Black Bean Market Size (2024 – 2030)

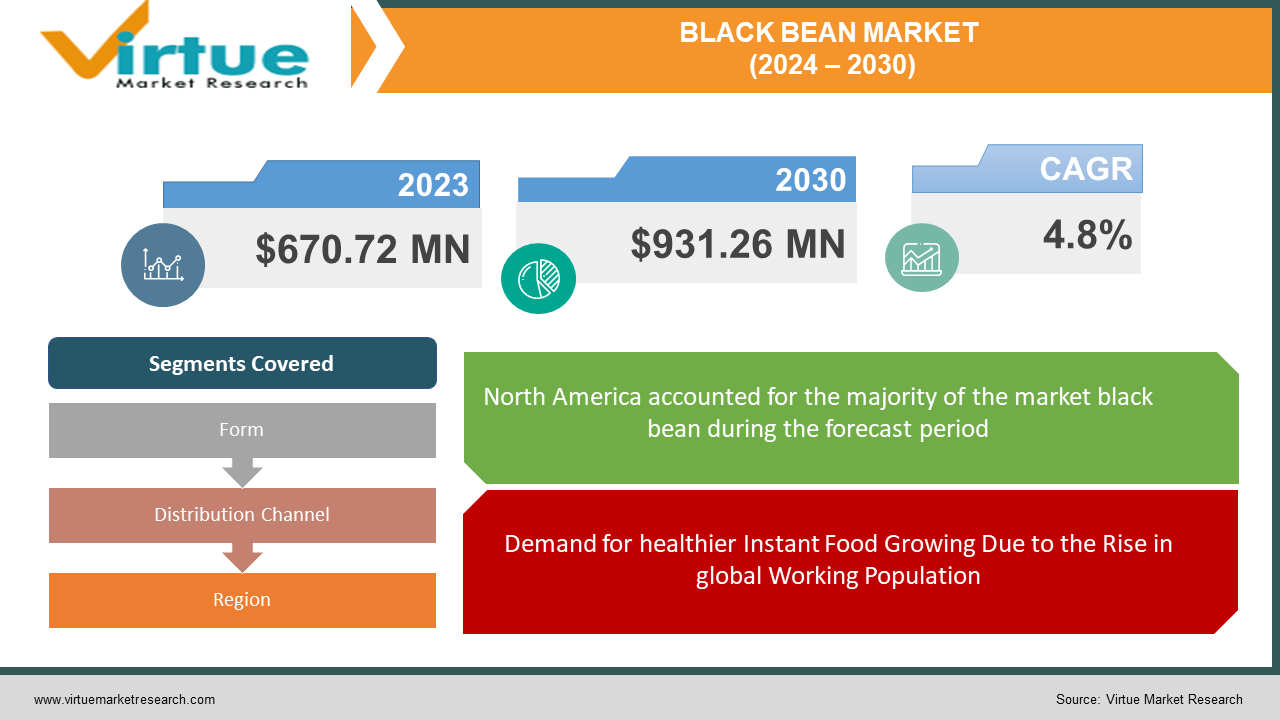

The Global Black Bean Market was valued at USD 670.72 Million in 2023 and is projected to reach a market size of USD 931.26 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.8%.

Black beans are a rich source of protein, fiber, and various vitamins and minerals. They are very low in fat and cholesterol, making them a healthy choice for a balanced diet. Black beans have a mild, slightly sweet flavor that works well in a variety of dishes. They are very commonly used in soups, stews, salads, and side dishes. Black beans are a staple ingredient in Latin American, Caribbean, and Southwestern cuisines. Black beans are available in both dried and canned forms. Dried black beans need to be soaked before cooking to rehydrate them. This can be done overnight or through a quick-soak method. Canned black beans are convenient and can be used directly in recipes after draining and rinsing. The high fiber content in black beans is very helpful in promoting digestive health and it can contribute to weight management and diet loss. They have been linked to a reduced risk of certain chronic diseases, including heart disease and diabetes, due to their nutrient content. The iron in black beans is essential for production of hemoglobin, which is crucial for oxygen transport in the blood. Black beans have been steadily gaining popularity among worldwide consumers since the 1980s when they were virtually unknown. Not only are people eating more black beans in the traditional boiled or canned form, but black beans are also making their way into many new products such as hummus, crackers and pasta.

Key Market Insights:

The rising global emphasis on health-conscious dietary choices and sustainable food production has propelled the demand for organic farro. The black bean industry has grown significantly because of reasons such as knowledge of numerous health benefits of black beans and its effects in transitioning to a more health-conscious diet. The growing trend of consumers adapting a healthier lifestyle and the overall increase in the consumption of healthy products exhibits a substantial potential for the black beans market. The increasing awareness of the nutritional content and culinary versatility of black beans further contributes to its market growth. Black Beans Market Revenue is expected to grow at a healthy CAGR propelled by staggering demand from millennials and emerging markets. Implementation of advanced automation in the production of canned black beans can lead to increased efficiency, reduced labour costs, and enhanced overall productivity. These insights collectively highlight the Market's potential to capitalize on health trends, sustainability preferences, and collaborative efforts to carve a distinct place in the broader food sector.

Black Beans Market Drivers:

Demand for healthier Instant Food Growing Due to the Rise in global Working Population.

Beans are an essential and widely consumed source of nutrition around the world. The rise of instant foods has revolutionized the food industry, making food packaging one of the most profitable sectors in the food and beverages industry. The growing demand for processed canned beans reflects the convenience and ease of use that such products offer to modern consumers. As consumers become more conscious of their dietary choices, there is an increased emphasis on the quality and nutritional value of the beans used in these products.

Canned beans labeled as organic or non-GMO may attract consumers who prioritize these qualities in their food choices. Manufacturers are focusing on minimal processing of as brine, which, when taken in small amounts, raises sodium levels in the body. Eating beans improves diet quality and reduces health risks, but many customers are not familiar with the idea of dried beans. In terms of the latest market trends, there is a notable shift towards organic and natural black beans. Consumers are increasingly looking for products that are free from artificial additives, preservatives, and chemicals. This has led to the introduction of organic and natural variants of canned black beans by various market players. Innovative packaging strategies play a crucial role in attracting a wider consumer base, especially as consumers become more conscious of environmental sustainability and seek convenience. A key driver behind the success of the black beans market is their widespread availability and presence in both developed and developing economies. Instantly available black beans cater to the demands of time-constrained individuals and individuals who are working long hours, so the black beans have become a staple in supermarkets, convenience stores, and online marketplaces. The growing demand for more environmentally friendly packaging is influencing the choices of the consumers in the instant food business. Consumers prefer products with recyclable or biodegradable packaging, leading manufacturers to develop sustainable sourcing, production methods, and eco-friendly packaging alternatives.

Increasing preference Toward Vegan/vegetarian Diet is fueling market growth.

Food consumption patterns are changing rapidly. In the last few years, the number of people following the animal-free diet has significantly increased, which is one of the major drivers for the black beans industry. Black beans have a huge number of fibers and proteins, which makes them perfect for people with diabetes and those who want to reduce their overall meat consumption. Over the years, there has been a growing trend towards vegan diet in Europe and the North America, which is spreading across the world. Based on the most recent UN database, in 2022, there are approximately 80 million people around the world that follow veganism. The number is increasing, which is fueling the demand for the crops like black beans in the market as they are rich in several important micronutrients, including iron, antioxidants, dietary fiber, zinc, which are important sources of protein in the vegetarian diets.

Moreover, people are focused on plant-based diets, which has been the reason for the higher consumption of black beans. Animal proteins, which are found in meat and dairy products, are often associated with higher levels of cholesterol, saturated fats, and calories. Excessive consumption of animal protein has been linked to an increased risk of cardiac diseases, high blood sugar levels, and obesity.The current market is increasingly shifting towards plant-based protein sources as an alternative to animal products. Plant-based diets are perceived as healthier, as they are typically lower in saturated fats and cholesterol, and higher in fiber and certain essential nutrients. Black beans are an excellent source of plant-based protein, making them a valuable component of a vegetarian diet. They provide protein along with essential nutrients like fiber, vitamins, and minerals. Plant-based proteins, including those from sources like black beans, offer a range of health benefits. They are often considered heart-healthy, can contribute to better weight management, and helps in reducing the risk of chronic diseases.

The rise of black beans in culinary creativity is a testament to the dynamic nature of the food world.

One of the key factors driving the market for black beans is their extraordinary culinary adaptability. From soups and stews to vibrant salads and sides, black beans seamlessly integrate into diverse recipes, offering a unique combination of taste, texture, and nutritional benefits. The richness they bring to soups and stews, coupled with their impeccable taste, makes them an important ingredient in traditional and modern culinary creations. In recent times, the culinary world has witnessed a new trend: the integration of black beans into the realm of desserts. As the demand for vegan options continues to soar, black beans have found their way into the hearts of dessert aficionados, enhancing the texture and nutritional value of treats like brownies, cakes, and muffins. Their creamy consistency and nutritional richness make them a preferred choice for those seeking innovative and health-conscious alternatives in baking. Furthermore, the contemporary lifestyle, characterized by a demand for convenience, has fueled the popularity of ready-to-eat meals. Black beans, with their nutritional prowess and Savory charm, have become an essential component in packed salad mixes, wraps, burritos, and other on-the-go options. Consumers seeking both taste and nutrition can now indulge in the convenience of these packed meals without compromising on the culinary experience.

Black beans Market Restraints and Challenges:

The specter of climate change looms large over global agricultural landscapes, posing a multifaceted threat to the production of staple crops like black beans.

Desertification, land degradation, crop failures, soil pollution, water pollution and damage to food supply infrastructure are all consequences of climate change. Extreme weather events are becoming more common: rising temperatures will lead to more frequent droughts, which will impact the highly fertile yet arid regions such as the Mediterranean countries, southern Africa, Middle East, United States, and various grasslands worldwide. The fluctuations in weather patterns and the frequency of extreme weather events have also risen. The impact on black Beans production is significant, potentially leading to a higher probability of shortages in the overall production of black beans worldwide.

The black bean market faces a dynamic and interconnected set of challenges arising from trade restrictions and geopolitical instability.

There are several trade restrictions imposed on various food commodities throughout the world, including export bans imposed by different countries and different requirements for licencing imposed to address inflation and improve domestic production. Some countries may impose export bans on certain commodities, including black beans, to ensure domestic food security, control inflation, or stabilize prices. Licensing requirements can also be implemented to regulate the export of agricultural products, and failure to comply may result in trade barriers. The instability in the current geopolitical system is also a cause for concern for the global agriculture market in the black beans market. The different economic sanctions imposed by United States and the European Union On countries like Russia, China will affect the global trade market. Slower trade market may lead to lacklustre demand and lower prices for agricultural commodities such as black beans. Trade restrictions and geopolitical instability can disrupt supply chains, causing delays in transportation and distribution of black beans. These disruptions may affect the availability of black beans in certain regions and impact market prices. Many Countries and businesses may respond to trade restrictions by searching for alternative trading partners to mitigate risks and ensure a more stable supply chain for black beans.

Black beans Market Opportunities:

The Global Black Bean Market is poised for dynamic growth, driven by consumer preferences for health, sustainability, and unique Flavors. Businesses that strategically engage in acquisitions, partnerships, product innovation, and ethical practices are likely to unlock lucrative opportunities and contribute to the sustained expansion of the black beans market in the coming years. The growing popularity of plant-based diets is a major trend driving the black beans market. With consumers seeking sustainable and ethical food choices, black beans, rich in protein and other essential nutrients, are positioned as an attractive option. Capitalizing on this trend can lead to increased market penetration and expansion. The collective shift towards more sustainable and ethical food choices represents a significant trend in the food industry. As a result, companies are adapting their practices to meet these consumer expectations, leading to a more environmentally conscious and ethically driven food market.

Companies that are adopting sustainable and ethical practices in black bean cultivation and processing will gain a competitive edge. Certifications for organic and fair-trade practices can enhance brand reputation and attract environmentally conscious consumers.

BLACK BEAN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.8% |

|

Segments Covered |

By Form, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nikken Foods, Damin Foodstuff Co.Ltd, Green Image Organic, Woodland Foods, Kroger, S&W Beans, Bush Brothers & Company, Eden Foods |

Black beans Market Segmentation: By Form

-

Whole Black Beans

-

Canned Black Beans

-

Dried Black Beans

-

Black Bean Powder

-

Others

Canned black beans currently dominate the market occupying the highest share, the global canned black beans market is valued at US$ 5.65 billion and is projected to reach US$ 15 billion by the end of 2033 expanding at a CAGR of 10.3%. This form involves pre-cooking black beans and packaging them in cans with water. The convenience factor is a significant driver of the popularity of canned black beans. As the demand for convenience foods continues to rise, these pre-cooked beans find increased application in various dishes, including soups, salads, dips, sauces, and more. Canned black beans appeal to consumers seeking time-saving solutions in the kitchen, as they require minimal preparation. Additionally, the canned format ensures a longer shelf life, preventing spoilage and allowing for easy storage.

The black bean powder segment is identified as the fastest-growing segment during the forecast period. This form involves drying and grinding black beans into a powder, offering a concentrated and versatile product. Black bean powder provides a convenient way to incorporate the flavour and nutritional benefits of black beans into a variety of dishes. Chefs and home cooks can use it in marinades, soups, sauces, roasted vegetables, and other culinary creations. Moreover, the powder form facilitates its inclusion in processed food products, contributing nutritional value and flavour to items like protein powder, snack bars, energy bars, and gluten-free food products.

Whole black beans, in their natural and unprocessed form, constitute a substantial share of the market. These beans require soaking and cooking before being incorporated into dishes. Whole black beans are versatile and find application in various dishes, including burgers and rice items, adding a nutritious element to the culinary experience. While the preparation process may be more involved compared to canned beans, their natural state allows for a distinct texture and flavour in dishes.

Black beans Market Segmentation: By Distribution Channel

-

Online Retail

-

Offline Retail

The Offline retail segment commands the largest market share primarily due to the proliferation of supermarkets and hypermarkets that offer a diverse range of products including black beans under one roof. Traditional retail spaces such as supermarkets and grocery stores remain primary outlets for purchasing black beans. These physical stores offer consumers the advantage of a hands-on shopping experience, allowing them to inspect product quality and make immediate purchasing decisions. Black beans, especially in organic or specialty varieties, can often be found in health food stores or specialty markets. These stores cater to consumers with specific dietary preferences and are likely to offer a curated selection of high-quality black bean products.

The online retail market is projected to exhibit significant growth. The projection of significant growth in the online retail segment, including the online food and grocery market, reflects the ongoing transformation in consumer behavior and the retail landscape. Brands and businesses are adapting to this shift by enhancing their online presence and optimizing their digital strategies to meet the changing preferences of consumers. Online markets open opportunities for global exposure Small or specialty black bean producers can reach a wider audience through online platforms, potentially expanding their market presence. The shift towards online channels reflects changing consumer preferences for convenience, information accessibility, and diverse product options. Both markets coexist, offering consumers flexibility in how they choose to access and purchase black beans based on their preferences and lifestyle.

Black beans Market Segmentation: Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America currently holds the biggest share (35%) of the black beans market. This dominance is attributed to the increasing demand for plant-based food products. The rise of plant-based diets and veganism in North America has driven the demand for black beans. Young adults are incorporating black beans into various dishes, including burgers, pasta, and snacks, seeking nutritious options without compromising taste. The use of black beans in dishes like rice, tacos, enchiladas, and soups has become popular, adding a flavorful and nutritious element to these culinary creations.

The Asia-Pacific region has witnessed the fastest growth during the forecasting period, reflecting the diverse culinary influences and traditional dishes that incorporate black beans. Traditional culinary traditions from various Asian countries, including Mexican, Japanese, Chinese, and Indian, have influenced the integration of black beans into regional cuisines. Black beans are used in various dishes, including curries and soups, sides and rice items, noodles, and more. Popular dishes like Chinese black bean soup and Korean black noodles showcase the increasing influence of black beans in the region.

While North America and Asia-Pacific dominate the market, the Europe, Middle East, and Africa region has shown a growing adoption of black beans. The trend is partly influenced by the increasing awareness of plant-based diets and a desire for diverse and nutritious food options. In Europe, there is a rising trend of culinary fusion, with black beans being incorporated into traditional dishes and innovative recipes. The Middle East and Africa are also witnessing an exploration of black beans in various culinary applications. While not dominating in overall market share, Latin America's stable demand for black beans is driven by cultural ties and the continued use of black beans in both traditional and contemporary recipes.

COVID-19 Impact Analysis on the Global Black beans Market:

The COVID-19 pandemic has had both positive and negative impacts on the black bean market. On the positive side, the pandemic has increased consumer awareness about the importance of a healthy diet and boosted the demand for nutritious and healthy food products. As a result, the market for black beans, with its nutritional value, has witnessed increased traction. However, the pandemic has also disrupted the global supply chains and caused fluctuations in material prices. Lockdown measures and restrictions on manufacturing and distribution industry have posed significant challenges for industry players. Additionally, the economic impact of the pandemic has led to changes in consumer spending patterns, with some individuals becoming more price sensitive. Despite these challenges, the long-term prospects for the black bean powder market remain positive. The increased focus on health and wellness, along with the growing demand for plant-based proteins, is expected to drive market growth in the post-pandemic period.

Latest Trends/ Developments:

New Product Launches Several companies are introducing innovative black bean products featuring unique flavors, blends, and functional properties. These launches are strategically designed to align with the changing tastes and preferences of consumers, offering them a diverse range of options beyond traditional black beans. These launches aim to cater to evolving consumer preferences. Companies are leveraging these launches to capture market share and establish a strong foothold in the competitive market. Industry players have engaged in partnerships and collaborations to enhance their product offerings, distribution networks, and market presence. Collaborations with key stakeholders, such as food manufacturers, retailers, and ingredient suppliers, enable a synergistic approach to innovation and growth. This collaborative strategy facilitates the development of new and improved products, catering to a wider audience and addressing emerging market trends. Companies are investing in research and development activities to explore new applications and formulations of black beans. This focus on innovation aims to differentiate products and meet the changing needs of consumers. This includes the development of different varieties of canned black beans products that align with health and wellness trends, sustainability considerations, and emerging culinary habits. Industry participants are adopting marketing and branding strategies to create awareness, educate consumers, and build brand loyalty. Digital marketing campaigns, influencer collaborations, and product endorsements are being used to reach target audiences.

Key Players:

-

Nikken Foods

-

Damin Foodstuff Co.Ltd

-

Green Image Organic

-

Woodland Foods

-

Kroger

-

S&W Beans

-

Bush Brothers & Company

-

Eden Foods

Chapter 1. Black Bean Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Black Bean Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Black Bean Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Black Bean Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Black Bean Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Black Bean Market – By Form

6.1 Introduction/Key Findings

6.2 Whole Black Beans

6.3 Canned Black Beans

6.4 Dried Black Beans

6.5 Black Bean Powder

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Form

6.8 Absolute $ Opportunity Analysis By Form, 2024-2030

Chapter 7. Black Bean Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Online Retail

7.3 Offline Retail

7.4 Y-O-Y Growth trend Analysis By Distribution Channel

7.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Black Bean Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Form

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Form

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Form

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Form

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Form

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Black Bean Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Nikken Foods

9.2 Damin Foodstuff Co.Ltd

9.3 Green Image Organic

9.4 Woodland Foods

9.5 Kroger

9.6 S&W Beans

9.7 Bush Brothers & Company

9.8 Eden Foods

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Black Bean Market was estimated to be worth USD 640 Million in 2022 and is anticipated to reach a value of USD 931.26 Million by 2030, growing at a fast CAGR of 4.8% during the forecast period 2023-2030.

The Increasing demand for a plant-based diet and culinary versatility are the market drivers for Global Black Bean Market.

The North America dominates the market for Black Beans.

The COVID-19 pandemic disrupted supply chains and increased health consciousness, driving higher demand for nutrient-rich foods like organic farro in the market.

The market is expected to see growth through increased adoption of plant-based diets, innovation in products, and rising consumer awareness of health.