End-Users

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Test Type

9.3.3 By Application

9.3.4 By End-Users

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Test Type

9.4.3 By Application

9.4.4 By End-Users

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Test Type

9.5.3 By Application

9.5.4 By End-Users

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Bone Mineral Testing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 GE Healthcare

10.2 Hologic, Inc.

10.3 Siemens Healthineers

10.4 Swissray International, Inc.

10.5 Medtronic plc

10.6 BeamMed Ltd.

10.7 Lone Oak Medical Technologies, LLC

10.8 Osteometer MediTech, Inc.

10.9 OsteoSys Co., Ltd.

10.10 Medilink International Co., Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global bone mineral testing market was valued at USD 325.76 million and is projected to reach a market size of USD 520.37 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 6.92%.

An aging population and technological advancements are the main factors propelling the global bone mineral testing market.

Based on test type, the global bone mineral testing market is segmented into bone marker tests and immunoassays.

North America is the most dominant region for the global bone mineral testing market.

GE Healthcare, Hologic, Inc., and Siemens Healthineers are the key players operating in the global bone mineral testing market.