Blazers Market Size (2024 – 2030)

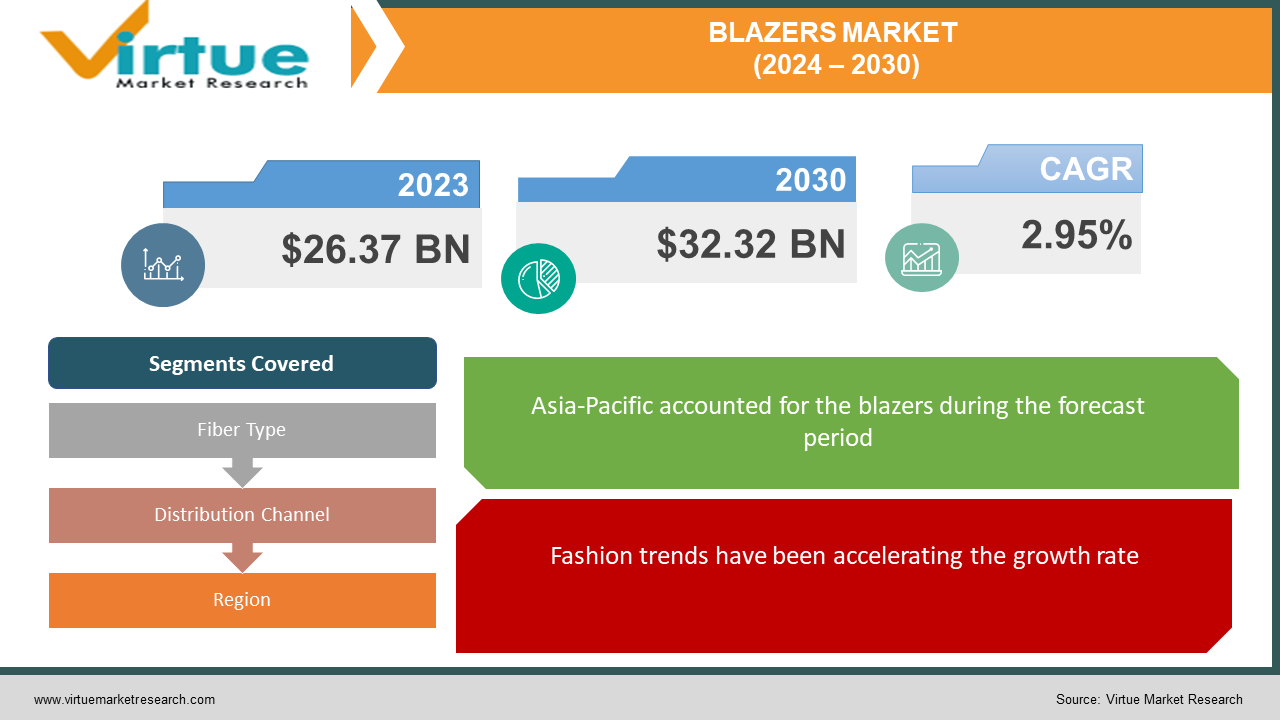

The global blazer market was valued at USD 26.37 billion and is projected to reach a market size of USD 32.32 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 2.95%.

A blazer is a type of jacket with a more relaxed style that resembles a suit jacket. Since a blazer is more formal and made of solid-colored fabric, it may be distinguished from a sport coat. Blazers go well with pants of a contrasting color, pattern, or material when worn to formal events. Traditionally, they are double-breasted, thigh-length coats. In the past, they were worn for special occasions only. A lot of people were not able to afford this due to the economic conditions. As such, there was limited scope. Presently, the market has seen notable growth owing to diversification and fashion trends. In the future, with a focus on personalization and other technological innovations, this market is anticipated to witness an expansion.

Key Market Insights:

The Indian blazers market is expected to produce US$0.77 billion in 2024, with an annual growth rate of 2.80% from 2024 to 2028, according to Statista. Global sales of blazers are predicted to reach US$3.51 per person in 2024, while volume sales are predicted to reach 317.3 million pieces in 2028, with a 0.8% volume rise predicted in 2025.The Blazers market in the US brought in $1.50 billion in sales in 2024. It is anticipated that the Blazers market will have 41.2 million pieces by 2028. Sales in these businesses are negatively impacted by a 15% drop in demand for classic jacket designs, which was a result of emerging customer tastes favoring casual wear over formal dress. To tackle this, companies are offering diverse options that are more comfortable. Additionally, marketing strategies are being enhanced by using customized solutions.

Blazers Market Drivers:

Fashion trends have been accelerating the growth rate.

Over the years, there have been many changes in consumer preferences. Social media has played a crucial role in setting the bar and increasing popularity. Social media influencers have been promoting blazers. They make videos about styling and recommend styling tips for their audience. Celebrities and models set trends by wearing them and styling them with unconventional options. This helps in drawing the interest of a larger consumer base. Besides, Runaway and other fashion shows have become popular. A lot of young people tend to go to these programs in their free time. Many models wear blazers in these shows that are designed by reputed designers and fashion industry experts. This promotes blazer clothing. Apart from this, a lot of people can afford different and unique styles due to the improving economic conditions. As such, many people are buying this clothing item and updating their wardrobes to stay on par with the new culture.

The dress code in corporate culture has been enabling the development.

The demand for blazers is also influenced by the current corporate culture and dress rules at work. The need for blazers as staple items of clothing is constant in fields or organizations where the business dress is expected. The market for blazers may benefit in response to modifications in workplace conventions, such as a move towards more accommodating or loose dress requirements. Blazers are consistently in demand as acceptable clothing for occasions including business meetings, job interviews, and formal parties. Earlier, only men used to wear blazers, as the designs were made specifically for that gender. They used to wear it for business meetings and other occasions. With the entry of women into corporate, sales of blazers increased. Companies started to design these clothes even for women, which has led to better revenue.

Blazers Market Restraints and Challenges:

Intense competition, casualization trends, affordability, and seasonal variation are the main issues that the market is currently experiencing.

Even though blazers are popular, other clothing items like jackets, hoodies, and cardigans are in demand. These alternatives are usually lighter and more comfortable. As such, a lot of consumers opt for this wear, which can cause losses for the blazer market. Secondly, many workplaces usually lean towards casual clothing. Sales of these clothes may suffer if more businesses embrace business-casual or casual dress rules. Thirdly, a lot of blazers are expensive. Customers might go for affordable options. Moreover, blazers are usually heavy, resulting in warm temperatures. This might result in customers buying them only during the winter season. Manufacturers need to come up with suitable solutions to address these barriers for the market to expand.

Blazers Market Opportunities:

Blazer merchants and manufacturers have a chance to broaden their product offerings to incorporate more informal and adaptable designs, given the growing trend of casualization in fashion. This comprises knit blazers, unstructured blazers, and hybrid styles that are appropriate for both dressy and casual settings. Additionally, other styling methods are continuously being explored to create catchy looks. Experimentation with colors and fabrics is being made and introduced into the market. Another popular innovation is the oversized blazer collection. These silhouettes feature dropped shoulders, long lengths, and boxier shapes, promoting gender-neutral fashion. Besides this, bold and unique prints are preferred by a lot of customers. Abstract paintings and art are also encouraged. These prints can have the design of a particular culture, art, state, country, etc. The mixing of two completely different fabrics is another trend. This gives an eye-catching look and can set fashion trends. Secondly, e-commerce has been very beneficial. By having a digital presence, revenue generation is increasing. Customers get to choose from a lot of options. Investing in user-friendly websites and constantly upgrading their features is advantageous for the vendors. Thirdly, collaborations with fashion influencers, designers, and celebrities can provide an ample number of possibilities. These people have a huge fan following. As such, the clothing reaches more audiences. Furthermore, offering personalization is helping with growth. This involves tailoring the material as per the needs of an individual. There can be specifications for the fabric, color, embroidery, and other details.

BLAZERS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

2.95% |

|

Segments Covered |

By Fiber Type, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Zara, H&M, Mango, ASOS, Topman, Banana Republic, Hugo Boss, Ralph Lauren, Brooks Brothers, Calvin Klein |

Blazers Market Segmentation: By Fiber Type

-

Polyester

-

Cellulose

-

Cotton

-

Others

Based on fiber type, polyester is the largest segment holding the majority of the market share in 2023. Polyester, with its distinct sheen, dries the fastest of all textiles. This makes it a popular choice for all seasons. This material is prone to wrinkles and is affordable. Secondly, for warm weather, this linen is a lightweight, breathable fabric that works well. Thirdly, it is resistant to wear & tear, as well as abrasion, due to its strength and durability. This property makes them easy to wash. Besides, it is possible to machine wash and dry polyester jackets without them losing their color or form. They hold their form nicely and don't shrink. All these advantages make them an ideal choice for driving their growth. However, cellulose material is the fastest-growing. Cellulose fibers have many benefits over artificial fibers, including low density, low cost, recyclable nature, and biodegradability. Because of these benefits, cellulose fibers may be utilized in composite materials in place of glass fibers. Clothes made of cellulose fiber are smoother and softer than cotton. Clothes made of this fiber may absorb more moisture than conventional cotton can. This prevents the growth of microorganisms and helps control humidity. Additionally, they are hypoallergenic. This means it is less likely to cause an allergic reaction to the human skin. Furthermore, this material is quite comfortable to wear, which makes it perfect for apparel.

Blazers Market Segmentation: By Distribution Channel

-

Offline

-

Online

Based on the distribution channel, the offline segment is the segment that holds the most dominant share in 2023. This includes retail centers, convenience shops, and other specialized stores. This is because consumers can visually inspect the quality of the fabric. They can try out the dresses and choose the one that fits their size accordingly. Clients can clarify any sort of doubt that they have with the salespeople and owners. Moreover, it is possible to bargain at these places. Online channels are the fastest-growing. Virtual retail has gained significant prominence. This is due to their ease. Customers can place orders from the comfort of their homes. Besides, a lot of unique and trendy designs are available on various websites and shopping apps. They gain access to a variety of options to choose from. Discounts and doorstep delivery make them an attractive choice.

Blazers Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is both the largest and fastest-growing market. Countries like China, India, Bangladesh, and Vietnam are at the top. China leads the world in the blazer market, with $10,310 million in sales projected for 2024, according to Statista. In the blazer jacket market, the Asia Pacific region is predicted to have the greatest compound annual growth rate (CAGR) of 5.4% until 2028, making it a major participant. This is because of the growing population in Asian countries. The fashion industry is expanding as a result. Many fashion trends are prevalent in these areas. Corporate culture and fashion influencers have been promoting blazers. The manufacturing hub in Asian countries is very big. It provides employment opportunities to millions of rural and urban populations. A lot of companies are involved in bulk manufacturing. The dye industry has immense growth that is indirectly helping with the success of the fashion industry. Urbanization has led to rising disposable incomes. All these factors are playing a vital role in enabling the upsurge of this market.

COVID-19 Impact Analysis on the Global Blazer Market:

The viral epidemic hurt the market. Lockdowns, movement limitations, and social isolation became the new standards. Transportation, logistics, and the supply chain were all affected by this. As a result, import-export operations deteriorated. All factories and businesses were forced to close to stop the virus from spreading. Production and other operations were stopped as a result. Remote work was emphasized to prevent the spreading of the virus. People stopped going to their workplaces. Most of them hardly dressed up as a result. All fashion walks and shows were halted. Granskog et al.'s research during the first half of the pandemic indicated that there was a 90% decline in the fashion business. Because of the unpredictability of the economy, layoffs are presumed in several industries. Numerous people experienced job losses. The majority of the investments were used for necessities and basic utilities. Funds were directed toward medical applications, such as PPE kits, hospital beds, oxygen tanks, masks, and vaccinations. Launches and partnerships were delayed as a result. Following the epidemic, the market has started to improve. The market is now adjusting to sustainable methods. Normal operations have resumed with the updating of guidelines and the loosening of regulations. Online retail has helped with increasing profits due to its convenience in shopping.

Latest Trends/ Developments:

In the blazer market, ethical and sustainable methods are becoming more important. Sustainable wool, recycled polyester, and organic cotton are a few of the eco-friendly materials that brands are using in their blazer lines. Transparent supplier chains, ethical labor methods, and minimizing environmental effects during the production process are all being prioritized.

Key Players:

-

Zara

-

H&M

-

Mango

-

ASOS

-

Topman

-

Banana Republic

-

Hugo Boss

-

Ralph Lauren

-

Brooks Brothers

-

Calvin Klein

In January 2024, Mumbai-based designer and businessman Oshin Sarin established Oshin, a sustainable apparel line. The brand sells entirely unisex designs and debuted its first collection on its new online site. The business was founded with the specific goal of elevating unisex fashion by dispelling the myth that it is only defined by big items. Maxi dresses, blazers with matching shorts, and light-washed denim ensembles are the main emphasis of Oshin's debut collection. The company has used a proprietary sizing scheme to promote inclusion even further.

In April 2023, Arrow offered a premium selection of blazers and suits that were appropriate for the wedding season. These include designs like tuxedos and bandhgalas, with rich color tones and materials like velvet, suede, knits, and jacquard. It is designed to seamlessly transition between formal events and nighttime receptions. This suede jacket, with its styled lapel design, looks well with dark jeans for a laid-back get-together or black pants for a formal evening.

Chapter 1. Blazers Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Blazers Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Blazers Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Blazers Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Blazers Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Blazers Market – By Fiber Type

6.1 Introduction/Key Findings

6.2 Polyester

6.3 Cellulose

6.4 Cotton

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Fiber Type

6.7 Absolute $ Opportunity Analysis By Fiber Type, 2024-2030

Chapter 7. Blazers Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Offline

7.3 Online

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Blazers Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Fiber Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Fiber Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Fiber Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Fiber Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Fiber Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Blazers Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Zara

9.2 H&M

9.3 Mango

9.4 ASOS

9.5 Topman

9.6 Banana Republic

9.7 Hugo Boss

9.8 Ralph Lauren

9.9 Brooks Brothers

9.10 Calvin Klein

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global blazer market was valued at USD 26.37 billion and is projected to reach a market size of USD 32.32 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 2.95%.

Fashion trends and dress codes in corporate culture are the main factors propelling the global blazer market.

Based on distribution channels, the global blazer market is segmented into offline and online.

Asia-Pacific is the most dominant region for the global blazer market.

Zara, H&M, and Mango are the key players operating in the global blazer market.