Blood Culture Tests For Mycobacterial Market Size (2024 – 2030)

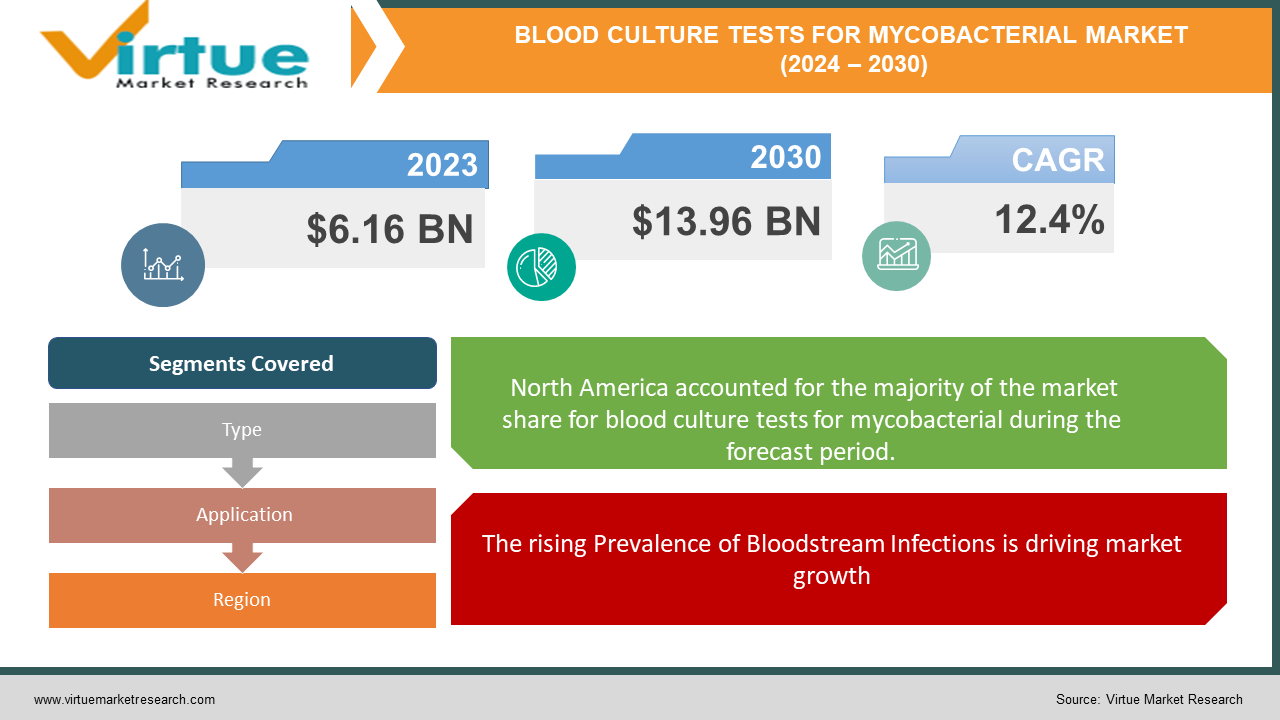

The Global Blood Culture Tests For Mycobacterial Market was valued at USD 6.16 billion in 2023 and will grow at a CAGR of 12.4% from 2024 to 2030. The market is expected to reach USD 13.96 billion by 2030.

The broader blood culture test market itself is significant, reaching billions of dollars, but for diagnosing mycobacteria, different tests like PCR are needed.

Key Market Insights:

Increasing prevalence of bloodstream infections, rising demand for rapid diagnostics, and growing geriatric population.PCR (Polymerase Chain Reaction) is a dominant method for detecting mycobacteria, along with other techniques like culture on specialized media and immunological assays.Blood culture tests are not the primary method for diagnosing mycobacterial infections. The broader blood culture test market is substantial, but for mycobacteria, specific tests like PCR cater to this segment.

Global Blood Culture Tests For Mycobacterial Market Drivers:

The rising Prevalence of Bloodstream Infections is driving market growth:

Sepsis, a life-threatening condition triggered by the body's overwhelming response to an infection, is a prime example of why blood cultures are vital. When bacteria invade the bloodstream, the body launches an inflammatory attack. This can lead to a cascade of events including fever, rapid breathing, and organ damage. Blood cultures act as a detective tool in this scenario. A healthcare professional will extract a blood sample and cultivate it in a special broth. If bacteria are present, they'll multiply in the broth, allowing for identification and targeted antibiotic treatment. Early diagnosis and appropriate antibiotics are crucial in preventing organ failure and death from sepsis. Blood cultures provide the necessary information to fight this life-threatening condition effectively. By pinpointing the specific culprit, doctors can choose the most effective antibiotics, minimizing the risk of resistance and ensuring a faster recovery for the patient.

Growing Demand for Rapid Diagnostics is driving market growth:

In the critical battle against bloodstream infections, faster turnaround times for blood culture results are like receiving real-time intelligence on the enemy. Traditionally, blood culture results can take 24-48 hours, a timeframe that can feel agonizing when a patient's health hangs in the balance. However, advancements in technology are shaving off precious hours. Automated systems continuously monitor cultures for growth, enabling earlier detection of bacterial activity. Additionally, rapid diagnostic tests like MALDI-TOF can identify the specific bacteria within a shorter window. This expedited information empowers doctors to make quicker and more informed treatment decisions. Instead of waiting for confirmation before initiating broad-spectrum antibiotics, a faster result might reveal a specific pathogen, allowing for targeted antibiotic therapy. This not only improves the patient's response but also reduces the risk of developing antibiotic resistance, a growing global threat. Ultimately, faster turnaround times for blood cultures translate to more timely and effective treatment, potentially minimizing complications, shortening hospital stays, and improving patient outcomes.

The increasing Geriatric Population is driving market growth:

As we age, our immune system's efficiency naturally declines. This phenomenon, known as immunosenescence, weakens our ability to fight off infections. In older adults, the thymus gland, responsible for producing T-cells that combat pathogens, shrinks, leading to a decreased production of these crucial immune soldiers. Additionally, the function of existing immune cells wanes, making them less effective in recognizing and eliminating invaders. This heightened vulnerability to infections translates to a higher risk of developing bloodstream infections. Common culprits like E. coli or pneumonia can easily overwhelm an older adult's weakened defenses, potentially leading to sepsis, a life-threatening complication. To combat these hidden enemies, blood culture tests become a critical tool for diagnosis. By identifying the specific bacteria causing the infection, doctors can prescribe targeted antibiotics, significantly improving treatment outcomes. The earlier the diagnosis, the faster the appropriate treatment can be initiated, minimizing the risk of complications and potentially saving lives. Therefore, the growing population of older adults, coupled with their increased susceptibility to infections, fuels the demand for blood culture tests as a crucial diagnostic tool in safeguarding their health.

Global Blood Culture Tests For Mycobacterial Market challenges and restraints:

Limited Efficacy of Blood Cultures for Mycobacteria is a significant hurdle for Blood Culture Tests For Mycobacterial:

Standard blood cultures, while excellent tools for identifying many bacteria causing bloodstream infections, fall short when it comes to mycobacteria. These unique organisms are notorious for their slow growth rates, often taking weeks to multiply in culture media. This sluggish pace creates a major pitfall in diagnosis. A negative blood culture result doesn't necessarily signify the absence of mycobacterial infection. The bacteria might simply be hiding undetected within the slow-growing culture, leading to a false sense of security and delaying crucial treatment. This window of missed opportunity can have serious consequences. Mycobacteria, like those causing tuberculosis, can wreak havoc on the body if left unchecked. Early diagnosis is paramount for a successful outcome. The limitations of blood cultures for mycobacteria highlight the need for complementary diagnostic tools that can overcome these slow-growth hurdles and provide a more accurate picture of potential mycobacterial infections.

The need for Specialized Diagnostic Techniques is throwing a curveball at Blood Culture Tests For the Mycobacterial market:

Unveiling mycobacterial infections demands a more specialized approach than the workhorse blood culture test. While blood cultures offer a rapid turnaround time, they often miss the culprit entirely due to mycobacteria's leisurely growth. In such cases, specialized tests like PCR (Polymerase Chain Reaction) take center stage. PCR acts as a detective, identifying the specific genetic fingerprint of the mycobacteria. However, this enhanced accuracy comes at a cost. PCR tests involve complex laboratory procedures and specialized equipment, making them more expensive than blood cultures. Additionally, while faster than traditional culture methods, PCR still takes some time to process. Another option is culturing the bacteria on specialized media formulated to nurture the specific needs of mycobacteria. These enriched media entice mycobacteria to grow, but again, the wait can be agonizing, often extending for weeks. The cost of these specialized media adds another layer of expense. While these specialized tests provide the necessary precision to diagnose mycobacterial infections, the trade-off lies in their increased cost and time required compared to standard blood cultures.

Lack of Awareness is a growing nightmare for Blood Culture Tests For Mycobacterial:

A crucial challenge in diagnosing mycobacterial infections lies in the potential knowledge gap among some healthcare providers regarding the limitations of blood cultures for these unique bacteria. Standard blood cultures, while effective for many bacterial infections, struggle to detect mycobacteria due to their slow growth. This lack of awareness can lead to a cascade of inefficiencies. A physician, unaware of this limitation, might order a blood culture for a patient suspected of a mycobacterial infection. The blood culture, even if negative, might be misinterpreted as a clean bill of health, causing a delay in pursuing the most appropriate diagnostic tests. This delay can be critical, as mycobacterial infections like tuberculosis can silently progress if left undiagnosed. To bridge this knowledge gap, continuous medical education and improved communication between clinicians and laboratory professionals are essential. By understanding the limitations of blood cultures for mycobacteria, healthcare providers can make informed decisions about which tests to order, leading to faster and more accurate diagnoses for patients with these potentially serious infections.

Market Opportunities:

Firstly, the rise of antimicrobial resistance across various bacterial strains necessitates a multi-pronged approach to diagnosing bloodstream infections. Blood cultures remain crucial for identifying a broad range of bacteria, providing valuable information for initial treatment decisions. If a blood culture indicates a bacterial infection, even if it doesn't pinpoint mycobacteria specifically, it can prompt further investigation using specialized mycobacterial diagnostic tests like PCR or cultures on specific media. This combined approach can offer a more comprehensive picture of the potential causative agent. Secondly, advancements in blood culture technology hold promise for future applications. Research into rapid blood culture systems that can differentiate between various bacterial types, including mycobacteria, could be a game-changer. Imagine a blood culture test that not only confirms a bacterial infection but also offers clues about the specific culprit, including mycobacteria. This would significantly improve diagnostic efficiency and potentially reduce reliance on separate mycobacterial tests. Thirdly, the growing focus on point-of-care diagnostics creates exciting possibilities. Currently, mycobacterial tests often require specialized lab facilities, delaying diagnosis. The development of rapid and portable tests that can be performed closer to the patient, even in resource-limited settings, would be a breakthrough. This could be particularly impactful in regions with high burdens of tuberculosis and other mycobacterial infections. In conclusion, while blood cultures themselves won't dominate the mycobacterial diagnostics market, they can play a valuable role in a comprehensive diagnostic strategy. Continued research in blood culture technology, coupled with advancements in rapid mycobacterial testing and point-of-care solutions, offer promising opportunities for a more efficient and effective approach to diagnosing these challenging infections.

BLOOD CULTURE TESTS FOR MYCOBACTERIAL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

12.4% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Becton, Dickinson and Company (BD), bioMérieux SA, Thermo Fisher Scientific, Roche Diagnostics, Bruker Corporation, Cepheid (Danaher Company), Abbott Laboratories, Siemens Healthineers, Hologic (acquired by PerkinElmer), Beckman Coulter (Danaher Company) |

Blood Culture Tests For Mycobacterial Market Segmentation - By Type

-

Conventional Blood Culture

-

Automated Blood Culture

Neither Conventional Blood Culture nor Automated Blood Culture is a prominent sector in the Blood Culture Tests for Mycobacterial Market because these tests are not very effective in detecting mycobacteria. Mycobacteria have slow growth rates, rendering standard blood cultures unreliable for diagnosis. The broader market for blood cultures focuses on identifying a wider range of bacteria while diagnosing mycobacteria requires specialized tests like PCR or cultures on specific media.

Blood Culture Tests For Mycobacterial Market Segmentation - By Application

-

Tuberculosis (TB) Diagnosis

-

Non-tuberculous Mycobacterial (NTM) Infections

Tuberculosis (TB) Diagnosis holds a more prominent position. This is primarily due to the higher global burden of TB compared to Non-tuberculous Mycobacterial (NTM) Infections. While NTM infections exist, they are less common than TB. The focus of the market reflects this disparity, with a wider range of diagnostic tests and research efforts directed towards tackling the more prevalent threat of tuberculosis.

Blood Culture Tests For Mycobacterial Market Segmentation - Regional Analysis

-

Asia-Pacific

-

North America

-

Europe

-

South America

-

Middle East and Africa

North America currently holds the largest market share due to factors like a significant presence of blood culture test providers, rising product approvals, and a growing geriatric population susceptible to infections. However, the Asia Pacific region is expected to experience the fastest growth due to an increasing focus on healthcare improvements and a large population base.

COVID-19 Impact Analysis on the Global Blood Culture Tests For Mycobacterial Market

The COVID-19 pandemic has had a complex impact on the landscape related to blood culture tests and mycobacterial diagnostics. Initially, there was a potential decline in blood culture test volumes as hospitals prioritized COVID-19 testing and patient management. This could have indirectly impacted the mycobacterial diagnostics market as well since blood cultures sometimes serve as an initial screening tool. However, there's also reason to believe that the pandemic might have increased awareness of the importance of diagnosing bloodstream infections, potentially leading to a rebound in blood culture test utilization as the crisis subsides. Additionally, with increased focus on immunocompromised patients susceptible to both COVID-19 and other infections, there might be a rise in demand for more specific mycobacterial diagnostic tests alongside blood cultures to provide a more comprehensive diagnostic picture. The long-term impact of COVID-19 on these markets remains to be seen, but it could involve a renewed emphasis on strengthening diagnostic capabilities for various infectious diseases, including mycobacterial infections. Research efforts might be directed toward developing integrated diagnostic solutions or rapid tests that combine blood culture functionalities with the ability to detect mycobacteria.

Latest trends/Developments

Firstly, advancements in blood culture technology hold promise. Research is ongoing to develop rapid blood culture systems that can differentiate between various bacteria, potentially including mycobacteria. This would be a game-changer, offering clues about the specific culprit during the initial blood culture stage, reducing reliance on separate mycobacterial tests. Secondly, the rise of antimicrobial resistance across various bacteria necessitates a multi-pronged diagnostic approach. Blood cultures remain crucial for identifying a broad range of bacteria, and informing initial treatment decisions. Even if a blood culture doesn't pinpoint mycobacteria, it can trigger further investigation with specialized mycobacterial tests like PCR, leading to a more comprehensive diagnosis. Thirdly, the focus on point-of-care diagnostics is crucial for mycobacterial infections. Currently, diagnosis often requires specialized labs, delaying treatment. The development of rapid and portable tests for closer-to-patient use, especially in resource-limited settings with high TB burdens, would be a breakthrough. Finally, there's potential for integration between blood culture and mycobacterial diagnostics. Imagine a blood culture system that not only detects a bacterial infection but also flags the possibility of mycobacteria, prompting further investigation. This combined approach could significantly improve diagnostic efficiency. In conclusion, while blood cultures themselves won't revolutionize mycobacterial diagnostics, advancements in both areas, along with the development of rapid and point-of-care solutions, offer promising avenues for a more effective approach to diagnosing these serious infections.

Key Players:

-

Becton, Dickinson and Company (BD)

-

bioMérieux SA

-

Thermo Fisher Scientific

-

Roche Diagnostics

-

Bruker Corporation

-

Cepheid (Danaher Company)

-

Abbott Laboratories

-

Siemens Healthineers

-

Hologic (acquired by PerkinElmer)

-

Beckman Coulter (Danaher Company)

Chapter 1. Blood Culture Tests For Mycobacterial Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Blood Culture Tests For Mycobacterial Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Blood Culture Tests For Mycobacterial Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Blood Culture Tests For Mycobacterial Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Blood Culture Tests For Mycobacterial Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Blood Culture Tests For Mycobacterial Market – By Type

6.1 Introduction/Key Findings

6.2 Conventional Blood Culture

6.3 Automated Blood Culture

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Blood Culture Tests For Mycobacterial Market – By Application

7.1 Introduction/Key Findings

7.2 Tuberculosis (TB) Diagnosis

7.3 Non-tuberculous Mycobacterial (NTM) Infections

7.4 Y-O-Y Growth trend Analysis By Application

7.5 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Blood Culture Tests For Mycobacterial Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Blood Culture Tests For Mycobacterial Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Becton, Dickinson and Company (BD)

9.2 bioMérieux SA

9.3 Thermo Fisher Scientific

9.4 Roche Diagnostics

9.5 Bruker Corporation

9.6 Cepheid (Danaher Company)

9.7 Abbott Laboratories

9.8 Siemens Healthineers

9.9 Hologic (acquired by PerkinElmer)

9.10 Beckman Coulter (Danaher Company)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Blood Culture Tests For Mycobacterial Market was valued at USD 6.16 billion in 2023 and will grow at a CAGR of 12.4% from 2024 to 2030. The market is expected to reach USD 13.96 billion by 2030.

Rising Prevalence of Bloodstream Infections, Growing Demand for Rapid Diagnostics, and Increasing Geriatric Population are the reasons which is driving the market.

Based on Application it is divided into two segments – Tuberculosis (TB) Diagnosis and non-tuberculous Mycobacterial (NTM) Infections.

North America is the most dominant region for the luxury vehicle Market.

Becton, Dickinson and Company (BD), bioMérieux SA, Thermo Fisher Scientific, Roche Diagnostics, Bruker Corporation.