Bitumen Market Size (2025-2030)

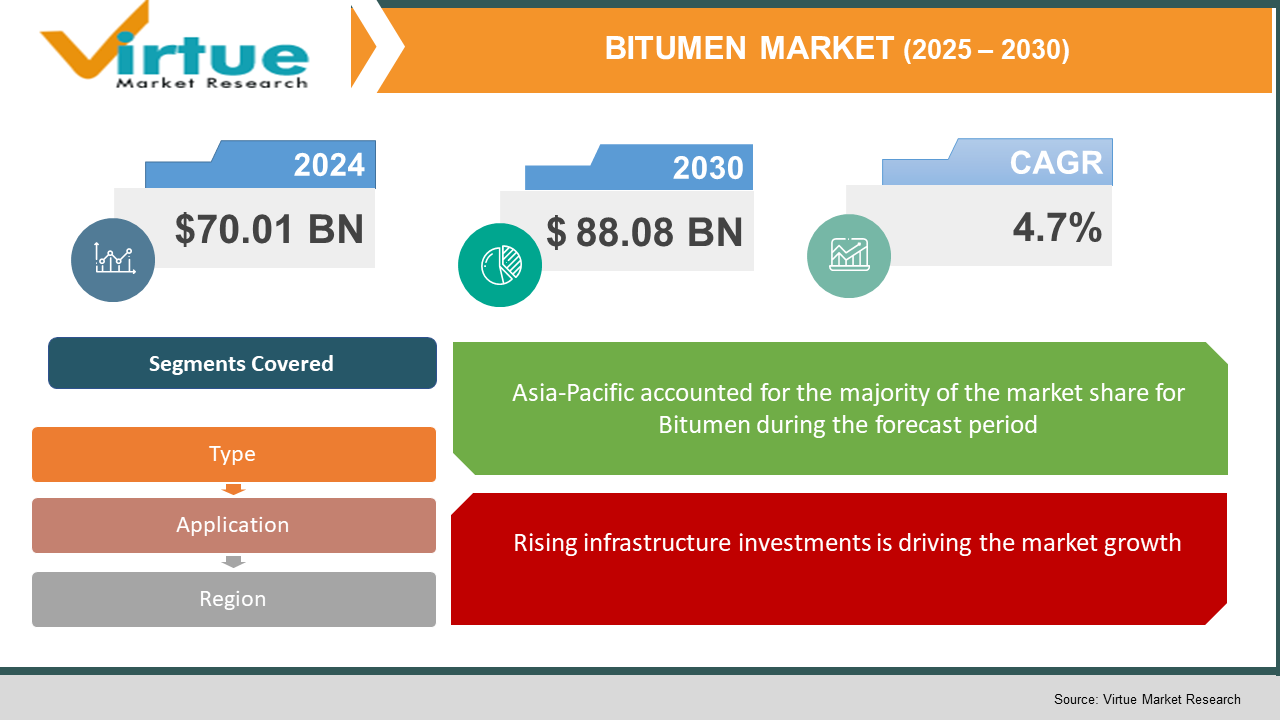

The global Bitumen Market was valued at USD 70.01 billion in 2024 and is projected to grow at a CAGR of around 4.7% from 2025 to 2030, reaching approximately USD 88.08 billion by 2030.

Bitumen, a viscous binder derived from crude oil refining, is predominantly used in road construction, roofing, waterproofing, adhesives, and insulation. Its extensive use in asphalt applications stems from high adhesion and water resistance, while its waterproofing properties support commercial and residential roofing. Factors such as rapid urbanization, large-scale infrastructure investments, and sustainable construction trends are fueling demand. Technological improvements including modified bitumen variants and smart city initiatives further bolster market expansion, underscoring bitumen’s central role in modern infrastructure and built environments.

Key market insights:

Paving grade bitumen accounted for over 60% of product revenue in 2023, driven by its usage in asphalt binder for durable roads.

Roadways remained the dominant application, representing approximately 84% of consumption in 2023 due to global transport infrastructure growth.

Asia Pacific led the regional market with about 30–47% share in 2024–2025, driven by rapid urbanization in China, India, and Japan.

Europe held a market share of around 26% in 2023, with steady growth supported by advanced infrastructure and production technologies.

North America’s bitumen market in the U.S. was valued at USD 10 billion in 2023 and projected to grow at a CAGR of 4.7% through 2032.

Modified bitumen, including polymer-modified grades, reached nearly USD 24 billion in

Global Bitumen Market Drivers

Rising infrastructure investments is driving the market growth

Government and private sector investment in road, highway, airport, and urban infrastructure continues at a global scale. In emerging economies, infrastructure spend is expected to reach USD 1.8 trillion by 2025, significantly supporting paving-grade bitumen demand. Rehabilitation of aging roads in mature markets like North America and Europe further strengthens consumption. Bitumen’s role as a key asphalt binder for durable, weather-resistant pavement ensures its indispensability in infrastructure development, while growing emphasis on sustainable, high-performance infrastructure encourages innovations like modified and emulsified bitumen solutions to meet durability and efficiency targets.

Urbanization and construction growth is driving the market growth

Rapid urbanization, particularly across Asia Pacific and Latin America, is results in expanding road networks, residential and commercial projects, and industrial plants. This surge drives demand not only for road paving but also for bitumen-based waterproofing, insulation, and roofing applications. APAC held around 30–47% of global share in 2024, highlighting the region’s rapid growth. Western markets supplement this trend through retrofitting and expansion of airport runways, parking lots, and public works, consolidating bitumen’s central role across multiple construction verticals.

Emphasis on sustainability and modified products is driving the market growth

Environmental concerns and regulatory pressures are prompting a shift in bitumen innovation. Modified bitumen markets—like SBS and APP—reached nearly USD 24 billion in 2023, with ~5.5% CAGR projected to 2033. Producers are also exploring bio-based alternatives and recycled bitumen blends, declining carbon footprint and aligning with circular economy principles. Demand for warm mix asphalt and greater recycling of reclaimed asphalt pavement (RAP) further encourages eco-conscious bitumen formulations and production methods, aligning infrastructure growth with environmental mandates.

Global Bitumen Market Challenges and Restraints

Environmental impact regulations is restricting the market growth

Bitumen’s petroleum-derived nature and high embodied carbon draw regulatory scrutiny. Governments are imposing stricter environmental standards on asphalt production and emissions. The oil sands extraction process associated with natural bitumen also raises greenhouse gas concerns, markedly higher than conventional crude, which heightens pressure on producers to reduce carbon footprints. Natural bitumen extraction from tar sands adds fuel to environmental debates. Reducing emissions and meeting regulatory requirements increases production costs, challenging conventional bitumen players to innovate or face higher compliance burdens.

Feedstock price volatility is restricting the market growth

As bitumen is a high-value byproduct of crude oil refining, its market price is directly influenced by volatile crude oil prices. Price fluctuations can significantly affect producer margins and end-user pricing. Sudden spikes in oil price, triggers uncertainty in infrastructure budgets and project viability. Similarly, economic slowdowns or supply disruptions affect demand projections, complicating long-term planning for governments and construction companies reliant on stable bitumen supply and pricing.

Market Opportunities

Expanding infrastructure development, urbanization, and sustainability mandates create significant growth avenues for the bitumen market. Asia Pacific, riding a rapid infrastructure wave, remains the fastest-growing region, supported by national initiatives and financial investment to upgrade transport and industrial infrastructure. Demand spans beyond road paving to include waterproofing membranes in residential and industrial buildings, and insulation applications. Modified bitumen variants—such as polymer-modified and emulsified products—present performance-enhancing alternatives. The market is also innovating with bio-based bitumen from agricultural residues or algae, offering low-carbon alternatives aligned with circular economy goals and green certifications. Recycling of reclaimed asphalt pavement and shingles reduces raw material dependence while addressing waste disposal and emissions. Government incentives for warm mix asphalt and low-temperature technologies further support sustainable bitumen adoption. Integration with smart city frameworks, like IoT-enabled roads with sensors and embedded systems, can add data-rich layers to infrastructure, offering opportunity for smart bitumen-enabled solutions. Partnerships between bitumen manufacturers, construction firms, and technology providers can deliver turnkey solutions balancing cost, environmental, and regulatory demands. Altogether, the synergy of modified grades, sustainability, recycling, and infrastructure expansion positions the bitumen market for strong future growth and impact.

BITUMEN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

4.7% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ExxonMobil, Shell, Chevron, Valero, Suncor, Saudi Aramco, BP, NYNAS, CNPC, Gazprom Neft, IOC, TotalEnergies, Reliance. |

Bitumen Market Segmentation

Bitumen Market Segmentation By Type:

- Paving grade bitumen

- Oxidized bitumen

- Polymer modified bitumen

- Bitumen emulsions

- Others (cutback, penetration-grade, hard-grade)

Paving grade bitumen is the market-leading product segment. It comprised over 60% of revenue in 2024 and serves as the primary binder in asphalt mixes for roads, highways, and airport infrastructure. Its ability to provide strong adhesion, durability, and climate resistance ensures its indispensability in paving applications, which account for roughly 84% of total bitumen usage. Highway expansions and maintenance across developing and developed regions, combined with its compatibility with modified bitumen technologies, reinforce paving-grade bitumen’s dominant role. It remains the foundational product segment due to its alignment with global infrastructure priorities and the breadth of its applications in modern transportation networks.

Bitumen Market Segmentation By Application:

- Roadways

- Waterproofing

- Adhesives

- Insulation

- Others (pipe coatings, roofing, decorative)

Roadways dominate the application segment, accounting for approximately 84% of global bitumen consumption in 2024. As the core use case for bitumen, road construction and maintenance require significant volumes each year. Governments worldwide prioritize pavement durability, resilience, and highway expansion, positioning bitumen as an essential input. Even with growth in waterproofing and insulation applications, roadways hold a clear lead. The segment’s dominance is rooted in continuous infrastructure investment, urban expansion, and evolving construction standards. Roadways remain the biggest demand center, supported by regulatory funding and major transportation projects globally.

Bitumen Market Regional segmentation:

• North America

• Asia-Pacific

• Europe

• South America

• Middle East and Africa

Asia-Pacific leads the global bitumen market, accounting for approximately 30–47% of total market share in 2024, driven by massive infrastructure development in China, India, and Southeast Asia. With transit-driven urbanization and national highway spending, APAC nations are expanding road networks and implementing large public works, which require substantial paving-grade bitumen. Residential and commercial construction in the region is also increasing demand for waterproofing and insulation applications. Government strategies focus on smart cities and transport modernization, further boosting bitumen consumption. While Europe and North America demonstrate mature, stable growth—supported by maintenance and retrofit projects—APAC is the fastest-growing and most dominant region. This dominance reflects a combination of large-scale spending, rapid urban transformation, and favorable economic policies favoring construction material use.

COVID‑19 Impact Analysis on the Bitumen Market

The COVID‑19 pandemic initially disrupted bitumen supply chains by causing refinery shutdowns and limiting raw material availability, exacerbated by transportation restrictions. Lockdowns paused road construction and reduced demand in 2020. Yet, infrastructure stimulus and reconstruction funding in 2021–2022 countered the downturn. Governments rolled out recovery packages focusing on public works, accelerating road and airport projects and reactivating bitumen demand. As projects resumed, demand rebounded sharply, particularly in Asia‑Pacific. COVID also highlighted durability and resilience in infrastructure. Governments emphasized long-term pavement performance, catalyzing wider adoption of polymer-modified bitumen and warm-mix technologies for sustainability and maintenance ease. Meanwhile, declining crude oil prices in 2020 lowered raw material costs temporarily, benefiting producers and facilitating margin recovery. The strong rebound in 2021–2022 propelled the market beyond pre-pandemic levels. By 2023, bitumen usage returned to growth trajectories, supported by global road construction and smart city implementations. In 2024, market valuations ranged from USD 56 billion to USD 77 billion across various sources, reflecting economic divergence post-pandemic. Environmental considerations intensified as sustainable road programs gained momentum, with recycled bitumen and eco-friendly production methods prioritized in recovery budgets. Overall, COVID‑19 caused short-term contraction but accelerated infrastructural resilience strategies and sustainable bitumen adoption. Stimulus-led project restarts and emphasis on improved performance fostered long-term market resilience.

Latest trends/Developments

The bitumen market is witnessing transformative shifts driven by sustainability, innovation, and smart infrastructure integration. One prominent trend is the rise of polymer-modified bitumen (PMB), which reached nearly USD 24 billion in 2023 and is forecast to grow at 5.5% CAGR. PMBs enhance pavement durability, resistance to deformation, and lifespan—aligning with modern infrastructure demands. Next, eco-conscious practices are being adopted, with bio-based bitumen made from lignin, algae, or agricultural waste gaining traction. These sustainable binders reduce carbon emissions and support green certifications. Recycling also plays a central role, featuring reclaimed asphalt pavement (RAP) and shingles mixed with virgin bitumen, aligning with circular economy goals and lowering production waste. Warm mix asphalt techniques, which reduce production temperatures and energy usage, are being incentivized, reducing greenhouse gas emissions and health risks. Digitalization is emerging in the form of smart asphalt and sensor-embedded roads. Bitumen formulations now accommodate fiber-optic sensors and IoT nodes, enabling asset performance monitoring and predictive maintenance, supporting smart city development. Technological innovation continues with carbon nanotubes and nanomaterials introduced to improve thermal and ductility properties, enhancing performance under extreme conditions. Infrastructure firms partner with tech providers to develop intelligent pavement systems. Regulatory advancements are also shaping standards. Governments are tightening environmental rules and incentivizing bio-bitumen use, while standardization facilitates adoption. Industry consolidation continues as major players and refiners invest in R&D and expanded production capacity to meet shifting demand. Together, these trends are transforming bitumen from a commodity binder into a high-performance, sustainable, digitally integrated material essential for modern infrastructure ecosystems.

Key Players:

- Exxon Mobil Corporation

- Shell plc

- Chevron Corporation

- Valero Energy Corporation

- Suncor Energy

- Saudi Aramco

- BP plc

- NYNAS AB

- China Petroleum & Chemical Corporation

- Gazprom Neft

- India Oil Corporation

- TotalEnergies

- Reliance Industries

Chapter 1. Bitumen Market – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Type s

1.5. Secondary Type s

Chapter 2. BITUMEN MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. BITUMEN MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. BITUMEN MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. BITUMEN MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. BITUMEN MARKET – By Type

6.1 Introduction/Key Findings

6.2 Paving grade bitumen

6.3 Oxidized bitumen

6.4 Polymer modified bitumen

6.5 Bitumen emulsions

6.6 Others (cutback, penetration-grade, hard-grade)

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. BITUMEN MARKET – By Application

7.1 Introduction/Key Findings

7.2 Roadways

7.3 Waterproofing

7.4 Adhesives

7.5 Insulation

7.6 Others (pipe coatings, roofing, decorative)

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. BITUMEN MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. BITUMEN MARKET – Company Profiles – (Overview, Product, Portfolio, Financials, Strategies & Developments)

9.1 Exxon Mobil Corporation

9.2 Shell plc

9.3 Chevron Corporation

9.4 Valero Energy Corporation

9.5 Suncor Energy

9.6 Saudi Aramco

9.7 BP plc

9.8 NYNAS AB

9.9 China Petroleum & Chemical Corporation

9.10 Gazprom Neft

9.11 India Oil Corporation

9.12 TotalEnergies

9.13 Reliance Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global Bitumen Market was valued at USD 70.01 billion in 2024 and is projected to grow at a CAGR of around 4.7% from 2025 to 2030, reaching approximately USD 88.08 billion by 2030.

Key drivers include infrastructure investments, urbanization, demand for sustainable and modified bitumen products

Segments include paving-grade, oxidized, polymer-modified, emulsions; and applications like roadways, waterproofing, adhesives, insulation.

Asia‑Pacific dominates, accounting for up to ~47% share driven by infrastructure expansion in China, India, and Southeast Asia.

Major players include ExxonMobil, Shell, Chevron, Valero, Suncor, Saudi Aramco, BP, NYNAS, CNPC, Gazprom Neft, IOC, TotalEnergies, Reliance