Body in White Market Size (2025 – 2030)

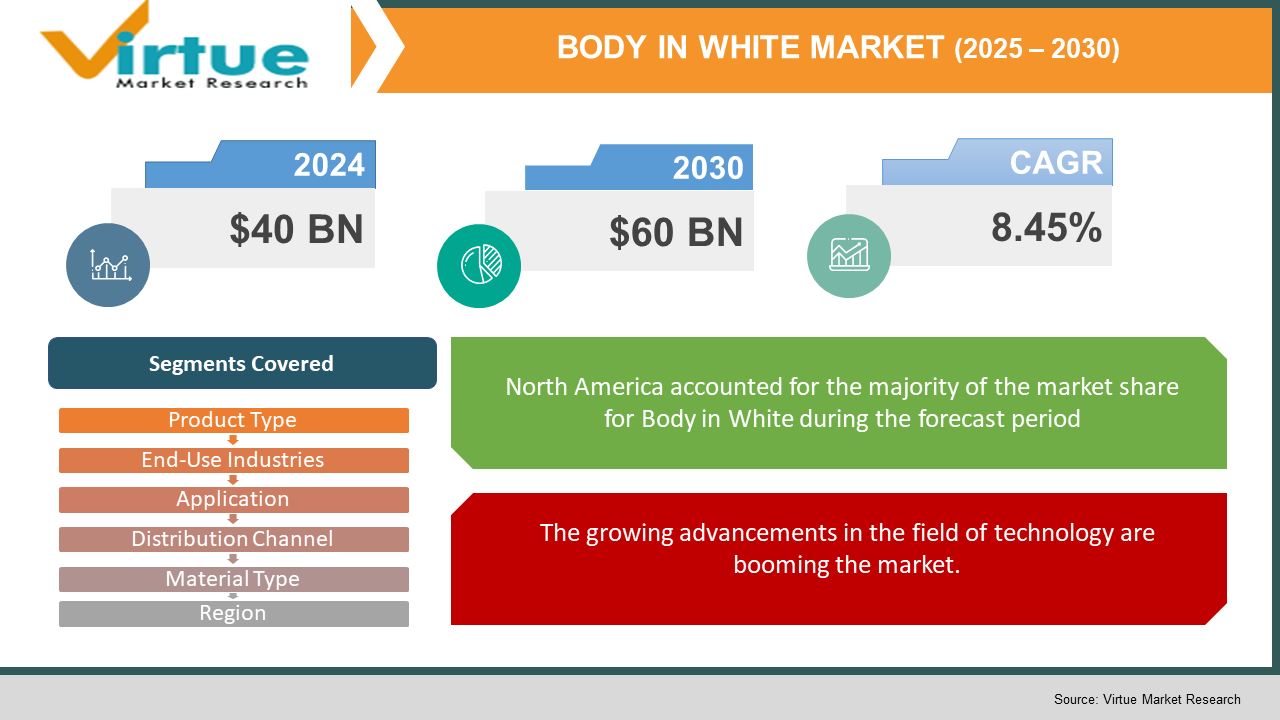

The Global Body in White Market was valued at USD 40 billion and is projected to reach a market size of USD 60 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 8.45%.

As vehicle makers around continue to stress lightweighting, fuel efficiency, and structural safety, the World Body in White (BIW) Market is ready for strong expansion over the 2025–2030 forecast period. BIW is the phase of car production in which the core structure of the vehicle is welded together from sheet metal components before more components are fitted. Driving the industry are constant technological improvements in welding and joining methods as well as growing demand for sophisticated materials, including aluminum and composites. Stricter safety standards, the rise of electric cars, and the worldwide drive for sustainability together promote creativity in BIW design and manufacture.

Key Market Insights:

- To lower car weight and improve fuel efficiency, more than half of OEMs are moving from steel and other materials to aluminum and composites in BIW manufacture. Reported 15-20% better vehicle efficiency is the result of innovations in lightweight building.

- More and more modern techniques, such as laser welding and hybrid joining approaches, could improve production speed by up to 25% while keeping safety levels constant.

- Roughly 40% of new automobile designs today useable materials in BIW, reflecting both legal requirements and consumer demand for green cars, with significant investigation into sustainable and recyclable manufacturing methods.

- By improving production accuracy and efficiency in BIW assembly, digital twin technology, robotics, and AI-based quality control helps to. According to industry studies, integrating conventional manufacturing methods with these digital solutions raises productivity by 30%.

Body in White Market Drivers:

The growing advancements in the field of technology are booming the market.

By letting manufacturers achieve superior strength-to-weight ratios, innovations in high‑strength steel, aluminum alloys, and composite materials have fundamentally changed the BIW market. These improvements enable the production of lighter vehicle bodies while retaining, or even enhancing, crash performance and overall safety. Advanced high-strength steel (AHSS) and aluminum alloys, for example, are growing more popular in new vehicle designs to reduce weight and enhance fuel efficiency, a vital need given the worldwide emphasis on emissions reduction. Furthermore, composite materials are being developed to provide corrosion resistance and design flexibility, therefore facilitating sophisticated, integrated structures. As a result, OEMs are making major R&D investments to develop and integrate these advanced materials. This constant advancement in material technology ensures not just improved vehicle performance and safety but also compliance with strict environmental laws, therefore qualifying the BIW sector as a main driver of growth.

The growth in the demand for Electric Vehicles (EVs) is said to have a great impact on the market.

The fast worldwide movement toward electric cars (EVs) is significantly affecting the BIW market since car manufacturers are redesigning vehicle platforms to fit electric powertrains. Extending battery life and optimizing car range depend on reducing weight, so lightweighting improvements in the BIW design are crucial. To satisfy these needs, sophisticated materials, including composites and aluminum, are starting to be included throughout the BIW system. Furthermore, government incentives and regulations intended to reduce emissions are speeding up the adoption of EVs, therefore raising demand for creative BIW solutions customized exactly to electric vehicle platforms. Rising expenditures on sophisticated manufacturing methods and material developments related to the design and construction of more fuel-efficient, environmentally friendly vehicles, as OEMs' focus will help to drive the BIW business forward.

Strict rules and regulations for safety and efficiency are driving the growth of the market.

More stringent safety and environmental rules for automobile manufacturing worldwide are directly affecting the BIW market due to government orders. Standards for crashworthiness, structural integrity, and emission control, such as those strictly followed by Euro NCAP, NHTSA, and other regional bodies, demand that vehicles not only protect occupants but also minimize environmental impacts. Stricter rules are driving businesses to be creative in their BIW processes by applying sophisticated joining methods, using high-performance materials, and integrating intelligent design elements that raise both safety and productivity. Complying with many different worldwide standards raises the pressure on OEMs to put money into cutting-edge production processes and research and development, therefore guaranteeing that new BIW designs surpass current performance norms. Even as it presents difficulties in terms of rising complexity and cost, this regulatory environment encourages technological development and propels market growth.

The ongoing digital transformation and the adoption of Industry 4.0 are considered a major market growth driver.

Through the use of Industry 4.0 technologies, the continuous digital transformation in automotive production is revolutionizing the BIW process. Robotic automation, digital twin technology, AI-driven quality control systems, and other advanced digital tools are being included in production lines, resulting in greater accuracy, less downtime, and substantial operational cost reductions. Manufacturers can virtually simulate and perfect body-in-white (BIW) assembly processes with digital twins, thus spotting possible flaws and allowing real-time corrections. Moreover, artificial intelligence and machine learning are more and more used to keep track of production quality and forecast maintenance requirements, therefore guaranteeing constant product quality and cutting down on waste. This move toward a completely automated and digitally linked production environment is lowering mistake levels and raising throughput, therefore making digital transformation a crucial driver of growth for the BIW sector.

Body in White Market Restraints and Challenges:

The production cost related to this market is very high, which is a great challenge, especially for the SMEs.

Integrating advanced materials, including high-strength steel, aluminum alloys, and composites, along with the use of modern manufacturing equipment into the BIW system calls for significant initial investment. Large-scale investments are needed in both equipment and building improvements by modern technologies such as robotic welding systems, laser cutting, and digital twin simulations. Furthermore, digital integration calls for substantial spending on IT infrastructure, software licenses, and staff training. For mid-tier companies, these high production costs can serve as a serious entry and innovation barrier, therefore limiting their capacity to compete with bigger players who may more easily cover these costs. Furthermore, impacted are price-sensitive markets in which companies must strike a balance between the advantages of technological innovation and the necessity of keeping costs under control. Especially in areas with limited access to money or strict budget restrictions, this financial pressure slows the rate of new technology adoption and could result in slower general market development.

The disruption in the supply chain due to the pandemic poses a great challenge for the market, affecting its growth.

The global supply chain for advanced materials important to BIW production is becoming intricate and sensitive to outside shocks. Key raw materials such as high‑strength steel, aluminum alloys, and composite components are subject to volatility due to geopolitical tensions, fluctuating commodity prices, and unforeseen events (such as pandemics or natural disasters). Disruptions in the supply chain can lead to production delays, increased material costs, and challenges in maintaining consistent quality. Particularly with the move toward electric and hybrid cars, as automotive supply networks become more interconnected, the dependence on timely, high-quality material deliveries becomes even more essential. Sudden production stoppages resulting from supply chain uncertainties could limit manufacturers' capability to meet demand, hence affecting market expansion and profitability.

The process of integrating with the existing legal system is so complex that it acts as a challenge for the market.

Many reputable car makers have long depended on legacy production systems not inherently created to support the most current sophisticated materials and digital technologies. Upgrading these systems to integrate modern processes such as robotic welding, laser technology, and digital twins presents substantial technical challenges. Aligning new equipment with current production lines could cause compatibility problems that lengthen downtime and lower productivity. Integrating sometimes calls for particular knowledge, thorough testing, and major changes to production guidelines, which causes operational inefficiency. Higher total operating costs resulting from this steep learning curve and the need for regular recalibration and maintenance slow the acceptance of innovative BIW technology among companies shifting from conventional methods.

The existence of complex regulations and a difficult certification process is seen as a hurdle for the market.

The automobile sector is overseen by a challenging and changing scenario of safety, environmental, and quality standards that vary widely by geography. Meeting these different legal criteria is quite difficult for BIW producers. Different national agencies, the U.S. NHTSA, Euro NCAP, and other regulatory bodies set strict crash performance objectives, structural integrity requirements, and emission standards for vehicles. All of this calls for thorough testing, certification procedures, and ongoing monitoring, which all provide major time-to-market limitations and expense. Moreover, alterations in environmental laws and stiffening of emissions criteria force manufacturers to regularly upgrade their materials and production techniques. Particularly affecting small firms trying to gain a footing in a highly regulated industry, the extended regulatory approval processes and related costs may slow down new product launches and hamper creativity.

Body in White Market Opportunities:

The market has an opportunity to expand its reach into the developing nations as they are seen as emerging markets.

Rapid industrialization and an explosion in automobile demands in developing countries, especially in the Asia-Pacific and Latin American regions, could present the BIW market with substantial growth prospects. Strong government programs in nations such as China and India, such as "Made in China 2025" and several national automotive policies, are providing incentives for modern manufacturing technologies and digital production systems. Growing disposable incomes and urbanization are driving consumer preferences toward newer, more efficient vehicle designs, which require creative BIW solutions that are lightweight but structurally sturdy. Companies that customize their BIW approaches to meet local demands, such as designs best for densely packed urban areas or production methods adapted to regional materials, can claim significant market share. Improved distribution channels, digital infrastructure investments, and targeted government subsidies further support the expansion of BIW applications in these high-growth regions.

The latest innovations in the market are leading to product diversification, helping the market to grow.

Constant innovation in material science and composite technologies is allowing next-generation BIW solutions with outstanding performance features to be developed. Companies are making big investments in research and development to produce customized and modular BIW designs, including advanced traits like better corrosion resistance, energy absorption, and integrated smart sensors. These advances enable businesses to expand their product lines and meet different consumer and regulatory demands across several vehicle categories. For example, automakers are now looking for BIW solutions that increase crash performance while lowering vehicle weight, a fundamental element for both electric vehicle design and fuel efficiency. Product diversification not only improves competitive differentiation but also opens new market sectors as brands may provide customized solutions meeting the particular needs of luxury, commercial, and specialty automobile markets.

The recent integration with digital technologies and smart manufacturing is helping the market to transform.

The automotive manufacturing scene is quickly changing as digital technologies are integrated with conventional BIW production processes. Industry 4.0 technologies, including digital twin simulations, artificial intelligence-driven analytics, and robotic automation, are increasingly being used in BIW assembly lines, producing increased accuracy, decreased waste, and considerable cost savings. These digital technologies enable companies to monitor production parameters in real time, streamline process flows, and forecast maintenance requirements, therefore increasing general production efficiency and product quality by means of leveraging them. This digital change supports cooperation with technology partners, therefore speeding creativity and cutting the time-to-market for new BIW designs. Companies that invest in digital integration are set to enjoy a great competitive edge in speed, quality, and cost-efficiency as worldwide manufacturing systems embrace these smart manufacturing techniques.

The initiatives taken regarding the sustainability and recycling of materials are seen as an opportunity for the market to grow further.

Rising environmental worries and more stringent government requirements on emissions and waste management have made sustainability a key concern in the BIW sector. Including sustainable production techniques and recyclable ingredients helps manufacturers under more and more pressure to lower their environmental impact. Progress in recycling materials and environmentally friendly production techniques is driving the development of BIW solutions utilizing renewable energy sources in the factory and composites and recycled metals. Leading companies in sustainability not only lower their operating costs by energy savings, but also increase their market position by fulfilling consumer needs for more environmentally friendly goods. Favorable government policies, including carbon reduction projects and green incentives, also encourage the use of sustainable BIW technologies, so offering a major chance to reach fresh market segments and develop a permanent competitive edge.

BODY IN WHITE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.45% |

|

Segments Covered |

By Product Type, END USER, COMPONENT, APPLICATION, MATERIAL TYPE, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Magna International, Martinrea International Inc., Gestamp, Tower International , ABC Group, Martin Automotive, Webasto, Faurecia, Benteler International AG |

ZF Friedrichshafen AG

Body in White Market Segmentation:

Body in White Market Segmentation: By Product Type

- Structural Component

- Non-Structural Components

- Integrated Modules

The structural component segment holds the dominant position in the market, essential in all kinds of vehicles, especially with rising crash safety criteria, structural elements make up the foundation of vehicle design. The integrated modules segment is the fastest-growing segment, which includes front-end modules or rear-end constructions, pre-assembled functional components. Particularly among premium OEMs and EV companies, cost and time effectiveness in production is a driver of rising demand for modular assembly.

Usually used for aesthetics and aerodynamics, non-structural components include enclosures, mounts, and panels covering or supporting.

Body in White Market Segmentation: By Application

- Welding & Assembly

- Coating &Finishing

- Lightweighting Technologies

- Others

The welding and assembly segment is the dominant one here. This is a fundamental process in BIW production in which metal parts are joined. Owing to its role in structural integrity, welding covers a big portion of BIW manufacturing. The lightweighting technologies segment is the fastest-growing segment in the market. Lightweighting Technologies includes advanced processes like laser welding and material optimization. Increasing pressure to reduce emissions and maximize fuel efficiency is forcing automakers to give priority to lightweight BIW designs.

Rust prevention and surface treatment are covered in the coating and finishing segment, and the others segment includes small fittings and noise/vibration damping.

Body in White Market Segmentation: By End-Use Industries

- Passenger Vehicle

- Commercial Vehicle

- Heavy-Duty & Specialty Vehicles

The passenger vehicle segment is the dominant one in the market, including sedans, hatchbacks, SUVs, etc. Especially in Asia-Pacific and Europe, passenger cars constitute the most of worldwide automobile output. The Heavy-Duty & Specialty Vehicles segment is the fastest-growing segment here. This includes armored vehicles, construction trucks, and EV-specific heavy platforms, and the demand for specialized lightweight body-in-white platforms is rising in response to electrification and increased military spending. The commercial vehicles segment includes light trucks, buses, and vans.

Body in White Market Segmentation: By Distribution Channel

- Direct Sales

- Distributors

- Online Retail

The direct sales segment holds dominance here, as most BIW components are sold directly to Tier 1 customers or OEMs. These components have unique requirements and need integration, making this segment the dominant one. The online retail segment is considered to be the fastest-growing segment, as this channel is more readily available, particularly for small-scale producers, thanks to increasing digitalization and B2B platforms. The distributors serve in underdeveloped markets, particularly the small to mid-sized companies.

Body in White Market Segmentation: By Material Type

- Steel

- Aluminum

- Composite

- Others

Here, steel is the dominant player of the market, as high-strength steel is widely used for mass market vehicles because of its cost-effectiveness and well-established manufacturing compatibility. The aluminum segment is the fastest-growing, as it is lightweight and corrosion-resistant. Increasingly used in premium cars and EVs. To satisfy the strict emissions and fuel-economy standards, OEMs are moving to aluminum.

Composites are sophisticated materials, including carbon fiber, that are meant for high-performance or luxury vehicles. The others segment includes hybrid metal-polymer combinations as well as magnesium alloys.

Body in White Market Segmentation: By Region

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

With major automotive companies, robust manufacturing capacity, and increasing attention on lightweight materials for better fuel efficiency, North America is considered a big market, making it the fastest-growing region. The Asia-Pacific region is the dominant region for the market. Rising demand for cars fueled by fast urbanization, growing vehicle output, and increasing disposable income in developing nations like China and India, driven by modernization, are the reasons behind this.

Europe is progressing in BIW technologies, especially in electric vehicle production and sustainable manufacturing practices, and is home to several top automotive companies. South America is considered an emerging market with potential for growth as local automotive production increases and manufacturers seek to enhance vehicle quality and safety. The MEA region market is smaller, but interest in automotive manufacturing and assembly activities, especially in areas with advancing car sectors, is increasing.

COVID-19 Impact Analysis on the Global Body in White Market:

The adoption of digital manufacturing and automation technologies was accelerated by the COVID‑19 epidemic, therefore greatly impacting the global Body in White industry. As a consequence, many companies increased their spending on robotic welding, digital twin technologies, and advanced materials to guarantee production continuity amid uncertainties. By laying the foundation for a more resilient and effective manufacturing system, this change not only helped businesses to overcome disruptions caused by the pandemic but also set the stage for market growth in the post-pandemic era.

Latest Trends/ Developments:

Body in White assembly process optimization uses advanced simulation and digital twin technology to improve accuracy and cut waste.

Streamlining production procedures and reducing dependence on manual work is brought about by more use of robotic welding and machine vision systems.

Improving fuel efficiency and supporting electric vehicle initiatives requires a greater emphasis on including hybrid components and lightweight materials.

To lower environmental damage and meet green rules, manufacturers are investing in sustainable production processes, including the recycling of metals and composites.

Key Players:

- Magna International

- Martinrea International Inc.

- Gestamp

- Tower International

- ABC Group

- Martin Automotive

- Webasto

- Faurecia

- Benteler International AG

- ZF Friedrichshafen AG

Chapter 1 Body in White Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2 Body in White Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3 Body in White Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4 Body in White Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5 Body in White Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6 Body in White Market – By Product Type

6.1 Introduction/Key Findings

6.2 Structural Component

6.3 Non-Structural Components

6.4 Integrated Modules

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type , 2025-2030

Chapter 7 Body in White Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Direct Sales

7.3 Distributors

7.4 Online Retail

7.5 Y-O-Y Growth trend Analysis By Distribution Channel

7.6 Absolute $ Opportunity Analysis By Distribution Channel , 2025-2030

Chapter 8 Body in White Market – By End-User

8.1 Introduction/Key Findings

8.2 Passenger Vehicle

8.3 Commercial Vehicle

8.4 Heavy-Duty & Specialty Vehicles

8.5 Y-O-Y Growth trend Analysis End-User

8.6 Absolute $ Opportunity Analysis End-User , 2025-2030

Chapter 9 Body in White Market – By Material Type

9.1 Introduction/Key Findings

9.2 Steel

9.3 Aluminum

9.4 Composite

9.5 Others

9.6 Y-O-Y Growth trend Analysis Material Type

9.7 Absolute $ Opportunity Analysis Material Type , 2025-2030

Chapter 10 Body in White Market – By Application

10.1 Introduction/Key Findings

10.2 Welding & Assembly

10.3 Coating &Finishing

10.4 Lightweighting Technologies

10.5 Others

10.6 Y-O-Y Growth trend Analysis Application

10.7 Absolute $ Opportunity Analysis Application , 2025-2030

Chapter 11 Body in White Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A.

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.2. By Application

11.1.3. By Material Type

11.1.4. By End-User

11.1.5. Distribution Channel

11.1.6. Product Type

11.1.7. Countries & Segments - Market Attractiveness Analysis

11.2. Europe

11.2.1. By Country

11.2.1.1. U.K.

11.2.1.2. Germany

11.2.1.3. France

11.2.1.4. Italy

11.2.1.5. Spain

11.2.1.6. Rest of Europe

11.2.2. By Application

11.2.3. By Material Type

11.2.4. By End-User

11.2.5. Distribution Channel

11.2.6. Product Type

11.2.7. Countries & Segments - Market Attractiveness Analysis

11.3. Asia Pacific

11.3.1. By Country

11.3.1.2. China

11.3.1.2. Japan

11.3.1.3. South Korea

11.3.1.4. India

11.3.1.5. Australia & New Zealand

11.3.1.6. Rest of Asia-Pacific

11.3.2. By Application

11.3.3. By Material Type

11.3.4. By End-User

11.3.5. Distribution Channel

11.3.6. Product Type

11.3.7. Countries & Segments - Market Attractiveness Analysis

11.4. South America

11.4.1. By Country

11.4.1.1. Brazil

11.4.1.2. Argentina

11.4.1.3. Colombia

11.4.1.4. Chile

11.4.1.5. Rest of South America

11.4.2. By Application

11.4.3. By Material Type

11.4.4. By End-User

11.4.5. Distribution Channel

11.4.6. Product Type

11.4.7. Countries & Segments - Market Attractiveness Analysis

11.5. Middle East & Africa

11.5.1. By Country

11.5.1.1. United Arab Emirates (UAE)

11.5.1.2. Saudi Arabia

11.5.1.3. Qatar

11.5.1.4. Israel

11.5.1.5. South Africa

11.5.1.6. Nigeria

11.5.1.7. Kenya

11.5.1.11. Egypt

11.5.1.11. Rest of MEA

11.5.2. By Application

11.5.3. By Material Type

11.5.4. By End-User

11.6.5. Distribution Channel

11.5.6. Product Type

11.5.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12 Body in White Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Magna International

12.2 Martinrea International Inc.

12.3 Gestamp

12.4 Tower International

12.5 ABC Group

12.6 Martin Automotive

12.7 Webasto

12.8 Faurecia

12.9 Benteler International AG

12.10 ZF Friedrichshafen AG

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The factors that are driving the growth of the market are the latest digital manufacturing technologies, automation, and the integration of advanced materials

Strong research and development spending and sophisticated production facilities enable North America to prevail in this market.

Significant challenges faced by the market are high capital investments, disturbances in the supply chain, technical integration problems with legacy systems, and legal roadblocks.

Lightweighting and the use of recycled materials are becoming more popular thanks to increasing environmental legislation and a drive for fuel efficiency, therefore improving performance and environmental credentials.

Production processes are being transformed by digital twin technology, robotic automation, lightweight materials innovation, and sustainable manufacturing practices.