Global Bluetooth Qualification Testing Services Market Size (2024-2030)

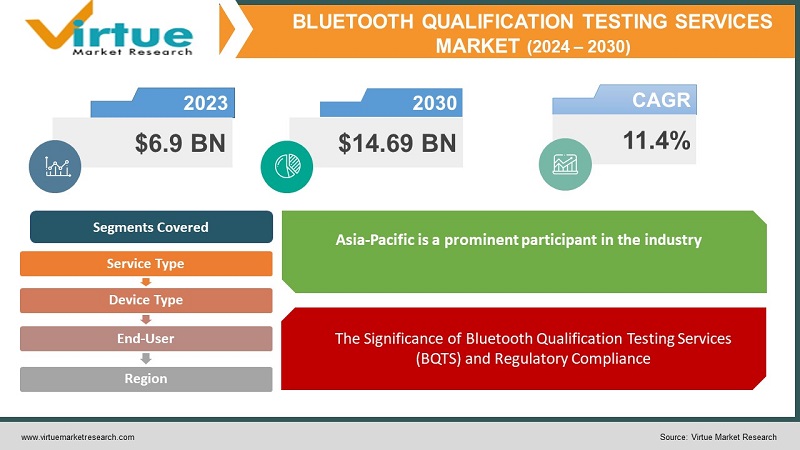

The Global Bluetooth Qualification Testing Services Market was valued at USD 6.9 billion in 2023 and is projected to reach a market size of USD 14.69 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 11.4%.

Bluetooth Qualification Testing Services (BQTS) are essential if you want to make sure your Bluetooth device satisfies industry standards and works smoothly with other Bluetooth devices. BQTS, which is provided by authorized businesses, puts your device through a battery of tests to ensure it complies with Bluetooth requirements. Radiofrequency, protocol compliance, and profile testing are all included in this. You can obtain Bluetooth SIG certification after passing testing, which enables you to put the official emblem on your product. Customers will be informed by this that your product meets quality requirements and is interoperable with other Bluetooth devices.

Key Market Insights:

According to estimates, the global market for Bluetooth qualification testing services will rise significantly to a $10.6 billion market size by 2027. The increasing number of Bluetooth-enabled devices, especially in the growing Internet of Things (IoT) space, is what is driving this increase. Smooth interoperability becomes increasingly important as more devices connect and exchange data, necessitating appropriate Bluetooth certification testing.

According to the Bluetooth SIG, the use of Bluetooth technology is significantly increasing in areas like Asia Pacific. This trend offers BQTS providers a profitable chance to enter these developing markets and broaden their services offering, therefore capitalizing on a big and quickly expanding market.

New iterations of the Bluetooth standards, including mesh networking and Bluetooth Low Energy (BLE) Audio, are regularly released by the Bluetooth Special Interest Group (SIG). This calls for more thorough and exacting testing protocols. The increasing demand may be tapped into by BQTS suppliers that create customized testing solutions for these new Bluetooth applications.

BQTS providers, device makers, and regulatory agencies can collaborate strategically to promote innovation and optimize the testing procedure. All market participants stand to gain from the development of more effective and affordable testing solutions that can result from this cooperative approach.

Global Bluetooth Qualification Testing Services Market Drivers:

The Significance of Bluetooth Qualification Testing Services (BQTS) and Regulatory Compliance

Regulatory compliance and market access are critical checkpoints on the Bluetooth device navigation road to market. A lot of international regulatory agencies, as well as certain merchants, mandate Bluetooth certification for products that use this technology. By ensuring that gadgets adhere to set safety and performance criteria, this certification procedure protects consumers and promotes technological confidence. This is where BQTS, or Bluetooth Qualification Testing Services, are useful. Manufacturers can put the official Bluetooth logo on their goods after completing BQTS and earning Bluetooth SIG certification. Customers are more confident in the device's quality, safety, and smooth operation with other Bluetooth devices thanks to this emblem, which serves as an obvious indicator of conformity to industry standards. Ultimately, market accessibility and marketability for Bluetooth goods are greatly aided by Bluetooth SIG certification via BQTS.

Changing Bluetooth Specifications and BQTS Providers Encourage Creativity in the Cutting-Edge Device Market

Because of Bluetooth SIG's unwavering quest for innovation, the Bluetooth landscape is continuously changing. Every now and then, interesting new capabilities and functions are added to the Bluetooth standards. Examples include mesh networking, which builds strong networks of linked devices, and Bluetooth Low Energy (BLE) Audio, which provides high-quality wireless sound. But these developments also provide a challenge to companies that offer Bluetooth Qualification Testing Services (BQTS). To remain competitive and meet the needs of manufacturers creating state-of-the-art Bluetooth products, BQTS suppliers need to make constant improvements to their testing apparatus and protocols. This guarantees that they can evaluate a device's capacity to handle the newest Bluetooth features in a thorough manner. By providing these cutting-edge testing options, BQTS suppliers present themselves as indispensable collaborators for producers. Because of their proficiency in navigating the always-evolving Bluetooth landscape, manufacturers can confidently introduce cutting-edge gadgets to the market, knowing that they adhere to the most recent specifications and features.

Global Bluetooth Qualification Testing Services Market Restraints and Challenges:

Numerous reasons are impeding the Bluetooth Qualification Testing Services' (BQTS) prospective growth. Among these is the absence of a device-wide communication standard, which complicates test design. Furthermore, BQTS may be expensive, especially for startups or businesses that release new products on a regular basis. BQTS suppliers also have issues keeping up with the ever-changing Bluetooth standards and the possibility of major corporations developing their own internal testing capabilities.

Global Bluetooth Qualification Testing Services Market Opportunities:

Bluetooth Qualification Testing Services (BQTS) have a promising future. With so many devices now linked, the Internet of Things (IoT) is growing rapidly. BQTS helps to ensure that these devices operate together flawlessly. The adoption of Bluetooth by developing nations creates new opportunities for BQTS suppliers. Robust testing will become increasingly necessary as Bluetooth technology develops. Better testing solutions may be produced by providers, producers, and regulators working together. BQTS suppliers may transform into one-stop shops for Bluetooth product development by providing more than just basic testing.

Global Bluetooth Qualification Testing Services Market Segmentation:

Global Bluetooth Qualification Testing Services Market Segmentation: By Service Type:

- Basic Qualification Testing

- Advanced Testing Services

- Pre-Compliance Testing

- Interoperability Testing

It is anticipated that the Advanced Testing Services category will grow at the quickest rate in the Global Bluetooth Qualification Testing Services Market. As the Bluetooth SIG continues to add capabilities like mesh networking and low-energy audio, devices must undergo additional testing in addition to the standard certification processes to guarantee optimal functionality. This increases the demand for sophisticated testing solutions along with the growth of applications such as low-power wearables and location-based services.

BLUETOOTH QUALIFICATION TESTING SERVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

11.4% |

|

Segments Covered |

By service Type, device type, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

UL, TÜV SÜD, SGS, iCertifi, Eurex UK, Bureau Veritas, Element Materials Technology, Rohde & Schwarz, Intertek, PCTEST Engineering Laboratory |

Global Bluetooth Qualification Testing Services Market Segmentation: By Device Type:

- Smartphones & Tablets

- Wearables & Fitness Trackers

- Smart Home Devices

- Consumer Electronics

- Industrial & Automotive Applications

Wearables & Fitness Trackers and Smart Home Devices are probably in a tight battle for the fastest-growing category in the Global Bluetooth Qualification Testing Services Market by device type. The need for strong BQTS in Smart Home devices to guarantee smooth communication throughout the ecosystem is fueled by the expanding Internet of Things. However, the demand for thorough testing to ensure the functioning of wearables with new features is growing due to their growing popularity. Since both markets are expanding significantly, it is challenging to identify a single leader.

Global Bluetooth Qualification Testing Services Market Segmentation: By End-User:

- Consumer Electronics Manufacturers

- Semiconductor & Chipset Companies

- Medical Device Manufacturers

- Industrial Automation Companies

According to end user's expectations, the global market for Bluetooth qualification testing services would be dominated by spending by consumer electronics manufacturers. Their large-scale manufacturing of Bluetooth wearables and smartphones needs regular BQTS to enter the market and guarantee perfect performance. Consumer gadgets are developing at a rapid rate, and since new features appear often, testing is necessary to ensure that these developments function properly within the Bluetooth ecosystem.

Global Bluetooth Qualification Testing Services Market Segmentation: By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

There is a surge in numerous parts of the global market for Bluetooth qualification testing services. With its fast-expanding number of Bluetooth device makers, Asia-Pacific is a prominent participant in the industry. Some experts believe that this spike in production and rising consumer electronics consumption will cause Asia-Pacific to overtake North America, which is now leading the market in growth rate. Due to established rules, Europe has a consistent need for BQTS, while South America and the Middle East & Africa show potential but may have slower development than the leaders.

COVID-19 Impact Analysis on the Global Bluetooth Qualification Testing Services Market:

There has been a mixed impact of the COVID-19 epidemic on Bluetooth Qualification Testing Services (BQTS). The market was harmed by supply chain breakdowns and a decline in demand for specific products, such as office supplies. However, because of the COVID-19 lockdowns, smart home appliances and health monitors have become increasingly popular, which has led to a counterbalanced spike in demand for BQTS to make sure these devices work correctly. The possibility for remote testing solutions and the growth of e-commerce may have also helped BQTS providers. The long-term benefits of COVID-19 for the BQTS market are anticipated to exceed the short-term negative effects because of the predicted expansion of smart home and health devices.

Recent Trends and Developments in the Global Bluetooth Qualification Testing Services Market:

The market for Bluetooth Qualification Testing Services (BQTS) worldwide is facing both opportunities and problems. The market is anticipated to increase as a result of the growing ecosystem of Bluetooth devices and the Internet of Things (IoT), despite obstacles like the absence of universal communication standards, high testing costs, keeping up with new Bluetooth versions, and probable in-house testing by major firms. The need to ensure smooth interoperability between IoT devices, the growing adoption of Bluetooth technology in developing nations, the need for more thorough testing of advanced Bluetooth functionalities, and the possibility of cooperation between BQTS providers, manufacturers, and regulators will all contribute to this growth. The COVID-19 pandemic has had a mixed effect on the BQTS industry; supply chain interruptions and a decline in demand for some devices have hurt the business, while lockdowns have led to a rise in demand for BQTS that has been balanced out by the rising popularity of smart home gadgets and health monitors. The possibility for remote testing solutions and the growth of e-commerce may have also helped BQTS providers. Long-term growth in smart homes and health devices is anticipated to offset short-term negative effects. As Bluetooth becomes more and more integrated into our lives, the market is seeing exciting advancements with a focus on efficiency and automation through tools and machine learning, the rise of remote testing solutions, the growing demand for advanced testing services for new Bluetooth features, strategic partnerships and collaborations for innovation in testing methodologies, and an emphasis on cybersecurity.

Key Players:

- UL

- TÜV SÜD

- SGS

- iCertifi

- Eurex UK

- Bureau Veritas

- Element Materials Technology

- Rohde & Schwarz

- Intertek

- PCTEST Engineering Laboratory

Chapter 1. GLOBAL BLUETOOTH QUALIFICATION TESTING SERVICES MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL BLUETOOTH QUALIFICATION TESTING SERVICES MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL BLUETOOTH QUALIFICATION TESTING SERVICES MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL BLUETOOTH QUALIFICATION TESTING SERVICES MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL BLUETOOTH QUALIFICATION TESTING SERVICES MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL BLUETOOTH QUALIFICATION TESTING SERVICES MARKET– BY Service Type

6.1. Introduction/Key Findings

6.2. Basic Qualification Testing

6.3. Advanced Testing Services

6.4. Pre-Compliance Testing

6.5. Interoperability Testing

6.6. Y-O-Y Growth trend Analysis By Service Type

6.7. Absolute $ Opportunity Analysis By Service Type, 2024-2030

Chapter 7. GLOBAL BLUETOOTH QUALIFICATION TESTING SERVICES MARKET– BY DEVICE TYPE

7.1. Introduction/Key Findings

7.2. Smartphones & Tablets

7.3. Wearables & Fitness Trackers

7.4. Smart Home Devices

7.5. Consumer Electronics

7.6. Industrial & Automotive Applications

7.7. Y-O-Y Growth trend Analysis By DEVICE TYPE

7.8. Absolute $ Opportunity Analysis By DEVICE TYPE , 2024-2030

Chapter 8. GLOBAL BLUETOOTH QUALIFICATION TESTING SERVICES MARKET– BY End Use

8.1. Introduction/Key Findings

8.2. Consumer Electronics Manufacturers

8.3. Semiconductor & Chipset Companies

8.4. Medical Device Manufacturers

8.5. Industrial Automation Companies

8.6. Y-O-Y Growth trend Analysis End Use

8.7. Absolute $ Opportunity Analysis End Use , 2024-2030

Chapter 9. GLOBAL BLUETOOTH QUALIFICATION TESTING SERVICES MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By Device Type

9.1.3. By service Type

9.1.4. By End Use

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By DEVICE TYPE

9.2.3. By End Use

9.2.4. By service Type

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.1. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By DEVICE TYPE

9.3.3. By service Type

9.3.4. By End Use

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By DEVICE TYPE

9.4.3. By service Type

9.4.4. By End Use

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.1. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By DEVICE TYPE

9.5.3. By service Type

9.5.4. By End Use

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL BLUETOOTH QUALIFICATION TESTING SERVICES MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 UL

10.2. TÜV SÜD

10.3. SGS

10.4. iCertifi

10.5. Eurex UK

10.6. Bureau Veritas

10.7. Element Materials Technology

10.8. Rohde & Schwarz

10.9. Intertek

10.10. PCTEST Engineering Laboratory

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Bluetooth Qualification Testing Services Market size is valued at USD 6.9 billion in 2023

The worldwide Global Bluetooth Qualification Testing Services Market growth is estimated to be 11.4% from 2024 to 2030

The Global Bluetooth Qualification Testing Services Market is segmented By Service Type (Basic Qualification Testing, Advanced Testing Services, Pre-Compliance Testing, Interoperability Testing); By Device Type (Smartphones & Tablets, Wearables & Fitness Trackers, Smart Home Devices, Consumer Electronics, Industrial & Automotive Applications); By End-User (Consumer Electronics Manufacturers, Semiconductor & Chipset Companies, Medical Device Manufacturers, Industrial Automation Companies) and by region.

Strong BQTS is required because of the increasing number of Bluetooth-enabled devices in the growing Internet of Things (IoT), which raises the requirement for flawless interoperability. In the future, there will be chances to test cutting-edge Bluetooth technologies, work together to find effective solutions and address cybersecurity issues in an increasingly interconnected world.

COVID-19 had a variable effect on BQTS. Market damage comes from supply chain interruptions and declines in demand for technologies. But lockdowns caused a boom in smart home and health gadgets, which in turn led to a counterbalanced spike in demand for BQTS to guarantee operation. Overall, it is anticipated that these industries' long-term development will exceed their short-term disadvantages