Blood Stream Infection Testing Market Size (2024 – 2030)

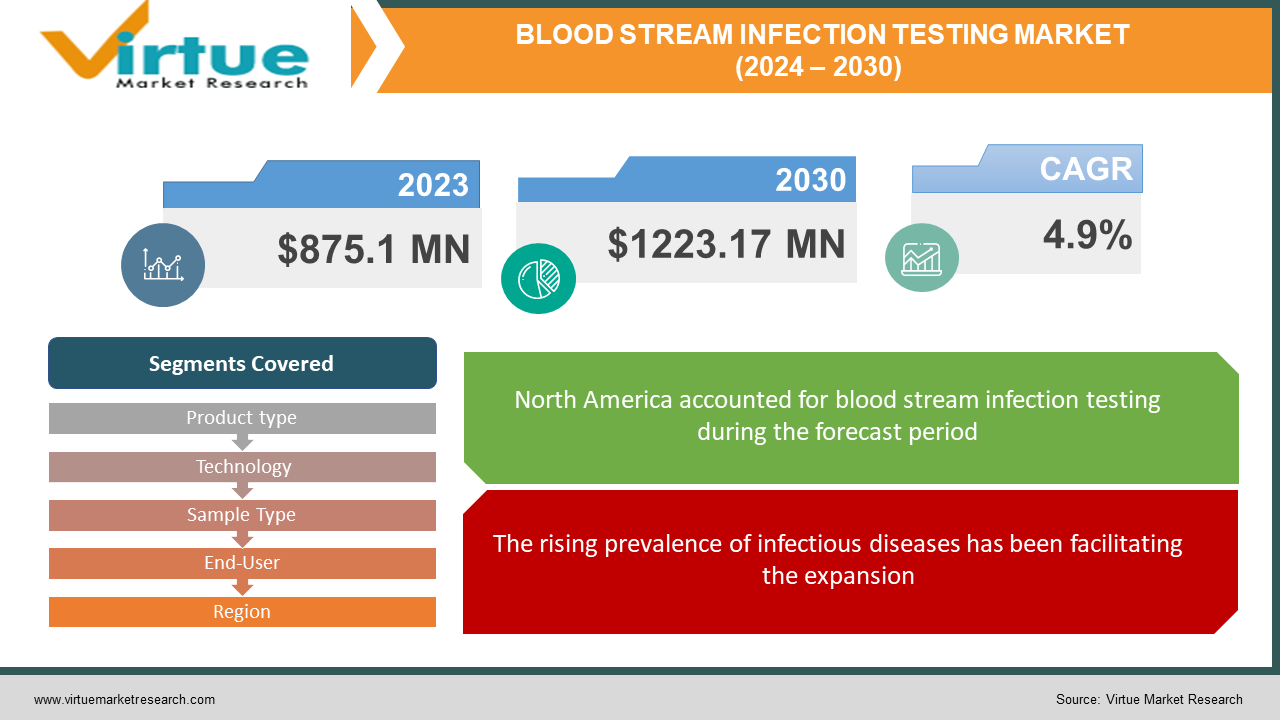

The global bloodstream infection testing market was valued at USD 875.1 million in 2023. The bloodstream infection testing market is projected to reach USD 1223.17 million by 2030, exhibiting a compound annual growth rate (CAGR) of 4.9% during 2024–2030.

Bloodstream infection testing helps in diagnosing the reason for our fever and chills; that is, it identifies harmful microbes thriving in the blood. Traditional methods involve culturing these invaders, but newer options like PCR speed up diagnosis. This accuracy is crucial, as early treatment saves lives. With rising antibiotic resistance and an aging population, the market for these tests is booming, with advancements like point-of-care options expected to fuel further growth in the future.

Key Market Insights

The growth of the global bloodstream infection testing market is driven by the rising prevalence of infectious diseases, increasing awareness, a focus on early diagnosis, and technological advancements. Key trends include the adoption of rapid and accurate molecular testing methods like PCR and nucleic acid testing, growing demand for point-of-care testing for faster decision-making, and rising investments in automation and digitalization to improve efficiency. However, high costs, stringent regulations, and limited access to diagnostics in developing regions pose challenges. North America dominates the market, followed by Europe and Asia Pacific, with emerging economies like India and China showcasing significant potential. Overall, the market offers promising opportunities for players who can address affordability concerns, develop innovative technologies, and expand their reach in developing markets.

Global Blood Stream Infection Testing Market Drivers:

The rising prevalence of infectious diseases has been facilitating the expansion.

The global threat of bloodstream infections is escalating due to an increasing incidence of chronic illnesses and other diseases. Firstly, hospital-acquired infections are surging due to antibiotic resistance, a growing elderly population with weaker immune systems, and an increase in immunocompromised individuals. Secondly, chronic diseases like diabetes and cancer leave people more vulnerable to infections. Finally, new and re-emerging infectious diseases like COVID-19 further complicate the battle against these potentially deadly blood invaders. This perfect storm is driving the demand for faster, more accurate bloodstream infection testing, which is crucial for early intervention and improved patient outcomes.

Growing awareness and emphasis on diagnostics have been accelerating the growth rate.

Early diagnosis of bloodstream infections is essential to avoid complications and save the patient's life. Healthcare professionals and the public are increasingly aware of the dangers of BSIs, leading to a demand for rapid diagnostic tests that can pinpoint the cause quickly. These tests deliver results in hours instead of days, allowing for targeted treatment and improved patient outcomes. Faster recovery, reduced healthcare costs, and potentially saving lives are the outcomes due to the power of early and accurate BSI diagnosis.

Increasing healthcare expenditures are driving market growth.

The fight against bloodstream infections isn't just a medical battle; it's an economic one too. Healthcare budgets worldwide are swelling, but the focus is shifting from simply spending more to spending smarter. This is where advanced diagnostic technologies, like rapid BSI testing, come in. While upfront costs might seem high, their ability to deliver faster diagnosis and targeted treatment translates to significant long-term savings. Early intervention prevents complications, reduces hospital stays, and minimizes the need for expensive broad-spectrum antibiotics. Additionally, an accurate diagnosis helps avoid unnecessary testing and treatment, further streamlining costs. Advanced technology empowers not just doctors but also healthcare systems to fight BSIs effectively and economically, ensuring better patient outcomes while staying within budget.

Global Blood Stream Infection Testing Market Challenges and Restraints

Advanced diagnostic technologies come with a hefty price tag, limiting accessibility in resource-constrained settings.

While advanced diagnostic technologies revolutionize healthcare, their hefty price tag creates a stark divide. In resource-constrained settings, the very tools meant to save lives remain out of reach, leaving vulnerable communities exposed to the dangers of bloodstream infections (BSIs). Methods like traditional blood culture often yield inconclusive results. Precious time ticks by while the patient waits, potentially progressing toward life-threatening complications. Advanced technologies like PCR offer rapid, accurate diagnosis, enabling early intervention and improved outcomes. Unfortunately, their high cost excludes them from these settings. The equipment itself comes with a hefty price tag, requiring specialized personnel for operation and upkeep. In resource-scarce environments, these burdens are simply insurmountable.

Operating and interpreting complex tests require well-trained personnel, which can be scarce in some regions.

Advanced BSI tests may hold the key to faster diagnoses, but unlocking their potential hinges on a crucial factor, which is skilled personnel. Operating these complex technologies demands specialized training, often unavailable in resource-constrained regions. This lack of trained personnel creates a frustrating bottleneck, leaving advanced tests inaccessible and their benefits unrealized. Collaborative efforts like targeted training programs and knowledge-sharing initiatives are crucial to bridge this gap and empower healthcare professionals in these regions to wield the full power of these life-saving tools.

Stringent regulatory processes for new technologies can delay their market entry and adoption.

Stringent regulations, while crucial for ensuring safety and efficacy, can create a double-edged sword for innovative BSI testing technologies. The rigorous approval processes, designed to protect patients, can inadvertently delay the market entry of potentially life-saving tools. This wait can be agonizing, especially in regions battling high BSI mortality rates. Striking a balance between thoroughness and speed is vital. Streamlining approval processes for low-risk technologies without compromising safety could accelerate adoption, especially in regions facing critical healthcare needs. Additionally, regulatory bodies can collaborate with manufacturers to provide clear guidelines and expedite approvals for demonstrably beneficial technologies. By bridging this gap, it is possible to ensure that innovative BSI tests reach patients faster, saving lives and contributing to a healthier future.

Market Opportunities:

The global bloodstream infection testing market, poised for a CAGR of 4.9% until 2030, presents several lucrative opportunities. The rising burden of infectious diseases and healthcare-associated infections (HAIs) fuels the demand for faster, more accurate diagnostics. This opens doors for innovative technologies like rapid molecular testing (PCR, nucleic acid amplification) and point-of-care (POCT) devices, enabling quicker treatment decisions and improved patient outcomes. Growing awareness about early diagnosis and antimicrobial resistance further accentuates market potential. Automation and digitalization offer opportunities to streamline workflows, enhance efficiency, and reduce costs, particularly in resource-constrained settings. Emerging economies like India and China, with their expanding healthcare infrastructure and increasing disposable incomes, are promising new markets. Additionally, addressing affordability concerns through cost-effective solutions and expanding access to diagnostics in these regions presents significant untapped potential. Finally, collaborations between diagnostic companies, healthcare providers, and research institutions can accelerate the development and adoption of novel technologies, ultimately shaping the future of the bloodstream infection testing market. By capitalizing on these trends and addressing existing challenges, companies can carve out profitable niches and contribute to improved global health outcomes.

BLOOD STREAM INFECTION TESTING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.9% |

|

Segments Covered |

By Product type, Technology, Sample Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Becton, Dickinson, and Company, Thermo Fisher Scientific, BioMérieux, Cepheid, Roche Diagnostics, Danaher Corporation, Luminex Corporation, Abbott Laboratories, Cepheid (a subsidiary of Danaher Corporation), Bruker Corporation |

Blood Stream Infection Testing Market Segmentation: By Product Type

-

Instruments

-

Reagents and Consumables

-

Software and Services

Based on product type, reagents, and consumables are the largest and fastest-growing in the market. While conducting a lab test, consumables such as needles, syringes, bandages, test tubes, reagents, and others are used. Growing numbers of laboratories worldwide and growing public awareness of the significance of blood infection testing in illness diagnosis are the primary drivers of consumer demand.

Blood Stream Infection Testing Market Segmentation: By Technology

-

Culture-based

-

Molecular

-

Proteomics

In the battle against bloodstream infections, three main technologies clash with traditional blood culture and growing microbes in broth to identify them, which takes days. Currently, culture-based methods hold the largest share due to their familiarity and lower cost, though their slowness is a drawback. Molecular methods are the fastest-growing category. Molecular methods, like PCR, identify the reason for a disease or infection in hours but can be more expensive. Finally, proteomics analyzes protein fingerprints, potentially predicting antibiotic resistance, but it is still emerging. Molecular tests are gaining ground for their speed and accuracy, while proteomics holds future potential for more personalized treatment options.

Blood Stream Infection Testing Market Segmentation: By Sample Type

-

Whole Blood

-

Blood Culture

With a revenue share of 74%, the blood culture category is anticipated to be both the largest and fastest-growing segment in 2023. Blood culture assays are crucial for the diagnosis of mycobacterial, fungus, and bacterial infections, among other illnesses. Healthcare practitioners employ both computerized and manual ways to identify these illnesses. Furthermore, blood culture testing has developed with technology, even though it is a tried-and-true approach.

Blood Stream Infection Testing Market Segmentation: By End-User

-

Hospitals and Diagnostic Centers

-

Laboratory Service Providers

-

Academic and Research Institutes

-

Others

Hospitals and diagnostic centers hold the largest market share among end users in 2023. When an illness is diagnosed, hospitals are the first place that people contact. The patient initially contacts the hospital when they have signs of a bloodstream infection. In addition, hospital doctors prescribe the next course of action and advise testing if they have any doubts about a bloodstream infection. Laboratory service providers are the fastest-growing category. This is because they can be cost-effective when compared with hospitals and diagnostic centers. Moreover, with economic progress, the number of providers has increased drastically.

Blood Stream Infection Testing Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America currently reigns the market, boasting advanced healthcare infrastructure, high awareness, and established players. The economy of this region makes it easier to fund and invest in various projects. Companies in this region have a global presence, contributing to greater revenue. However, the fastest growth belongs to Asia-Pacific. Its booming healthcare expenditure, rising infectious disease burden, and increasing adoption of technology fuel this trend. Europe, though a significant player due to strong research and technology, experiences slower growth due to stringent regulations and diverse healthcare systems. In contrast, Latin America, the Middle East, and Africa exhibit the slowest growth. Limited resources, fragmented healthcare systems, and lower awareness create hurdles in these regions. Despite the regional differences, one thing remains constant: the global fight against bloodstream infections demands continued innovation and accessibility, ensuring this market evolves to serve patients worldwide.

COVID-19 Impact Analysis on the Global Blood Stream Infection Testing Market

The COVID-19 pandemic delivered both challenges and opportunities for the global bloodstream infection testing market. Initially, concerns over hospital capacity and resource allocation diverted attention from routine procedures, leading to a temporary decline in bloodstream infection testing. However, increased awareness of secondary infections in COVID-19 patients and concerns about antimicrobial resistance due to overuse of antibiotics drove a rebound in testing later in the pandemic. This shift spurred demand for rapid and accurate diagnostic tools, particularly molecular methods like PCR, and accelerated the adoption of point-of-care testing for faster decision-making. Additionally, the pandemic highlighted the need for robust healthcare infrastructure and infection control measures, potentially leading to increased investments in diagnostic technologies in the long run. However, supply chain disruptions and resource constraints posed challenges during the peak of the pandemic, impacting the availability and affordability of testing kits. Moving forward, the long-term impact of COVID-19 on antibiotic resistance and the potential emergence of new infectious diseases remain uncertainties that may influence the market's trajectory. Overall, while the pandemic presented initial disruptions, it has also driven innovation and highlighted the critical role of accurate and timely bloodstream infection testing, potentially shaping the market's future growth toward more advanced and accessible diagnostic solutions.

Latest trends/Developments

The global bloodstream infection testing market buzzes with exciting advancements. Rapid molecular techniques like PCR and nucleic acid testing gain traction, offering swift and precise pathogen identification. Point-of-care testing surges, empowering faster treatment decisions at the bedside. Automation and digitization streamline workflows, boosting efficiency and affordability. Additionally, AI integration for data analysis holds immense promise for predicting antibiotic resistance and optimizing treatment strategies. However, balancing innovation with cost-effectiveness remains crucial, particularly in resource-limited settings. Overall, the market thrives on continuous development, aiming for faster, more accurate, and more accessible diagnostics to combat the rising threat of bloodstream infections.

Key Players:

-

Becton, Dickinson, and Company

-

Thermo Fisher Scientific

-

BioMérieux

-

Cepheid

-

Roche Diagnostics

-

Danaher Corporation

-

Luminex Corporation

-

Abbott Laboratories

-

Cepheid (a subsidiary of Danaher Corporation)

-

Bruker Corporation

Chapter 1. Blood Stream Infection Testing Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Blood Stream Infection Testing Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Blood Stream Infection Testing Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Blood Stream Infection Testing Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Blood Stream Infection Testing Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Blood Stream Infection Testing Market – By Product Type

6.1 Introduction/Key Findings

6.2 Instruments

6.3 Reagents and Consumables

6.4 Software and Services

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Blood Stream Infection Testing Market – By Technology

7.1 Introduction/Key Findings

7.2 Culture-based

7.3 Molecular

7.4 Proteomics

7.5 Y-O-Y Growth trend Analysis By Technology

7.6 Absolute $ Opportunity Analysis By Technology, 2024-2030

Chapter 8. Blood Stream Infection Testing Market – By Sample Type

8.1 Introduction/Key Findings

8.2 Whole Blood

8.3 Blood Culture

8.4 Y-O-Y Growth trend Analysis End-Use Industry

8.5 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Blood Stream Infection Testing Market – By End-User

9.1 Introduction/Key Findings

9.2 Hospitals and Diagnostic Centers

9.3 Laboratory Service Providers

9.4 Academic and Research Institutes

9.5 Others

9.6 Y-O-Y Growth trend Analysis End-User

9.7 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Blood Stream Infection Testing Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Technology

10.1.3 By Sample Type

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Technology

10.2.4 By Sample Type

10.2.5 By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Technology

10.3.4 By Sample Type

10.3.5 By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Technology

10.4.4 By Sample Type

10.4.5 By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Technology

10.5.4 By Sample Type

10.5.5 By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Blood Stream Infection Testing Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Becton, Dickinson, and Company

11.2 Thermo Fisher Scientific

11.3 BioMérieux

11.4 Cepheid

11.5 Roche Diagnostics

11.6 Danaher Corporation

11.7 Luminex Corporation

11.8 Abbott Laboratories

11.9 Cepheid (a subsidiary of Danaher Corporation)

11.10 Bruker Corporation

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The global bloodstream infection testing market was valued at USD 875.1 million in 2023. The market is projected to reach 1223.17 million by 2030, exhibiting a compound annual growth rate (CAGR) of 4.9% during 2024–2030.

The rising prevalence of infectious diseases, growing awareness and emphasis on diagnostics, and increasing healthcare expenditure are driving market growth.

Based on technology, it is divided into three segments: culture-based, molecular, and proteomics.

North America is the most dominant region for the bloodstream infection testing market.

Becton, Dickinson & Company, Thermo Fisher Scientific, BioMérieux, Cepheid, and Roche Diagnostics are the major players.