Global Blockchain RegTech & Security Solutions Market Size (2024 – 2030)

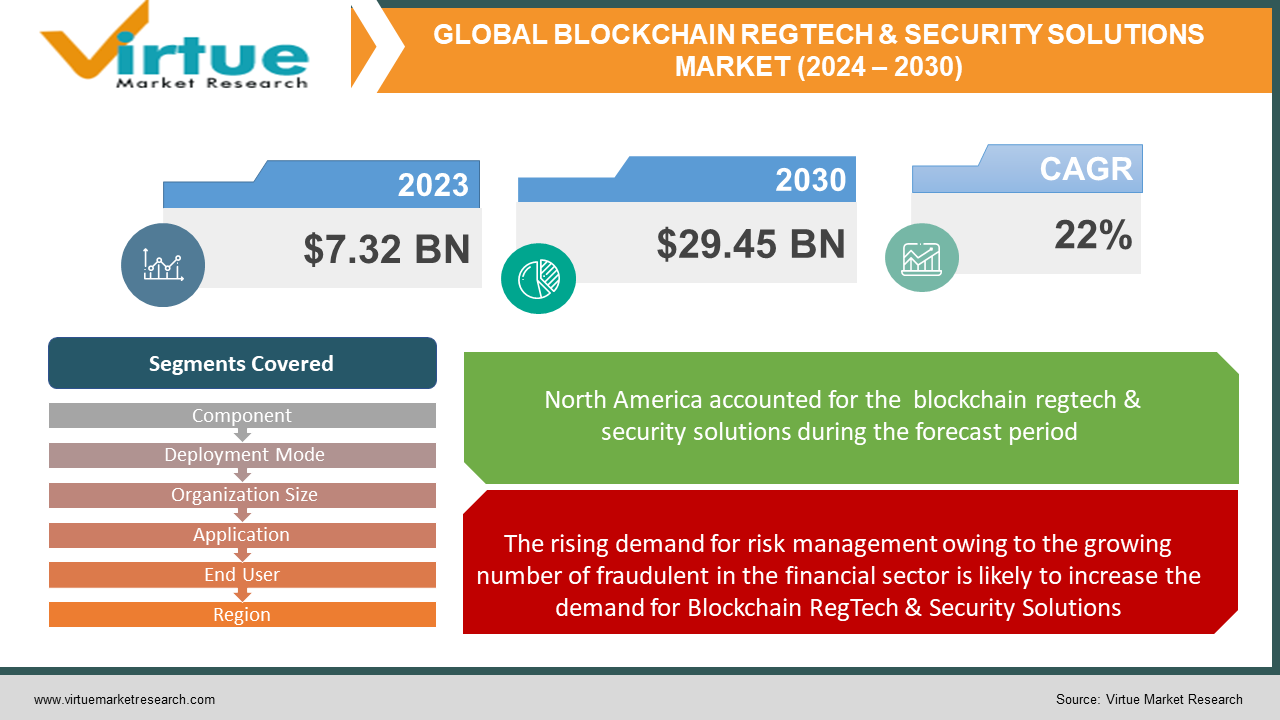

Global Blockchain RegTech & Security Solutions Market was valued at USD 7.32 Billion and is projected to reach a market size of USD 29.45 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 22%. Rising demand for risk management owing to the growing number of fraudulent in the financial sector, Increased translucency, decentralization, and more cost-effective processing through automation and enhanced security, and changing government policies and regulations to improve the quality of reported data across various regimes are majorly driving the growth of the market.

Industry Overview:

RegTech or Regulatory technology applies innovative techniques and capabilities to help financial institutions improve their reporting, monitoring, regulatory governance, compliance, and risk management. A regTech system involves a group of companies using computing technology, offering SaaS to help businesses comply with regulations efficiently. Technologies like blockchain, artificial intelligence, data mining, and big data provide robust, effective, and reliable solutions to financial institutions. Such technologies provide data on money laundering activities and help to minimize the risk of financial fraud. Blockchain is a decentralized distributed ledger that consists of blocks containing the records of transactions stored using cryptography. Blockchain allows banks to manage payments, improve the internal process, and streamline complex procedures. Blockchain offers automation and intermediary redundancy benefits for banks. After the global financial crisis, regulators started shifting their focus more on the compliance element in the business and introduced many rules and provisions across the globe. According to the Financial Conduct Authority (FCA), about USD 189.8 million has been paid against the regulatory violations. All global regulators are showing great interest in blockchain technology for regulatory purposes as the cost of doing compliant business is higher. The cost of compliance is getting high with time be it a big bank like HSBC or a small organization. Blockchain technology can be used by banks to offer faster processing of payments, cross-border transactions, and transparency of operations to users. It can improve productivity and reduce the overall cost of doing business by making it safer and easier to transmit information across financial institutions. Blockchain systems can help in screening customer names through automated regulatory compliance systems, verify data in real-time, and help compliance officers automatically monitor transactions. Blockchain RegTech & Security Solutions can be implemented across several verticals including banks, insurance companies, fintech firms, the public sector, IT and telecom, and others. The companies providing blockchain regTech & security solutions offer regulatory reporting, fraud & risk management, transaction monitoring, identity management, compliance, and many other functions.

The regulatory focus on data protection is set to increase with the implementation of the General Data Protection Regulation (GDPR) in May 2018 which is likely to provide lucrative opportunities for the blockchain regTech & security solutions market. The importance of data protection and security was already increasing with concerns about cyber resilience and technology risk, with millions of individuals finding that their personal information had been compromised or otherwise stolen. Emerging economies such as Australia, China, Singapore, India, and South Korea offer significant opportunities for Blockchain RegTech & Security solutions to expand and develop their offerings. With changing government policies and regulations, the requirement to improve the quality of reported data across various regimes and jurisdictions is rising. For instance, In Europe, the implementation of RegTech security services is gaining traction in the European Parliament’s MiFID II legislation and is likely to grow in the coming years. Technological innovation will continue to grow with evolving regulations and increasing regulatory expectations. Blockchain RegTech is also gaining momentum in the field of cryptocurrencies which is likely to provide lucrative opportunities for market growth.

COVID-19 impact on Blockchain RegTech & Security Solutions Market

The COVID-19 outbreak has significantly impacted the global Blockchain RegTech & Security Solutions market. The pandemic increased the adoption of online or digitalized financial services across the globe. The rise in online transactions also caused an increase in cyber threats in the form of identity theft, ransom attacks, cyber hacking, and malware attacks. Compliance, regulatory, and security issues are challenging enough for standard financial instruments. The COVID-19 pandemic combined with the growing regulatory burden led to an exponential rise in the regulation technology industry. RegTech providers offered software-as-a-service platforms which have gained momentum amid the covid-19 crisis. Technological advances such as blockchain are one of the key strengths of the current era that may help in overcoming challenges created by the covid-19 pandemic by introducing intelligent emergency strategies. Compliance practices are likely to get more digitalized with business processes going digital. Technology plays a vital role in ensuring timelines and norms are met and increases the efficiency of a business. Streamlining operations using digital processes under compliance norms plays a key role in achieving operational resilience. Naturally, the blockchain RegTech & security solution market is anticipated to benefit from this.

MARKET DRIVERS:

Increased translucency, decentralization, and more cost-effective processing through automation and enhanced security through cryptography are driving the Blockchain RegTech & Security Solutions Market growth

Banks may find vast amounts of data too complex, precious, and time-consuming to comb through. Financial regulators and service providers are looking for the most cost-effective solutions to help banks and other financial institutions do business in a compliant regulatory environment. Blockchain regTech & security solutions can analyze complex information with data from regulatory failures to predict implicit trouble areas that the bank needs to concentrate on. The RegTech companies save the bank’s time and capital by successfully creating the analytical tools to comply with the laws and regulations. Blockchain offers solutions for the financing institutions in terms of Know Your Customer (KYC) and Anti-Money Laundering (AML). Blockchain systems provide transparency regarding KYC and AML compliance as the transactions in the blockchain system are immutable and cannot be changed and altered.

The rising demand for risk management owing to the growing number of fraudulent in the financial sector is likely to increase the demand for Blockchain RegTech & Security Solutions

Financial organizations need a powerful RegTech framework as fraudulent activities such as money laundering have increased. Blockchain regTech & security solutions help risk and compliance teams to manage the deluge of progressively sophisticated breaches and ever-increasing regulatory and compliance. Blockchain RegTech services reduce the threats of money laundering, security breaches, and cyberattacks by using regulatory-driven transformations. Companies of all shapes and sizes around the world are vulnerable to cyber attacks in the online world. Good customer outcomes can be under threat in the event of a failure of cyber resilience owing to the growing cyber risk, and cyber-attacks. The concerns are borne out by the statistics around cyber-attacks which show the threat to be increasing rapidly. Blockchain RegTech tools are being specially developed to address security-related risks which are driving the market growth.

MARKET RESTRAINTS:

Lack of technical knowledge, skills, and complexity associated with software deliverables may hamper the market growth

The lack of knowledge and up-to-date skills inhibits progress. It is necessary to understand the industry domain knowledge along with detailed regulatory processes and how they differ across regions. New regulations, data privacy, and tax considerations make it a complex environment. There is a growing need for training and skills in all aspects of fintech and regTech digital innovation and disruption. RegTech poses risks for regulators, as they may lack the skills and tools required to adequately supervise the use and success of businesses using RegTech which can hamper the market growth.

Challenges like high cost and cumbersome process of upgrading legacy systems can affect the market growth

The cost of implementing regTech services is still high for banks owing to hundreds of new compliance rules originating every year. Banks have to comply with the new rules to avoid getting penalized by the regulators. The need to upgrade legacy systems and IT infrastructure along with cyber resilience and technology risks is a challenge for firms. Many firms have legacy systems with fixes and workarounds that often need substantial investment to upgrade. The upgrades required in legacy systems become more challenging by the continuing huge amount of regulatory change absorbing much of the IT change capacity.

GLOBAL BLOCKCHAIN REGTECH & SECURITY SOLUTIONS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

22% |

|

Segments Covered |

By Component, Deployment Mode, Organization Size, Application, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM Corp, Microsoft Corp, Deloitte, Thomson Reuters, Coinfirm, MetricStream Inc., ACTICO, Ascent Technologies Inc., and Broadridge Financial Solutions, Inc |

Blockchain RegTech & Security Solutions Market – By Component

-

Solutions

-

Services

Based on Component, the Blockchain RegTech & Security Solutions Market is segmented into Solutions and Services. The Solutions segment holds the largest market share in the global blockchain regTech & security solutions market. The demand for blockchain regTech solutions is increasing with the increasing incidences of money laundering followed by non-compliance owing to changing regulatory scenarios. Blockchain Regtech providers offer Sofware-as-a-Service (SaaS) solutions to help businesses to run effectively.

Blockchain RegTech & Security Solutions Market – By Deployment Mode

-

Cloud

-

On-Premises

Based on Deployment Mode, the Blockchain RegTech & Security Solutions Market is segmented into Cloud and On-Premises. The Cloud segment is anticipated to hold a significant market share during the forecast period. Cloud services provide flexibility to organizations to adjust to dynamic environments. It provides many advantages like low maintenance cost, 24/7 data accessibility from anywhere and anytime, and reduced physical infrastructure. With the growing advancements in cloud technology, Blockchain RegTech & security solutions are emerging as cost-effective practices for companies. Blockchain RegTech solutions are majorly cloud-based, providing the capacity to remotely monitor, secure, and backup information. The degree of deftness enabled by cloud-based arrangements guarantees a significant level of consistency, security, and control of information management.

Blockchain RegTech & Security Solutions Market – By Organization Size

-

Large Enterprises

-

SMEs

Based on Organization Size, the Blockchain RegTech & Security Solutions Market is segmented into Large Enterprises and SMEs. The Large Enterprises segment is anticipated to hold a higher market share during the forecast period as publicly traded companies involve a huge amount of data and are obliged to adopt regulatory programs. As rules and regulations vary as per industry and region, it is not feasible to keep a check on all the processes manually which further emphasizes the importance of blockchain regTech & security solutions. Service and consulting vendors, such as IBM, PwC, Delloite, and Thomson Reuters assist large enterprises in efficiently managing their business functions under the compliance mandates by effective implementation of blockchain regTech & security solutions as per their business requirements. The SMEs segment is anticipated to grow significantly during the forecast period as blockchain regTech & security solutions enable the storage of data safely and cost-effectively.

Blockchain RegTech & Security Solutions Market – By Application

-

Risk and Compliance Management

-

Identity Management

-

Regulatory Reporting

-

Anti-Money Laundering (AML) and Know Your Customer (KYC)

-

Transaction Monitoring

-

Others

Based on Application, the Blockchain RegTech & Security Solutions Market is segmented into Risk and Compliance Management, Identity Management, Regulatory Reporting, Anti-Money Laundering (AML) and Know Your Customer (KYC), Transaction Monitoring, and Others. The Risk and Compliance Management segment is anticipated to hold the largest market share during the forecast period. Risk management is crucial for seamless business functioning. Identifying risks, taking timely inputs, analyzing, monitoring, controlling, implementing risk impact analysis, and prioritizing the risks to organizations are some of the major functionalities of risk management software. Transaction Monitoring services monitor clients' transactions in real-time. Blockchain regTech & security solutions effectively manage AML and KYC regulations for client onboarding.

Blockchain RegTech & Security Solutions Market – By End User

-

Banking

-

FinTech Firms

-

Insurance Companies

-

IT & Telecom

-

Public Sector

-

Others

Based on End-User, the Blockchain RegTech & Security Solutions Market is segmented into Banking, FinTech Firms, Insurance Companies, IT & Telecom, Public Sector, and Others. Banks and Fintech firms use blockchain RegTech & security services to effectively manage financial transactions taking place in businesses. Blockchain RegTech & security solutions allow precise decisions to be reached almost in real-time with growing volumes of data. The Banking segment holds a significant market share as these institutions are adopting blockchain regTech & security solutions to simplify the process and reduce compliance-related costs. Banks are known to operate in a regulated environment and have to face an ever-changing regulatory scenario. They are liable to face hefty fines for non-compliance measures. These institutions are adopting blockchain regTech & security solutions owing to the strict compliance guidelines across many regions.

Blockchain RegTech & Security Solutions Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America, the Middle East, and Africa

Geographically, the North American Blockchain RegTech & Security Solutions Market is anticipated to hold the largest market share during the forecast period. This is attributed to the early adoption of RegTech technologies by financial institutions to reduce compliance costs and stringent regulations.

The European Blockchain RegTech & Security Solutions Market is anticipated to grow significantly during the forecast period owing to the increased adoption of regulatory technologies by companies for compliance management.

The Blockchain RegTech & Security Solutions Market in the Asia Pacific is anticipated to register the highest CAGR during the forecast period. This growth is attributed to the rising adoption of new technologies to increase the efficiency of financial systems and comply with procedures, extensive development of infrastructure, and high investments in digital transformation. The governments of several countries in this region like China, India, and Japan are promoting the use of blockchain technology for increased efficiency and transparency in multiple industries.

Major Key Players in the Market

-

IBM Corp

-

Microsoft Corp

-

Deloitte

-

Thomson Reuters

-

Coinfirm

-

MetricStream Inc.

-

ACTICO

-

Ascent Technologies Inc.

-

Broadridge Financial Solutions, Inc.

The key players in the Blockchain RegTech & Security Solutions Market are focusing on the integration of advanced technologies, strategic innovative product launches, partnerships, and collaborations to gain a stronger foothold in the market.

Notable happenings in the Global Blockchain RegTech & Security Solutions Market in the recent past:

-

Partnership- In March 2022, Actico, an international provider of digital decision-making software using Artificial Intelligence, entered into a strategic partnership with Coinfirm, a leading crypto anti-money laundering, and analytics company. This partnership would enable banks and financial service providers to analyze and assess money laundering risks for crypto transactions directly within the ACTICO Compliance Suite.

-

Partnership- In March 2021, Broadridge Financial Solutions, Inc., a global Fintech leader, partnered with AccessFintech to deliver a new Strategic Gateway for Settlement Workflow that offers efficiencies in resolving multi-party settlement fails. The solution is powered by Broadridge’s post-trade platforms and integrates AccessFintech’s cloud-based operations workflow model. As a result, banks, prime brokerages, and custodians would be able to achieve transformational benefits that include reduction of operational risk, expedited resolution of settlement fails, cost savings, and a seamless experience for their clients.

-

Expansion- In May 2021, Circle Internet Financial Ltd., a blockchain technology provider, raised USD 440 million in funds from strategic and institutional investors. The fund would be utilized by the company for market expansion and organizational development.

-

Acquisition-In June 2021, BearingPoint RegTech, a European provider of innovative regulatory, risk, and supervisory technology solutions signed an agreement regarding the acquisition of Vizor Software to accelerate their future growth journey. Vizor is a leading provider of regulatory and supervisory technology headquartered in Dublin, Ireland.

-

Partnership- In November 2021, Authenteq, a leader in the identity verification space, announced a strategic partnership with Coinfirm, a leading blockchain AML, and analytics firm, to help increase the safety and security of crypto exchanges and platforms.

-

Expansion- In March 2020, MetricStream, a market leader in governance, risk, and compliance (GRC) products and solutions, announced the acceleration of its investment in Australia and New Zealand. This follows the company’s stepped-up growth in Europe and UK and is in response to the increased volume of risk and regulatory change globally. MetricStream’s business expansion will also serve as a gateway to the growing Asia market.

-

Partnership- In July 2020, Ascent, a provider of AI-based solutions that automate regulatory compliance processes, announced a partnership with IBM to integrate their respective RegTech solutions to help banks and other financial institutions effectively manage their growing and ever-changing regulatory requirements.

-

Acquisition- In September 2020, RoperTechnologies, Inc., a leading diversified technology company, announced the acquisition of Vertafore, a leading provider of SaaS solutions for the property and casualty insurance industry.

Chapter 1. Blockchain RegTech & Security Solutions Market– Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Blockchain RegTech & Security Solutions Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Blockchain RegTech & Security Solutions Market– Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Blockchain RegTech & Security Solutions MarketEntry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Blockchain RegTech & Security Solutions Market– Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Blockchain RegTech & Security Solutions Market– By Component

6.1 Introduction/Key Findings

6.2 Solutions

6.3 Services

6.4 Y-O-Y Growth trend Analysis By Component

6.5 Absolute $ Opportunity Analysis By Component, 2024-2030

Chapter 7. Blockchain RegTech & Security Solutions Market– By Deployment Mode

7.1 Introduction/Key Findings

7.2 Cloud

7.3 On-Premises

7.4 Y-O-Y Growth trend Analysis By Deployment Mode

7.5 Absolute $ Opportunity Analysis By Deployment Mode, 2024-2030

Chapter 8. Blockchain RegTech & Security Solutions Market– By Organization Size

8.1 Introduction/Key Findings

8.2 Large Enterprises

8.3 SMEs

8.4 Y-O-Y Growth trend Analysis Organization Size

8.5 Absolute $ Opportunity Analysis Organization Size, 2024-2030

Chapter 9. Blockchain RegTech & Security Solutions Market– By End-User

9.1 Introduction/Key Findings

9.2 Banking

9.3 FinTech Firms

9.4 Insurance Companies

9.5 IT & Telecom

9.6 Public Sector

9.7 Others

9.8 Y-O-Y Growth trend Analysis End-User

9.9 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Blockchain RegTech & Security Solutions Market– By Application

10.1 Introduction/Key Findings

10.2 Risk and Compliance Management

10.3 Identity Management

10.4 Regulatory Reporting

10.5 Anti-Money Laundering (AML) and Know Your Customer (KYC)

10.6 Transaction Monitoring

10.7 Others

10.8 Y-O-Y Growth trend Analysis Application

10.9 Absolute $ Opportunity Analysis Application, 2024-2030

Chapter 11. Blockchain RegTech & Security Solutions Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Component

11.1.2.1 By Deployment Mode

11.1.3 By Organization Size

11.1.4 By Application

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Component

11.2.3 By Deployment Mode

11.2.4 By Organization Size

11.2.5 By End-User

11.2.6 By Application

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Component

11.3.3 By Deployment Mode

11.3.4 By Organization Size

11.3.5 By End-User

11.3.6 By Application

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Component

11.4.3 By Deployment Mode

11.4.4 By Organization Size

11.4.5 By End-User

11.4.6 By Application

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Component

11.5.3 By Deployment Mode

11.5.4 By Organization Size

11.5.5 By End-User

11.5.6 By Application

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Blockchain RegTech & Security Solutions Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 IBM Corp

12.2 Microsoft Corp

12.3 Deloitte

12.4 Thomson Reuters

12.5 Coinfirm

12.6 MetricStream Inc.

12.7 ACTICO

12.8 Ascent Technologies Inc.

12.9 Broadridge Financial Solutions, Inc.

Download Sample

Choose License Type

2500

4250

5250

6900